![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

95 Cards in this Set

- Front

- Back

|

Discretionary? |

Did I tell you how many shares? (How much to buy) Did I tell you to buy/sell? Did I tell you what stock? If all of your answers were yes, then it is not discretionary |

|

|

How often are discretionary accounts to be reviewed? |

Frequently |

|

|

DPP Roll-up Compensation |

Pay for this is 2% of the total transaction and you get paid whether 9 not the roll-up is approved. |

|

|

What holdings will not get transferred via ACAT? |

Option positions expiring within seven business days of validation are not transferred. |

|

|

Regulation S-P |

Firms must adopt policies and procedures to address the protection of nonpublic personal information. |

|

|

Formula to calculate equity in a Combined Account |

LMV-DR+CR-SMV=EQ |

|

|

APO |

Additional Public Offering |

|

|

Rule 415 - Shelf Offering |

Typically 2 years. For well known seasoned issuers it is 3 years |

|

|

WKSIs |

Well - known seasoned issuers At least $700 million in public common equity float or $1 billion in debt issued in past 3 years |

|

|

FPI |

Foreign Private Issuer Side note: they file a 20-F form to have a new issue in the U.S. |

|

|

Prospectus delivery requirement for an IPO |

As long as the securities have not been sold previously under a registration statement it is 90 days. |

|

|

25 day prospectus delivery |

- Never before been registered - listed on an exchange or authorized for inclusion on an inter-dealer quotation system (IDQS) such as the OTCBB |

|

|

40 day prospectus delivery |

Securities sold previously under a registration statement. |

|

|

Zero days prospectus delivery |

Securities sold by issuer subject to reporting requirement of the 1934 Securities Exchange Act |

|

|

FINRA Rule 5130 |

Prohibits member firms from selling a new issue to any account which restricted persons are beneficial owners. |

|

|

Filed Form 144 is effective for how long? |

Effective for 90 days |

|

|

Trading on form 144 |

1 - greater of 1% outstanding 4- average weekly trading volume of last 4 weeks 4- can be done up to 4 times a year (good for 90 days) |

|

|

Qualified Institutional Buyer (QIB) |

Allows non registered foreign and domestic securities to be sold to certain institutional investors in U.S. Most be a minimum of $100 million in securities |

|

|

Members may not solicit buyers of 144 stock unless |

A. Customer has expressed interest in previous 10 business days. B. Member had expressed interest in previous 60 calendar days |

|

|

Form 3 |

Corporate insiders are required to file information on changes to their holdings with the SEC. Initial report within 10 calendar days |

|

|

Form 4 |

Report change in holdings within 2 business days - officers, directors, or more than 10% shareholders |

|

|

Form 13-D |

When an investor, investor group, or other entity acquires a 5% ore more interest in an issuer |

|

|

Form 13-G |

When an investment company acquires a 5% or more interest in an issuer |

|

|

13-D and 13-G report to who? |

SEC, Issuer and market where security trades |

|

|

What forms does a reporting company file? |

10-K, 10-Q, and 8-K or 6-K |

|

|

10-K |

Annually audited report filed by a publicly traded company withing 90 days of year end. |

|

|

10-Q |

Unaudited quarterly report filed by publicly traded companies withing 45 days of each quarter |

|

|

8-K |

Filed by a publicly traded company within 4 days of big news taking place. |

|

|

6-K |

Filed by a Foreign Private Issue (FPI) within 4 days of big news taking place. |

|

|

Rule 10b-18 |

Pertains to an issuer buying it's own securities |

|

|

Rule 10b-18 Details |

1) One market maker or DMM on any given day 2) Transactions on any day cannot exceed 25% of Average Daily Trading Volume (ADTV) 3) Block purchases do not count against daily purchase limit (once each week) |

|

|

Rule 10b-18 opening/closing trading |

Cannot affect opening of closing of security. Issuer can't be first transaction of the day Issuer can't trade during last half hour |

|

|

Rule 10b-18 pricing |

Price no higher than highest independent bid or last sale, whichever is higher |

|

|

Rule 10b-13 |

Tender offers- Once announced, cannot buy shares in open market - non equivalent purchases ok |

|

|

Rule 10b-13 details |

Tender offer must remain open for 20 business days additionally it must remain open 10 business days from any change. |

