![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

155 Cards in this Set

- Front

- Back

|

What is long run economic growth? |

The expansion of an economy's productive capacity (capacity to produce goods and services). |

|

|

What is short run economic growth? |

An increase in real GDP over time. |

|

|

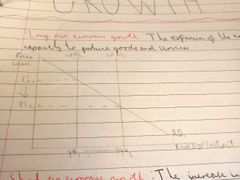

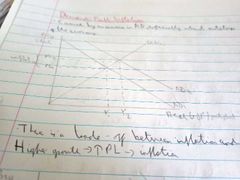

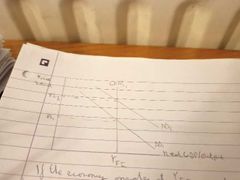

Draw a diagram showing long run economic growth. |

|

|

|

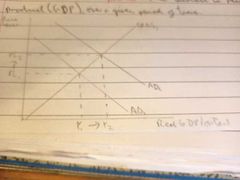

Draw a diagram showing short run economic growth. |

Note: can also be achieved by shifting SRAS. |

|

|

How does the UK government define a recession? |

As 2 consecutive quarters of negative economic growth. |

|

|

How does the exam board define a recession? |

Any period if negative economic growth. |

|

|

What is the government's objective for long run economic growth? |

Positive, stable and sustainable long run economic growth. |

|

|

What's the governments objective for short run economic growth? |

To minimise impact of short run fluctuations in GDP. |

|

|

What does the government aim to do to output gaps? |

Reduce the size of both positive and negative output gaps, to smooth fluctuations in the business cycle. |

|

|

Why are negative output gaps bad? |

The economy has spare capacity (unused factors of production). Unemployment, etc. |

|

|

Why are positive output gaps bad? |

The level of production is not sustainable, factors of production are being overutilised (e.g. overtime). |

|

|

Why do we measure GDP? |

It is a measure of the overall size of the economy. It tells us where we are on the business cycle in order to let us make policy decisions. It helps evaluate the effectiveness of policy decisions. It is used to determine amounts of aid, contributions to international organisations, ability of governments to afford debt. |

|

|

What is the formula for calculating GDP growth? |

[(current GDP - original GDP)/original GDP] X 100 |

|

|

If GDP was £1271 billion in 2011, up from £1252 billion in 2010, what was GDP growth in 2010/2011? |

[(1271bn - 1252bn)/1252bn] X 100 = 1.52% |

|

|

What are some of the difficulties in measuring GDP? |

Exclusion of real transactions: only items purchased and sold through the market are included. (e.g. For developed countries it includes childcare by nannies but not by house-husbands and wives) (e.g. for developing countries is does not include subsistence agriculture). Does not take into account the value of leisure. Does not take into account the underground economy (transactions hidden from tax collectors/government) (e.g. tax avoidance/evasion, breaking the law, etc). Does not take into account zero priced goods (e.g. a free software update on an old computer/free internet services). Difficult to account for inflation: making international comparisons in terms of GDP requires using real, rather than nominal, GDP figures. You need to use a GDP deflator to convert nominal to real GDP. |

|

|

How do we calculate real GDP without using a GDP deflator? |

Take the number of good A in year X and multiply it by the price of good A from the base year. Add all the goods and services together to get GDP. |

|

|

What is the GDP deflator? |

An index of prices for a basket of goods and services, used to put the output of year X into the prices of a base year. It gives us the change in nominal GDP from the base year that cannot be attributed to a change in real GDP. |

|

|

What is the difference between the GDP deflator and CPI? |

GDP deflator is all goods and services whilst CPI is just consumer goods and services. GDP deflator includes only domestic goods and nothing imported, whereas CPI includes imports purchased by consumers. |

|

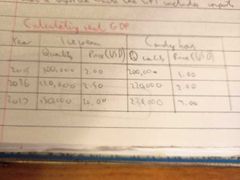

This economy produces only ice cream and candy. Using 2015 as a base year, calculate real GDP for 2015, 2016 and 2017. |

2015: 2(100,000) + 1(200,000) = $400,000 2016: 2(120,000) + 1(220,000) = $460,000 2017: 2(150,000) + 1(230,000) = $530,000 |

|

|

What is the equation for the GDP deflator? |

GDP deflator = (nominal GDP/real GDP) X 100 |

|

|

What is the equation for Real GDP, using the GDP deflator? |

Real GDP = (nominal GDP/GDP deflator) X 100 |

|

|

What is GDP per capita? And what is it often used to indicate? |

It is GDP divided by population. It is often used to estimate standard of living in a country. |

|

|

Why is GDP per capita not a perfect measure of standard of living in a country? |

