![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

255 Cards in this Set

- Front

- Back

Definitions: Basketball Related Income (BRI) |

The aggregate operating revenues of the NBA, NBA-controlled entities, and all NBA teams.

Note: This is a very broad overview. There are about 10 pages of nuance to what BRI is. |

|

Definitions: Projected BRI

VII(1)(c) |

1. NBAPA and NBA try to agree on Projected BRI prior to the end of the moratorium period.

2. If they can't agree, Projected BRI is the sum of: -For all income that isn't national broadcast rights (i.e. ticket sales, local broadcast, sponsors, etc), Projected BRI is 104.5% of previous year's BRI from those sources. -For national TV contracts, the amount of the contract that corresponds to that Salary Cap Year. -Revenue sharing payments for that Salary Cap Year (See VII(1)(a)(8) --Value of air time provided to NBA by broadcast partners used to promote the WNBA or any other purpose not listed in VII(1)(a)(1)(ii)(A-D) -Contingent payments for that Salary Cap Year |

|

Definitions: Local Expansion Team BRI

VII(1)(d) |

BRI of an Expansion Team in it's first and second seasons not attributable to league-wide sources. E.g., ticket revenue is part of it, national broadcast contract isn't.

|

|

Definitions: Projected Local Expansion Team BRI

VII(1)(e) |

104.5% of Local Expansion Team BRI for the preceding season.

|

|

Definitions: Interim Projected BRI

VII(1)(f) |

A projection of BRI for a salary cap year using Estimated BRI for the previous year because BRI isn't available yet.

|

|

"Estimated" Total Salaries/Total Benefits/BRI

VII(1)(h-k) |

All calculated using the Interim Audit Report.

Note: See Section 10, Interim Audit Report is provided by the Accountants if the Final Audit Report isn't available yet at the end of the Moratorium Period |

|

Calculation of Salary Cap

VII(2)(a)(1) |

44.74% of Projected BRI for the upcoming Salary Cap Year, less Projected Benefits, divided by # of teams (except expansion teams in their first 2 years). |

|

What happens if the final audit report isn't ready at the end of the moratorium period and players/NBA don't agree on the next year's cap?

VII(2)(a)(4) |

Projected BRI/benefits/etc are used to calculate the cap.

|

|

Minimum Team Salary |

90% of the Salary Cap. $52.81 million for 2013-14, as calculated as of the team's last regular season game. |

|

Salary Cap for 2014-15

|

$70 million |

|

What happens when team does not meet the minimum salary? |

The NBA forces the team to make payments equal to the shortfall to the players on that team, to be disbursed pro rata or by some other formula reasonably determined by the NBAPA. |

|

Expansion Team Salary Caps and Minimum Team Salaries

VII(2)(c) |

1st Year: 66.2/3 % of the regular salary cap, minimum salary 90% of that.

2nd Year: 80% of regular salary cap, minimum salary 90% of that. |

|

Designated Share

VII(12)(b)(3) |

Amount of BRI that the players get. Default is that it's 50% of BRI, but has to fall within 49-51% of BRI. Whether it's higher or lower than 50% depends depends on whether BRI exceeds (higher) or is less than (lower) projected BRI.

|

|

Designated Share: If actual BRI exceeds Projected BRI

VII(12)(b)(3) |

Designated Share = 50% of forecast BRI plus 60.5% of (actual BRI minus Projected BRI). But designated share cannot exceed 51% of actual BRI, no matter how much higher actual BRI is than projected BRI.

|

|

Designated Share: If actual BRI is lower than Projected BRI

VII(12)(b)(3) |

Designated Share = 50% of forecast BRI minus 60.5% of (Projected BRI minus actual BRI). But designated share cannot be lower than 49% of actual BRI, no matter how much lower BRI is than Projected BRI.

|

|

What happens to Salary Cap if Total Salaries and Benefits are less than the Designated Share?

VII(2)(d)(1) |

Salary Cap for the next year is increased by the amount of the shortfall divided by the number of Teams in the NBA during the next year.

Note: Number of teams does not include Expansion Teams in first 2 years. |

|

Overage

VII(12)(a)(14) |

The amount that Total Salaries and Benefits exceeds the Designated Share, if applicable.

|

|

What happens to the next season's Salary Cap if there is an Overage the previous year?

VII(2)(d)(2) |

1. If Overage is 6% or less or Total Salaries and Benefits, nothing changes.

2. If Overage is over 6%, then the cap is reduced. (See next card.) |

|

Formula for Reduction of Salary Cap in event of an Overage exceeding 6%

VII(2)(d)(2)(ii) |

1. If Projected BRI for the next year is not more than 8% higher than actual BRI the previous year, OR if the Overage is more than 9%, then salary cap determined as follows:

Subtract six percent (6%) of Total Salaries and Benefits from the Overage, then divide by number of teams in the NBA. The Salary Cap for the next year is then reduced by that amount. 2. If Projected BRI exceeds previous year's BRI by more than 8% AND the Overage is not higher than 9% of Total Salaries and Benefits, then use following formula: (Overage - 6% of Total Salaries and Benefits) - ((Projected BRI - Previous BRI) - (8% of Previous BRI)) x 44.74%. If result is < 0, no adjustment to cap. If result is > 0, then divide by # of NBA teams. Cap is reduced by this amount. Purpose is to even out the Overage the next year by reducing the Cap. |

|

If an Interim Audit report must be used to calculate the cap, effect on the Salary Cap of a difference between Interim and Final Audit report

|

If the next year's salary cap is based on an Interim Audit Report, and the Audit report changes BRI and Total Salaries and Benefits so that the Salary Cap would have been changed, then the amount of the change is debited or credited from the Cap for the subsequent year.

Note: If it's the last year of the CBA, then the difference is applied to the then-current Salary Cap Year with interest from the date of the Interim Audit Report |

|

Timing and method of payment if Total Salaries and Benefits are less than the Designated Share.

VII(2)(e) |

Difference is paid to players within 30 days following the completion of the Audit Report.

Payment gets distributed to all players who were on an NBA roster during the year, on a proportional basis determined by the NBAPA. NBAPA has to provide the league with its proposed distribution within 30 days after the completion of the Audit Report |

|

Determination of Salary: Deferred Compensation General Rule

VII(3)(a) |

Contracts with deferred compensation must specify the Season(s) in which it is earned. That compensation is included in the player's Salary for that Cap Year.

|

|

Over 36 Contract

VII(3)(a)(2) |

Generally applies to contracts 4 or more years, one of which encompasses a season which starts after the player turns 36.

For purposes of this rule, the season is considered to start October 1, so the question is whether the player turns 36 before October 1 of that season. Note: See exceptions. |

|

Zero Year

VII(3)(a)(2)(vi) |

Under the Over 36 rule, a year of salary that is either the 4th or 5th year of a contract to be paid after the player turns 36. This salary is treated as deferred salary, and therefore accelerated onto the years of the contract before the player turns 36.

Only seasons 4 and 5 of a contract that take place when a player is 36 or older can be Zero Years. |

|

Purpose of Over 36 Rule

VII(3)(a)(2) |

To prevent older players from signing at a lower salary for more years, then collecting salary after they have retired and effectively inflating their salary while they're actually playing. More of an issue under the old CBAs where there were longer contracts.

By accelerating the years 4 and 5 salary onto the first 3 years, the league effectively prevents those players from earning any more money than they could have under a 3 year contract, so there is no reason to do a contract longer than 3 years. |

|

Exceptions to Over 36 Rule

VII(3)(a)(2)(ii, iv) |

Note: With Qualifying Veteran Free Agents, exceptions only apply if they re-sign with their old team.

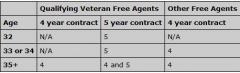

Chart via Larry Coon, CBAFAQ.com Exception 1: If a Qualifying Veteran Free Agent is re-signed by his prior team to 4 year deal and is 33 or 34, Over 36 rule doesn't apply. Exception 2: 33 or 34 year old Qualifying Veteran Free Agents who sign 5 year deals with Prior Team. Only the 5th year is a zero year--according to general language of the rule the 4th and 5th years would be. |

|

Allocation of Zero Years' Salary to each of first 3 years of contract under over 36 rule

VII(3)(a)(2)(I) |

Zero years are allocated pro rata to each of first 3 years based on salary for those years.

Example: player signs 4 year, 21 million contract. Salaries starting in year 1 are $4.5, $5.0, $5.5, $6 million. The 6 million gets allocated over the first 4 years in proportion to the salaries for those years. So, $4.5 million is 30% of the salary for first 3 years, so 30% of the $6 million year 4 salary is allocated to year 1, i.e. $1.8 million. $2 million allocated to year 2, $2.2 million allocated to year 3. |

|

What is player's Salary attributable to each year as the Over 36 contract continues?