|

|

10b-13 Target Company |

Has 10 business days to provide a statement to shareholders. No short tendering |

|

|

State Registration (Blue Sky) |

Types of Registration: Coordination (most common) Notice Filing Qualification |

|

|

Offer of Rescission |

(Blue Sky) For unsuitable/illegal sales Offers must be accepted or rejected within 30 days |

|

|

Insider Trading Penalties (Controlled person) |

Civil penalty is 3 times the profit made or loss avoided on the person who committed the violation |

|

|

Insider Trading (Controlling Person) |

Civil penalty is greater of $1 million or 3 times the profit made or losses avoided. When the controlling person knew that the controlled person was likely to violate the law and did nothing to prevent it. |

|

|

Insider Trading (Criminal penalties) |

Imprisonment for 20 years and fines up to $5 million for natural persons. $25 million for other persons (business entities) |

|

|

Insider Trading (Bounty) |

Up to 10% of civil penalty |

|

|

NYSE Listing Requirements |

1) Minimum number of shares 2) Minimum market value *3) No minimum Earnings Per Share (EPS) 4) Broad National Interest |

|

|

Nasdaq, BATS, Direct Edge |

Listing Requirements: $4 initial |

|

|

NYSE Regulated by: |

FINRA and NYSE Regulation, Inc. |

|

|

OTCBB regulated by: |

FINRA |

|

|

Rule 127 block |

10,000 shares/$200,000 ore more |

|

|

Inside Market |

Highest Bid Lowest Ask |

|

|

Market Maker (dealer/principal) |

Sells net (with markup) |

|

|

Non - market maker (broker/agency) |

Firms buys at inside Market and sells at that price with a commission. Firm buys at inside Market and sells with a markup. - riskless principal transaction (essentially a commission is charged) |

|

|

Market Maker obligations with short positions |

Twice monthly reports |

|

|

Withdrawals from NASDAQ - excused |

Must apply for and receive permission and is up to 5 business days. Acceptable reasons 1. Personnel 2. Equipment 3. Inside information 4. Involuntary failure to maintain clearing agreement |

|

|

Withdrawals from NASDAQ |

Voluntary termination 1. Withdraw quotes from NASDAQ or the ADF 2. Cannot re register for 20 business days. |

|

|

Withdrawals from NASDAQ ( Involuntary termination? |

Failure to abide by the rules |

|

|

ACES |

Allows order entry firms access to a marker makers internal order book for order placement and execution |

|

|

Volume Weighted Average Price (VWAP) Orders |

Calculate the total cost of all shares. Divide that result by the total number of shares. |

|

|

Form 211 |

File with FINRA to register as a non - nasdaq market maker Must be filed 3 business days prior to entering quotes on the OTCBB or OTC Pink |

|

|

Piggybacking |

(Form 211 not required) Allowed if meeting the continuous quote rule. - existing market maker has published quotes on at least 12 business days out of the last 30 calendar days. - no more than 4 consecutive business days without a quote. |

|

|

5% markup in an active market |

Markup percentage is not based on your markup to what you purchased. It is based on the inside market. Inside Market: 9.95-10.00 Black securities sells to its customers at 10.20 net. Amount of markup is .20 points; % markup (.20) ÷ (10) = 2% |

|

|

Limit order |

Order to buy or sell a security at a stated price. |

|

|

NASDAQ order display |

Member must display customer bid or offer and size if better than briker/dealer. A Nasdaq market maker has the following quote? 21.25-21.45, 10 x10 Upon receiving the following customer order: Buy Limit 300 at 21.25 The market maker Must update the its quote to: 21.25-21.45 13 X 10 |

|

|

Nasdaq trading halt T1 |

News pending |

|

|

Nasdaq trading halt T2 |

News released |

|

|

Nasdaq trading halt T3 |

Two different times displayed - first is the time market markets can begin quoting - second is the time market makers can begin trading |

|

|

Regulation SHO |

1. Mandates a locate requirement for short sales in all equities. 2. Mandates closeout of short sales not resulting in delivery of market maker has fails in a threshold security for 13 consecutive settlement days. |

|

|

Reclamation |

Member inadvertently accepts delivery of securities not in good deliverable form. - standard Time frame is 15 days |