It does not take into account levels of income inequality within a country. |

|

|

What are the causes of short run economic growth? |

An increase in AD (caused by any factors that increase C, I, G or (X-M) An increase in SRAS (caused by any factor that lowers costs of production) |

|

|

What causes long run economic growth? |

Any factor that increase LRAS will increase long run economic growth. (Quality of FoP, quantity of FoP, efficiency with which FoP are used). |

|

|

What are the benefits of economic growth. |

Higher incomes. Lowe levels of unemployment (firms sell more products as income rises, so require more workers to increase output to meet demand. Firms also have more profit which they can use to employ more workers). A higher standard of living (incomes rise and unemployment falls, so households can afford to purchase more goods and services including health and education). Increased government revenue (higher incomes and lower unemployment means more income tax revenue. Higher spending also means more VAT revenue. Governments can reduce their budget deficit or increase spending on things that will increase standard of living/reduce poverty). Higher levels of economic development (higher incomes mean households can spend more on health and education and more tax revenue means governments can spend more on infrastructure, health and education). Higher levels of FDI (due to higher relative growth rates. FDI may lead to increased exports and decreased unemployment). |

|

|

What are the costs of economic growth? |

Economic growth may not lead to higher standards big living because of... - increased pollution and environmental costs (because of higher levels of industry. This depends on environmental policies. Developed countries are more likely to spend on less polluting technologies). - inflation (demand may outstrip the productive capacity of the economy, leading to firms raising prices. Consumers will have a higher cost of living). - workers may need to work longer hours/commute further/have less leisure time - diseases of affluence such as obesity and diabetes. - increasing income inequality (the benefits of growth may go mostly to top-earners, meaning that quality of life increases will be smaller). - growth driven by substituting capital for labour may not decrease unemployment. - short run growth, which will not lead to higher output and incomes as it is not sustainable. (In fact, if it is financed by consumption there will be less savings which may lead to less investment and decreased growth in the future. This is the opportunity cost of short run growth). |

|

|

How should I evaluate economic growth? |

The effect of growth on living standards depends on what type of goods are made. (If more consumer goods and services are produced, living standards will rise. If more capital goods are produced, it may take longer for living standards to rise. If more demerit goods are produced, people may not feel better off). If growth is caused by substituting capital for labour, unemployment may increase. For living standards to rise, real GDP has to increase by more than population (so GDP per capita increases). If income is unequally distributed, only a small portion of the population may benefit from growth (depends on government policies to redistribute income). The more sustainable growth is, the more beneficial it is likely to be. |

|

|

What are the costs of a recession? |

Higher unemployment Falling real incomes Falling inflation/deflation (due to steep discounts offered by businesses on excess stock). Falling investment by firms (negative accelerator effect). Capital flight (FDI leaves the country). Low levels of consumer and business confidence. Increased inequality (because unemployment benefits are much lower than wages). More business failures. Reduced tax revenue+increased benefits payments lead to worsening budget deficit. Hysterisis (when an economy fails to return to its long run green growth after a recession, LRAS has shifted to the left. This is due to a loss of human capital during periods of unemployment, and s loss of investment (capital falls into disuse if firms close permanently and is not replaced). |

|

|

What are the three things you can always use to analyse GDP? |

Size Duration Cause |

|

|

What policies can you use to affect short term growth? |

Demand side (fiscal and monetary) policies. |

|

|

What policies can you use to affect long run growth? |

Supply side policies |

|

|

What is inflation? |

A sustained increase in the general price level over a period of time (leading to a fall in the purchasing power of money). |

|

|

What is deflation? |

A decrease in the general price level over a period of time. |

|

|

What is disinflation? |

A reduction in the rate of inflation (e.g. from 3% to 2%). Price level is still rising, but at a slower rate. |

|

|

What is hyperinflation? |

Very high and usually accelerating rates of inflation, rapidly eroding the value of the local currency. |

|

|

What is the general objective that governments have for inflation? |

Low, positive and stable inflation (price stability). |

|

|

What is the UK government's inflation target? |

2% (+/- 1%) using the CPI. |

|

|

What does inflation actually measure? |

The cost of living. Changes in the average cost of buying a basket of different goods and services for a typical household. |