VII(3)(a)(2)(iii) |

After the first year of an Over-36 contract, the player's Salary for thta year is determined by taking the next 3 years of the contract and averaging them.

Note: Assuming player has not been waived. This basically has the effect as they go along of shifting salary back onto the Zero Year(s), so the player's cap hit goes down each year. Example: Player signs 4/$24 million Over 36 contract paying $6 million each year. Original cap hit for first 3 years is $8 million per year ($6 million for last year shifted onto first 3 years). But after first year, you take the average of the next 3 years as the cap hit. So the remaining salary to be paid $18 million, spread over 3 years is $6 million. So cap hit goes down after first year. |

|

Special exceptions for calculating a player's age:

VII(3)(a)(2)(ii, vii) |

1. MORATORIUM BIRTHDAY: If player's birthday is during the Moratorium period, and he signs a contract by the fifth day after the Moratorium period, then he's treated as if his birthday hasn't happened yet. E.g. player turns 34 during the Moratorium period and signs a 5 year deal immediately after, he's still treated as if he's 33.

2. Qualifying Veteran Free Agent 32 YEAR OLDS who enter into an Over 36 Contract prior to October 1, but who turn 33 before October 1 ("start of season under Over 36 Rule") are considered to be 33 at the time he enters into the contract. NOTE: I don't think this makes a difference anymore b/c rules for 32 and 33 year old Qualifying Veteran Free Agents are the same with shorter contracts under new CBA. |

|

Effect of new CBA contract length on Over 36 rule

VII(3)(a)(2 |

Doesn't matter as much now because the only way there can be more than 1 Zero Year on a contract is if a 35 y/o Qualifying Veteran Free Agent signs a 5 year deal w/ his new team.

|

|

What constitutes a signing bonus?

VII(3)(b)(1) |

1. Regular signing bonus, earned upon signing of the contract.

2. Trade kicker bonus. 3. Payments in excess of the Excluded International Player Payment (buyouts to international teams) |

|

How do signing bonuses count against the cap?

VII(3)(b)(2) |

General rule: Signing bonuses are spread over the guaranteed years of the contract in proportion to the guaranteed base compensation earned in those years.

Other rules: 1. If contract contains an ETO, bonus is only spread over years before the ETO. 2. If contract is totally nonguaranteed, or not guaranteed beyond that year, then the signing bonus is allocated to the year in which it is earned. (Note: This would be the year player is traded in the case of a trade bonus.) Note: If a year is only partially guaranteed, then only the guaranteed amount counts for allocation purposes. E.g., 2 year $2 million contract, $1 million guaranteed first year and $250k guaranteed second year. 80% of signing bonus allocated to year 1. |

|

Exception to proration rule: Signing bonuses for extensions by teams under the cap

VII(3)(b)(3) |

Teams under the cap may pay signing bonuses on extension prior to the first day of the first year covered by the extension. How this gets allocated depends on whether the current contract and extension are guaranteed or not.

Note: Such an extension counts as a Renegotiation, and is subject to such rules. See VII(7). |

|

Signing bonuses for extensions by under the cap team: Allocation If current contract and extension are both nonguaranteed

VII(3)(b)(ii)(A) |

All of the signing bonus from the extension is allocated to the current salary cap year (the one before the extension even kicks in)

|

|

Signing bonuses for extensions by under the cap team: Allocation If either current contract or extension are guaranteed.

VII(3)(b)(ii)(A) |

Allocated in the normal fashion, proportionate to the base compensation over the guaranteed years.

|

|

Payment of signing bonuses on extensions for teams that are over the cap

VII(3)(b)(ii)(A) |

Bonus can't be paid any sooner than the first day of the first Cap Year covered by the extension. Bonus is allocated in proportion to the base compensation over the guaranteed years of the contract.

|

|

Cap charge for interest on a loan to a player

VII(3)(c)(1) |

If the loan has a lower interest rate than the Target Rate, then the difference between the loan interest rate and the Target Rate is imputed on the remaining balance of the loan and added to the player's cap charge.

|

|

Definition of Target Rate

VII(3)(c)(1) |

Prime rate +1%. Prime rate is that reported in WSJ "Money Rates" column.

Exception: Target rate must be between 7% and 9%. |

|

Maximum amount of loan made to a player per year

VII(3)(c)(2) |

No loan (along with any other outstanding loans) can exceed the amount of the player's guaranteed Salary for that Salary Cap year.

E.g., if a player's salary is $1 million per year guaranteed, the loan amount cannot exceed $1 million, even if he has more guaranteed money remaining on his contract. |

|

What is the method for repaying loans to players?

VII(3)(c)(2) |

Must be repaid from future guaranteed salary in equal annual amounts.

Note: Does not include salary due after an ETO. Example: Player has a 5 year/$5 million contract all guaranteed. He gets his max loan of $1 million before the first season. $200,000 per year is then taken out of his pay for each year of his contract to repay the loan. If he has an ETO after the 4th year, or the 5th year is nonguaranteed, then $250,000 per year has to be taken out to repay the loan. |

|

Reduction in maximum loan amount if part of guaranteed salary already paid that season

VII(3)(c)(2) |

If the amount of a player's remaining guaranteed salary for that season is less than the Annual Allocable Repayment Amount (i.e., amount to be taken out of player's salary per season as repayment), then the Maximum loan amount is reduced by the difference.

Example: Player has 5 year/$5 million fully guaranteed contract. Gets a loan in year one with only $100k guaranteed left to be paid that year. Normally maximum loan is $1 million b/c that's how much he makes that year. But, because the $100k remaining is less than the annual allocable amount of $200k ($1 million/5 years on contract), then the $100k difference between the two is subtracted from the max loan amount. So max loan amount is $900k. |

|

Annual allocable repayment amount

VII(3)(c)(2) |

The amount of a player loan to be repaid each year out of his future salary. Calculated by taking loan amount divided by number of years with guaranteed money remaining.

So 5 year, $5 million contract. Max loan is $1 million, annual allocable repayment amount is $200k per year. |

|

Maximum annual allocable repayment amount.

VII(3)(c)(2) |

The annual allocable repayment amount on the maximum possible loan the player could get (which is determined by his guaranteed salary in a given year.)

|

|

Loans made to minimum salaried players.

VII(3)(c)(3) |

Are not allowed.

|

|

Forgiveness of loans to players

VII(3)(c)(4) |

This is deemed a Renegotiation for the cap year in which it occurs, subjecting it to the rules governing Renegotiations in VII(7)

|

|

General rule of whether incentives (aka Performance Bonuses) are included in a player's salary cap charge

VII(4)(d)(1) |

They are included if the player or team's performance the preceding year would have triggered them.

|

|

If NBAPA or the team believes the performance the year before doesn't accurately predict the likelihood of earning a performance bonus

VII(4)(d)(1) |

Either can request that a jointly selected basketball expert determine whether it is very likely the bonus wlil be earned.

Note: NBA will want to say bonus is likely, because a bonus included in Salary but not actually earned reduces the amount they have to pay out. NBAPA has the opposite incentive. It wants a player's cap charge to be lowered so other players can get that money. |

|

Procedure for Expert determining whether bonus is very likely to be earned

VII(4)(d)(12) |

1. Expert conducts a hearing within 5 business days, and renders a determination within 5 business days after that.

2. Party initiating the proceeding has the burden of proof. 3. To uphold challenge, Expert must find that player is very unlikely to earn bonus (NBAPA challenge) or very likely to earn bonus (NBA challenge). 4. No party can mention whether the bonus would or wouldn't be included under the default rule. 5. Expert's opinion is unappealable. 6. Costs of Expert borne equally by the parties. |

|

Procedure when default likely/unlikely status can't be calculated b/c player is a rookie, didn't play last year, or is acquired by an Expansion Team

VII(4)(d)(3) |

NBAPA and NBA try to agree on whether bonus is likely to be earned. If there is no agreement, an Expert conducts a hearing on whether bonus is likely or unlikely to be earned.

Note the difference in standard of proof from the normal challenge where the player did play last year. Expert determines whether bonus is likely or unlikely to be earned, not VERY likely or unlikely to be earned. And there's no burden of proof because no side is bringing the challenge. Note: For player acquired by Expansion Team, this procedure only applies to incentives based on team performance. Note: Team-based performance incentives is a very good reason players don't want to be traded to a bad team. |

|

How is team salary affected while the Expert hearing procedure is occurring?

