![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

18 Cards in this Set

- Front

- Back

|

Note

|

U.S. GAAP requires that exchanges of nonmonetary assets be categorized into one of two groups:

1- Those that HAVE "commercial substance," 2- Those that LACK "commercial substance." |

|

|

When does an exchange of non-monetary assets is having commercial substance?

|

If the future cash flows change as a result of the transaction.

|

|

|

Note

|

If the economic position (including areas of risk, timing, or amount of cash flows) of the two parties changes because of the exchange, then the exchange has "commercial substance."

|

|

|

Note

|

In the exchange of non-monetary assets that is having commercial substance, FV approach is used.

|

|

|

Note

|

The FV of assets given up is assumed to be equal to the FV of assets received, including any cash given or received in the transaction.

|

|

|

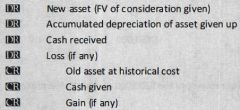

What is the JE of non-monetary exchange that is having commercial substance?

|

|

|

|

Note

|

Gains & losses are always recognized in exchanges having commercial substance & are computed as the difference between FV & BV of the asset given up.

|

|

|

Note

|

The cash given up does not enter into the calculation of gain on exchange of non-monetary assets, which is FV less BV.

|

|

|

Note

|

Under IFRS, nonmonetary exchanges are characterized as:

1- Exchanges of similar assets 2- Exchanges of dissimilar assets. |

|

|

Note

|

Exchanges of dissimilar assets are regarded as exchanges that generate revenue & are accounted for in the same manner as exchanges having commercial substance under U.S. GAAP, But Exchanges of similar assets are not regarded as exchanges that generate revenue & no gains are recognized.

|

|

|

When does an exchange of non-monetary assets is lacking commercial substance?

|

1- If projected cash flows after the exchange are not expected to change significantly

2- If FVs are not determinable 3- If exchange is made to facilitate sales to customers |

|

|

Note

|

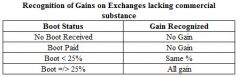

If the exchange lacks commercial substance & no boot is received , no gain is recognized.

|

|

|

Note

|

If the exchange lacks commercial substance & boot is paid, no gain is recognized.

|

|

|

Note

|

If the exchange lacks commercial substance & the boot received is less than 25% of the total consideration received, a proportional amount (the total boot received / the total consideration received) of the gain is recognized.

|

|

|

Note

|

When the boot received equals or exceeds 25% of the total consideration, both parties consider the transaction a monetary exchange & gains & losses are recognized in their entirety by both parties to the exchange.

|

|

|

Note

|

|

|

|

Note

|

If the transaction lacks commercial substance & a loss is indicated , the loss should be recognized.

|

|

|

Note

|

Whenever a nonmonetary asset is involuntarily converted (e.g., fire loss, theft, or condemnation ) to cash, the entire gain or loss is recognized for financial accounting purposes.

|