|

|

What are the 2 measures of inflation that we use in the UK? |

RPI (Retail price index) CPI (Consumer price index) |

|

|

Which if these is the main official measure of inflation in the UK? |

CPI |

|

|

How do we calculate the CPI? |

1. The ONS uses the family expenditure survey to decide which goods and services are bought by a 'typical' British household. 2. Using the FES, the ONS will decide how to weight each category of goods and services, based on their importance to the household budget. 3. Use the formula (%price change X weight)/sum of all weights for each category, to find the weighted price change for each category. Add all the weighted price changes together to get the total index change for that year. 4. Use the formula [(Current year index - previous year index)/previous year index] × 100 to calculate the inflation rate using the change in the index. |

|

|

What is a base year? |

The first of a series of years in an economic or financial index, normally set to an arbitrary value of 100. |

|

|

What does the contribution a particular good or service makes to the the overall change in CPI depend on? |

The % change in its price It's relative weight/importance to the household budget. |

|

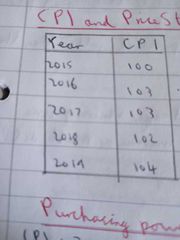

In this table: In which year were prices stable? In which year were prices highest? In which year was inflation highest? |

Prices were stable in 2017 Prices were highest in 2019 Inflation was highest in 2016 |

|

|

What is the formula to calculate the change in the purchasing power of money? |

(CPI in original year/CPI in target year) × 100 |

|

|

The CPI in 2000 was 181.3, the CPI in 2009 was 219.235. What was the change in the purchasing power of money? |

(CPI 2000/CPI 2009) × 100 (181.3/219.235) × 100 = 82.69% Purchasing power has fallen by 100 - 82.69 = 17.31% |

|

|

How would you calculate the equivalent amount of money after inflation? |

(CPI target year/CPI original year) × money amount |

|

|

How much was £500 in 2000 worth in 2009? |

(219.235/181.3) × 500 = £604.62 |

|

|

What are some of the difficulties in measuring inflation? |

The basket of goods and services may not be representative. (Because only a selection of goods and services are included and it is difficult to judge what is a typical household). New technology enters the market and makes it difficult to calculate a change in price. Doesn't take into account increasing quality (e.g. smartphones). Doesn't account for shrinkflation. Smoking errors Consumers may switch to cheaper products if prices rise to much, so the cost of living may not increase as much as CPI. |

|

|

What things are linked to RPI? |

Student loans Savings Treasury income and expenditure Taxes on fuel, alcohol and tobacco Private pensions Government debt repayments |

|

|

What things are linked to CPI? |

Benefits Inflation-linked bonds Inflation targeting Public pensions |

|

|

Why is using RPI better than CPI? |

Continuity, as data chat be compared if methods of measuring change. |

|

|

Why so CPI better than RPI? |

CPI is more accurate and less volatile. |

|

|

Which index is used for international comparisons? |

CPI |

|

|

Which groups does RPI exclude? |

Too wage earners (top 4%) and lower eating households. |

|

|

Why would switching to CPI save the treasury money? |

CPI is typically about 1% lower than RPI, so increases in pensions and benefits may be less so the treasury has to pay less. |

|

|

What was the purpose of the first cost of living measure in the UK? |

To help ordinary workers argue for fair cost of living wage rises. |

|

|

Why was CPI developed? |

To allow the EU to compare inflation rates across Europe to see who's as fiscally responsible enough to join the EU. |

|

|

What is the 'formula effect'? |

The difference between CPI and RPI due to them using different formulas. |

|

|

Why doesn't CPI include housing costs? |

Because no-one can agree how to include them. |

|

|

How does CPIH try to include housing costs? |

By calculating how much it would cost if you were to rent, rather than own, your property. |

|

|

What is a kitemark and why does CPIH not have one? |

A Kitemark is the UK statistics authority's seal of approval, but they disapprove of CPIH's method of measuring housing costs. |

|

|

What are the two possible types of causes for inflation? |

Demand side factors (leading to demand pull inflation) Supply side factors (leading to supply side inflation). |

|

|

When does supply side inflation occur? |

When cost increases force businesses to raise prices for consumers to maintain profit levels. |

