![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

49 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Deductible for AGI? Y/N

Ordinary and necessary expenses incurred in a trade or business? |

Yes

|

|

|

|

Deductible for AGI? Y/N

1/2 of Self Employment Tax Paid |

Yes

|

|

|

|

Deductible for AGI? Y/N

Alimony Paid |

Yes

|

|

|

|

Deductible for AGI? Y/N

Certain payments to traditional Individual Retirement Accounts and Health Savings Accounts |

Yes

|

|

|

|

Deductible for AGI? Y/N

Moving Expenses |

Yes

|

|

|

|

Deductible for AGI? Y/N

Penalty for premature withdrawal from savings account |

Yes

|

|

|

|

Deductible for AGI? Y/N

Capital Loss Deductions |

Yes

|

|

|

|

Deductible for AGI? Y/N

Deductions attributable to rents and royalties |

Yes

|

|

|

|

Deductible for AGI? Y/N

Personal and nonbusiness expenses |

No

(Itemized, so it's a deduction FROM AGI) |

|

|

|

Deductible for AGI? Y/N

Medical Expenses |

No

|

|

|

|

Deductible for AGI? Y/N

Charitable Contributions |

No

|

|

|

|

Deductible for AGI? Y/N

The production or collections of income |

No

|

|

|

|

Deductible for AGI? Y/N

The management of property held for the production of income |

No

|

|

|

|

Deductible for AGI? Y/N

The determination, collection, or refund of any tax |

No

|

|

|

|

The tax system is adjusted to remove the effects of inflation. What is this process called?

|

Indexing

|

|

|

|

Can the additional standard deduction be claimed by dependents?

|

No

|

|

|

|

What is the additional standard deduction amount for 2008. For being over 65 or Blind?

Remember to segregate the amounts |

HoH, Single : $1,350

Married (J or S), Surviving Spouse: $1050 |

|

|

|

What's the personal exemption for 2008?

|

$3,500

|

|

|

|

Can dependents use a personal exemption?

|

No

|

|

|

|

The qualifying child definition is also used to determine eligibility for other tax benefits

Name 1 of 2 |

1. Child Tax Credit

2. Head of Household Filing Status |

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Mother |

No

|

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Brother |

Yes

|

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Stepbrother |

Yes

|

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Half-Brother |

Yes

|

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Nephew |

Yes

|

|

|

|

Do I pass the Relationship Test for Qualifying Child?

Cousin |

No

|

|

|

|

For the qualifying relative test, what is the Gross Income amount that cannot be exceeded.

|

$3,500 also the Personal and Dependency Exemption amount.

|

|

|

|

Exemptions are phased out by

(a)__?___ % for each (b)_$____ {(c) $_____for married} or fraction thereof by which the taxpayer's AGI exceeds the threshold amounts. Finally, this amount is multiplied by (d)__/___ to arrive at the phaseout amount for 2008 and 2009 |

(a) 2%

(b) $2,500 (c) $1,250 (d) 1/3 |

|

|

|

What is the general formula for the phaseout of exemptions?

Hit the HINT on This One |

AGI - Threshold Amount = Excess Amount

Excess Amount / $2500 = Reduction Factor (Rounded Up Always) x 2% Phaseout Percentage x Aggregate Exemptions = Amount of Exemption to Phaseout Amount to Phaseout x 1/3 = Amount to Subtract from Exemptions |

This measure is based on the AGI and it is a REDUCTION of the Personal and Dependency Exemption (the Aggregate!)

Just repeat this out loud, it's not complicated but requires full understanding |

|

|

Why aren't individuals who taxable income exceed 100,000 can't use the tax table method?

|

Because it doesn't even go that high, these people make A LOT OF money!

|

|

|

|

What's the alternative to the tax rate tables?

|

The Tax Rate Schedule

|

|

|

|

If a child decides to allow their parents to file because of the kiddie tax, should they still file a tax return? Why or why not?

|

No

Remember that the parents only pay the taxes on the allocable parental tax. Thus, the child will not have gross income. |

|

|

|

If a married couple files separately, who is responsible for the kiddie tax if they decide to transfer the allocable parental tax?

|

The parent with the greater taxable income.

|

|

|

|

How does one qualify for Head of Household?

|

You must maintain a house for a dependent

|

|

|

|

A married taxpayer can file as Head of Household, if she meets the?

|

Abandoned Spouse Rules

|

|

|

|

What is the subsequent step after you have determined if there was a gain or loss from a property transaction?

|

You must determine if it is a capital or ordinary (gain/loss) for tax purposes

|

|

|

|

Are Ordinary Losses Fully Deductible?

|

Yes

|

|

|

|

Are Ordinary Gains Fully Taxable?

|

Yes

|

|

|

|

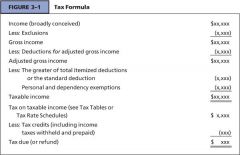

What is the tax formula?

LINE BY LINE |

|

|

|

|

How do you determine the gain or loss from property transactions - IN GENERAL?

|

|

|

|

|

Explain Capital Assets

|

Capital Assets are defined as any property other than a list of exceptions.

The main exceptions are: 1.Anything held for sale (Inventory) and 2. Any real estate 3. Any depreciable property used in business. Almost everything you own and use for personal purposes, pleasure or investment is a capital asset. If something is a capital asset for tax purposes, gains or losses on sale or disposition are capital gains or capital losses. For individuals, however, capital losses on property held for personal use are generally not deductible. |

|

|

|

A vehicle used for a business is a (ordinary/capital) asset?

|

Ordinary

|

|

|

|

A vehicle used for personal use is a (ordinary/capital) asset?

|

Capital

|

|

|

|

Are collectibles capital assets?

|

Yes

|

|

|

|

Short Term gains are held for?

And are subject to a MAXIMUM tax rate of ON NET CAPITAL GAIN? HINT CARD |

(a) Less than 1 year

(b) 35% |

Remember this is the tax on the GAIN and not the return of capital.

|

|

|

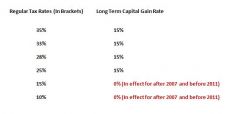

Long Term gains are held for?

And are subject to a MAXIMUM tax rate of ON NET CAPITAL GAIN: (b)___% for Collectibles (c)___% for Certain depreciable property used in business. (d)___% all other long-term gains |

(a) More than 1 year

(b) 28% (c) 25% (d) 15%, 5%, or 0% HINT CARD |

Remember this is the tax on the GAIN and not the return of capital.

|

|

|

In no event will the capital gain be taxed at a rate higher than the ____?____ bracket rate for the year

|

Regular

If your tax bracket is 15%, you will not be charged greater than 15% on any capital gain. |

|

|

|

What are the long term capital rates for each tax bracket?

|

|

|

|

|

Net capital loss can be used to offset ordinary income of up to $______ ($_____ for married person filing separate returns).

|

(a) $3,000

(b) $1,500 |

|