![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

87 Cards in this Set

- Front

- Back

|

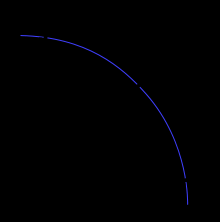

What is PPF?

|

It's a production possibility curve (PPC) which shows the maximum combinations of goods and services that can be produced at that time if all the resources are being used fully. This is the "Potential output" or the production possibility frontier (PPF)

|

|

|

What shape is PPF and why?

|

It's concave because of the law of diminishing returns. Which means not all resources can be transferred between different uses without some cost or time.

|

|

|

How is the opportunity cost on a PPC measured

|

By the number of units of the 2nd goof forgone if an additional unit of the first good is made

|

|

|

What are the two types of economic growth?

What are their definitions? |

Actual Growth: when there is a movement from a point inside the PPF towards the curve. Achieved by using the resources better

Potential growth: When there is an outwards shift of the PPF achieved by the quantity or quality of resources |

|

|

What is demand?

|

The quantity of goods and services that consumers are able and willing to buy at a certain price

|

|

|

What is the law of demand?

|

Under ceteris paribus, a change in price will lead to a change in quantity demanded.

|

|

|

What is the income effect?

|

If the price of a good falls and your income remains the same, you can now buy more goods

|

|

|

What is the substitution effect?

|

If the price of a good falls, what has really happened to the price of alternative goods (substitutes)

|

|

|

What does the demand curve assume?

|

There is a competitive market and perfect knowledge.

|

|

|

What factors determines demand?

|

Price, income, substitute goods, complement goods, taste and preferences, expectations, population and season (umbrella for example)

|

|

|

What is the law of supply?

|

As the price of a product rises, the quantity supplied will usually increase with ceteris paribus.

|

|

|

What causes a movement along the supply curve?

|

A change in the price

|

|

|

What determines supply?

|

Cost of factors of production

Changes in technology Government intervention (indirect taxes or subsidies) |

|

|

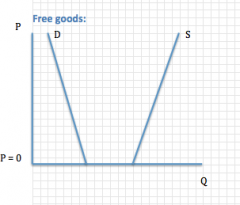

Diagram for a free good

|

|

|

|

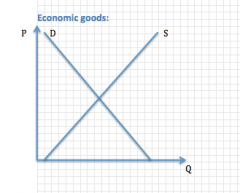

Diagram of an economic good

|

|

|

|

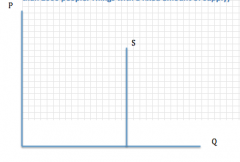

Diagram of an economic good with a fixed supply

|

|

|

|

What is allocative efficiency?

|

What to produce

|

|

|

What is productive efficiency?

|

How to produce

|

|

|

What are price controls?

|

maximum prices (price ceilings), minimum prices (price floors), and commodity agreements

|

|

|

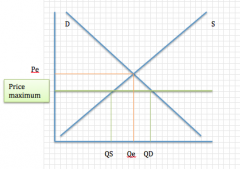

Maximum price:

Situation? Purpose? Problem? Solutions? +graphs |

Situation: government will set a maximum price below the equilibrium

Purpose: usually to protect the consumer Problem: create excess demand (shortages), black markets and queues may result Solutions: shift demand to the left (but this will mean less consumption), or shift supply to the right (via subsidies) |

|

|

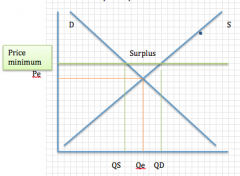

Minimum price:

Situation? Purpose? Problem? Solutions? + Graph |

Situation: government will set a minimum price above the equilibrium

Purpose: raise income for producers or protect workers (minimum wage) Problem: excess supply Solutions: government could buy the surplus (can be then destroyed or sold to another country), impose quotas, or attempt shift the demand curve to the right through advertising, and restricting imported products |

|

|

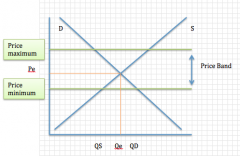

Commodity agreements:

Situation? Purpose? + Graph |

Situations: when countries operate buffer stock schemes together for a particular commodity

