![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

14 Cards in this Set

- Front

- Back

|

Which of the following is the only traditional loan product?( )Home Equity Line of Credit( )Fixed rate 2nd mortgage( )15 year fixed rate mortgage(x)30 year fixed rate mortgage ← Correct answer |

Explanation:pg 86NOTE: All mortgage loan type/products are considered non-traditional mortgages (i.e. 15 year fixed, Adjustable Rate Mortgages (ARM). Home Equity Line of Credits (HELOC), close ended 2nd mortgages. Therefore there is ONLY one traditional loan product – 30 year fixed rate mortgage. |

|

|

VA requires ____ years after a foreclosure to qualify for a VA mortgage.(x)2 ← Correct answer( )3( )4( )7 |

|

|

|

Which of the following programs is intended to assist borrowers that were caught in the storm of the recent credit crisis and resulting global recession.( )Expanded Jumbo products(x)Clean Slate ← Correct answer( )5+ Financed Properties Products( )Alternative Verification |

Explanation:U3 Alternative Qualified Mortgage: 3 Clean SlateClean Slate Program is intended to assist borrowers that were caught in the storm of the recent credit crisis and resulting global recession.Immediate path back to homeownershipTake advantage of historically low home prices without having to wait the typical waiting periodDown payment as low as 20% with a 680 or higher FICO scoreFICO scores as low as 600 up to 75% LTV6 months reservesJumbo loans up to $1,000,000No seasoning requirements for Short Sales and Foreclosure in most casesMinimum 6 months seasoning on Bankruptcies and max LTV of 70%Primary Homes onlyOnly single family detached properties allowed |

|

|

Liability for failing to meet the Ability-to-Repay includes all of the following except:(x)Reimbursement for lost down payment on a property ← Correct answer( )Statutory damages of up to $4,000, all fees and up to 3 years of finance charges( )Up to 5 years in jail ( )Court costs

|

Explanation:U2 Ability-to-Repay (ATR)Liability for failing to meet the ATR, including actual damages, such as1. Lost down payment on a property2. Statutory damages of up to $4,000, all fees and up to three years of finance charges (on an average loan of $200,000 at 4.5%, approximately $25,000),3. Court costs and reasonable attorney’s fees.

|

|

|

Which of the following is not one of the 3 Cs?( )Credit(x)Character ← Correct answer( )Capacity( )Collateral |

Explanation:U1 Summary of Subprime Lending: 4 Guidance on Non-Traditional Mortgage Product Risks3 C’s to be addressed1) Credit – low credit scores2) Capacity – inability to verify income3) Collateral – not enough assets |

|

|

ATR violation may be made against all of the following except:( )Creditor( )Assignee(x)Real Estate Broker ← Correct answer( )Holder of a residential mortgage loan |

Explanation:Only those that lend the money must be accountable for Ability to Repay – therefore realtors are not responsible for Ability to Repay |

|

|

How much time must pass after a foreclosure to qualify for a FHA mortgage?( )1 Year(x)3 Years ← Correct answer( )7 Years( )No requirement - lender discretion

|

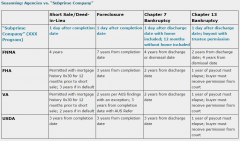

see chart on card 2 |

|

|

Which of the following laws covers information sharing among affiliates?( )RESPA ( ) TILA (x) FCRA ← Correct answer( )HMDA

|

Explanation:FCRA, Regulation V (privacy provisions) FCRA 12 CFR Part 1022.20 – 1022.271. Covers information sharing among affiliates.2. In general, entities may share customer transaction and experience information with affiliated entities under certain circumstances.3. However, an entity may not use information received from an affiliate to market its products or services to a consumer, unless the consumer is given notice and a reasonable and simple method to opt out of the making of such solicitations. |

|

|

Which of the following means providing information regarding the risks of a subprime loan product in addition to the benefits in a clear and balanced manner?(x)Transparency ← Correct answer( )Steering( )Control Systems( )Education |