VII(4)(d)(4) |

Full amount of any disputed bonuses are included in team salary until Expert makes a decision.

|

|

Procedure if the NBAPA and the NBA can't agree on an Expert?

VII(4)(d)(5) |

Challenge may be filed with the Grievance Arbitrator. (See Article XXXI Sections 2 through 7 and 15)

|

|

Inclusion of incentives based on physical condition, academic achievement, or extra promotional appearances in Team Salary

VII(4)(d)(6) |

All are automatically included in Salary

|

|

Definition of Excluded International Player Payment Amounts

VII(4)(e)(1-2) |

Amount that NBA teams can pay as a buyout to international teams that doesn't count against the salary cap. $575,000 for 2013-14 year and goes up $25k each year.

|

|

How do buyouts in excess of the Excluded International Player Payment Amounts count against the cap?

VII(4)(e)(1) |

They count as Salary (in the form of a signing bonus) to the player.

|

|

Timing of Excluded International Player Payment Amount payments

VII(4)(e)(3) |

1. Can be paid in single or multiple installments. |

|

How much do minimum salary contracts count against the cap?

VII(4)(f) |

Cap charge for minimum salary is lesser of 1) minimum salary or 2) portion of minimum salary that is not reimbursed out of the league-wide benefits fund. (See IV(6)(k)(2))

Note: This is why teams want to do one-year minimum salary contracts rather than extending it past one year, so they can reduce the salary cap charge if part of the minimum contract is paid through the fund. |

|

Calculation of Salary for Restricted Free Agents with 1-2 years of service who sign an offer sheet including maximum amount (MLE) in years 1 and 2 of offer sheet.

VII(4)(h) |

Their salary is deemed to be the average of the contract over all the years of the deal if the offer sheet is not matched.

So, 3 year max offer sheet to 1-2 year restricted free agent is MLE for first 2 years, then maximum salary the third (and potentially fourth) years. If Prior Team doesn't match, cap hit is average of all the years of the contract. If Prior Team does match, cap hit is equal to amounts actually paid each year, i.e. it goes up to the max after 2 years. Note: This is the Omer Asik/Jeremy Lin situation from summer 2012. |

|

Calculation of Salary for contracts that predate 2011 CBA

VII(4)(i) |

It is still calculated under the rules in effect at the time it is signed.

|

|

Computation of Team Salary: waived players

VII(4)(a)(1)(i) |

Salaries paid or to be paid to waived players count as team salary, unless the stretch provision is used. See VII(7)(d)(5) for calculation of team salary with respect to stretch provision.

|

|

Computation of Team Salary: Retired Players

VII(4)(a)(1)(iI) |

Amounts paid or to be paid to a retired player under their contract count as part of team salary. The aggregate amount paid to retired players is allocated pro rata over the remaining years of the contract in proportion to the guaranteed salary remaining on the contract for each of those years.

|

|

Computation of Team Salary: Grievances for present/future cap year salary--If Grievance is resolved prior to expiration of relevant Salary Cap Year

VII(4)(a)(1)(iii)(A)(1) |

If a player initiates a Grievance over compensation that the team says is not owed, 50% of the disputed amount is included in Team Salary for the Salary Cap Year the amount was supposed to be paid.

Once the Greivance is resolved, if the award is more than the 50% of the amount sought, it is that additional amount is added to the relevant Salary Cap Year. If it's below the 50% amount, then there's a subtraction in team salary. |

|

Computation of Team Salary: Grievances for present/future cap year salary--If Grievance is resolved after expiration of relevant Salary Cap Year

VII(4)(a)(1)(iii)(A)(2) |

The difference between the awarded Grievance amount and the 50% of the sought amount is added or subtracted to Team Salary for the year in which the Grievance is resolved.

|

|

Computation of Team Salary: Grievances for present/future cap year salary--Effect on luxury tax payment if Grievance is resolved prior to expiration of relevant Salary Cap Year

VII(4)(a)(1)(iii)(A)(2) |

If, by splitting the disputed Grievance amount over 2 years, the team ends up paying less luxury tax than it would have had to if the Grievance amount were all paid in the year it was originally scheduled, then it owes additional tax. Vice-versa if the team ended up having to pay more as a result of the Grievance.

Note: This is an issue if the team is over the luxury tax in the original season but not in the season the Grievance is settled, or vice-versa. |

|

Computation of Team Salary: Grievances for present/future cap year salary--League mechanism for luxury tax payment/refund if Grievance is resolved prior to expiration of relevant Salary Cap Year

VII(4)(a)(1)(iii)(A)(2) |

NBA sets aside the amount of luxury tax paid by the team that is attributable to the 50% allocation in that Salary Cap Year.

After the Grievance is resolved, the NBA pays any applicable refund if the Grievance is settled for less than the 50% amount. |

|

Computation of Team Salary: Grievances for prior cap year salary

VII(4)(a)(1)(iii)(B) |

If the player wins, the Grievance amount is added to the present Salary Cap Year (in which the Grievance was resolved).

Note: Luxury tax rules work the same as for Grievances for compensation in present or future cap years. If team has to pay more or less as a result of having it count in the year Grievance is resolved, then it owes/is refunded the relevant amount. Note: League procedure for facilitating payment of potential tax refund is the same as when Grievance is for current or future cap year (see card above) |

|

Computation of Team Salary: Grievances for multiple cap year salary

VII(4)(a)(1)(iii)(C) |

The aggregate amounts payable to the player are allocated to each relevant season in proportion to the amount that was in dispute for each season.

Exception: The Grievance Arbitrator makes his own allocation. |

|

Rules to avoid game-playing with Grievances to increase cap room or reduce luxury tax payments.

VII(4)(a)(1)(iii)(D) |

1. Team must notify NBA by fax or email immediately when oral or written agreement to resolve Grievance is reached. Failure to do so can be considered cap circumvention under Article XIII.

2. If a team tries to create a Grievance or delay its resolution to create more cap room or reduce tax payments, it WILL be considered cap circumvention. |

|

Calculation of Team Salary: Effect of oral or written agreement to sign a contract that has yet to be formally reduced to a Uniform Player Contract

VII(4)(a)(1)(iv) |

It becomes part of Team Salary immediately.

Note: This also includes contracts that are contingent upon passing a physical. Note: Does not apply if the player is re-signing with his old team, hasn't been renounced and the new contract is less than his cap hold (aka free agent amount). Then they have to wait until UPC is formally in effect for new salary to replace the cap hold in Team Salary. |

|

Calculation of Team Salary: Cap Hold for Unrestricted Veteran Free Agents

VII(4)(a)(2)(i) |

For Unrestricted Veteran Free Agents who last played for a team, cap hold is included in Team Salary until he is renounced, signs with another team, or is re-signed formally to a new UPC.

|

|

Calculation of Team Salary: Salary Cap amount for Restricted Free agents

VII(4)(a)(2)(ii) |

Greater of:

A. His normal cap hold B. Qualifying offer (if tendered) C. Salary in a First Refusal Exercise Notice (i.e., matching of an offer sheet by another team to the RFA) |

|

Calculation of Team Salary: Offer Sheets to RFAs

VII(4)(a)(3) |

Are included in Team Salary until matched. See XI(5)(b)

|

|

Calculation of Team Salary: Unsigned First Round Picks

VII(4)(a)(4) |

Unsigned First Rounders are generally included in Team Salary at 100% of the Rookie Scale amount. See VII(4)(f)

Exceptions: If player signs with a non-NBA team, then that amount isn't included as of either the first day of the Regular Season or the day he signs with the non-NBA team, whichever is later. He then comes back on the following July 1 or whenever his contract ends or he's released from it, whichever is earlier. Exception to Exception: If player and team both state in writing player won't sign with team that year, then he's off the books immediately. He automatically comes back on the next July 1 at 100% of that season's rookie scale amount. |

|

Calculation of Team Salary: Cap Holds for having fewer than 12 players

VII(4)(a)(5) |

If team has less than 12 players under contract between July 1 and start of the season, there is a cap hold for the rookie minimum included for that roster slot. See VII(4)(f)

|

|

Calculation of Team Salary: Consideration to Retired Players

VII(4)(a)(6) |

If a retired player is given some consideration that qualifies as cap circumvention, that amount is included in Team Salary. (See Article XIII(5))

|

|

Calculation of Team Salary: Inclusion of Salary Cap Exceptions

VII(4)(a)(7) |

Any Exception deemed included in Team Salary under VII(6)9m)(2) counts against the cap.