Purpose: alleviate difficulties in some countries (especially developing) which are reliant on commodity exports but which suffer from these products having low products |

|

|

What are the 4 types of elasticity?

|

Price elasticity of demand (PED)

Cross elasticity elasticity of demand (XED) Income elasticity of demand (YED) Price elasticity of supply (PES) |

|

|

What is PED and what is the formula?

|

PED (price elasticity of demand) It's the measure of how much the quantity demanded of a product changes when there is a change in the price of a product

%change in quantity demanded of the product/ %change in price of the product |

|

|

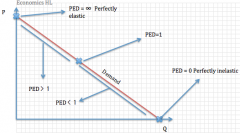

In PED when is it inelastic and elastic?

|

Inelastic: PED = 1, 1>PED>0

Elastic: ∞>PED>1 |

|

|

Theoretical PED's (perfectly inelastic and elastic)

|

Perfectly inelastic when PED = 0

Perfectly elastic when PED = ∞ |

|

|

Determinants of price elasticity

|

1. Availability of substitute goods (product with many substitute goods are usually more elastic)

2. Necessity of the product (the bigger the need the more inelastic) 3. Time period (takes time for consumers o react to a change in price) 4. How widely it's defined (meat>chicken>chicken nuggets>McDonals nuggets) 5. Price of product (the cheaper the product, the more inelastic) |

|

|

PED graph

|

|

|

|

What is XED and what is the formula?

|

XED (cross elasticity of demand) determines the relation between two goods (Compliment, unrelated or substitutes)

XED = %change in QD of product X / % Change in Price of product Y |

|

|

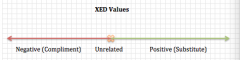

What does it mean when XED is positive, negative or 0?

+ graph |

positive: two goods are substitutes (coke and pepsi)

negative: two goods are compliments (bread and butter) 0: unrelated (phones and candles) |

|

|

What is PES and what is the formula?

|

PES (price elasticity of supply) It's a measure of the responsiveness of quantity supplied for a good or service to change in its price

PES = %Change in Quantity supplied of the product / %Change in price of the product |

|

|

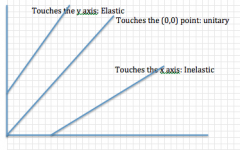

PES when is it inelastic, elastic or unit elastic?

+ Graph |

Inelastic: 1>PES>0

Elastic: ∞>PES>1 Unit elastic: PES = 1 |

|

|

In PES what are the costs of inputs?

|

If the cost of production increase significantly as supply increases then the producers may decide not to raise the supply, therefore PES will be inelastic. Even if price increase, it will take larger rises to make increasing the supply worthwhile

|

|

|

In PES why do you have to consider the time period?

|

Immediately, PES may be very inelastic as supply may be hard to increase straight away.

Short run, producers have the ability to increase some of the factors of production but not all, so PES is more elastic than the immediate Long run: PES is likely to be much more elastic as firms can increase the quantity f all factors of production. |

|

|

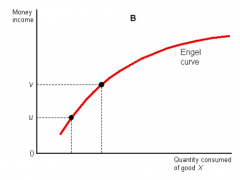

What is YED and what it the formula?

|

It calculates how much the demand for a product changes when there is a change in the consumer's income.

%change in quantity demanded of the product/ %change in income of the consumer |

|

|

What does it mean when YED is positive, negative?

|

Positive: normal good

1>YED>0: income elastic 1<YED: income inelastic Negative: inferior good |

|

|

What is a normal good?

|

Demand increases as income increases

|

|

|

What is an inferior good?

|

Demand decreases as income increases

|

|

|

What is a superior good?

|

Have a high elasticity demand. As income rises, the buyers can buy the products that they want

|

|

|

YED graph?

|

|

|

|

What is a subsidy?

|

This is a payment made by the government to producers of consumers

|

|

|

What are 4 purposes of taxation?

|

1. Reduce consumption of demerit goods (e.g. cigarettes, alcohol)

2. Reduce consumption of imported goods (tariffs) 3. Raise or lower levels of aggregate deand in an economy (Keynes) 4. Redistribute income in an economy |

|

|

What are direct taxations?

|

A tax on income or wealth

|

|

|

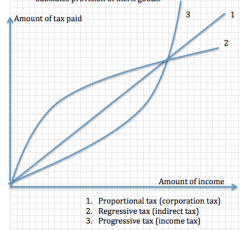

What are the three types of taxation?

|

1. Progressive taxes

2. Regressive taxes 3. Proportional taxes |

|

|

What are progressive taxes and what does it do to the distribution of income?

|

As income rises, people pay a higher proportion of their income in taxes.