|

|

Draw a diagram showing cost push inflation. |

|

|

|

What factors might cause cost push inflation? |

Anything that increases firms' factor costs, such as... An increase in raw material costs Interest rates rise Taxes rise (corporation tax, VAT)(the burden of an indirect tax rise may he passed onto the consumer with higher prices. Depends on PED)/subsidies fall Rents rise Rising labour costs (real wage increases greater than improvements in productivity. In times of 'tight' labour markets, workers have more power to demand higher wages). Falling exchange rates (increased prices of imported raw materials). Expectations (an initial rise in prices triggers higher pay claims as workers look to maintain real income and living standards. If workers anticipate inflation, they will demand higher wage increases which lead to more cost push inflation). (This is the wage price spiral). |

|

|

(Evaluation) what does the effect if cost push inflation depend on? |

If it is permanent or temporary (cost push factors like a lower exchange rate/decreased subsidies may prove temporary so central banks may tolerate a higher inflation rate if it is cost push). The size of the rise in costs of production. Whether workers continue to expect higher inflation in the future, leading to a wage price spiral (less likely to happen if central bank targets are credible, as workers will expect the target rate of inflation). The extent to which firms pass on higher costs of production to consumers. |

|

|

What causes demand pull inflation? |

An increase in AD, especially one that outstrips the productive capacity of the economy. |

|

|

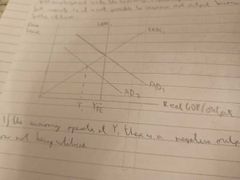

Draw a classical diagram showing demand pull inflation. |

|

|

|

What must governments make a trade-off between? |

(Inflation and economic growth) and employment |

|

|

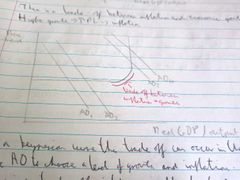

Draw a Keynesian curve showing the area where there is a trade off between inflation and unemployment/growth |

|

|

|

Why is there no trade off in the other sections of the curve? |

In the perfectly elastic section, growth can increase without price level increasing. In the perfectly inelastic section, price level can be decreased without growth decreasing. |

|

|

What can cause demand pull inflation? |

Any factor that causes AD to increase: Depreciating exchange rate (increased price of M decreases demand for M, decreased price of X increases demand for X). Expansionary fiscal policy Expansionary monetary policy Faster economic growth in other countries providing a boost to UK exports. |

|

|

What is monetary inflation? |

When the money supply in the economy is increased by households, firms and governments borrowing more money from banks to find extra spending. The extra money lent creates more demand and prices are driven up. |

|

|

What are the possible causes of deflation? |

A decrease in AD (usually through a fall in C) A fall in costs of production A fall in the money supply (this increases the value of money and so reduces prices. Not having enough money in circulation causes those with money to hold onto it instead of spending it as it's value increases). |

|

|

Which if these causes of inflation is the least harmful? |

A fall in costs of production. |

|

|

What are the costs of deflation? |

Falling asset prices. Lower consumer confidence leads to lower consumption and investment. Real cost of borrowing is higher. |

|

|

What are the benefits of low inflation? |

Managing expectations to avoid a wage price spiral. Avoiding problems of inflation/deflation. Real cost of borrowing higher. |

|

|

What are money or nominal wages? |

The amount workers earn in money terms. |

|

|

What are real wages/incomes? |

The amount workers earn when inflation is taken into account. |

|

|

% change in real wage = ? |

% change in nominal wage - inflation rate |

|

|

What are the consequences of inflation? |

Real incomes may fall Fall in the real value of savings Loss of consumer confidence Shoe leather costs Higher wage demands Increased income inequality UK becomes less internationally competitive Menu costs Producers lose business confidence |

|

|

Why does inflation lead to a fall in real incomes? |

Because the purchasing power of money has fallen, so the cost of living has increased. This means that consumers will not be able to afford the same goods and services as before and their standard of living has fallen. |

|

|

When might inflation not lead to a fall in real incomes? |

When nominal pay is increasing at a rate equal to or greater than inflation. |

|

|

What is the nominal interest rate? |

The interest rate without taking inflation into account. The interest rate listed on a loan, bond or savings account. |

|

|

What is the real interest rate? |

An interest rate that has been adjusted to remove the effects of inflation. This reflects the real cost of funds to the borrower and the real yield to the lender or investor. |

|

|

Real interest rate = ? |

Nominal interest rate - rate of inflation |

|

|

Why might inflation lead to a fall in the value of savings? |

Because nominal interest rates may be lower than the inflation rate, meaning that savings will be able to purchase less goods and services than before. |

|

|

Who might be more severely affected by a decrease in the value of their savings? |

