![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

79 Cards in this Set

- Front

- Back

|

First phase(1951-66) |

-Nehruvian Era of Planning.

Model: Harrod Domar (Eco growth increases with increase in savings and investments.)

Features:

1. High govt presence(Imperative Planning) 2. Mahalanobis Startegy 3. Inward Oriented Policy |

|

|

Second phase (67-90) |

Important features: 1. Green Revolution 2. Social welfare policies. 3. Infrastructure Development & higher industrial growth(post 1980) 4. Outward oriented policy, gradual liberalisation (post 1980) |

|

|

Third phase(91-present) |

Policy features:

LPG(l, g introduced earlier, p- new)

1. Industrial Reforms 2. Financial Sector Reforms 3. External Sector Reforms 4. Fiscal Reforms 5. Indicative Planning |

|

|

4th FYP(1969-74) |

- Stagflation - first talk of socio - economic reforms. |

|

|

Plan holiday |

Between 1966-69 -first green revolution. |

|

|

5th FYP(1974-79) |

- official rejection to trickle down effect - socio-economic reforms introduced for first time. 1978,1979- Rolling plans by Janata party (not successful) |

|

|

6th FYP(1980-85) |

- implementation of SER (first wage employment and self employment) - First infrastructure Development concentration -officially done away with mahalanobis Startegy - higher industrial growth |

|

|

7th FYP(1985-1990) |

Start of Indicative Planning -Outward oriented policy -Focus on modern services sector -Gradual liberalisation |

|

|

Reasons for 1991 BoP crisis |

1. Deficit Financing 2. Gulf war(lower remittances & higher import bill) 3. Rising external debt & borrowings due to SER and infrastructure |

|

|

8th FYP(1992-1997) |

-Jobless growth (6.8%) -FD and CAD decreased due to higher industrial growth and tax reforms. |

|

|

11th FYP |

- US Subprime Crisis - slowdown in India(however not much affected, the economy) - decrease in trade and foreign capital movement. *first time the concept of inclusive growth and monitor able targets for Centre and states. |

|

|

10th FYP |

- foreign capital inflows increased. (FPI introduced, stocks doing well) (foreign financial institutions doing well, in terms of returns) *lowest FD and CAD EVER Only Negative: Neglected Agriculture Sector. |

|

|

Tarapore Committee |

For: Capital Account convertibility |

|

|

9th FYP(1997-2002) |

FD and CAD increased

-resaons( East Asia Crisis)

- Service Sector share increased |

|

|

Recommendations of Tarapore Committee |

1. Low FD to GDP 2. Low CAD to to GDP 3. Stable Financial Sector 4. Lower Inflation Rate. |

|

|

What are money markets? |

- Short term money markets - three types : 1) overnight market 2) notice money market 3) term money market |

|

|

Instruments of Money Markets |

1. Call Money Markets 2. Commercial Bills 3. Certificate of Deposits 4. Treasury Bills 5. Repo Market 6. Reverse Repo Market 7. Commercial Papers. |

|

|

Call Money Markets |

- Short term loans - show day to day status of banks - interest rate (inter bank offer rate-IBOR) : usually in sync with LIBOR or MIBOR) |

|

|

Commercial Bills |

- given by buyer to seller after affirmation from a bank. - Sent to a commercial bank by buyer (receives funds - discount rate) - C banks can send CBs to RBI and get funds- Bank Rate(rediscounting rate) |

|

|

Certificate of Deposits |

- Short term loan raised by a commercial bank or financial institution

- tradeable. |

|

|

Commercial Papers |

-loans raised by corporate entities from public |

|

|

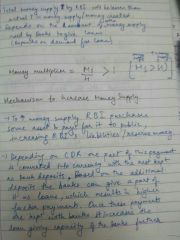

Money multiplier |

- for each rupee increase in reserve money resulting increase in money supply is called money multiplier. |

|

|

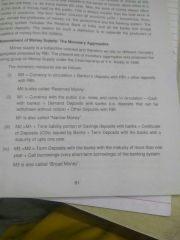

Money aggregates |

|

|

|

Monetary Policy Instruments |

1. Quantitative- uniform for all banks and borrowers 2. Qualitative - RBI has discretionary power. |

|

|

Quantitative Instruments are |

1. CRR 2. SLR 3. OMOs(eg quantitative easing) 4. RR & Bank Rate 5. Market Stabilisation Scheme. (to control sudden increase in liquidity) 6. Liquidity Adjustment Facility (for short term adjustments) (eg a combination of RR and RRR changes)

|

|

|

Quantitative Easing |

- Expansionary OMO - usually taken up in case of liquidity trap and slowdown/recession - central bank of country buys govt securities and no. Of other securities.(usually long term) |

