![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

109 Cards in this Set

- Front

- Back

|

short-run fluctuations in output and employment |

business cycle |

|

|

ending date of a recession |

business cycle trough |

|

|

starting date of a recession |

business cycle peak |

|

|

for every percentage point the unemployment rate rises, real gdp growth falls by |

2% |

|

|

when unemployment rate rises from 5 to 7 percent, percentage change in real GDP= |

3% - 2x(7%-5%) |

|

|

average workweek length, average claims for UI, new orders for consumer goods, new orders for nondefense capital goods |

leading indicators |

|

|

index of supplier deliveries, new building permits issued, index of stock prices, M2 growth adjusted for inflation, interest rate spread, index of consumer expectations |

leading indicators |

|

|

irrelevance of the money supply for the determination of real variables |

monetary neutrality |

|

|

relationship between the quantity of output |

aggregate demand |

|

|

the quantity of goods and services people want to buy at any given |

aggregate demand |

|

|

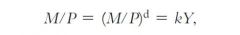

k is 1/V, states that supply of real money balances (m/p) equals demand for real money |

|

|

left axis of AD curve ___, right axis of AD curve _ |

price level, income/output/Y |

|

|

Why does the AD curve slope downward |

When M and V are fixed if P goes up Y must go down by the equality -- intuition is that price level rising means each transaction requires more dollars such that quantity purchased must fall |

|

|

is the relationship between the quantity of goods |

aggregate supply |

|

|

the Long run aggregate supply is _______ |

vertical because output does not depend on the price level |

|

|

LRAS is fixed at the _____ level of output |

natural or full-employment |

|

|

policy actions aimed at reducing the severity of short-run economic fluctuations. |

stabilization policy |

|

|

introduction of credit cards has what effect on aggregate demand? |

reduce quantity of money people hold, which increases velocity, decreasing parameter k, thus aggregate demand shifts outward |

|

|

union aggressiveness, environmental regulation, oil cartels, drought |

adverse supply shocks |

|

|

government debt does not influence national |

recardian equivalence |

|

|

causes of deficit |

age composition, rising healthcare costs |

|

|

The budget deficit includes the change in debt as a result of |

inflation, (pi)D is extent of over-statement of debt |

|

|

measurement problems of debt/deficit |

inflation, capital assets, uncounted liabilities, business cycle |

|

|

capital asset problem of gov. debt? |

the budget deficit should be measured as the change in debt minus the change in assets. |

|

|

A budget procedure that accounts for assets as well as liabilities |

capital budgeting |

|

|

implicit debt not counted in deficit includes |

pensions, Social security |

|

|

the liability that is due only if student loans, low- and moderate-income families, and deposits in banks and savings in loan institutions are defaulted |

contingent |

|

|

TARP, how it worked |

The Treasury borrowed money, gave the |

|

|

based on estimates of what government spending and tax revenue would be if the economy were operating at its natural level of output and employment |

cyclically adjusted budget deficit |

|

|

base their spending decisions not only on their |

forward-looking Ricardian consumer |

|

|

reasons against Ricardian consumer |

myopia, future generations, and borrowing constraints |

|

|

why deficit or surplus is okay? |

stabilization of business cycle, tax smoothing, intergenerational redistribution |

|

|

benefits of indexed bonds |

less inflation risk, more financial innovation, better government incentives, |

|

|

stimulates consumer spending and lowers national saving. This increase in consumer spending leads to greater aggregate demand and |

traditional view of government debt |

|

|

a debt-financed tax cut does not stimulate consumer spending because it does not raise |

ricardian view of government debt |

|

|

cyclical low income and high unemployment caused by what according to Keynes |

aggregate demand |

|

|

LM stands for ________ and represents what's happening to _____________ |

liquidity and money, supply and demand for money |

|

|

measures amount firms households and government spend on goods and services, equals GDP |

actual expenduture |

|

|

amount firms households and government would like to spend on goods and services |

planned expenditure |

|

|

planned expenditure is a function of _ _ _ _ |

C(Y-t), I G |

|

|

slope of the planned expenditure function |

marginal compensity to consume |

|

|

Keynesian cross assumes that _________ |

economy is in equilibrium when actual expenditure equals planned expenditure because when people's plans are realized they have no reason to change what they're doing. |

|

|

assumption of Keynesian cross that actual expenditure equals planned expenditure holds when _______________ |

