![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

|

The high-low method |

Used to get estimates of the slope and intercept of a mixed cost function using 2 data points.

1. Find high and lowest level of activity and cost. 2. To find variable = the difference in cost/the change in activity. 3. To find fixed = Total cost - variable cost (Answer 2 x no. of units) 4. Put into equation y = a + bX where a = FC and b = VC (answer to 2). |

|

|

Plotting the high-low method |

1. y = vertical axis and is known as the dependent variable as the amount of cost incurred during period depends on level of activity in period. 2. x = horizontal axis and is known as the independent variable as it causes variations in cost 3. A straight line is drawn between high and low point and represents the variable cost per unit. |

|

|

Problems with the high-low method |

1. Two points aren't enough to produce accurate results. 2. Doesn't take into consideration periods in which activity is unusually low/high and therefore produce inaccurate results. |

|

|

Define cost structure? |

The relative proportion of each type of cost present in a firm (variable, fixed and mixed). |

|

|

Define an activity base (cost driver) |

The measure of whatever causes the incurrence of variable cost e.g. direct labour, machine hours, units produced, units sold. |

|

|

What types of variable costs does a merchandising company's have? |

1. Cost of goods e.g. clothings |

|

|

What types of variable costs do manufacturing company's have? |

1. Manufacturing costs (direct materials & direct labour) Variable portions of manufacturing overheads: 2. Indirect materials 3. Lubricants 4. Supplies & power |

|

|

What types of variable costs do manufacturing company's and merchandising company's have? |

1. Selling and administration costs 2. Commission 3. Clerical costs (e.g. invoicing) 4. Shipping costs |

|

|

What types of variable costs do service organisations have? |

1. Supplies 2. Travel clerical |

|

|

What are true variable costs (proportionately variable costs)? |

Direct materials are true costs because the amount used during a period varies in direct proportion to the level of production activity. Surplus can also be carried forward as inventory. |

|

|

What are step variable costs? |

A cost that is obtainable only in large chunks and that increases/decreases in repose to fairly wide changes in activity level. |

|

|

Economist vs accountant view of variable costs |

Economists argue many costs accountants classify as variable actually behave in a curvilinear fashion. |

|

|

What is the relevant range? |

The range of activity within which the assumptions made about cost behaviour by the manager are valid. Anything outside is not accurate and a poor approximation to curvilinear cost relationship. |

|

|

Define fixed costs (capacity cost) |

A cost that remains constant, in total, regardless of changes in the level of activity. e.g. Rent |

|

|

Discuss fixed costs in management accounting |

Fixed costs remain constant in total and should be used for internal purposes as they can accurately be assigned a 'per unit cost' |

|

|

What purpose can different types of fixed costs be used for? |

Planning |

|

|

What are two types of fixed costs? |

1. Committed fixed costs 2. Discretionary fixed costs |

|

|

Define committed fixed costs? (CFC) |

Relate to the investment in facilities, equipment and basic organisation of a firm e.g. depreciation of buildings and equipment, taxes on real estate and insurance. |

|

|

What are the key factors of committed fixed costs? |

1. They are long term in nature 2. They can't be reduced down to zero without causing serious problems to business's long run goals and profits. |

|

|

Define discretionary fixed costs (managed fixed costs) |

Usually, arise from annual decisions by management to spend in certain fixed cost areas. e.g. advertising, research, public relations, management development programs and interns for students. |

|

|

Describe some of the key factors of discretionary fixed costs (DFC) |

1. Can be adjusted to zero temporarily 2. Not locked into decision regarding cost ` |

|

|

What are the key differences between DFC and CFC? |

1. Planning horizon for a DFC is fairly short term (single year) but for CFC it can be many years 2. DFC can be reduced for short periods of time with minimum damage whereas long run goals in CFC can be massively damaged. |

|

|

Why must management be careful when considering CFC and DFC? |

Workers can be seen as CFC because they can be laid off when work is slow however if work increases they may have lost loyalty and is slower than if workers are still paid when there is not much work. |

|

|

Why is relevant range important when deciding DFC's? |

DFC are typically decided at the start of the year but can be adjusted depending on the level of activity. However, once DFC's have been budgeted they are not affected in respect to actual no. of units sold (e.g. marketing) so become a fixed cost. |

|

|

What are the main differences between step-variable costs and fixed costs? |

1. Step-variable costs can be adjusted quickly as conditions change whereas fixed cost's can't. 2. The 'width of steps' is wide for fixed costs with the width relating to the volume/level of activity and narrow for variable costs. |

|

|

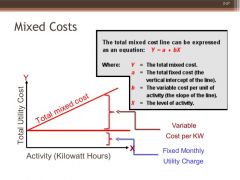

Define mixed costs (semi-variable costs)? |

One that contains both variable and fixed cost elements. |

|

|

Give an example of a mixed cost |

Equipment license, e.g. costs £2500 to rent and £3 every time it is used |

|

|

Y = a + bX Y - The total mixed cost a - total fixed cost b - variable cost per unit of activity X - Activity level |

|

|

What is the contribution format? |

A profit statement format that is geared to cost behaviour in that costs are separated into variable and fixed categories rather than being separated according to the functions of production, sales and administration. |

|

|

What is a dependent variable? |

1. A variable that reacts or responds to some casual factors; total costs 2. Y in Y = a + bX 3. Is plotted on the vertical axis. |

|

|

What is an independent variable? |

1. A variable that acts as a casual factor; basically the activity 2. X in Y = a + bX 3. Is plotted on the horizontal axis. |

|

|

Define the contribution margin? |

The amount remaining from sales revenue after variable expenses have been deducted. This amount 'contributes' towards covering fixed expenses and then towards profits for the period. |

|

|

What does the contribution approach allow managers to organise data? |

(PUMP) 1. Product-line analysis 2. Pricing 3. Use of scarce resources 4. Make or buy analysis |