People living off the savings (e.g. pensioners). |

|

|

When might inflation not lead to a fall in the real value of savings? |

When the nominal interest rate is higher than the inflation rate. |

|

|

Why might inflation lead to a fall in consumer confidence? |

Because unstable prices mean there is greater uncertainty for consumers about what they can and can't afford. This may lead consumers to bring forward purchases in order to avoid paying higher prices in the future. |

|

|

Why might inflation lead to shoe leather costs? |

Because consumers are less sure about prices in different parts of the market. This means it will take time and resources for consumers to gather information about prices due to rapid and frequent price changes. |

|

|

Why might inflation lead to higher wage demands for firms? |

Because workers will want to maintain their real wage. This will lead to more industrial disputes. This will lead to lower productivity. It may lead to a wage price spiral. It may also lead to increased costs for the government as an employer. |

|

|

Why might inflation lead to increased income inequality? |

Some nominal incomes will rise with inflation whilst others will see their real incomes fall. This depends on whether incomes are index-linked of fixed, on the strength of different trade unions and on wage premiums. |

|

|

Why might higher (relative) inflation lead to the UK becoming less internationally competitive? |

Higher domestic prices make exports more expensive in foreign markets so there is less demand for exports. Higher price level will also lead to increased demand for cheaper imported goods rather than domestic ones. This means the CAD will increase. |

|

|

Why will inflation lead to menu costs for firms? |

Because rapidly changing prices means firms have to adjust their price list more frequently. This means firms have additional costs of production. |

|

|

Why does inflation lead to producers losing busines confidence? |

There is increased uncertainty as firms are unsure of future prices and therefore unsure about their potential profit. This means firms will be more hesitant to invest so long run economic growth will fall. |

|

|

What does the effect of inflation depend on? |

Size (a higher inflation rate will be more problematic than a low one). Rate relative to other countries (a country with a low relative inflation rate may become more internationally competitive as prices increase). Duration (longer periods of inflation lead to less price stability). Causes of inflation (cost push inflation is more harmful as it is associated with a fall in output). |

|

|

What is a common result of hyperinflation? |

Prices rise so rapidly that money becomes worthless. |

|

|

What are the possible causes of hyperinflation? |

If a government can't raise money buy selling bonds (because of insufficient demand) and can't cover it's spending commitments through taxes, the central bank can print new money which the government then 'borrows into existence' and spends in the economy, increasing AD and inflation. Once high inflation is expected, consumers will bring forward their purchases, firms will raise prices and workers will demand higher wages. This causes prices to rise rapidly (hyperinflation). |

|

|

What are the consequences of hyperinflation? |

Similar to the consequences of inflation but much more severe. E.g. a fall in real incomes leads to consumers being unable to afford necessities such as food and medicine. |

|

|

What policies will reduce demand pull inflation? |

Contractionary fiscal (increased taxes and lower spending) and monetary (increased interest rates) policy. |

|

|

What policies will a government adopt to deal with high cost push inflation? |

Trying to tackle the cause of rising costs of production. |

|

|

What type of inflation will supply side policies help decrease? |

Both types (as the productive capacity of the economy will increase). |

|

|

What is the effect of inflation targeting? |

People expect inflation to be low and stable, so they will act in a way that causes inflation to be low and stable. (E.g. consumers will not bring forward their purchases, workers may accept lower wages). This may prevent a wage price spiral. It also makes central banks and governments more accountable. |

|

|

What are the consequences of deflation? |

Reduction in consumer spending. The real value of debts increase Real cost if borrowing increases Lower profits. Real wage unemployment Deflationary spiral |

|

|

Why might deflation lead to a reduction in consumer spending? |

Because consumers expect prices to fall further in the future. This means they hold onto their money and delay purchases (particularly if big ticket items). This leads to further falls in consumer spending and thus AD. |

|

|

Why doe deflation lead to an increase in the real value of debts? |

The amount of goods and services which can be purchased with the value of the debt has increased. This means that there is a fall in consumer confidence and consumer spending, since consumers with debts will spend more in real terms paying there debts, which can lead to further falls in AD. |

