![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

70 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What is the fraud triangle? |

Motive (or pressure) Rationalization (feel like they should) Opportunity |

|

|

|

What is the purpose of internal controls? |

Prevent and detect errors and irregularities from occurring (intentional) |

|

|

|

What is the Sarbanes-Oxley Act of 2002 (SOX)? |

Applies to all companies that file financial statements, created after embezzlement and fraud (Enron case), putting in place auditors, oversight board, internal control, etc. |

Aka Public Company Acct Reform and Investor Protection Act of 2002 |

|

|

What is the information and communication triangle? |

1. Monitors (report deficinies) 2. Control Activities (policies & procedures to reduce risk) 3. Risk Assesment (identity risk factors) 4. Control environments (overall ethical tone for company) |

|

|

|

What are the 2 control activities and some examples? |

1. Preventive controls - separation of duties, physical controls, proper authorization, employee management, e commerce controls 2. Detective Controls - reconciliation, performance reviews, audits |

|

|

|

Limitations to internal controls |

Collusion: 2 or more ppl acting together to circumvent internal controls |

|

|

|

What is cash? |

- Currency - Coins - Balances in savings and checking accts - Checks |

|

|

|

What are cash equivalents? |

- Mature within 3 months of date of purchase * money market funds * treasury bills * certificates of deposit (90 Days or less) |

|

|

|

Bank reconciliation |

|

|

|

|

What are possible differences in a bank reconciliation? |

-timing differences -errors |

|

|

|

What is a petty cash fund? |

Small amount of cash kept on hand to pay for minor purchases. |

|

|

|

How do you account for a petty fund? |

-establishing the fund -recognizing expenditure from fund -replenishing fund (Petty cash custodian) |

|

|

|

What are the cash controls? |

-controls over cash receipt -controls over cash disbursement |

|

|

|

What is a bank reconciliation? |

Matching the balance of cash in the bank account with the balance of cash in the company's own records. |

|

|

|

Identifying the major inflows and outflows of cash (activities) |

Operating -day to day basis (r+e) Investing -long term assets & invest Financial -borrowing & owner investing |

|

|

|

What are ways of cash management? |

1. Increase the speed of receivables collection 2. Keep inventory low 3. Monitor payment of liabilities 4. Plan timing of major expenditures 5. Invest idle cash |

|

|

|

What are credit sales? |

Transfer products & services to a customer today & collecting payment in the future |

Aka sales on account |

|

|

Are credit sales the same as credit card sales? |

No |

|

|

|

What are notes receivable? |

Formal credit arrangements evidenced by a written debt instrument, or note. |

|

|

|

What is net revenues? |

A company's total revenues less discounts, returns and allowances |

Referred as net sales |

|

|

Net revenue = ______ - _______ - ______ |

Sales - sales discounts- sales returns & allowances |

|

|

|

What is a trade discount? |

-Reduced from the list price of a product or service - not recognized directly - provides incentives to large customers |

|

|

|

What is a sales return? |

-seller issues a full refund -customer returns the product |

|

|

|

What is a sales allowance? |

-seller partially reduces the customers balance -customer does not return the product |

|

|

|

What is A/R; accured revenue |

A/R 100 Service rev/ sales 100 |

Recognize now, cash later |

|

|

What is a contra revenue account? |

- sales returns & allowances (contra revenue acct r&a) -opposite balance to that of its related revenue acct (ie. Debt balance) - to keep a separate record of the total revenue earned & reduction due to subsequent sales allowances |

|

|

|

What is a sales discount? |

Contra revenue acct -reduced from the amount to be paid by a credit customer if payment is paid within a specified period of time |

|

|

|

What are discount terms? |

2/10, n/30 (discount %/ discount period) |

|

|

|

Cost of doing business =? |

Bad debts |

Allowance method |

|

|

What is the allowance method? |

-allows for the possibility that some acct will be uncollectable -companies are required to: *estimate future uncollectable acts * record estimates in the current year |

|

|

|

What are uncollectable accts? |

Customers acts that are no longer considered collectable - reduce assets (a/r) -increase expense (A& R/E go down) |

|

|

|

What are doubtful accts? |

(Contra assest) Representing the amount of a/R that we do NOT expect to collect -reserve for bad debt -"rainy day fund" increase for future rainy days (future write offs), decrease when it rains (actual writeoffs) |

