![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

16 Cards in this Set

- Front

- Back

|

Cost of Loans (KL)

|

KL = (interest rate) x ( 1-tax rate)

= after tax cost of loan |

|

|

Weighted Average Cost of Capital

(3 steps) |

1. Calculate the cost of each source of capital.

2. Calculate the weight of each source of financing 3. Calculate the weighted average cost of capital |

|

|

Cost of Bonds (Kb)

|

Kb = (interest rate) x (1-tax rate)

= after tax cost of bonds |

|

|

Cost of preferred dividend (Kp)

|

Preferred dividend

---------------------------- price per share = after tax cost of preferred dividend |

|

|

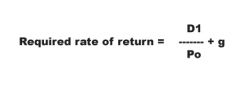

Cost of New common stock ( New Equity)

(Ke) |

|

|

|

CAPM formula

|

required rate of return = Rf + ( E [Xmkt] - Rf) (ß)

|

|

|

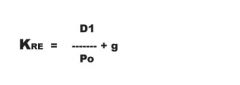

Cost of retaining Earnings within a Firm

(Kre) |

|

|

|

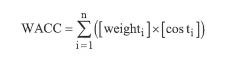

Weighted average cost of capital (WACC)

|

|

|

|

marginal cost of capital (MCC)

|

the weighted average cost of obtaining the next dollar of capital.

MCC rises as more capital is raised |

|

|

optimal capital structure

|

a firm's desired capital structure

|

|

|

How sources of finance change in regard to preferred stock

|

The changes are the same as for debt. As more money is raised through preferred stock, the cost to a firm rises, causing that firm's MCC to rise as well

|

|

|

How sources of finance change in regard to Equity.

|

retained earnings and common stock are both equity accounts, that Kre = Ke without flotation costs, and that Kre is less than Ke with flotation costs.

|

|

|

pooling-of-funds concept

|

the weighted average of all individual components as the cost of capital.

|

|

|

breakpoint in the MCC scedule

|

the amount of total financing at which change occurs.

|

|

|

3 reasons the cost of capital is important

|

1. To maximize profits, we must minimize costs---all of our costs, To minimize the cost of capital, it must first be calculated

2. To make accurate capital budgeting decisions, we need to know our cost of capital. 3. To make other financial decisions, the cost of capital must be known. |

|

|

Problems in determining the cost of capital

|

1) a firm gets the capital from many sources

2) the costs of each source change as a firm raises more and more capital |