![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

|

Cost Behavior Analysis |

The study about how specific costs respond to changes in business activity |

|

|

Fixed and Variable Costs With Activity Level |

Variable- Changes with activity level Fixed-Stay the same regardless |

|

|

Relevant Range |

Range of activity which a company expects to operate during a year |

|

|

Mixed Costs |

Have variable and fixed costs |

|

|

Variable Costs |

With change |

|

|

Fixed Costs |

Always there |

|

|

Contribution Margin Per Unit |

Unit Selling Price/Unit Variable Costs |

|

|

Contribution Margin Ratio |

CM/Sales |

|

|

Breakeven analysis: Mathematical Equation |

Sales=Variable Costs +Fixed Costs+Net Income or Fixed Costs/contribution margin then Fixed/cmr

|

|

|

Contribution Margin Technique |

Fixed Costs/CM |

|

|

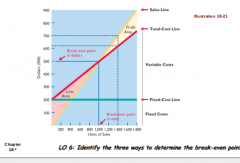

Break-even can be calculated from... |

Mathematical Equation Contribution Margin CVP graph |

|

|

CVP Graph |

|

|

|

Target Net Income |

Indicates sales necessary for a certain income

Calculate using cost volume profit analysis:

E sales x e cm - fixed costs |

|

|

Margin of safety |

Actual Sales-Break-even sales |

|

|

Margin of safety ratio |

Formula:Actual Sales (in dollars)/Actual Expected Sales |

|

|

Weighted Average Contribution Margin |

Sum of weighted contribution margin of each product |

|

|

Sales Mix |

Relative percentage in which a company sells its products |

|

|

Operating Leverage |

Extent to which net income reacts to a given change in sales

CM/Net Income |

|

|

Cost Structure |

Variable vs fixed costs in a company |

|

|

Benefits of budgeting |

plan ahead definite objectives early warning system coordination of activities greater management awareness motivates personnel |

|

|

Budgeting Process |

|

|

|

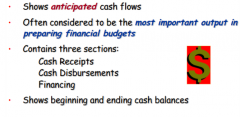

Cash Budget |

|

|

|

Cash Receipts |

principle sources of revenue |

|

|

Cash Disbursements |

expected cash payments |

|

|

Financing Section |

Expected borrowing and repayments |

|

|

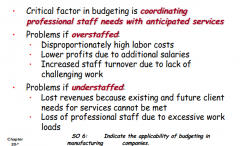

Service Companies budget |

|

|

|

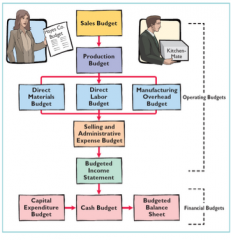

Master Budget |

|

|

|

Differences between long term and short term budgeting |

Time Period involved Emphasis Detail Presented |

|

|

Sales Budget |

expected Sales * Selling Price |

|

|

Production Budget |

Note desired is percentage of next expected unit sales |

|

|

Direct Materials Budget |

Note same as last |

|

|

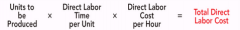

Direct Labor Budget |

|

|

|

Weighted Contribution |

Take both number and x by percent it takes and add |