This system makes income more evenly distributed |

|

|

What are regressive taxes and what does it do to the distribution of income?

|

Taxes decrease as income rises, for example indirect taxes

This system makes income less evenly distributed |

|

|

What are proportional taxes and what does it do to the distribution of income?

|

These taxes are set at a rate which is constant no matter the income level

This system does not alter the distribution of income |

|

|

What are transfer payments and what is the aim?

|

Money transferred from one group to another not in return for providing a good or service (e.g. child support assistance, unemployment benefits)

The aim is to redistribute income to those in society who need assistance. The government will use tax revenue to fund transfer payments |

|

|

What are 3 other methods to redistribute income? (not counting progressive taxation)

|

1. income distribution from businesses to employees (minimum wage)

2. Price support for farmers 3. Subsidies provision of merit goods |

|

|

Graph of the three types of taxation (progressive, regressive and proportional)

|

|

|

|

What could be a problem with high taxes?

|

It reduces the incentive to work and save. This has negative impacts on investment and growth

|

|

|

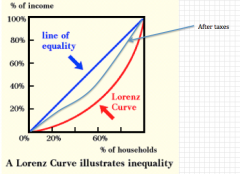

Draw and explain what the Lorenz curve is

|

The Lorenz curve is used to show the degree of income inequality in an economy

|

|

|

What is the equation for the GIni coefficient

|

Gini Index = area between diagonal and Lorenz Curve / Entire area under diagonal

|

|

|

What does the Gini index tell us?

|

The higher the Gini index, the more unequal the distribution of income

|

|

|

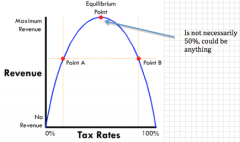

Draw and explain the Laffer curve

|

The Laffer curve shows the relationship between income tax rates and government revenues

|

|

|

What are 5 different reasons for Market failure?

|

1. The existence of Public goods

2. The under-provision of merit goods 3. Imperfect competition (such as monopoly power) 4. The existence of positive and negative externalities 5. The existence of asymmetric information |

|

|

Why would the existence of Public good cause market failure?

|

Public goods are non-excludable and non-rivalrous, as the private sector is unlikely to provide these. Therefore the government provides by financing these through general taxation. (E.g. street lights, police, roads)

|

|

|

Why would the under-provision of merit goods cause market failure?

|

Merit goods are goods and services that the government thinks are good for society, but if left to the free market will not be provided in sufficient quantity. Social benefits are likely to outweigh the Private Benefits. (E.g. Health, education, libraries, vaccination)

|

|

|

Why would imperfect competition cause market failure?

|

Due to the lack of competition, firms will seek to maximize profit at output levels that are lower than the optimal level and at higher prices, which leads to a welfare loss.

|

|

|

Why would the existence of positive and negative externalities cause market failure?

|

The social costs or benefits of consumption or production are different to the private costs benefits of consumption or production

|

|

|

Why would the existence of asymmetric information cause market failure?

|

When buyers make decisions, which are not based on the full information available.

|

|

|

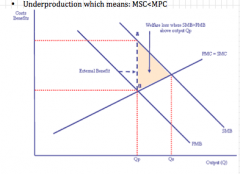

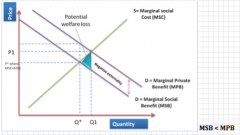

Graph of positive externalities of production (MSC<MPC)

|

|

|

|

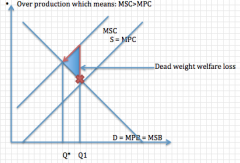

Graph for negative externalities of production (MSC>MPC)

|

|

|

|

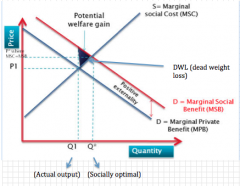

What is MSB?

