![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

30 Cards in this Set

- Front

- Back

|

What are the three types of Income Tax? |

Non Savings Income (earnings from employment)

Savings Income (interest from bank accounts)

Dividend Income (dividends payable by companies and investment funds) |

|

|

What are the three steps to calculate income tax? |

1 - All the income from the three categories is added up for the year

2 - Deduct the annual personal allowance from the bottom pile of income

3 - Calculate the tax due on the remaining income after deducting the personal allowance |

|

|

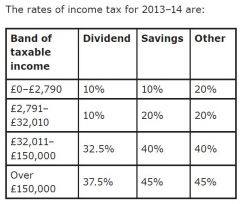

What are the income rates of tax for 2013/14? |

|

|

|

What types of income can be tax free? (6) |

Premium Bond Prizes Interest on National Savings Certificates Incomes from ISA's Gambling National Lottery Wins Compensation from loss of employment (up to 30k) |

|

|

What is Interest Income referred to by the HMRC? |

Non Dividend Savings Income - Taxed after earned income |

|

|

What does Non-Dividend Savings income apply to? |

UK and Overseas savings income from the following sources

Interest from banks and building societies Interest from gilts and corporate bonds Purchased life annuities Some distributions from unit trusts |

|

|

What is the starting rate of tax for Saving Incomes Only? |

10% |

|

|

What is the amount of tax on Savings between £2,791 - £32,010? |

20% |

|

|

What is CGT? |

Capital Gains Tax |

|

|

Explain Capital Gains Tax |

A tax levied on an increase in the capital value of an asset.

Usually paid when disposed of/sold on |

|

|

What may Capital Gains Tax be added on? |

Shares Unit Trusts Certain Bonds Property (Except Main Home) |

|

|

What is exempt from Capital Gains Tax? |

Main Home Car and other possessions up to £6,000 Gains on Gilts Betting, Lottery or Pools Winnings Transfers between spouses |

|

|

What is the "Annual Exempt Amount"? |

Annual tax free allowance which allows a certain amount of gains tax free each year |

|

|

What is the annual tax free allowance on Capital Gains? |

£10,900 |

|

|

What are the three excess charges for Capital Gains tax? |

18% and 28% for individuals (rate used depends on amount of total taxable income and gains)

28% for trustees or personal representatives

10% for gains qualifying for Entrepreneurs Relief |

|

|

What is Inheritance Tax based on? |

The value of assets that are transferred during an individuals lifetime or that are remaining at death |

|

|

What is the Nil Rate Band set at for Inheritance Tax? |

£325,000 any transfer in excess of this is charged at 40% |

|

|

What is exempt from Inheritance Tax? |

Assets left to a spouse Assets left to registered charitites Gifts made more than 7 years before death |

|

|

When would Inheritance Tax change from 40% to 36%? |

If 10% or more of a net estate (after deductions) is left to charity |

|

|

What is Stamp Duty? |

A tax paid on UK share trades where a stock transfer form is used |

|

|

What is Stamp Duty Reserve Tax? |

A tax paid when an individual buys shares electronically with no stock transfer form |

|

|

When is no Stamp Duty added? (5) |

When purchasing foreign shares Bonds OEIC's Unit Trusts ETF's |

|

|

What is VAT? |

Value Added Tax

A charge added by firms and individuals whose turnover exceeds a certain amount when they supply taxable goods or services |

|

|

What is the standard rate of VAT? |

20% |

|

|

What are Investment Wrappers? |

A way for individuals to own both savings and shares with certain tax advantages |

|

|

What do Investment Wrappers include? (4) |

ISA's Child Trust Funds/Junior ISA's Pensions Investment Bonds |

|

|

Who creates the rules around Investment Wrappers? |

The HMRC (Her Majesty's Revenue and Customs) |

|

|

What is an ISA? |

Individual Savings Account

An account that holds other savings and investments such as deposits, shares, OEIC's and unit trusts

They are invested in a tax efficient manner |

|

|

Who are ISA's available for? |

Stocks and Shares ISA's - UK residents over 18 Cash ISA's - Aged 16 or over |

|

|

What are the tax incentives for ISA's? |

They are free of Income Tax and Capital Gains Tax

As of 2005 is it no longer possible to reclaim tax credit on dividends |