![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

53 Cards in this Set

- Front

- Back

|

It is more usually regarded as an incorporated association which has a legal identity distinct from its owners and those who participate in its activities. |

Company |

|

|

It is `the relation which subsists between persons carrying on a business in common with a view of profit'. |

Partnership |

|

|

It is required to form or expand the long-term capital of the firm. It will be used to purchase fixed assets such as buildings, plant, and equipment, the durable (fixed) assets of the firm. |

Long-term finance |

|

|

It is a company limited by shares or limited by guarantee and having a share capital, being a company. |

Public company |

|

|

This is the simplest form of business unit or firm. As the title implies, the owner of the firm is the firm, at least from the legal viewpoint. |

Single-person enterprise |

|

|

It has a par, face or nominal value which represents the ownership contribution of each share. |

Shares |

|

|

It is `characterized by oligopolistic partners', which suggests particular features of the organizations involved and their behaviour, especially due to their market power. |

Joint ventures |

|

|

(also called abnormal, monopoly or excess) profit is profit earned in excess of normal profit and may be a short-period or long period situation depending upon the type of competition prevailing. |

Supernormal profit |

|

|

These are fixed-interest securities which are issued by a company in return for a long-term loan. |

Debentures |

|

|

It is classified into three types by time period of the requirement; short, medium, and long. |

Capital |

|

|

It is that level of surplus of income over expenditure which accrues to the entrepreneur over the long period and is the minimum return required to retain the investment in that use. |

Normal profit |

|

|

It is profit retained within the firm instead of being distributed to the owners |

Retained earnings |

|

|

It is a bookkeeping and costing exercise by which the initial cost of an asset is written off over its useful life, i.e. the value of the asset is reduced by a predetermined amount each year. |

Depreciation |

|

|

It is the granting of ownership of commodities prior to payment for them. |

Credit |

|

|

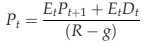

FORMULA:Current price of a share |

|

|

|

It is the most indeterminate of the three categories, being regarded by some as akin to short-term and by others as akin to long-term capital. |

Medium-term capital |

|

|

This is a procedure in which a specialist organization buys the debt owed to the firm at a discount, thereby providing the firm with short-term capital and reduced risk. |

Debt factoring |

|

|

It is a persistent raising of the price level in an economy relative to money incomes |

Inflation |

|

|

It is this type of capital which is required for day-to-day activities. |

Short-term capital |

|

|

It is, primarily, a market where various securities (e.g. government stocks, shares, debentures) are bought and sold. |

Stock exchange |

|

|

It is influential upon the cost of capital by two means: first, through the system of corporation tax and, second, through income tax levied on individuals in respect of both earned and, more importantly in this context, unearned income. |

Taxation |

|

|

It is a process whereby a customer of a commercial bank is permitted to overdraw on that account (to draw in excess of any positive balance) up to an agreed limit for a prescribed period. |

Bank overdrafts |

|

|

It is the return (average over a period or at a particular time) on the investment compared with its purchase price. |

Yield |

|

|

It is a reduction in the price to be paid for a commodity, usually applicable if payment is made by the purchaser within a prescribed period from date of invoice or date of delivery (cash discount) or applicable because the purchaser is a business within a particular trade (trade discount) |

Discount |

|

|

These are considered to be those costs which must be borne even if there is no output from the firm. They are fixed costs. |

Overheads |

|

|

It considers the cost of the requisite capital from the possible sources and is, obviously, likely to produce a cost in excess of the firm's average cost of capital due, inter alia, to the additional risks likely to be involved. |

Marginal cost of capital |

|

|

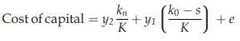

FORMULA:Equity capital (rights issues) |

|

|

|

It includes all those who supervise the production work but do not actually execute the work themselves. |

Line management |

|

|

This may be considered to be providing the greatest possible return to the owner's investments in the firm. |

Optimum capital structure |

|

|

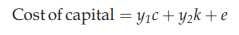

FORMULA:Cost of capital (new issues) |

|

|

|

These are costs are those which vary proportionally with output, whereas indirect costs are independent of the level of output (at least, in the short period). |

Direct costs |

|

|

It is concerned with two quite distinct areas: costs and revenues. |

Budgeting |

|

|

It is the ratio of (fixed interest) debt finance to equity finance (owners' stake in the firm). |

Gearing |

|

|

It is a measure of the utility of the item(s). |

Value |

|

|

It is an estimate of the costs and incomes to be generated if a proposed project is undertaken. |

Budget |

|

|

It may be viewed as being the opposite of security, higher risks being less secure. |

Risk |

|

|

These are useful to indicate how costs vary over different levels of output, and between different types of project. |

Cost patterns |

|

|

It is gross profit minus depreciation and interest on loans. |

Net profit |

|

|

It is net profit minus tax payable upon that profit and, thus, represents the earnings available as a surplus, which may be used as a source of capital or may be distributed among the owners of the firm. |

Profit after tax |

|

|

Its used depends primarily upon the nature of the production system, but the aim of any costing system is cost control which is achieved by recording the costs actually incurred, comparing those costs with a predetermined standard, and taking any necessary corrective action. |

Systems of costing |

|

|

It calculates the period required for the incremental net cash inflows generated by the investment to amount in total to the initial incremental capital outlay. |

Payback method |

|

|

It is total sales revenue minus production and sales expenses. |

Gross profit |

|

|

This is the simplest costing system whereby the overall cost of a completed project is compared with the revenue generated to determine whether the project achieved the required level of profit. |

Overall historic costing |

|

|

They will use budgeting techniques in respect of their own activities which, although often similar in their underlying principles to those used in the construction industry, will be adapted to the clients' requirements. |

Clients |

|

|

They are the architect, PQS, structural engineers, and services engineers ± are usually employed under standard contracts (conditions of engagement/appointment, produced by the appropriate professional institution) with the client. |

Consultants |

|

|

This is a similar process to the overall historic costing described above, but is carried out for each project at predetermined intervals (often monthly). |

Periodic historic costing |

|

|

It is a system whereby costs are predetermined and subsequently compared with actual costs achieved to facilitate control. |

Standard costing |

|

|

This system is most suited to production in which a unit of output may be readily identified throughout the production process so that all costs attributable to the production of that unit may be allocated to it. |

Job and unit costing |

|

|

It is the normal basis for price calculation and may be classified in several ways but, whatever classification is used, the cost elements remain, each being worthy of separate attention. |

Predicted costs |

|

|

It is probably the primary objective of any business enterprise. |

Survival |

|

|

It is a sensitivity analysis technique to aid decision making where a spectrum of investments is being considered. |

Breakeven analysis |

|

|

It is a technique which takes the time-value of money into account and may be considered to operate as a reversal (or perhaps more accurately a reciprocal) of compound interest. |

Discounting |

|

|

It is a final stage in investment appraisal. It examines the effects of changes in the variables. |

Sensitivity analysis |