|

Stands for Marginal Social Benefit. It is the total benefit gained to society from the consumption of an addition unit

|

|

|

What is MSC?

|

Stands for Marginal Social Cost. It is the total cost to society as a whole for producing one addiction unit

|

|

|

What is MPB?

|

Stands for Marginal Private Benefits. It is the total benefit gained privately from the consumption of one extra unit

|

|

|

What is MPC?

|

Stands for Marginal Private Costs. It is the total private cost for producing one extra unit

|

|

|

Which externalities are represented on the demand curve?

|

MPB: Same as the demand curve

MSB: different to MPB when there is a consumption externality. NOT a demand curve |

|

|

Which externalities are represented on the supply curve?

|

MPC: Same as supply curve

MSC: different to MPC when there is a production externality. NOT a supply curve |

|

|

When graphing externalities, what is Q1, Q*, dead weight loss and cause of externality

|

Q1: The quantity that the market will produce - this is where MPB = MPC because individual consumers and producer only consider their own private benefits and costs

Q*: The efficient level of output - this is where MSB = MSC Dead weight loss: the area between MSB and MSC - Q* and Q1 Cause of externality: Label what causes MSB/ MSC to be different to MPB/ MPC |

|

|

What are 3 different solutions for negative externalities of production? (MSC>MPC)

|

1. Taxation (internalise the externality) - make the producer pay more and shift MPC towards MSC

2. Legislation / regulation - ban activity 3. Tradable emission permits - a licence to pollute |

|

|

What is the problem of taxing negative externalities of production? (MSC>MPC)

|

How to measure exactly how much tax? Which firms are polluting? Do taxes actually stop the pollution?

|

|

|

What is the problem regulating negative externalities of production? (MSC>MPC)

|

Job losses, non-consumption of the good, costs of policing and setting standards may costs a lot

|

|

|

What is the problem with tradable permits for negative externalities of production? (MSC>MPC)

|

Pollution still occurs at the agreed level. What level to set? How to measure output pollution?

|

|

|

What 2 solutions are there for positive externalities of production? (MSC<MPC)

|

1. subsidies so the PC curve shift downwards and socially efficient output would be achieved

2. Government provision of vocational training services |

|

|

What is the problem for subsidising positive externalities of production? (MSC<MPC)

|

Opportunity cost and dificulty in estimating the value of the subsidy

|

|

|

What is the problem with government provision of positive externalities of production? (MSC<MPC)

|

High costs: would the training be as good? Lack of expertise: disincentive for to offer training themselves

|

|

|

Graph negative externalities of consumption? (MSB<MPB)

|

|

|

|

What are 3 solutions for negative externalities of consumption? (MSB<MPB)

|

1. Ban (e.g. smoking)

2. Indirect taxes (to shift MSC upwards) 3. Negative advertising/ education (to shift MPB to the left) |

|

|

What is the problem with banning an negative externality of consumption? (MSB<MPB)

|

Would cause unemployment in tobacco companies and could go out of business. Government tax revenue cost would make them unpopular among voters. Could cause black markets.

|

|

|

What is the problem with putting an indirect tax on negative externalities of consumption? (MSB<MPB)

|

If it was elastic people would stop buying it and if it was inelastic it would be ineffective

|

|

|

What is the problem with putting negative advertisement on negative externalities of consumption? (MSB<MPB)

|

Costly and not always effective

|

|

|

Graph positive externalities of consumption (MSB > MSB)

|

|

|

|

3 Solutions for positive externalities of consumption? (MSB > MSB)

|

1. Subsidies (shift MSC curve downwards)

2. Positive advertising/ education (shift MPB curve right) 3. Laws |

|

|

What is the problem with putting a subsidy on positive externalities of consumption? (MSB > MSB)

|

Costly

|

|

|

What are the problems with positive advertisement on positive externalities of consumption? (MSB > MSB)

|

Costly and short run effects are minimal (takes time to have an impact

|

|

|

What are the problems with putting a law of positive externalities of consumption?

|

Ethical considerations and freedom of choice

|