|

|

|

Allowance for D/A |

|

|

|

|

What is NRV |

(Net realizable Value) = A/R- allowance |

|

|

|

Estimating uncollectable accts in the following year |

Adjust allowance to amount estimated to be uncollectable -permanent act -do not ignore existing balance |

|

|

|

What is the direct write off method |

|

Gaap doesn't allow |

|

|

What are notes receivable? |

Similar to A/R but more formal, written debt instrument or promissory note, classified as current or noncurrent asset Promissory note-> N/R Service rev |

|

|

|

What is the interest calculation? |

Interest = principal x rate x time |

|

|

|

What is th equation to mature value? |

Mv= p+i |

|

|

|

What is the receivable turnover ratio? |

Net credit sales/ average accounts receivables (beg A/R + Ending A/R) ÷2 (beg A/R + Ending A/R) ÷2 |

|

|

|

What is the average collection period? |

365 days/ receivables turnover ratio |

|

|

|

What is the percentage of credit sales method? |

-estimates uncollectable accts based on the percentage of credit sales ( not A/R) -adjusts allowance for doubtful accounts, ignoring existing balance |

|

|

|

Assets turn into what? |

Expense |

|

|

|

Supplies turn into what? |

Supplies expense |

|

|

|

PPD RENT -> EQUIPMENT -> INVENTORY -> |

Rent exp Depreciation exp COGS Exp |

|

|

|

What does merchandising require? |

2 step (multiple) income statement |

|

|

|

What does service require? |

Regular 1 step Income statement |

|

|

|

Inventory wise what do merchandising and manufacturing do? |

|

|

|

|

What are cost of goods sold? |

Cost of the inventory that is sold during the period ( benefit received) |

|

|

|

What is the COGS formula? |

BI (beginning inventory) +NP (Net purchases) =TGAS ( total good avaible for sale) -EI (ending inventory) =COGS (cost of goods sold) |

|

|

|

What are operating expenses? |

Selling, general & administrative exp |

|

|

|

What are the multiple levels of profit? |

-gross profit -operating income - income before income taxes -net income |

|

|

|

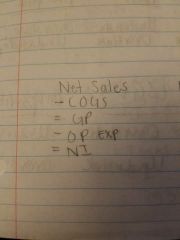

What is the multiple step income? |

SALES - SALES R+A - SALES DISCOUNT =NET SALES -COGS =GROSS PROFIT -OPERATING EXP =NET INCOME |

|

|

|

What are the 4 inventory cost methods? |

1. Specific identification 2. FIFO 3. LIFO 4. Weight Average cost |

|

|

|

What is the specific identification method? |

-unique, expensive products (Automobiles, jewelry) -most logical, not usually practical |

|

|

|

For Fifo, ending inventory where do you start & For COGS? |

Bottom, top |

|

|

|

For Lifo, ending inventory where do you start? & for COGS? |

Top (on hand), bottom (sold) |

|

|

|

Weighted average cost method |

|

|

|

|

From a financial standpoint which is better? & for Tax purposes? |

1. FIFO ( Higher assests) 2. LIFO (Expenses) |

|

|

|

What is a perpetual inventory system? |

Preferred -maintains a continual track of inventory -helps a company manage inventory levels - COGS determined each time sale occurs |

|

|

|

What is a periodic inventory system? |

-doesnt maintain a continual track of inventory -periodically adjusts for purchases & sale inventory -reports inventory based on a physical count - COGS determined at end of accounting period |

|

|

|

What are additional inventory transactions? |

Freight charges, (freight in, freight out), purchase discounts, purchase returns |

|

|

|

What is FOB shipping point mean? |

Buyer pays (date purchase occurred) Inventory Cash (Pay freight in charge) |

Free on board |

|

|

FOB destination |

Seller pays Freight out (operating exp) Cash |

|

|

|

Freight in is represented on which financial statement? |

Balance sheet -inv- assets |

|

|

|

What is the fair market value? |

Cost today |

|

|

|

What is the inventory turnover ratio? |

= COGS/ AVERAGE INVENTORY (BEG + ENDING/2) Shows the # of times the firm sells it's average inventory balance during a reporting period |

|

|

|

What is the cross profit ratio? |

=gross profit/ net sales, net sales - COGS = gross profit Indicator of the company's successful management of inventory. Measures the amount by which the sale price of inventory exceeds it's cost per dollar of sales (markup) |

|

|

|

Net sales |

|

|

|

|

What happens when you make an error to affect next period? |

|

|