![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

29 Cards in this Set

- Front

- Back

|

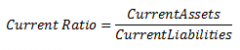

What is the current ratio calculation? |

|

|

|

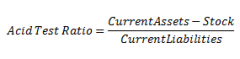

What is the acid test ratio calculation? |

|

|

|

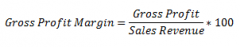

What is the gross profit margin calculation? |

|

|

|

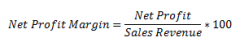

What is the net profit margin calculation? |

|

|

|

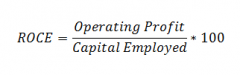

What is the return on capital employed calculation? |

|

|

|

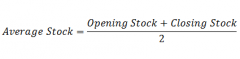

What is the average stock calculation? |

|

|

|

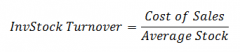

What is the inventory/stock turnover (number of times per year) calculation? |

|

|

|

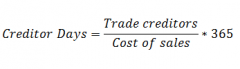

What is the creditor days calculation? |

|

|

|

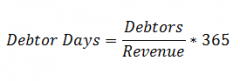

What is the debtor days calculation? |

|

|

|

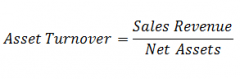

What is the asset turnover calculation? |

|

|

|

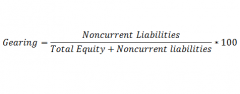

What is the gearing calculation? |

|

|

|

What does the acid test show you? |

The acid-test ratio shows whether a firm has enough short-term assets to cover its immediate liabilities. |

|

|

What does the gross profit margin show you? |

Gross profit margin shows how much money received from sales is actually gross profit |

|

|

What does the net profit margin show you? |

Net profit margin shows how much money received from sales is actually net profit |

|

|

What does the return on capital employed show you? |

ROCE shows how much money you get back from an investment. |

|

|

What does asset turnover show you? |

Asset ratio shows how well a businesses uses its assets to generate sales revenue |

|

|

What does creditor days show you? |

Creditor days measures how long, on average, it takes a business to pay its creditors |

|

|

What does current ratio show you? |

The Current Ratio shows the businesses current assets in relation to current liabilities |

|

|

What does debtor days show you? |

Debtor days shows how long debtors are taking to settle their accounts |

|

|

What does gearing show you? |

The gearing ratio looks at the capital structure of a business i.e. how it is financed |

|

|

What does inventory stock turnover show you? |

This ratio measures a business’ success in converting stock into sales |

|

|

What are liabilities? |

A liability is a sum of money that a business is legally required to pay back such as a loan |

|

|

How do you interpret the acid test ratio? |

Atypical business should have an acid test ratio of between 1.5 : 1 and 1 : 2, Closer to 1 is safer however a high ratio shows that money should be invested or used to pay off loans |

|

|

What are the golden rules? |

1. You must have past data 2. Businesses can only be compared if they are in the same industry |

|

|

What is the normal gearing ratio? |

25-50% |

|

|

What does a high capital gearing ratio show? |

A business has borrowed a lot of money inrelation to its own capital |

|

|

What does a low capital gearing ratio show? |

A firm has raised most of its capital from shareholders, in the form of share capital and retained profits |

|

|

What are the benefits from a high capital gearing ratio? |

•Relatively few shareholders, easier forexisting shareholders to keep control •Company can benefit from a very cheap source of finance when interest rates are low •In terms of high profit, interest payments are usually much lower that shareholders dividend requirements –allowing the company to retain more profit for future expansion |

|

|

What are the benefits from a low capital gearing ratio? |

•Most capital is permanent share capital, so with low gearing the company is less at risk of payables (creditors) •Avoids the problem of having to pay high levels of interest on its borrowed capital when interest rates are high •Avoids the pressure facing highly geared companies that must repay their borrowing at some stage. |