Explanation:Pg 85 Transparency: information provided consumers should clearly explain the risk of payment shock and the ramifications of prepayment penalties, balloon payments and the lack of escrows, as necessary. In this context, transparency means providing information regarding the risks of a subprime loan product in addition to the benefits in a clear and balanced manner. |

|

|

Which of the following is not considered Predatory Lending( )Making loans based predominately on value of the collateral rather than the borrower’s ability to repay the mortgage.(x)Refinancing a High Cost (HOEPA) loan into a 30 year FHA mortgage ← Correct answer( )Inducing a borrower to repeatedly refinance a loan in order to charge high points and fees each( )Engaging in fraud or deception to conceal the true nature of the loan obligation from an unsuspecting or unsophisticated borrower. |

Explanation:Predatory LendingThe Agencies guidance was clear to state; “Subprime lending is not synonymous with predatory lending…” (https://www.fdic.gov/regulations/laws/rules/5000-5160.html, FDIC Law, Regulations, Related Acts – Statement on Subprine Mortgage Lending - last updated 4/20/2014) the statement on subprime lending went on to define that predatory lending involved at least one of the following elements: 1. Making loans based predominately on the foreclosure or liquidation value of the collateral rather than the borrower’s ability to repay the mortgage according to its terms.2. Inducing a borrower to repeatedly refinance a loan in order to charge high points and fees each time the loan is refinanced, known as “loan flipping” or;3. Engaging in fraud or deception to conceal the true nature of the loan obligation, or ancillary products, from an unsuspecting or unsophisticated borrower.

|

|

|

Which of the following is defined as: Originators should not use their expertise or position of trust to steer consumers to products favorable to the originator?( )Transparency(x)Steering ← Correct answer( )Suitability( )Consumer Education |

Explanation:Pg 85Steering: originators should not use their expertise or position of trust to steer consumers to products favorable to the originator, at the exclusion of other products offered by the institution for which the borrower may qualify. |

|

|

Which of the following is not a subprime lending risk? ( )ARM products with low introductory rates, known as “teaser” rates.(x)Requirement of escrow accounts for payment of taxes and insurance ← Correct answer( )Payment shock and ability to repay( )Unfair or deceptive practices, predatory lending issues |

Explanation:Pg 84The following are considered Subprime Lending risks:1. ARM products with low introductory rates, known as “teaser” rates.2. Qualifying borrowers on limited or no documentation of income3. Imposing substantial prepayment penalties4. Prepayment penalty periods that extend beyond initial fixed period5. No escrow accounts for payment of taxes and insurance6. Inadequate knowledge of product features and risks7. Payment shock and ability to repay8. Unfair or deceptive practices, predatory lending issues9. Shared Appreciation Mortgage |

|

|

How many “traditional loan products” exist?(x)1 ← Correct answer( )3( )5( )No set number |

Explanation:Pg 86NOTE: All mortgage loan type/products are considered non-traditional mortgages (i.e. 15 year fixed, Adjustable Rate Mortgages (ARM). Home Equity Line of Credits (HELOC), close ended 2nd mortgages. Therefore there is ONLY one traditional loan product – 30 year fixed rate mortgage. |

|

|

When an examiner notes violations root causes may be found in weaknesses in which of the following? ( )Internal controls( )Training( )Management oversight(x)All of these ← Correct answer |

Explanation:Module 8 – Examiner Conclusions and Wrap-Up1. Summarize the findings, supervisory concerns, and regulatory violations.2. For the violations noted, determine the root cause by identifying weaknesses ina. Internal controls,b. Audit and compliance reviews,c. Training,d. Management oversight, ore. Other factors.f. Determine whether the violation(s) are pattern or practice, or isolated.3. Identify action needed to correct violations and weaknesses in the institution’s compliance management system, as appropriate.4. Discuss findings with the institution’s management and, if necessary, obtain a commitment for corrective action.5. Record violations according to Bureau policy in the Report of Examination/Supervisory Letter and CFPB’s electronic database system to facilitate analysis and reporting.6. If the examiner believes enforcement action may be appropriate, contact appropriate agency personnel for guidance.7. Prepare a memorandum for inclusion in the work papers and CFPB’s official system of record that outlines planning and strategy considerations for the next examination and, if appropriate, interim follow-up. |