If a team is below the cap by less than the amount of the exception, the amount of the exception is included in Team Salary until used or renounced by the team. |

|

Inclusion of waived players selected in an expansion draft in Team Salary

VII(4)(b) |

Salary of waived player isn't included in Team Salary, except for purposes of calculating the Minimum Team Salary obligation.

|

|

Inclusion of players received in trade in Team Salary

VII(4)(c) |

That year's salary and all future salary is included in Team Salary upon receiving the player in trade.

|

|

When does a cap hold apply to a Veteran Free Agent?

VII(4)(d) |

Until he re-signs with the team, signs with another team, or is renounced. |

|

Amount of cap hold for Bird rights free agent: General Rule for FAs not coming off first or 2nd option year of rookie contracts.

VII(4)(d)(1)(i) |

If player's salary is equal to or greater than Estimated Average Player Salary, then cap hold is 150% of prior salary.

If player's salary is less than Estimated Average Player Salary, then cap hold is 190% of prior salary. Note: Estimated Average Player Salary is 104.5% of previous year's Average Player Salary |

|

Cap holds for players coming off first or second option year of rookie contracts

VII(4)(d)(1)(ii-iii) |

After 2nd option year: 200% of prior salary if equal to or higher than EAPS, 250% of prior salary if less than EAPS.

After 1st option year: The maximum Salary team can pay the player, which is the amount he could have made under his rookie contract if his second year option were picked up. Note: The only way a rookie scale player can be FA after first option year is if second option year isn't picked up. So his salary (with that team) is limited to what it would have been under the rookie contract had it been picked up. This prevents teams from letting players out of rookie contracts early to pay them more sooner. |

|

Cap Holds for Early Bird Rights Free Agents

VII(4)(d)(2) |

1. General Rule: Included at 130% of his prior salary.

2. Exception: If he's coming off the second season of his rookie scale contract, then he's included at amount equal to what he'd have made in 3rd year of rookie contract had option been picked up. 3. Exception to exception: Team renounces his rights, in which case cap hold is same as non-Bird free agent (120% of prior salary) |

|

Cap Holds for Non-Bird Free Agents

VII(4)(d)(3-4) |

120% of prior salary.

Exception: If player is coming off a minimum contract, then his cap hold is only the amount of the minimum salary for the upcoming season that would not be paid by the League. |

|

Maximum and Minimum Cap Holds

VII(4)(d)(5) |

Maximum cap hold cannot exceed the player's maximum possible salary for the upcoming year.

Minimum cap hold cannot be less than the minimum salary less what is paid by the League. |

|

What constitutes "prior Salary" for the purposes of calculating Cap holds?

VII(4)(d)(6) |

Regular Salary for prior Season plus any signing bonus allocation and actually earned incentives for that Season.

|

|

When do unsigned first round picks have cap holds?

VII(4)(e) |

1. General Rule: Included in Team Salary immediately upon being selected at 100% of Rookie Scale Amount

2. Under general rule, player continues to be included at that Rookie Scale Amount until he signs with team or is renounced. Each year he remains unsigned his cap hold is the Rookie Scale Amount for that cap year. 3. Exception: If he signs with non-NBA team for that year, then as of date of signing or start or regular season, whichever is later, cap hold is extinguished for that year and comes back on the later of the following July 1 or whenever his non-NBA contract expires. 4. Player and team agree in writing he won't play for team that year, then cap hold is extinguished at that point until the later of next July 1 or whenever his non-NBA contract expires. Player can't play for team that year if this is done. Note: Player with a non-NBA contract for that year can enter a Rookie Scale Contract with the team for the NEXT salary cap year after February 1. VII(5)(e)(4)(ii). |

|

Rules for cap holds for incomplete rosters

VII(4)(f) |

1. If a team has less than 12 players under contract between July 1 and start of Regular Season, then there is a cap hold of the rookie minimum salary for each unused slot.

2. The only players who count as being on the roster for purposes of this rule are i) players under contract; ii) free agents who still have cap holds; iii) players to whom offer sheets have been given; iv) unsigned first rounders. |

|

Procedure for Renouncing Free Agent

VII(4)(g)(1) |

1. Team must provide NBA with a written statement renouncing the player, effective no earlier than July 1 following last season covered by player's contract.

2. NBA must notify NBAPA of renunciation by fax or email within 2 business days. |

|

Effect of renouncing free agent

VII(4)(g)(1) |

Player loses his Bird rights, and team must use cap room or an exception to re-sign him.

|

|

"Unrenouncing" player after RFA offer sheet is matched.

VII(4)(g)(1) |

Team may "unrenounce" the player within 2 business days of the Offer Sheet being matched, at which point he gets his Bird rights back and his cap hold returns.

But, the team can't do this if: i) the team was at or below the cap before the renouncement and unrenouncing would cause it to exceed the cap or; ii) the team was over the cap before the renouncement and unrenouncing would cause the team to be further over the cap than it was originally. So basically, the team can't unrenounce if it has signed other players to anything more than the rookie minimum unless it still has cap room after the unrenouncing. |

|

Exclusion of long-term injured player from Team Salary

VII(4)(h) |

A player who suffers a career-ending injury or illness and who is waived by the team can be excluded from Team Salary

|

|

At what point may team apply to have long-term injured player excluded from Team Salary?

VII(4)(h)(1) |

1. If the player played in more than 10 games in his last season, one year after the player last played in a regular season or playoff game.

2. If the player played in less than 10 games in his last season, then the later of 60 days after he last played or 1 year after the last game he played the previous season. Note: Only regular season or playoff games count. |

|

How is it determined whether a player has a career-ending injury or illness?

VII(4)(h)(2) |

A physician selected jointly by NBA and NBAPA determines whether player's injury or illness either:

i) prevents him from playing at an NBA level for the rest of his career or; ii) substantially impairs his ability to play AND would subject the player to medically unacceptable risk or life-threatening or permanently disabling injury or illness. |

|

When long-term injured player's salary can be re-included in team salary.

VII(4)(h)(3) |

If player plays 25 regular season or playoff games in any season for any team, his salary for that season is then re-included on the books of his original team. The original team can then reapply to have him excluded for any remaining cap years under the same criteria as normal, including the waiting period.

|

|

Player cooperation in long-term injury exclusion process

VII(4)(h)(4) |

He has to cooperate, including by showing up for the physical and being truthful in connection with the application.

|

|

What team can apply for long-term injury exclusion?

VII(4)(h)(5) |

Only the team for which he was under contract at the time the injury became known or reasonably should have been known.

|

|

Limitations for the team once it applies for long-term injury exclusion

VII(4)(h)(6) |

i) If the exclusion is granted, the team can NEVER re-sign or re-acquire that player.

ii) If team applies to replace this player under the Disabled Player Exception during that Salary Cap Year, it can't apply for a long-term injury exclusion for the player that same year. |

|

What is a summer contract?

VII(4)(i) |

Summer Contracts are contracts that are not included in Team Salary until the first day of the regular season, assuming they satisfy requirements of a Summer Contract (see next card)

|

|

Requirements of a Summer Contract

VII(4)(i)(1) |

i) Can't provide for any Compensation that can be paid or earned prior to the start of the regular season;

ii) Cannot be guaranteed at all iii) Only consideration is per diem, lodging, transport, disability insurance policy, etc. iv) Must be terminated prior to the regular season unless the team has cap room/exception for such contract. V) If player is a Veteran Free Agent who last played for the team, he can only sign a Summer Contract for the 1-year minimum. |

|

Team Salary Summaries

VII(4)(j) |

NBA has to provide the NBAPA with Team Salary summaries and a list of current Exceptions twice a month during the regular season and once a week during the off-season.

|

|

Basic Rule for Operation of the Salary Cap

VII(5)(a) |

Team Salary cannot exceed the Salary Cap at any time unless the team is using one of the exceptions. See VII(6)

|

|

General rule regarding entering contracts when a team has cap room

VII(5)(b) |

A team with cap room can sign a player to a contract that calls for a salary in the first year covered by the contract that does not exceed the team's cap room.

|

|

General rule for raises/decreases in contracts (i.e. for players not re-signing with Bird rights) |

Player's non-incentive compensation can only increase or decrease by 4.5% of the FIRST YEAR'S salary. |

|

Maximum allowable raises in contracts between Bird/Early Bird free agents and their prior teams |

Annual raises or decreases by 7.5% of the first year's salary.

|

|

When are players with Bird-rights who re-sign with prior team not allowed 7.5% raises? |

Exceptions: Players signed pursuant to MLE, MMLE, Room Exception, Bi-annual Exception, or Sign and Trade can only receive 4.5% raises.

