![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

|

Gross Margin Percentage

|

Note: more stable for retail companies than for other companies because COGS (costs of goods sold) in retailing excludes fixed costs (a periodic change that doesn’t vary with business volume such as insurance, rent, and mortgage.

-when fixed costs are included in the cost of goods sold, the gross margin percentage should increase and decrease with sales volume. increased sales volume ⇒fixed costs spread across more units⇒Gross % increase. |

|

|

Gross Margin

|

|

|

|

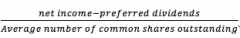

Earnings per Share

|

Note: net income for common stockholders = net income – dividends paid to preferred stock holders.

|

|

|

Earnings per Share

|

Note: net income for common stockholders = net income – dividends paid to preferred stock holders.

|

|

|

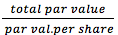

Average # of Common shares outstanding

|

|

|

|

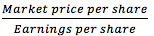

Price-Earnings Ratio

|

Note: With a high P – E ratio, investors are willing to pay a premium for the company’s stock (they expect the company to grow)

|

|

|

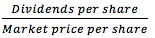

Dividend Yield Ratio

|

Note: Measures the rate of return (in the form of cash dividends only) that would be earned by an investor who buys common stock at the current market price.

|

|

|

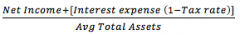

Return on Total Assets

|

Note: interest expenses are added back to the net income to show what earnings would have been if the company had not debt. (this allows comparison of companies with and without debt)

-Placed on an after-tax basis by multiplying it by the factor (1- tax rate) |

|

|

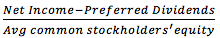

Return on Common Stock

|

Average Common Stockholders’ Equity = Avg total stockholders’ Eq – Avg Prf stock.

Note: based on the book value of common stockholders’ equity. |

|

|

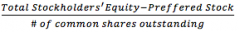

Book Value per Share

|

Note: This is the amount that would be distributed to holders of each share of common stock if all assets were sold at their balance sheet carrying amounts and if all creditors were paid off.

- Reflects the results of events that have occurred in the past. |

|

|

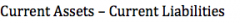

Working Capital

|

Note: WC is expense and this is why managers often want to minimize this. To put it into proper perspective, it should be supplemented with these ratios: Current ratio, acid-test ratio, accounts receivable turnover and the inventory turnover.

|

|

|

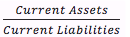

Current Ratio

|

Note: usually regarded as the short-term paying ability

-Declining – sign of deteriorating financial condition, or it might be the result of eliminating obsolete inventories or other stagnant CA. -Improving = might be result of stockpiling inventory, or might indicate an improving financial situation. |

|

|

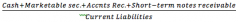

Acid- Test (quick) Ratio

|

Note: More rigorous test of a comp’s ability to meet its short-term debts than the current ratio. It excludes the inventories and prepaid expenses from the total current assets leaving the more liquid assets to be divided by current liabilities.

-Measures how well a company can meet its obligations without having to liquidate or depend too heavily on its inventory. |

|

|

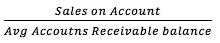

Accounts Receivable Turnover

|

Note: measures how quickly sales are converted into cash.

|

|

|

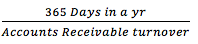

Average Collection Period

|

Note: whether this measurement is or good bad depends on the credit terms your firm is offering its customers. If credit terms are 30 days, then 35 avg C.P. would usually be viewed as good.

|

|

|

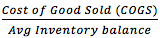

Inventory Turnover

|

Note: measures how many times a company’s inventory has been sold and replaced during the year.

|

|

|

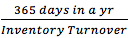

Average Sale Period

|

|

|

|

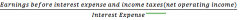

Times Interest Earned Ratio

|

Note: based on earnings before interest expense and income taxes because that is the amount of earnings that is available for making interest payments.

- 1 is inadequate because interest expense is included in the numerator. - 2 or more is considered sufficient to protect long-term creditors. |

|

|

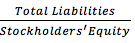

Debt-to-Equity Ratio

|

Note: Creditors like to see less debt and more equity because equity represents the excess of total assets over total liabilities and means a better buffer for them.

|