45 degree line intersection with Planned Expenditure function |

|

|

to the right of intersection of Keynesian cross |

unplanned inventory accumulation causes income to fall because firm accumulation of inventory induces firms to decrease production |

|

|

to the left of intersection of Keynesian cross |

unplanned drop in inventory causes income to rise because firms increase production |

|

|

the ratio change in Y to change in G (dY/dG), measures how much income rises with a $1 increase in G |

government purchases multiplier |

|

|

why does fiscal policy have a multiplied effect on income? |

in consumption function c(Y-T) higher income causes higher consumption --- eg dG+MPC.G+MPC(MPC.G)+.... feedback effect |

|

|

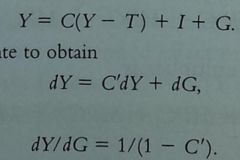

government purchases multiplier = |

dY/dG=1+MPC+MPC^2+MPC^3... = 1/(1-MPC) |

|

|

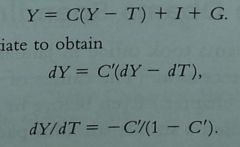

tax multiplier + |

-MPC / (1 - MPC) |

|

|

things that shift the PE curve up ... |

decrease in taxes, increase in G |

|

|

derivation of the tax multiplier |

|

|

derivation of government purchases multiplier |

|

|

argue that economic boom resulted from incentive effects to work more from the income tax cut |

supply siders |

|

|

why is increasing G better than decreasing T |

government purchases multiplier exceeds tax multiplier because some of tax cut will be saved |

|

|

the cost of borrowing |

interest rate |

|

|

slope of the interest rate is __________ the y is __ and the x is ______ |

negative because it's the cost of borrowing, r, I |

|

|

an increase in the interest rate causes planned invetment to fall which in turn causes equilibrium income to fall means that |

IS curve slopes downward |

|

|

fiscal policy only refers to changes in |

G and T |

|

|

changes in G and T affect IS curve by _____ |

shifting planned expenditure |

|

|

plots the relationship between the interest rate and the level of income that arises in the market for money balances |

LM curve |

|

|

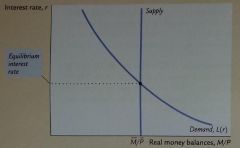

the interest rate adjusts to balance the supply and demand for the economy's most liquid asset - money |

theory of liquidity preference |

|

|

what's the assumption of the theory of liquidity preference |

fixed supply of real money balances |

|

|

real money balances supply is vertical because money supply is exogenous or doesnt depend on the interest rate |

|

|

demand for money curve is negative because |

a higher interest rate raises the cost of holding money and thus lowers quantity demanded |

|

|

money market disequilibrium what's actually happening |

interest rate altered because people adjust the portfolios of their assets |

|

|

individuals holding excess supply of money try to convert their cash into interest-bearing deposits and banks subsequently lower their interest rates so they dont have to pay as much |

interest rate is above equilibrium level |

|

|

people sell bonds and make withdrawals, banks have scarce funds and respond by increasing their interest rates |

r is below equilibrium or quantity of money demanded exceeds quantity supplied |

|

|

decrease in the money supply ________ the interest rate |

raises |

|

|

The quantity of real money balances demanded is ______________ related to the interest rate and ________________ related to income |

negatively, positively |

|

|

LM loin from L(r,Y) and M/P |

|

|

why is the LM upward sloping |

higher income leads higher demand for real money balances leads to a higher interest rate |

|

|

an increase in the money supply lowers the interest rate which stimulates investment and thereby expands the demand for goods and services |