Note: Bird or Early Bird players who re-sign with their prior teams using cap space rather than some other exception can receive 7.5% annual raises, a la Dwyane Wade in 2014. |

|

Maximum raises/decreases for normal extensions (non-Rookie Scale or Extend and Trades)

VII(5)(c)(3) |

Annual raises or decreases by 7.5% of the first year of the extension's salary. |

|

Maximum raises/decreases for extensions of Rookie Scale contracts

VII(5)(c)(4) |

Annual raises or decreases by 7.5% of the first year of the extension's salary.

Note: Same rule applies to Likely and Unlikely Bonuses, respectively. Each can only increase or decrease by 7.5% of what they each were in the first year of the extension. |

|

Maximum raises/decreases for Extend and Trades

VII(5)(c)(5) |

Player's non-incentive compensation can only increase or decrease by 4.5% of the first year of the extension's salary.

Note: Same rule applies to Likely and Unlikely Bonuses, respectively. Each can only increase or decrease by 4.5% of what they each were in the first year of the contract. Also note that the last year of the ORIGINAL contract has to include incentives for any to be included in new contract. Note: This was decreased in 2011 CBA mostly b/c of MeloDrama in 2011. |

|

How are physical condition or academic achievement incentives or promotional appearance incentives treated for purposes or raises/decreases?

VII(5)(c)(6) |

They are treated as Regular Salary rather than Incentive Compensation

|

|

What contracts have 4.5% maximum raises/decreases and what have 7.5%?

VII(5)(c) |

4.5%: Sign and trades, extend and trades, signings using MLE, MMLE, Room Exception, Bi-annual Exception, any free agent signing from another team.

7.5%: Qualifying and Early Qualifying Veteran Free Agents re-signing with prior teams, normal extensions (non-extend and trade), Rookie Scale extensions. |

|

Cap on unlikely bonuses

VII(5)(d)(1) |

No contract can have Unlikely Bonuses exceeding 15% of the player's Regular Salary for that year.

|

|

How do Unlikely Bonuses affect Salary Cap Room?

VII(5)(d)(2) |

If a player is being signed using cap room or an exception, the Unlikely Bonuses can't be so high that they would cause the player's Salary to exceed the amount of cap room the team had for that year if they were reached.

Note: To determine whether a team has cap room for a new Unlikely Bonus, the method is to assume that all Unlikely Bonuses in any new contracts handed out that year will be triggered. |

|

General rules regarding "Future Contracts"

VII(5)(e)(1-3) |

1. Contracts must be for at least one season.

2. Teams and players can't enter into contracts between the end of the Regular Season and June 30, except for amendments to existing contracts. 3. Any contract for more than one 1 season can't skip seasons. |

|

Exceptions to general rules regarding "Futures Contracts"

VII(5)(e)(4) |

1. A player who received a Required Tender or Qualifying Offer may accept beginning on the date he receives it.

2. First round picks who haven't yet signed can enter into contracts for the next year from February 1 to June 30 assuming they were under contract to a non-NBA team during that season. |

|

What are the exceptions to the salary cap?

VII(6)(a-k) |

a) Existing contracts

b) Veteran free agent exceptions c) Disabled Player Exception d) Bi-annual Exception. e) Non-Taxpayer Mid-Level Salary Exception (MLE) f) Taxpayer Mid-Level Salary Exception (MMLE) g) Mid-Level Salary Exception for Room Teams (Room Exception) h) Rookie Exception i) Minimum Player Salary Exception j) Traded Player Exception (TPE) k) Reinstatement |

|

Exceptions: Existing Contracts

VII(6)(a) |

A team can exceed the Salary Cap to the extent of its existing contractual commitments.

E.g., if a player is signed to a contract using cap room in year 1, his salary the next year (even if it includes raises) is allowed even if it causes the team to exceed the cap. |

|

Exceptions: Veteran Free Agent Exception

VII(6)(b) |

A team is allowed to exceed the Salary Cap to re-sign a player who last played for it.

Note: This also applies to an expansion team if a player is selected in an expansion draft that year |

|

How much is a Qualifying Veteran Free Agent allowed to re-sign for?

VII(6)(b)(1) |

Up to the maximum salary in the first Salary Cap year.

|

|

How much is a Non-Qualifying Veteran Free Agent allowed to re-sign for in the first year (if team is over cap)?

VII(6)(b)(2) |

The greater of:

i) 120% of the Regular Salary and 120% of the Likely and Unlikely Bonuses in the preceding year; II) Salary plus Unlikely Bonuses totaling 120% of the minimum salary; iii) If the player is a restricted free agent, the amount of a qualifying offer Annual raises and/or decreases are allowed up to the maximum raise/decrease for that player in subsequent years of the contract. |

|

How much is an Early Qualifying Veteran Free Agent (Early Bird rights) allowed to sign for?

VII(6)(b)(3)(i-ii) |

1. Contract must cover at least 2 seasons, not including one covered by an option year

2. May provide the greater of: A) 175% of Regular Salary and Likely/Unlikely bonuses, respectively, in the last year of his preceding contract; B) 104.5% of the Average Player Salary for the previous cap year C) If an EQVFA with 2 years of service receives an Offer Sheet, the team can use this exception to match the offer sheet. Note: For C, max offer sheet is MLE amount for first 2 years, then up to the max for years 3 and 4. In this scenario, matching team has to use the exception for the first 2 years, then a cap hit of the max in years 3 and 4. Offering team gets to distribute the salaries equally across the 4 years for their cap hit, a la Jeremy Lin and Omer Asik in the summer of 2012. |

|

What is the Disabled Player Exception?

VII(5)(c)(1) |

Allows a team to acquire one player to replace a player who can't play as the result of a Disabling Injury or Illness. |

|

Disabling Injury or Illness for purposes of Disabled Player Exception

VII(6)(c)(2), (4) |

Any injury or illness that in the opinion of a league-appointed (or neutral, if original finding is challenged by the NBAPA) physician, makes it substantially more likely than not that the player will not be able to play before June 15.

|

|

Dates team can apply for Disabled Player Exception

VII(6)(c)(1)(i) |

i. Application may be made between July 1 and January 15, regardless of when injury occurred.

|

|

Amount of Disabled Player Exception

VII(6)(c)(1)(ii-iii) |

Team can either sign a Replacement Player or acquire one from another team. |

|

Expiration of Disabled Player Exception

VII(6)(c)(3) |

March 10 if unused

|

|

Process for determining whether player is disabled |

1. Physician designated by the NBA determines whether it is substantially more likely than not that the player would be unable to play through the following June 15. Physician reviews the medical info and examines the player if necessary. NBA pays for this. |

|

What if the Disabled Player returns to action that year?

VII(6)(c)(6) |

He can resume playing for the team even if it has used the Disabled Player Exception. If it has not yet used the Exception, it is extinguished.

|

|

What teams can use the Disabled Player Exception with respect to a particular player?

VII(6)(c)(7) |

Only one team can use it, the team that had the player under Contract when the injury became known or should have become known.

|

|

What happens if the request for a Disabled Player Exception is denied?

VII(6)(c)(8) |

1. Team cannot make another request to replace the same player for another 90 days, and the team establishes that the new request is based on a new injury or aggravation of the previous injury.

2. Whether request is granted or denied, team can renew its request for the following season, beginning July 1. |

|

Bi-annual Exception (BAE)

VII(6)(d) |

1. A salary cap exception for $2.016 million in 2013-14 (goes up about 60k each year)

2. Can be divided among more than 1 player. 3. Contract(s) can't exceed 2 years. 4. Annual raises of 4.5% allowed for 2nd year. Note: If team uses BAE (or any exception) to sign player, cannot include above 4.5% annual raises/decreases even if it's re-signing it's own Bird rights free agent. Salary Cap Year Bi-annual Exception 2011-12 $1.900 million 2012-13 $1.957 million 2013-14 $2.016 million 2014-15 $2.077 million 2015-16 $2.139 million 2016-17 $2.203 million 2017-18 $2.269 million 2018-19 $2.337 million 2019-20 $2.407 million 2020-21 $2.479 million |

|

Restrictions on use of Bi-Annual Exception

VII(6)(d) |

1. As name implies, cannot be used in consecutive years.

2. Can only be used if team is below the apron (luxury tax level plus $4 million), and creates a hard cap at the apron for the rest of the year. 3. Can only be used if the team hasn't used the MMLE or the Room exception that year. |

|

Non-Taxpayer Mid-Level Salary Exception (MLE)

VII(6)(e) |

1. A salary cap exception for $5.15 million in 2013-14 (goes up about 150k each year)

2. Can be divided among more than 1 player. 3. Contract(s) can't exceed 4 years. 4. Annual raises allowed for subsequent years. Note: If team uses MLE (or any exception) to sign player, cannot include above 4.5% annual raises/decreases even if it's re-signing it's own Bird rights free agent. Salary Cap Year Non-Taxpayer Mid-Level Salary Exception 2011-12 $5.000 million 2012-13 $5.000 million 2013-14 $5.150 million 2014-15 $5.305 million 2015-16 $5.464 million 2016-17 $5.628 million 2017-18 $5.797 million 2018-19 $5.971 million 2019-20 $6.150 million 2020-21 $6.335 million |

|

Restrictions on use of MLE

VII(6)(e) |

1. Can only be used if team is below the apron (luxury tax level plus $4 million), and creates a hard cap at the apron for the rest of the year.