|

|

Why does deflation lead to an increase in the real cost of borrowing? |

As real interest rates rise above nominal rates, borrowers would find the real value of their debt repayments increases. This means firms and consumers are more reluctant to take on new debts, thus there is a decrease in investment and consumer spending leading to lower short and long run economic growth. |

|

|

Why does deflation lead to lower profits for firms? |

Because profits are squeezed as prices fall. This means that, unless costs fall faster than prices, unemployment may rise as firms try to reduce their costs by reducing the size of their workforce. This also leads to a fall in investment and therefore long run economic growth. |

|

|

Why does deflation lead to real wage unemployment? |

Because labour markets often exhibit 'sticky downwards wages' as workers resist nominal wage cuts. This means that in periods of deflation, real wages rise. This leads to higher costs of production for firms. This leads to higher unemployment. |

|

|

Why might deflation lead to a deflationary spiral? |

Because consumers may delay their purchases and firms may postpone their investment in expectation that Rockies will be lower in the future. The reduction in AD may lower prices and result in output declining even more. Such deflation can reduce consumer and business confidence, which can reduce the effectiveness of any government policy measures designed to increase economic activity. |

|

|

What is stagflation? |

A condition of slow economic growth and relitavely high unemployment - economic stagnation - accompanied by rising prices or inflation. |

|

|

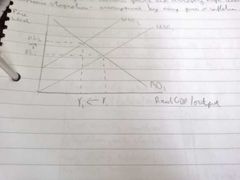

Draw a diagram of stagflation. |

|

|

|

Define the unemployed? |

That part of the labour force that are out of work and actively seeking employment at the current wage rate. |

|

|

What is underemployment? |

When people who have a job would prefer to work longer hours or have a job below their skillset. |

|

|

What 4 groups make up the population of a country? |

Population not of working age (younger than 18/older than 64) Economically inactive (stay at home parents, students, early retirees, disabled, discouraged workers) The unemployed The employed |

|

|

Of those groups, which 2 make up the working age population? |

Economically inactive Unemployed Employed |

|

|

Which groups make up the labour force? |

Unemployed Employed |

|

|

What is the formula for the participation rate? |

Labour force/working age population |

|

|

What is the formula for the inactivity rate? |

(economically inactive + unemployed)/population of working age |

|

|

What is the formula for the unemployment rate? |

Unemployed/labour force |

|

|

What is the governments objective for unemployment? |

Low and stable unemployment |

|

|

What is full employment? |

Yfe When an economy is operating at an output considered to be at full capacity. It is not possible to increase real output because all resources are fully utilised. |

|

Is the unemployment rate at Yfe zero? |

No, because some workers will always be between jobs, or may not have the right skills for the job available. |

|

|

What will happen if an economy has an unemployment rate between the rate of full employment? |

Inflation will increase. |

|

|

What is the labour force? |

All people who are willing and able to work. It represents the economic resource of labour. Increasing the size of the labour force increase the quantity of labour which increases productive capacity and LRAS. |

|

|

What are the two main methods of measuring unemployment in the UK? |

The labour force survey (generated from a quarterly survey of approximately 60,000 households. The claimant count - the number of people claiming JSA (job seekers allowance). |

|

|

Which measure can be used for international comparisons? |

The labour force survey, because it is based on international standards from the ILO (International labour organisation). |

|

|

What are some difficulties with measuring unemployment? |

Both methods underestimate unemployment, because: - they don't include part time workers who would like full time work of people with jobs below their skill level (underemployment). - some of the unemployed are moved from unemployment to disability benefits (areas of the country with high unemployment also tend to have high disability rates). |

|

|

Which method will generate a higher figure? |

The labour force survey, because there will be unemployed workers who do not claim JSA. |

|

|

What are some of the causes of unemployment? |

Cyclical/demand deficient unemployment. Frictional unemployment. Seasonal unemployment Structural unemployment (including international unemployment, technological unemployment and regional unemployment). Real wage/classical unemployment. Voluntary unemployment. |

|

|

What causes cyclical/demand deficient unemployment? |

Low levels of AD in the economy during a recession leads to reduced demand for labour. This occurs when there is a negative output gap. |

|

|

What do the solution to demand deficient unemployment? |

Governments boosting the level of AD in the economy using expansionary fiscal or monetary policy. |

|

|

What is frictional unemployment? |

It occurs when people are 'between jobs', and will exist even if the economy is at full employment. |

|

|

How can governments help decrease frictional unemployment? |

Improving information for employers with vacancies and job applicants (e..g job centres). |

