![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

90 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

401(k) plans and Roth 401(k) Requires beginning date |

Back (Definition)

|

|

|

|

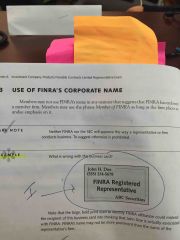

Business Card What's wrong with it? |

Back (Definition) |

|

|

|

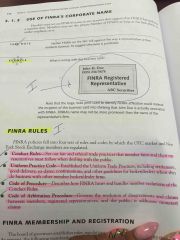

FINRA Rules |

Back (Definition) |

|

|

|

Broker/Dealer Registration |

Back (Definition) |

|

|

|

OSJ (office of supervisory Jurisdiction) |

The significance is that the office is responsible for the activities of registered representatives & associated persons not only housed in that office but also within other offices within that region. OSJ must be managed by at least one resident principal. |

|

|

|

Association Person Registration |

Back (Definition) |

|

|

|

Qualification Investigated & Rule 17f-2 Fingerprint Rule |

Back (Definition) |

|

|

|

Post registration Rules & Regulations |

Back (Definition) |

|

|

|

Continuing Commissions |

Back (Definition) |

|

|

|

Terminations |

Once an associated person ends employment with a member firm, registration with the firm ceases "30" calendar days from the date. |

|

|

|

Broker dealer records |

The SEC requires broker-dealers to make & keep for prescribed periods , & furnish copies thereof , such records in the public interest; for the protection of investors & the industry. Broker-dealers may store required records in electronic form. Electronic records must be preserved exclusively in a non-rewritable & non-erasable for their required retention period. |

|

|

|

Tape Recording of Conversations |

Back (Definition) |

60 days Switching |

|

|

Brokercheck |

Back (Definition) |

|

|

|

Obtaining an Order of Expungement from the CRD |

Members or associated persons seeking to expunge information from the CRD system arising disputes with customers must obtain an order from a court of competent jurisdiction directing such expungement or confirming an arbitration award containing expungement relief. |

|

|

|

Limited securities representative license (series 6) |

Back (Definition) |

A series 6 representative may not transact business in real estate investment trusts (REITs), hedge funds, or exchange -traded funds (ETFs) |

|

|

Registered Principals |

Anyone who manages or supervises any part of a members investment banking or securities business must be registered as a principal. This includes people involved solely in training associated persons. Principals must review every customer order, all customer correspondence, and the handling of all customer complaints. Unless the member firm is sole proprietorship, it must employ at least two registered principals. |

Don't be surprised if you see the exam ask about a complaint letter addressed to the registered representatives home address. In that case, the rule is the same---bring it into the office and submit it to the proper supervisory person. |

|

|

Ineligibility and Disqualifications |

Registered representatives must meet FINRA eligibility standards regarding training, experience, and competence. However, a registration may not be denied solely based on a lack of experience. |

|

|

|

Statutory Disqualification |

Back (Definition) |

|

|

|

Active Military Service |

Back (Definition) |

|

|

|

Investment Banking |

Back (Definition) |

|

|

|

Types Of Offerings |

Back (Definition) |

|

|

|

Firm Commitment |

Back (Definition) |

|

|

|

Best Efforts |

In a "best efforts arrangement" , the underwriter acts as agent for the issuing corporation. The deal is contingent on the underwriters ability to sell shares to the public. In a best efforts underwriting, the underwriter sells as much as possible, without financial liability for what remains unsold. The underwriter is acting in an "agency capacity" with no financial risk. |

|

|

|

All or None Underwriting |

A special type of best efforts underwriting is known as all or none, or all or nothing. In this case, unless all of the issue is sold to the public , the underwriting is canceled and all money is returned to the investors. |

|

|

|

Federal Registration |

The securities act of 1993 requires new issues of corporate securities to be registered with the SEC. The corporate issuer does so by filing a registration statement. Most of the registration statement becomes the prospectus. |

|

|

|

The three phases of an underwriting Chart Red Herring with a chart Tombstone Advertisents |

