![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

44 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Why is cash flow and financial planning important to Accounting?

|

You need to understand how depreciation is used for both tax and financial reporting purposes; how to develop the statement of cash flows; the primary focus on cash flows, rather than accruals, and financial decision-making; and how pro-forma financial statements are used within the firm

|

|

|

|

Why is cash flow and financial planning important to Information Systems?

|

You need to understand the data that must be kept to record depreciation for tax and financial reporting, the information needed for strategic and operating plans, and what data are needed as inputs for preparing cash plans and profit plans.

|

|

|

|

Why is cash flow and financial planning important to Management?

|

You need to understand the difference between strategic and operating plans, and the role of each; the importance of focusing on the firm's cash flows; and how use of pro-forma statements can head off trouble for the firm.

|

|

|

|

Why is cash flow and financial planning important to Marketing?

|

You need to understand the central role that marketing plays in formulating the firm's long-term strategic plans and the importance of the sales forecast as the key input for both cash planning and profit planning.

|

|

|

|

Why is cash flow and financial planning important to Operations?

|

You need to understand how depreciation affects the value of the firm's plant assets, how the results of operations are captured in the statement of cash flows, that operations provide key inputs into the firm's short-term financial plans, and the distinction between fixed and variable operating costs.

|

|

|

|

Why should cash flow and financial planning matter in your life?

|

Individuals, like corporations, should focus on cash flow when planning and monitoring finances. You should establish short and long-term financial goals (destinations) and develop personal financial plans (roadmaps) that will guide their achievement. Cash flows and financial plans are as important for individuals as for corporations.

|

|

|

|

What is depreciation?

|

allocation of historical costs of fixed assets over time

|

Definition |

|

|

What does MACRS stand for?

|

Modified Accelerated Cost Recovery System

Bonus for definition: System used to determine the depreciation of assets for tax purposes |

Modified... If you're this far, you don't know it! Go STUDY |

|

|

What is depreciable value of an asset?

|

The full costs of the asset, including outlays for installation

|

Definition |

|

|

What is the depreciable life of an asset?

|

Time period over which an asset is depreciated

|

Definition |

|

|

What is the recovery period?

|

The appropriate depreciable life of a particular asset as determined by MACRS

|

Definition |

|

|

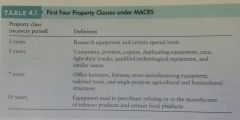

What are the first four property classes under MACRS?

|

3, 5, 7, 10 years

|

|

|

|

What types of assets fit under the MACRS 3-year property class?

|

Research equipment and certain special tools

|

research... |

|

|

What types of assets fit under the MACRS 5-year property class?

|

Computers, printers, copiers, duplicating equipment, cars, light-duty trucks, qualified technological equipment, and similar assets

|

Computers, printers,... |

|

|

What types of assets fit under the MACRS 7-year property class?

|

Office furniture, fixtures, most manufacturing equipment, railroad track, and single-purpose agricultural and horticultural structures

|

Office furniture, fixtures, ... |

|

|

What types of assets fit under the MACRS 10-year property class?

|

Equipment used in petroleum refining or in the manufacture of tobacco products and certain food products

|

Equipment used in petroleum refining... |

|

|

Name the three most common depreciation methods

|

Straight-line, Double-declining balance, and sum-of-the-years'-digits

|

Straight-line... |

|

|

Which depreciation method is used by MACRS for the first four property classes?

|

Double-declining balance method, using a half-year convention meaning that a half years depreciation is taken in the year the asset is purchased and switching to straight-line when advantageous.

|

Straight-line, double-declining balance, and sum-of-the-years'-digits? |

|

|

Draw the table of the first four property classes under MACRS

|

|

|

|

|

How many MACRS property classes are there in total?

|

6

Bonus for listing them: 3, 5, 7, 10, 15, 20 years |

Not 4 |

|

|

True/False: Because MACRS requires use of the full-year convention, assets are assumed to be acquired in the beginning of the year

|

FALSE

1. MACRS requires use of the half-year convention 2. Assets are assumed to be acquired in the middle of the year |

False, but why? |

|

|

Using the table, what percentage of depreciation occurs in the fourth recovery year under the 5-year MACRS property class?

|

12%

|

Page 112 |

|

|

Under MACRS' half-year convention, how many recovery years are needed to write off the cost of an asset in the 10-year property class?

|

11 years

|

Not 10 |

|

|

What is the statement of cash flows?

|

Summarizes the firm's cash flow over a given period.

|

Definition |

|

|

What are cash flows from operating activities?

|

Cash flows directly related to sale and production of the firm's products and services

|

Definition |

|

|

What are cash flows from investment activities?

|

Cash flows associated with purchase and sale of both fixed assets and equity investments in other firms

|

Definition |

|

|

What are cash flows from financing activities?

|

Cash flows that result from debt and equity financing transactions; include incurrence and repayment of debt, cash inflow from the sale of stock, and cash outflows to repurchase stock or pay cash dividends.

|

Definition |

|

|

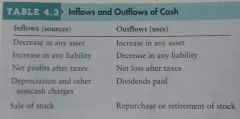

Draw a table of the basic inflows and outflows of cash

|

|

|

|

|

What is a non-cash charge?

|

An expense that is deducted on the income statement but does not involve the actual outlay of cash during the period; includes depreciation, amortization, and depletion.

|

Definition |

|

|

What does OCF stand for?

|

Operating Cash Flow

|

Operating |

|

|

What is Operating Cash Flow?

|

The cash flow a firm generates from its normal operations

|

Definition |

|

|

What is the equation used to calculate operating cash flow?

|

OCF = NOPAT+Depreciation

|

Add back depreciation to NOPAT |

|

|

What does NOPAT stand for?

|

Net Operating Profit After Taxes

|

Net... |

|

|

What is Net Operating Profit After Taxes (NOPAT)?

|

A firm's earnings before interest and after taxes

|

Definition |

|

|

How is Net Operating Profit After Taxes (NOPAT) calculated?

|

NOPAT = EBITx(1-Tax rate)

|

NOPAT = EBITx(?-?) |

|

|

What does EBIT stand for?

|

Earnings Before Interest and Taxes

|

Earnings before... |

|

|

What does FCF stand for?

|

free cash flow

|

|

|

|

What is free cash flow (FCF)?

|

The amount of cash flow available to investors (creditors and owners) after the firm has met all operating needs and paid for investment in net fixed assets and net current assets.

|

Definition |

|

|

How is free cash flow (FCF) calculated?

|

FCF = OCF-NFAI-NCAI

|

FCF= OCF-?-? |

|

|

What does NFAI stand for?

|

Net Fixed Asset Investment

|

Investment |

|

|

What is Net Fixed Asset Investment (NFAI)?

|

The net investment that the firm makes in fixed assets and refers to purchases minus sales of fixed assets

|

NFAI = ?+Depreciation |

|

|

What does NCAI stand for?

|

Net current asset investment

|

Investment |

|

|

What is Net Current Asset Investment (NCAI)?

|

Net investment made by the firm in its current (operating) assets. The difference between current assets and the sum of accounts payable and accruals. Notes payable are not included in the NCAI calculation because they represent a negotiated creditor claim on the firm's free cash flow.

|

Definition |

|

|

What does NCF stand for?

|

Net cash flow

|

|