|

|

What is seasonal unemployment? |

Caused by the seasonal variation of demand in certain industries or sectors of the economy (e.g. construction, tourism and agriculture). It is included in full employment. |

|

|

What are some solutions to seasonal employment? |

Industries affected can be encouraged to diversify their products so as to attract demand throughout the year (e.g. tourism venues competing for income from the conference market). Employees in the affected sectors can be encourage to retrain to compete for jobs in sectors unaffected by seasonal variations of demand. |

|

|

What is structural unemployment? |

Caused by changes in the structure of the economy over time (e.g. decline of UK manufacturing sector). Due to labour immobility this can result in high levels of unemployment in regions where the old industries were located. This causes workers to have to retrain or relocate. It occurs when the economy is at full employment. Cyclical unemployment can lead to structural unemployment if industries leave the country or close down due to a recession. |

|

|

What can the government do to decrease structural unemployment? |

Provide subsidies to employers in regions with high levels of unemployment. Improve labour mobility (occupational and geographical). Governments need to help workers retrain so that the skills they have match what employers want. Note: expansionary policy can't decrease structural unemployment. If that's all that's left it will only generate inflation. |

|

|

What are the different types of structural unemployment? |

International unemployment Technical unemployment Regional unemployment |

|

|

What is international unemployment? |

Where domestic producers are replaced by firms based overseas, due to the UK being seen as uncompetitive in terms of price and/or product quality. This is included in full employment. |

|

|

How might the government decrease international unemployment? |

Using protectionist policies (e.g. tariffs, quotas, subsidies, exchange rate manipulation). |

|

|

What is technological unemployment? |

Firms substituting capital for unskilled or semi-skilled labour. E.g. the car industry. This type of unemployment is included in full employment. |

|

|

How might the government decrease technological unemployment? |

Workers affected by technological unemployment must retrain to seek new jobs. |

|

|

What is regional unemployment? |

Where there are high levels of unemployment located in specific areas. This type of unemployment tends to exist in areas which were previously home to a concentration of industries that have declines as the economy has changed. If a region loses a key industry it can become a depressed area with higher unemployment than the national average. As people leave the area, more businesses close and house prices fall. This kind of unemployment is included in full employment. |

|

|

What can the government do to decrease regional unemployment? |

Offer regional aid, including incentives for new industry to relocate to the area. |

|

|

What is real wage unemployment? |

Occurs when wages are artificially set above the equilibrium level causing the supply of labour to be greater than the demand. E.g. minimum wage, trade unions. This is included in full employment. |

|

|

What is voluntary unemployment? |

When workers choose not to work at the current equilibrium wage rate. This may occur if unemployed workers choose not to accept a job because they are waiting for a better off. These workers may be unemployed due to any of the other causes of unemployment. Voluntary unemployment is thus included in full employment. |

|

|

What are some solutions to voluntary unemployment? |

Decrease benefit payments relative to minimum wage (reduce unemployment trap). Reduce benefit payments if people refuse to accept job offers. Make working more attractive by allowing low paid worker to keep more do their income e.g. working families tax credit, minimum wages personal allowance. |

|

|

What are the economic costs of unemployment to individuals? |

Loss of income to the individual. Loss of employability skills (loss of human capital). |

|

|

What are the economic costs of unemployment to the economy as a whole? |

Higher unemployment benefits and other income related benefits. Loss of tax revenue (indirect and direct). Foregone output. |

|

|

What are the benefits of unemployment? |

It is easier for firms who want to expand to employ new workers without pushing wages up. Unemployment may discourage industrial action (e.g. strikes and calls for higher wages). More time for unemployed workers to search for a more rewarding job. Note: it is generally accepted that the costs of unemployment above a really low level outweigh any possible benefits. |

|

|

How can you evaluate unemployment? |

Size: the higher the rate of unemployment the greater the costs are likely to be. Duration: if unemployment is sustained over a long period this may lead to falls in human capital (hysterisis). Cause: structural unemployment tends to have the highest costs as it tends to be on a large scale and result in high levels of involuntary unemployment, leading to large social impacts. Structural unemployment will be quite costly, especially if it lasts a long time. Frictional unemployment has quite low costs. The costs of unemployment are likely to be less if the labour force is quite occupationally and geographically mobile. The costs of unemployment may not be born evenly, but by particular regions or age groups. |