Back (Definition) |

|

|

|

SEC Disclaimer and Communications Not Deemed a Prospectus |

Back (Definition) |

|

|

|

The Final Prospectus (Effective Prospectus, Statutory Prospectus) |

Back (Definition) |

|

|

|

Exempt Issuers and Securities |

Back (Definition) |

|

|

|

SEC Rule 501 |

Back (Definition) |

|

|

|

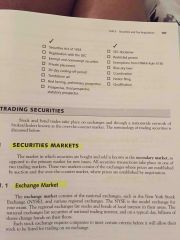

Trading Securities

Securities Markets Exchange Market |

Back (Definition) |

|

|

|

OTC Market Third Market (OTC Listed) Fourth Market |

Back (Definition) |

|

|

|

Negotiated Market and Market Makers Role Of The Broker/Dealer Brokers |

Back (Definition) |

|

|

|

Trade Confirmations |

Back (Definition) |

|

|

|

Transaction Settlement Dates and Terms

Regular Way Settlement |

Back (Definition) |

|

|

|

Cash Settlement and chart below

Regulation T Payment |

Back (Definition) |

|

|

|

Extensions |

If a buyer cannot pay for a trade within the time limit prescribed under Regulation T, the broker/dealer may request an extension. |

|

|

|

Dividend Department |

Collects and distributes cash dividends for equity securities. In addition to processing cash dividends, the department handles registered bond interest payments, stock dividends, stock splits, rights offerings, warrants and special distributions to a corporations stockholders or bond holders . |

|

|

|

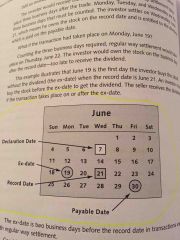

Declaration Date |

When a company's board of directors approved a dividend payment, it also designates the payment date and the dividend record date. The SEC requires any corporation that intends to pay cash dividends or make other distributions to notify FINRA or the appropriate exchange at least 10 business days before the record date. This enables FINRA or another SRO if appropriate , to establish the ex-date. |

|

|

|

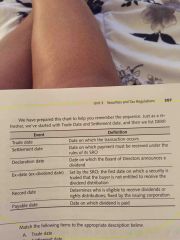

Ex-Date (ex-dividend date) Dividend Record Date Payable Date |

Back (Definition) |

|

|

|

June Calendar for record date |

Back (Definition) |

|

|

|

Trade Date and Settlement date chart and DERP |

Back (Definition) |

|

|

|

The Regulation of Trading |

Back (Definition) |

|

|

|

The Securities Exchange Act of 1934 |

Back (Definition) |

|

|

|

Registration of Exchange and Firms |

Back (Definition) |

|

|

|

Regulation of Broker/Dealers The Maloney Act |

Back (Definition) |

|

|

|

Regulation of Credit |

Back (Definition) |

|

|

|

Taxation |

Back (Definition) |

|

|

|

The Conduit Theory |

Because an investment company is organized as a corporation or trust, you might correctly assume its earnings are subject to tax. Consider, however, how an additional level of taxation shrinks a dividend distributions value. |

|

|

|

Capital Gains Distributions |

Back (Definition) |

|

|

|

Long-Term Capital Gain |

holding period of more than one year , taxed as a capital gain, which is (generally) lower than ordinary income tax rates for an investor. |

|

|

|

Long-Term Capital Gain |

holding period of more than one year , taxed as a capital gain, which is (generally) lower than ordinary income tax rates for an investor. |

|

|

|

Short Term Capital Gain |

Holding period of one year or less, taxed at ordinary income tax rates for an investor. |

|

|

|

Unrealized and Realized gain |

Unrealized is a paper profit Realized is actual profit made |

|

|

|

Reinvestment of Distributions |

Back (Definition) |

|

|

|

Taxation of Reinvested Distributions |

Distributions are taxable to shareholders whether the distributions are received in cash or reinvested. The fund must disclose whether each distribution is from income or capital gains. Form 1099-DIV which is sent to shareholders after the close of the year, details tax information related to dividend distributions for the year. |

