![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

9 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Money functions? |

Medium of exchange Unit of account Store of value |

3 |

|

|

Demand for money - reasons ? |

Transaction motive ( directly to Real GDP, income and price level) Speculative motive ( inversely to market rate of interest) |

|

|

|

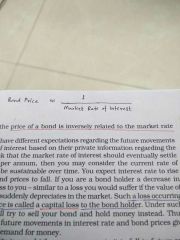

Relate "Bond Price" to "market rate of interest" Relate "Bond Price" to "Bond Yield" |

Inversely related - both. |

Direct or Inverse |

|

|

Relate "speculative demand of money" with "market rate of interest". How ? |

InDirectly related. HIGH interest -> expectation of fall and hence capital gain from bond holding -> so ppl invest in bonds -> LOW money demand |

|

|

|

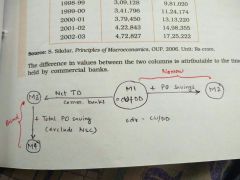

Define/relate M1,M2,M3,M4. Which are narrow,which broad |

M1 = CU+DD M2 = [M1] + PO-savings M3 = [M1] + Net TD-commercial banks M4 = [M3] + total PO deposit except NSC

M3 aka Aggregate Monetary Base |

Diagram |

|

|

What do you mean by high powered money? What other terms are used to denote it? |

Total liability of RBI i.e. Currency with public and vault cash of banks . + Deposits held by GoI & commercial banks.

High powered money = Monetary base |

|

|

|

Money multiplier? > 1 or <1 or = 1 |

Ratio of stock of [ money] : [high powered money] i.e. M/H Always > 1 => total amount of money stock in economy is much greater than volume of high powered money. |

|

|

|

CDR ? What does it imply? |

money held by public in CURRENCY : they hold in Bank DEPOSITS. People's preference for liquidity. Behavioural |

|

|

|

What's RDR ? Two components of Reserve money ? |

Banks keep reserve and loan out rest. RDR = reserve/total money deposited in bank (i.e. proportion of total deposits comm banks keep as reserves) Reserve money = vault cash in banks + deposits of comm banks with RBI. |

|