|

|

Qualitative Instruments |

1. Marginal Standing Facility (MSF) 2.Marginal Requirements for Secured loan 3. Selective Credit Control 4. Moral Suasion. |

|

|

Marginal Standing Facility |

- overnight loans - strict, usually high rate of interest - only for Scheduled Commercial Banks |

|

|

Marginal Requirements on Secured loands |

Marginal Requirements implies a particular limit to which a sector/industry can take a loan to the value of their securities. Secured loans - any loan taken by keeping financial security or collateral. |

|

|

Monetary policy transmission |

Refers to the process through which changes in monetary policy can effectively be passed onto general public. |

|

|

Benchmark Prime lending rate |

- it's the minimum interest rate at which banks give loans to prime borrowers - Calculated on the basis of: a) Cost of Deposits b) Administration expenses. c) Operating expenses. *2010: BPLR replaced by Base Rate. (statutory expenses added) (cost of Deposits to be calculated for 1 year maturity deposits) |

|

|

Marginal Cost of Funds based lending rates |

|

|

|

Scheduled banks |

- registered under RBI Act 1934 -They are (came into existence in) Before 1991: 1. SBI and associates 2. Nationalised Banks 3. Regional Rural Banks

After 1991: 1. IBRD & BMBs 2. Private Sector Banks 3. Foreign Banks. |

|

|

Priority Sector lending |

- Started in 1969(Coincides with GR) - every bank needs to give 40% loans to priority sectors

Priority sectors since before 1991: 1. Agriculture 2. Small enterprises

Since after 1991: 1. Education (not all) 2. Housing for Poor 3. Exports. *foreign Banks 32% PSL and no need to for agriculture |

|

|

Narsimhan Rao Committee |

-Banking Reforms. |

|

|

Major reforms of Narsimhan Rao Committee that were accepted |

1. Lower CRR and SLR 2. Interest rate deregulation 3. Public sector banks could raise money from share markets 4. Private and foreign banks allowerd 5. Capital adequacy reforms 6. Prudential norms related reforms |

|

|

What does double financial repression mean? |

- it refers to problems on liabilities( eg demonetization) & problems on assets side. (eg NPAs) |

|

|

Basel Norms. |

They are capital adequacy norms HQ: Bureau of Intl Settlements |

|

|

Basel 1 norms (1988) |

- any banks should have adequate capital for handling credit risk |

|

|

Basel 2 norms(2004) |

3 Requirements:

a) minimum capital requirements b) Supervisory Review(risk management department in every bank) c) Market Discipline (showing balance sheet to public, declaring NPAs etc)

Talks of 3 risks: 1) market risk 2) credit risk 3) operational risks

Gives a Capital adequacy ratio |

|

|

Capital adequacy ratio |

Higher CAR, better for the bank. |

|

|

Basel 3 norms |

Introduces Leverage ratio |

|

|

Categorisation of Assets |

1. Standard assets 2. Substandard assets(NPAs for under 12 months) 3. Doubtful assets( NPAs after 12 months) 4. Loss assets (when loan cannot be recovered according to auditor) *after declaring loss asset the loans are written off (removed from balance sheet) |

|

|

Scheme for sustainable structuring of stressed assets(S4A) - 2016 |

Divide NPAs into 2 parts 1. Sustainable Debt: has to be paid by company 2. Unsustainable Debt: Converted into Equity |

|

|

SARFAESI Act 2002 |

- enables bank to take possession of securities if loan hasn't been repaid in 60days of notice (without intervention of courts) - banks allowed to take services of ARCs |

|

|

Strategic Debt restructuring (SDR) |

- group of banks come together to convert part of NPA to equity |

|

|

PJ Nayak Committee (Indradhanush Committee) |

Reforms related to Public Sector Banks |

|

|

PMJDY |

- launched :2014 - under : Ministry of Finance -incentives : =zero balance accounts. =can be opened in both public and private banks =easier kyc norms(no reqt of PAN card) =Rupay Debit Cards, mobile services free of cost =life cover and accident insurance |

|

|

Types of Unemployment |

1. Frictional (or Voluntary) unemployment 2. Structural Unemployment (eg due to tech advancements) 3. Cyclical Unemployment (due to slowdowns/recession) 4. Seasonal Unemployment 5. Disguised/ Hidden Unemployment |

|

|

Natural rate of Unemployment |

= (Frictional + Structural) unemployment rate -unavoidable type of Unemployment -government can not completely take care of this problem |

|

|

Labour force |

- part of population which is willing and able to work (not necessarily employed) -age: 15-64 |