2. Can only be used if the team hasn't used the MMLE or the Room exception that year. 3. Notwithstanding the above, can be used to match an offer sheet in restricted free agency to a free agent with 1 or 2 years experience. (Like ones given to J. Lin and O. Asik in 2012, although they were not matched.) |

|

Order of use of BAE, MLE, MMLE, Room Exception

VII(6)(d-g) |

1. Team can use BAE and MLE in the same year. MMLE and Room Exception cannot be used after BAE is used.

2. If team uses MMLE, cannot use any other of these (MLE/Room/BAE) exceptions. 3. Once Room is used, none of the other 3 exceptions can be used after that. If team plans to use BAE, the only other exception that can be used is the MLE. Room, MLE, and MMLE can't be used in the same year. |

|

Taxpayer Mid-Level Salary Exception (MMLE)

VII(6)(f) |

General rule: Can be used only if Team Salary exceeds the Apron immediately after its use.

1. A salary cap exception for $3.183 million in 2013-14 (goes up about 100k each year) 2. Can be divided among more than 1 player. 3. Contract(s) can't exceed 3 years. 4. Annual raises allowed for subsequent years. Note: If team uses MMLE (or any exception) to sign player, cannot include above 4.5% annual raises/decreases even if it's re-signing it's own Bird rights free agent. Salary Cap Year Taxpayer Mid-Level Salary Exception 2011-12 $3.000 million 2012-13 $3.090 million 2013-14 $3.183 million 2014-15 $3.278 million 2015-16 $3.376 million 2016-17 $3.477 million 2017-18 $3.581 million 2018-19 $3.688 million 2019-20 $3.799 million 2020-21 $3.913 million |

|

Use of MLE/MMLE When Near the Apron

VII(6)(f)(5) |

If a team under the Apron uses its MLE, it can still exceed the Apron hard cap so long as it hasn't used more of it than would exceed the MMLE amount.

If it does exceed the Apron, then the team is considered to have used its MMLE instead of its MLE. |

|

Restrictions on use of MMLE

VII(6)(f)(1) |

1. Can only be used if Team Salary after its use exceeds the Apron. (Apron is Tax Level plus $4 million)

2. Team cannot have used any of BAE, MLE, or Room Exception and use MMLE. 3. Commencing with 2013-14 Season, if team has acquired a player via sign and trade it cannot use the MMLE. 4. Similarly, if a team has used its MMLE it cannot acquire a player via sign and trade. |

|

Mid-Level Salary Exception for Room Teams (Room Exception)

VII(6)(g) |

A salary cap exception for under the cap teams who have lost their salary cap exceptions, it is $2.652 million in 2013-14 and increases about $80,000 each year. Contracts can't exceed 2 seasons in length, with 4.5% annual raise/decrease allowed the 2nd year. Exception may be split up among multiple players.

Exception arises on the day after the team's salary falls below the cap. Mid-Level Salary Exception for Room Teams 2011-12 $2.500 million 2012-13 $2.575 million 2013-14 $2.652 million 2014-15 $2.732 million 2015-16 $2.814 million 2016-17 $2.898 million 2017-18 $2.985 million 2018-19 $3.075 million 2019-20 $3.167 million 2020-21 $3.262 million |

|

How are exceptions included in team salary if team drops below the cap?

|

When calculating team salary, a team's exceptions (including TPE and disabled player) are included in team salary if the team gets below the cap.

E.g. Team has salary of 58 million, cap is 62 million, and it still has MLE, team salary (for purposes of calculating cap room) is still about $63 million. if team salary plus exceptions including TPE and disabled player) still don't reach the salary cap at any point, those exceptions are lost. The team may also renounce them to drop lower under the cap if it likes. Note: Room Exception may only be used if team has lost MLE/MMLE/BAE in this way, or if team has renounced those exceptions. |

|

Restrictions on use of Room Exception

VII(6)(g) |

1. Team must be below the Salary Cap to use it.

2. Team has not used BAE, MLE, or MMLE, and in fact has lost those exceptions. 3. Team will be prohibited from using BAE, MLE, or MMLE once using Room Exception. |

|

Rookie Exception

VII(6)(h) |

A team can always enter into a Rookie Scale Contract.

|

|

Prohibition on Combining Exceptions

VII(6) |

Team cannot combine exceptions to sign a player to a contract, or combine exceptions with cap room to do so. If a team has multiple exceptions available it can choose which one to use.

|

|

Minimum Player Salary Exception

VII(6)(i) |

Team can sign a player to a minimum contract up 2 years in length that has no bonuses of any kind. No raises are allowed for the second year.

A team can also trade for a player with such a contract. |

|

Traded Player Exception (TPE)

VII(6)(j) |

Allows a team over the cap to replace traded player(s) with 1 or more players acquired by trade.

TPE allows teams to acquire players in trades either 1) simultaneously or 2) up to a year after the first trade if a team sends out more salary than it receives in the first trade AND it only trades away one player. Note: What we commonly refer to as matching salaries in trades is technically using a TPE created by the traded player to receive another player, even if it occurs simultaneously. Note: If year anniversary of the trade doesn't fall on a business day, it expires the next business day after the anniversary. |

|

Maximum amount a non-taxpaying team can receive in trade based on outgoing salary

VII(6)(j)(1)(i, iii) |

This depends on the amount of outgoing salary.

$0 to $9.8 million =150% of the outgoing salary, plus $100,000 $9.8 million to $19.6 million = outgoing salary plus $5 million $19.6 million and up = 125% of the outgoing salary, plus $100,000 Note: Relevant salary for the received players is their post-trade salary, important to consider if player has a trade bonus. Relevant salary for the sent player is his pre-trade salary. |

|

Maximum salary a taxpaying team can receive in trade:

|

125% of outgoing salary, plus $100,000.

Note: Relevant salary for the received players is their post-trade salary, important to consider if player has a trade bonus. Relevant salary for the sent player is his pre-trade salary. |

|

Amount of salary a team under the cap can receive in a trade:

VII(6)(j)(2-3) |

1. Amount equal to the team's cap room plus $100,000; or

2. Team can use the normal trade rules for teams over the cap as well if trade would put them over the cap and that would allow it to acquire more salary. |

|

Amount of non-simultaneous TPE

VII(6)(j)(1)(ii) |

100% of the traded player(s)' salary minus the received salary, plus $100,000.

Note: Relevant salary for the received players is their post-trade salary, important to consider if player has a trade bonus. Relevant salary for the sent player is his pre-trade salary. |

|

Rules regarding creation and use of non-simultaneous TPE

VII(6)(j) |

1. Team must receive less salary back than it sent out in an initial trade.

2. Team must be over the cap at start of the initial trade to receive TPE. 3. Team can trade away only one player to receive a TPE from that trade. If players' salaries are aggregated it cannot receive a TPE.* 4. TPE cannot be combined with any other exception. 5. TPEs can be used up piecemeal, or to acquire multiple players at once. 6. TPE expires a year after initial trade, or first business day after the year anniversary if it falls on holiday or weekend. *Note, this inspires teams to try to structure trades in which they trade away multiple players as technically separate transactions. |

|

Amount of TPE created by sign and trade or extend and trade

VII(6)(j)(4) |

1. Sign and Trades: If new salary is greater than 120% of player's previous salary, TPE is the greater of i) Salary for last season of his previous contract or ii) 50% of the salary for the first season of the new contract.

2. Extend and Trades: If new salary is greater than 120% of player's previous salary, TPE is the greater of i) Salary for last season of the original term of his contract or ii) 50% of the salary for the first season of the extension. Note: If previous contract was a minimum contract, his previous salary for purposes of this section includes the amount of the minimum contract paid by the league. |

|

Reinstatement Exception

VII(6)(k) |

If a player has been banned from the league for drug use and subsequently reinstated, the team may enter into a contract with him consistent with the applicable rules set forth in Article XXXIII, Section 12(f) or (g).

|

|

Prorated Reduction of Exceptions

VII(6)(m)(5) |

Starting on January 10, amount of exception is reduced by (1/# of days in regular season) for each day that passes until the end of the regular season.