|

|

|

Calculating a Funds Current Yield |

Back (Definition) |

|

|

|

Ex-Dividend Date |

Unlike the ex-dividend date for corporate securities, the ex-dividend date for mutual funds is set by the board of directors . Normally, the ex-dividend date for mutual funds is the day after the record date. |

|

|

|

Ex-Dividend Date |

Unlike the ex-dividend date for corporate securities, the ex-dividend date for mutual funds is set by the board of directors . Normally, the ex-dividend date for mutual funds is the day after the record date. |

|

|

|

Selling Dividends |

(Prohibited) Registered representative may not encourage investors to purchase fund shares before a distribution because of this tax liability doing so is selling dividends. A VIOLATION OF FINRA RULES |

|

|

|

Accounting Methods First In, First Out (FIFO) Share Identification |

Back (Definition) |

|

|

|

Average Cost Basis |

The shareholders may elect to use an average cost basis by dividing the total cost of all shares owned by the total # of shares. The shareholder may not change his decision to use the average basis method without IRS permission. |

|

|

|

Other Mutual Fund Tax Considerations Withholding Tax Cost Basis of Shares |

Back (Definition) |

|

|

|

Dividend Exclusions |

Corporations that invest in other companies stock may deduct 70% of dividends received for taxable income. No similar exclusion exists for individual investors. |

|

|

|

Other Mutual Fund Tax Considerations Withholding Tax Cost Basis of Shares |

Back (Definition) |

|

|

|

Dividend Exclusions |

Corporations that invest in other companies stock may deduct 70% of dividends received for taxable income. No similar exclusion exists for individual investors. |

|

|

|

Exchanges within a family of Funds |

Even though an exchange within a fund family incurs no sales charge, the IRS considers a sale to have taken place , and if a gain occurs, the customer is taxed. This tax liability can be significant, and shareholders should be aware of this potential conversion cost. |

|

|

|

Other Mutual Fund Tax Considerations Withholding Tax Cost Basis of Shares |

Back (Definition) |

|

|

|

Dividend Exclusions |

Corporations that invest in other companies stock may deduct 70% of dividends received for taxable income. No similar exclusion exists for individual investors. |

|

|

|

Exchanges within a family of Funds |

Even though an exchange within a fund family incurs no sales charge, the IRS considers a sale to have taken place , and if a gain occurs, the customer is taxed. This tax liability can be significant, and shareholders should be aware of this potential conversion cost. |

|

|

|

Wash Sales |

Back (Definition) |

|

|

|

Retirement planning and Non qualified retirement plans |

Back (Definition) |

|

|

|

IRA |

Back (Definition) |

|

|

|

IRA continued |

Back (Definition) |

|

|

|

Roth IRA Converting Traditional to Roth |

Back (Definition) |

|

|

|

CESA's Coverdale education savings account |

Back (Definition) |

|

|

|

Test Topic Key points of Roth IRA CESA |

Back (Definition) |

|

|

|

Section 529 Plans and Money-purchase plans |

Back (Definition) |

|

|

|

Simplified employee pension (SEP) Savings incentive match plans for employees (SIMPLES) |

Back (Definition) |

|

|

|

Self employed plans and contributions |

Back (Definition) |

|

|

|

Self employed plans and contributions |

Back (Definition) |

|

|

|

Contributions continued Self employed 401k plan |

Back (Definition) |

|

|

|

403(b) plans and Corporate retirement plans |

Back (Definition) |

|

|

|

Employee retirement income security act of 74(ERISA) Participation |

Back (Definition) |

|

|

|

Employee retirement income security act of 74(ERISA) Participation |

Back (Definition) |

|

|

|

Funding, vesting , communication,no discrimination and beneficiaries |

Back (Definition) |

|

|

|

Securities investor protection corp. Protection of customers Customer account coverage |

Back (Definition) |

|

|

|

Advertising SIPC membership Fidelity bonds |

Back (Definition) |

|

|

|

Insider trading act Written supervisory procedures Penalties |

Back (Definition) |

|

|

|

Regulation S-P Disclosures Right to Opt out |

Back (Definition) |

|