monetary transmission mechanism |

|

|

the fed can offset the recession caused by a tax hike if it |

expands the money supply at the expense of a large decrease in the interest rate |

|

|

SRAS equation |

Y=Ybar +a(p-ep) |

|

|

output deviates from its natural level when |

price level deviates from the expected price level |

|

|

slope of the aggregate supply curve |

1/a |

|

|

two reasons why aggregate supply slopes upward |

when prices are higher firms need to charge more to recoup costs, the imperfect information model |

|

|

all prices are free to adjust to balance supply and demand but short run and long run supply curves differ because of temporary misperceptions about prices |

imperfect information model |

|

|

when actual prices exceed expected prices, suppliers raise their output |

imperfect information model |

|

|

phillips curve |

pi = Epi - B(u-u^n) +v |

|

|

people form their expectations of inflation based on recently observed inflation |

adaptive expectations |

|

|

pi - pi(last year) - B (u-u^0)+v |

non accelerating inflation rate of unemployment NAIRU |

|

|

low employment pulls the inflation rate up; high aggregate demand is responsible --- high unemployment pulls the inflation rate down -- B |

demand-pull inflation |

|

|

v term in phillips curve. adverse supply shocks mean positive v |

cost-push inflation |

|

|

percentage of a year's real GDP that must be forgone to reduce inflation by 1 percentage point |

sacrifice ratio |

|

|

reducing inflation by 1 percentage point requires sacrifice of ______ of cyclical unemployment |

2.5 |

|

|

fluctuations in aggregate demand affect output and employment only in the short run |

natural rate hypothesis |

|

|

long-lasting influence of history on the natural rate of unemployment |

hysteresis |

|

|

time between a shock to the economy and the policy action responding to that shock; occurs because it takes time for policy makers to recognize that a shock has occurred |

inside lag |

|

|

time between a policy action and its influence on the economy because policies do not immediately affect anything |

outside lag |

|

|

which has the worse inside lag between fiscal and monetary policy |

fiscal |

|

|

income taxes, Unemployment insurance, welfare |

automatic stabilizers |

|

|

traditional methods of policy evaluation do not take into account the impact of policy on expectations |

lucas critique |

|

|

Lucas thoughts on disinflation and sacrifice ratio |

estimates of the sacrifice ratio are unreliable because they do not consider how policy affects expectations; reducing inflation can be less costly |

|

|

according to romer why hasn't keynesianism worked after 30s |

figment of the data; making "bad" modern data and good old data shows the disparity in data-gathering |

|

|

manipulation of the econoy for electoral gain |

political business cycle |

|

|

policymakers can sometimes better achieve their goals by having their discretion taken away from them because of |

time inconsistency of policy |

|

|

advocate rule where the Fed keeps money growing at a steady rate; doesn't allow adjustment for shocks |

monetarists |

|

|

fed announces planned path for nominal GDP and reduces or increase money growth to affect AD |

GDP targeting rule |

|

|

money supply adjustment that insulates economy from changes in velocity of money |

inflation targeting rule |

|

|

when inflation rises, the federal funds rate should _______, meaning smaller money supply |

rise |

|

|

responds to inflation and the output gap (as a measure of inflationary pressure) |

taylor rule |

|

|

increase in the money supply lowers interest rate, stimulating investment and expanding the demand for goods and services; how monetary expansion induces greater spending |

monetary transmission mechanism |

|

|

interest rate that banks charge one another for overnight loans |

federal funds rate |

|

|

hypothesis placing primary blame for the depression on an exogenous fall in spending on goods and services, thus a contractionary shift in the IS curve |

spending hypothesis |

|

|

places blame on the federal reserve for allowing the money supply to fall |

money hypothesis |

|

|

mechanism by which falling prices expand real money balances, making consumers spend more |

pigou effect |

|

|

unexpected falls in the price level enriches creditors and impoverishes debtors, affecting spending on goods and services because debtors probably have higher propensities to consume |

debt-deflation theory |

|

|

interest rates have fallen so low that monetary policy is no longer effective |

liquidity trap |