Note: Does not include TPE, minimum salary exception, and disabled player exception. |

|

Salary for players whose rookie options were not picked up and re-sign with original team

VII(6)(m)(4) |

Team can still enter into a new contract with them for the amount they would have been making in the option year had it been picked up.

|

|

|

Veteran Extensions: What contracts may be extended, and when?

VII(7)(a) |

1. Only contracts of 4 or more years may be extended.

2. Contract may not be extended any earlier than the third anniversary of the signing of the contract. Note: This applies to non-rookie extensions only. Those have separate rules. |

|

|

How soon after an extension or renegotiation (increasing salary by more than 10%) may another extension be agreed to?

VII(7)(a)(2)(i) |

Three years after the extension or negotiation is agreed to.

|

|

|

Effect of exercising ETO on right to extend a contract?

VII(7)(a)(2)(ii) |

Once an ETO has been exercised, that contract may not be extended.

|

|

|

Effect of team or player option on right to extension

VII(7)(a)(2)(iii) |

1. A contract may be extended even after an option is exercised by either player or team.

2. If an option is not exercised, contract may be extended only if: A) Extension covers at least 2 years, excluding any new option year; and B) The player's Regular Salary, Likely Bonuses, and Unlikely Bonuses are no less than what he would have received under the non-exercised option. |

|

|

What is the maximum amount of an extension?

VII(7)(a)(3)(i) |

107.5% of the Regular Salary, Likely Bonuses, and Unlikely Bonuses of the last year of the previous contract. Maximum annual increases/decreases are 7.5%.

Note: If extension is part of a trade and extend, then it's limited to 104.5% and 4.5% annual raises, respectively. |

|

|

Special extension rules for player who has played with a team for at least 10 seasons

VII(7)(a)(4) |

If player has a decreasing salary throughout the original contract, the average annual value of the contract or extension rather than the value in the last year may be used as the baseline for the extension.

|

|

|

When are Rookie Scale Extensions allowed?

VII(7)(b)(1) |

Between the end of the Moratorium Period and October 31 of his 4th season, aka second option year.

|

|

|

Definition of Renegotiation

I(ww) |

A Contract amendment that provides for an increase in Salary and/or Unlikely Bonuses for already existing years of the contract.

|

|

|

When are renegotiations allowed?

VII(7)(c)(1), (4) (5) |

1. Only allowed on contracts of 4 or more years.

2. Only after the third anniversary of the signing of that contract. 3. Team must be below the cap. 4. Cannot renegotiate between March 1 and June 30. 5. Cannot occur in conjunction with a trade. |

|

|

If a contract has been Renegotiated, when may it next be Extended or Renegotiated?

VII(7)(c)(2) |

Not until the third anniversary of the Renegotiation.

Note: Assumes original Renegotiation increased contract by more than 4.5%. |

|

|

Amount of renegotiation

VII(7)(c)(3)(i-iii) |

1. Renegotiation can provide for additional Regular Salary, and Likely/Unlikely bonuses up to the amount of the team's cap room (and the max salary, of course)

2. Every category (Salary, Likely/Unlikely bonuses) must also be increased (over the original for that season) for remaining seasons of the contract. 3. Annual raises/decreases from the renegotiated salary are limited to 7.5% for the rest of the contract. 4. No renegotiation can contain a signing bonus, unless it also includes an Extension. |

|

|

Renegotiations to decrease salary

VII(7)(d)(1) |

Are not allowed.

|

|

|

Amount of Extension when signed in conjunction with Renegotiation

VII(7)(d)(2) |

Salary and incentives, respectively, can decrease by no more than 40% of the Regular Salary in the last year of the renegotiated contract.

|

|

|

Waiver of Trade Bonus to facilitate trades

VII(7)(d)(3) |

Player may waive trade bonus for the sole purpose of facilitating a trade, but only to the extent necessary to match salaries to make the trade legal.

If the player waives his trade bonus, it cannot be extended or renegotiated until 6 months after the trade (subject to other rules on extensions/renegotiations) |

|

|

Stretch Provision

VII(7)(d)(5) |

Allows a team to waive a player and "stretch" any remaining guaranteed salary across succeeding salary cap years, provided contract or extension was entered into under new CBA. (If only the extension was entered under new CBA, only the salary attributable to the extension may be stretched.)

How long the contract is stretched for depends on when the player is waived. Limitation: Team cannot use stretch provision if it would cause the amount of Team Salary allocable to all waived players to exceed 15% of the cap. |

|

|

Stretch Provision: If player waived between September 1 through June 30

VII(7)(d)(5)(A) |

i) Player's post-waiver guaranteed Salary for that year is unchanged

ii) Player's guaranteed Salary for each remaining cap year on his contract is aggregated and then allocated evenly over twice the number of Seasons remaining on the contract following the year in which player was waived. E.g., player is waived in year 1 of a 3 year, $3 million contract. His Salary for that year is $1 million, but then $500,000 over each of the next 4 years rather than $1 million over each of the next 2 years. |

|

|

Stretch Provision: If player waived between July 1 and August 31

VII(7)(d)(5)(B) |

Salary is aggregated and allocated evenly over twice the number of years remaining on the contract plus one.

E.g., Bulls waived Richard Hamilton, who had $1 million guaranteed on his deal, in summer of 2013. Now his cap hit is $333,333 for each of the next 3 years. |

|

|

Stretch Provision: Procedure for exercising provision

VII(7)(d)(5) |

Within 1 business day of waiving the player, team must provide the NBA with written statement electing to stretch the player's salary. NBA must inform NBAPA by fax or email within 2 business days of that.

|

|

|

Limitation on amendments to shorten or terminate contracts

VII(7)(d)(6) |

They are not allowed, except in accordance with Waiver procedure or Article XII, Section 2 governing player options.

|

|

|

Maximum cash that can be sent or received in trades per Salary Cap Year

VII(8)(a) |

$3.2 million of each for 2013-14 Cap Year. This is in TOTAL for the year, not per transaction as under old CBA.

There are two separate limits, one for amounts received and another for amounts sent out. Note: In a sign and trade, any signing bonus paid by signing team counts towards the limit for both teams. 2011-12 $3.0 million 2012-13 $3.1 million 2013-14 $3.2 million 2014-15 $3.3 million 2015-16 $3.4 million 2016-17 $3.5 million 2017-18 $3.6 million 2018-19 $3.7 million 2019-20 $3.8 million 2020-21 $3.9 million |

|

|

Trades of players on one year contracts who would have Early Bird or Bird rights at the end of the year

VII(8)(b) |

Such players cannot be traded without their consent. If they assent to such a trade, they lose their Bird rights with the team they are traded to.

|

|

|

Trades of free agents to be after trade deadline

VII(8)(c) |

Team cannot trade players after the deadline who are in the last year of their contract, or in a year that COULD be the last year of their contract if options are not exercised by either player or the team.

Note: This is another reason to have non-guarantee rather than a team option. The latter must be exercised for a player to be traded between the deadline and start of the new cap year. Non-guarantees are not restricted in this way. |

|

|

Limitation on trading newly-signed rookies

VII(8)(d)(i) |

Can't be traded until 30 days after the contract is signed.

|

|

|

Limitation on trades of newly-signed free agents

VII(8)(d)(ii) |

Can't be traded until the later of A) 3 months after the date the contract was signed; or B) December 15.

Note: Does not apply to initial trade in a sign and trade, but does apply if contract were to be traded a second time. |

|

|

Limitation on trade of newly-signed free agents who signed using Bird rights or Early Bird rights

VII(8)(d)(iii) |

Cannot be traded until the later of x) 3 months after the contract was signed or y) January 15.

Note: Bird or Early Bird Exception must actually have been used to sign the player, i.e. the team must be over the cap. Player's new salary also must be greater than 120% of his previous year's salary. Note: Does not apply if the player is on a minimum contract. |

|

|

When are sign and trades allowed?

VII(8)(e)(1) |

i) Free agent must have finished season on Prior Team's roster

ii) Contract must be for at least 3 seasons (excluding an option year) but no more than 4 seasons. iii) Contract not signed pursuant to MLE, MMLE, or Disabled Player Exception iv) First year of contract is fully guaranteed v) Contract entered into prior to first day of regular season vi) If contract is for 5th year player, cannot exceed 25% of cap even if player is eligible for 30% vii) Team salary cannot exceed the Apron after the S&T, and team is hard-capped at the Apron that year. |

|

|

When are Extend and Trades allowed?