|

|

Rates of employment related things |

|

|

|

Methods to estimate employment and unemployment |

- given by NSSO 1. Usual Status Reference Period- 1 year Activity Status - 30+ days (considered employed) *used to calculate Chronic Unemployment 2. Current weekly status Reference period : 7 days Activity status - 1 hour+ *used to calculate Seasonal Unemployment 3. Current Daily status Reference period : 7 days Activity status: looks into each day, if 1-4 hrs work 1/2 day employment, if 4-8 hrs work 1 day employment, this is summed up for 7 days 3. |

|

|

Why is India' LFPR decreasing? |

1. More girls going to educational institutions. 2. Changes in HHs income & female LFPR (especially seen in rural India) - household income increase, has led to women staying at home and taking care of children etc 3. Mechanisation of agriculture |

|

|

Arjun Sengupta Committee (National Commission for Enterprises in Unorganised Sector) |

- to look into definition of formal and informal sector. Definition proposed for informal sector: no. Of informals in informal sector + no of formals in nature of being informal |

|

|

Poverty |

|

|

|

Methods to measure relative poverty |

1. Lorenz Curve 2. Gini Coefficient (better since it helps compare between numerous countries) |

|

|

Gini Coefficient |

|

|

|

Measures of absolute poverty |

1. Poverty Line 2. Head count ratio or incidence of poverty (total no. of BPL HHs/total HHs x 100) 3. Poverty Gap Ratio (poverty gap/per capita income) 1,2-> don't give depth of poverty 3-> does give depth of poverty |

|

|

Poverty Line estimation in India |

Step 1: Definition of Poverty Line (By Planning Commission) Step 2: Data Collection ( by NSSO) Step 3: Inflation Adjustment Step 4: Comparison between Definition & adjusted consumption expenditure |

|

|

Methods to calculate consumption expenditure survey |

|

|

|

Definitions of Poverty line |

1st - 1973-2005 : 2100/2400KCal per day 2nd - 2005 onwards : on recommendation of Tendulkar Committee 3rd - still not in place : Rangarajan committee's poverty line. |

|

|

Tendulkar Committee PL |

|

|

|

Rangarajan committee's (2012-14) |

|

|

|

Poverty lines |

|

|

|

Alternate Poverty Estimates for India |

1. Socio-economic Caste Census - 7 indicators on-nature of houses, land ownership, adult literacy - has classification of SC/ST & other HHs - needs updation, last census 2011 2. Multi dimension poverty index - Calculated by UNDP - 10 indicators - health, education standard of living - multidimensional poor HH is one which is deprived in 3+ indicators. |

|

|

Shankar Guru Recommendations |

Agriculture Market Reforms (Gave Model APMC) |

|

|

Model APMC Act 2003 |

Key recommendations: 1. Deregulation of Agriculture Markets 2. Separate market for perishable goods. 3. Development & Management of Agricultural markets 4. Promoting Contract Farming (between farmer & buyer) |

|

|

ReMs- Rashtriya e-marketing services Ltd. |

By: Karnataka Government & NC-DEX e-markets Ltd - to integrate all APMCs across Karnataka through an e- platform |

|

|

World Trade Organisation |

- Estb 1995 - Role: Management of Multilateral Trading System - Predecessor to WTO: GATT, 1948(Bretton woods conference) - Formed at end of Uruguay round of GATT(ended 1994) |

|

|

Principles of WTO: (NOT LEGALLY BINDING) |

1. Free Trade. 2. Fair Trade 3. Non-discriminatory Trade (MFN to all members of WTO and National Treatment, for domestic goods) |

|

|

Agreements on Agriculture, 1995 |

About: -reduction in domestic subsidies, export subsidies -improving market access |

|

|

3 types of subsidies WTO talks of: |

1. Green box- non-trade distorting 2. Blue box - subsidies given under production limiting programmes *1,2 need not be reduced 3. Amber Box- trade distorting subsidies. Need to be reduced (exception for deminimus level - I.e 5% of Agriculture GDP for developed countries and 10% of Agriculture GDP for developing countries) |

|

|

Box shifting |

Shifting from Amber Box to green or blue box (done by USA) |

|

|

In which WTO ministerial did India reject the peace clause given by DG of WTO? |

Bali Ministerial, 2013 |

|

|

Nairobi Ministerial |

- concept of Special Safeguard Mechanism(SSM) is discussed here. - available to mostly developed countries (India wants it but does not have it) |

|

|

Agreement on TRIPs(Trade related IPRs) |

- more stringent protection of IPRs - doha ministerial- compulsory licensing under Trips for country to make patented medicines - India fully TRIPs compliant. - India filed for compulsory licence for Nexavar( cancer med) |

|

|

Nexavar |

-patented by Bayer -USA rebutted, criticised India - India got licence - NATCO Made Nexavar at cheaper costs. |

|

|

Trips plus |

Not under WTO - India not a member |