![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

28 Cards in this Set

- Front

- Back

|

debt service coverage

|

=(free operating cash flow + interest) / (interest + annual principal repayment)

|

|

|

Debt Payback Ratio

|

total debt / discretionary cash flow

|

|

|

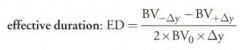

Effective Duration

|

|

|

|

Effective Convexity

|

|

|

|

value of embedded call option

|

vcall = vnoncallable - vcallable

|

|

|

value of embedded put option

|

vput = vputable- vnonputable

|

|

|

conversion value

|

market price of stock x conversion ratio

|

|

|

market conversion pnce

|

market price of convertible bond / conversion ratio

|

|

|

market conversion premium per share

|

market conversion price - market price

|

|

|

market conversion premium ratio

|

market conversion premium per share / market price of common stock

|

|

|

Premium Payback Period

|

market conversion premium per share / favorable income difference per share

|

|

|

Favorable Income Difference per Share

|

[ coupon interest- (conversion ratio x dividends per share) ] / conversion ratio

|

|

|

Premium Over Straight Value

|

(market price of convertible bond / straight value) - 1

|

|

|

single monthly mortality rate

|

1 - (1 - conditional prepayment rate) ^ 1/12

|

|

|

mortgage prepayment

|

SMM x (mortgage balance at beginning of month m - scheduled principal payment for month m)

|

|

|

debt-to-service coverage ratio

|

net operating income / debt service

|

|

|

loan-to-value ratio

|

current mortgage amount / current appraised value

|

|

|

bond-equivalent yield

|

2 [ (1 +monthly cash flow yield) ^6 - 1]

|

|

|

ROE

|

= net income / stockholders' equity

= (net income / sales) x (sales/total assets) x (total assets / stockholders' equity) |

|

|

Current Ratio

|

current assets / current liabilities

|

|

|

Acid-Test Ratio

|

(current assets - inventories) /current liabilities

|

|

|

long-term debt-to-capitalization ratio

|

long term debt / (long term debt + minority interest + shareholders' common and preferred equity)

|

|

|

total debt-to-capitalization ratio

|

(current liabilities +long term debt) / (current liabilities + long term debt + minority interest + shareholders' common and preferred equity)

|

|

|

coverage ratios

|

=EBIT / annual interest expense

=EBITDA / annual interest expense |

|

|

S & P cash flow ratios:

|

=funds from operations / total debt

or =funds from operations / capital spending requirements =(free operating cash flow + interest) / interest |

|

|

Free operating cash flow

|

Net income + Depr - Inc in NWC - CAPEX

|

|

|

Prefinancing cash flow

|

Discretionary cash flow - acquisitions + asset disposals + other sources (uses)

|

|

|

Discretionary cash flow

|

Free operating cash flow - cash dividends

|