|

|

DERP |

Declaration date, ex-date, Record date, payment date |

|

|

Dividends dates |

All dates are set by the issuer except the ex-date which is set by the SRO |

|

|

SEC Rule 10b-17 |

Notification to exchange or FINRA by the issuer at least 10 days in advance of the record date. |

|

|

SEC Rule 15c3-1 |

Minimum net capital requirements |

|

|

SEC Rule 15c3-1 Self-clearing firms (carrying firms) |

1. Holds customer funds and securities 2. Participates in firm commitment underwriting 3. Minimum $250,000 requirement 4. If acting as a prime broker - $1.5 million 5. If acting as executing broker - $1.0 million |

|

|

SEC Rule 15c3-1 Fully Disclosed firms (introducing firms) |

1. Cannot hold customer funds or securities 2. Introduces accounts to clearing firm 3. Permitted occasional trades in its investment account -- if >10 trades/year, minimum is $100,000 |

|

|

Rule 17A-11 |

Notify SEC and FINRA of violations to the net capital rule which is done electronically. |

|

|

Rule 17A-11 Net capital falls below minimum requirements |

Immediate notice |

|

|

Rule 17A-11 AI-to-NC ratio> 15:1 (8:1 first year) |

Immediate notice |

|

|

Rule 17A-11 Debt-Equity ratio exceeds 70% for a period of more than 90 days |

Immediate notice |

|

|

Rule 17A-11 Books and records are not current |

Immediate notification and followup within 48 hours of the notice to advise how you will fix it. |

|

|

Rule 17A-11 Material inadequacies in accounting system |

Notice within 24 hrs Follow up within 48 hrs how you will fix it |

|

|

Rule 17A-11 Early Warning |

1. Capital falls below 120% of minimum 2. AI-to-NC ratio > 12:1 3. Notification within 24hrs |

|

|

15c3-3 |

Customer protection rule |

|

|

15c3-3 Good Control Locations |

1. Commercial banks 2. DTC 3. Clearing accounts at other broker/dealers 4. Foreign custodian banks |

|

|

15c3-3 Not Good Control Locations |

1. Savings and loans (S&L's) 2. Credit Unions 3. Foreign BDs |

|

|

15c3-3 Reserve Computation |

Performed weekly (after close on Friday) 1. Determination is made as to: a. Monies owed to broker/dealer by customers - debit b. Monies owed by broker/dealer to customers - credits |

|

|

15c3-3 Reserve Account - if credits exceed debits |

Difference must be on deposit in special reserve account. 1. Withing 1 hour after banks open on second business day following computation 2. Acceptable deposits a. Cash or qualified securities (government) |

|

|

15c3-3 Reserve Accounts - failure to make required deposit |

Immediate electronic notice |

|

|

Securities Information Center (SIC) |

Computer bank designated by SEC to deal with lost or stolen securities. |

|

|

SIC SEC 17F-1 if securities are missing and no criminal action suspected |

2 business days to locate 3rd business day report to SIC and transfer agent. If recovered : 1 day to report |

|

|

SIC SEC 17F-1 if securities are missing and criminal action is suspected |

Notify FBI immediately 1 business day to report to SIC and Transfer agent If recovered: 1 day to |

|

|

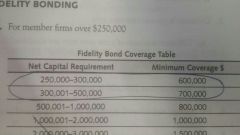

Fidelity Bonding for firms over $250,000 |

|

|

|

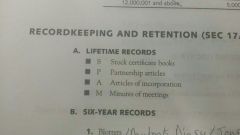

Recordkeeping and retention (SEC 17A-3, 17A-4) Lifetime records |

|

|

|

Recordkeeping and retention (SEC 17A-3, 17A-4) Six-year records |

1. Blotters/Daybook/Diary/Journal 2. General Ledger 3. Stock record 4. Customer ledgers (statements) 5. Customer account records 6. Principal designation record |

|

|

Recordkeeping and retention (SEC 17A-3, 17A-4) 3-years |

|

|

|

Recordkeeping and retention (SEC 17A-3, 17A-4) 4-year records |

Customer written complaints |

|

|

Recordkeeping and retention (SEC 17A-3, 17A-4) Electronic records |

Must be non-eraseable and nonrewritable |

|

|

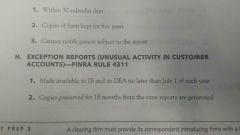

Exception reports (unusual activity in customer accounts) - FINRA rule 4311 |

|