VII(8)(e)(2) |

i) Cannot occur after regular season if it's during last year of the existing contract (or year that could be the last year if options are or are not exercised)

ii) Cannot cover more than 3 seasons from the date the extension is signed. |

|

|

Exhibit 6's with Sign or Extend and Trades

VII(8)(e)(3) |

Are not allowed. However, Teams involved in the trade are allowed to agree that trade is contingent on player passing a physical. Since S&T and E&T contracts are contingent on trade happening, failing the physical voids the contract, so it really has essentially the same effect as an Exhibit 6 anyway.

|

|

|

Limitations on trades after extensions that are larger or longer than that allowed in extend and trades

VII(8)(f) |

1. Player can't be traded for 6 months after signing such an extension.

2. If player is traded, the acquiring team can't sign him to larger or longer extension than that allowed in an extend and trade for 6 months. Note: This means any extension that is more than 3 seasons and/or in which starting salary is greater than 104.5% of last year of original contract's salary or has greater than 4.5% annual raises (assuming team can't sign player using cap room). Can't do an extend and trade contract exceeding those numbers. |

|

|

Trades of players who are in last year of rookie contract but signed an extension

VII(8)(g) |

For purposes of determining whether the acquiring team has cap room for the contract, the player's Salary is deemed to be the average of the Salaries for the last season of the rookie contract and all the years of the extension.

Note: This is to prevent a team for trading for a cheap rookie player before his extension that they wouldn't have cap room for kicks in. |

|

|

Original team re-signing traded players who are then waived by acquiring team

VII(8)(h) |

Cannot re-sign until the earlier of 1) a year after the trade is completed or 2) the July 1 following the last season of that player's contract.

|

|

|

Effect of trade on pre-existing financial arrangements between Team and Player

VII(8)(i) |

With a trade, "shall be required to divest themselves, on terms mutually agreeable to the player and the Team, of any pre-existing financial arrangements between such Team and such player.

|

|

|

NBA reporting of trade to NBAPA

VII(8)(j) |

NBA must report principle terms of the trade via fax or email to NBAPA. However, NBA can omit from this summary any terms that the league or one or more teams involved "reasonably deem confidential."

Note: Omitted information cannot include amount of cash payments. |

|

|

Computing allowable length of extension

VII(9)(a) |

If a a contract or extension is signed after the beginning of a Season, that season counts as a season of the contract or extension.

Option years on the original contract also count as a season covered by the contract. E.g., It is late in 2013. Player's 5-year contract expires in 2015, has ETO with effective year of 2014. Maximum extension he could sign is 4 years, BUT that is effectively only 2 years onto the end of the contract because he still has 2013-14 and 2014-15 (which counts regardless of the ETO) before his original contract expires. |

|

|

Escrow and Tax Arrangement Definitions: Adjustment Player

VII(12)(a)(1) |

Every current or former player who is included in Team Salary, plus those excluded under the Long-Term Injury Exclusion and Amnesty provisions.

Note: For Section 12, player and Adjustment Player may be used interchangeably. |

|

|

Escrow and Tax Arrangement Definitions: Aggregate Compensation Adjustment Amount

VII(12)(a)(2) |

The lesser of i) Aggregate Salaries and Benefits Adjustment Amount and (ii) 10% of Total Salaries. For purposes of ii), Total Salaries is increased by the amount included in Benefits pursuant to Article IV(6)(k)(1)

|

|

|

Escrow and Tax Arrangement Definitions: Aggregate Compensation Adjustment Amount Shortfall

VII(12)(a)(3) |

The amount that the NBA receives from the Escrow Agent is less than the Aggregate Compensation Adjustment Amount

|

|

|

Escrow and Tax Arrangement Definitions:Aggregate Salaries and Benefits Adjustment Amount

VII(12)(a)(4) |

The lesser of i) the Overage and ii) Total Salaries and Benefits.

|

|

|

Escrow and Tax Arrangement Definitions: Audit Report Challenge Period

VII(12)(a)(5) |

The period between when the Interim Audit Report is issued and the date on which all challenges to it are resolved.

|

|

|

Escrow and Tax Arrangement Definitions: Deduction Date

VII(12)(a)(6) |

Each of the 12 semi-monthly payment dates from 11/15 - 5/1 provided for under paragraph 3 of the UPC

|

|

|

Escrow and Tax Arrangement Definitions: Designated Share

VII(12)(a)(7) |

The amount of BRI that the players get. It is pegged at 50% as a default, but can changed based on league revenues and whether player salaries exceed or are below that number. See Section 12(b)(3) for calculation of Designate Share.

|

|

|

Escrow and Tax Arrangement Definitions: Escrow Agent

VII(12)(a)(8) |

The Agent who administers the Escrow Amounts

|

|

|

Escrow and Tax Arrangement Definitions: Escrow Amount

VII(12)(a)(9) |

For an Adjustment Player, sum of:

1: Base Escrow Amount 2. Performance Bonus Escrow Amount 3. Trade Bonus Escrow Amount |

|

|

Escrow and Tax Arrangement Definitions: Base Escrow Amount

VII(12)(a)(9)(i) |

10% of the player's Salary. For purposes of this calculation, Salary excludes all bonuses.

Note: Base Escrow Amount for minimum salaried players includes the amount reimbursed by the League. |

|

|

Escrow and Tax Arrangement Definitions: Performance Bonus Escrow Amount

VII(12)(a)(9) |

10% of the Performance Bonuses actually earned by the player during that year.

|

|

|

Escrow and Tax Arrangement Definitions: Trade Bonus Escrow Amount

VII(12)(a)(9) |

If player is traded between the end of the Season and June 30, this includes 10% of the trade bonus that is included in his Salary for that cap year.

|

|

|

Escrow and Tax Arrangement Definitions: Escrow Schedules

VII(12)(a)(10) |

Schedules prepared by the NBA with respect to each Cap Year setting forth when Escrow is supposed to be taken out of the player's compensation and/or delivered to the Escrow agent.

|

|

|

Escrow and Tax Arrangement Definitions: Individual Compensation Adjustment Amount

VII(12)(a)(11) |

Formula:

(Aggregate Compensation Adjustment Amount) x (Adjustment Player's Salary)/(All Adjustment Players' Salaries) For these purposes: Salary includes only Performance Bonuses actually earned. Minimum salaried players' salary includes amount paid by the League. |

|

|

Escrow and Tax Arrangement Definitions: Individual Shortfall Adjustment Amount

VII(12)(a)(12) |

If the players make such a high percentage of BRI that the escrow system can't adjust for it by only taking out 10%, the next year each player's contract gets reduced to make up for it. The Individual Shortfall Adjustment Amount is the amount each player's contract gets reduced.

|

|

|

Escrow and Tax Arrangement Definitions: New Benefit Adjustment Amount

VII(12)(a)(13) |

Difference between (Aggregate Salaries and Benefits Adjustment Amount) and (Aggregate Compensation Adjustment Amount)

|

|

|

Escrow and Tax Arrangement Definitions: Overage

VII(12)(a)(14) |

The amount, if any, by which Total Salaries and Benefits exceed the Designated Share for a given year

|

|

|

Escrow and Tax Arrangement Definitions: Performance Bonus Deduction Date

VII(12)(a)(15) |

Earlier of i) the date a Performance Bonus is paid to the player and ii) the day following the last day of the NBA Finals

|

|

|

Escrow and Tax Arrangement Definitions: Salary Escrow Agreement

VII(12)(a)(16) |

The Escrow Agreement to be entered into with the Escrow Agent

|

|

|

Calculation of Tax Level

VII(12)(a)(17) |

(53.51% of Projected BRI) - (Projected Benefits) / (Number of teams)

Note: Does not include expansion teams in first 2 years of existence. |

|

|

Tax Level if Total Salaries and Benefits are less than the Designated Share in the preceding year

VII(12)(a)(17)(vi) |

Tax Level is increased for the next year by the amount of the shortfall divided by # of teams in the NBA that next year.

Note: # of teams does not include expansion teams in first two years of existence. |

|

|

Calculation of Tax Level in event of an Overage less than 6% of Total Salaries and Benefits

VII(12)(a)(17)(vii) |

1. If Overage is less than or equal to 6% of Total Salaries and Benefits, then no change.

2. If Overage is more than 6% of Total Salaries and Benefits, then Tax Level is reduced. (See next card) |

|