![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

47 Cards in this Set

- Front

- Back

|

Floating Exchange Rate |

Price of one countries currency to another |

|

|

$108 in Yen / $1 in USD In terms of purchasing in Yen: [Reference Currency] [Indirect Quote] [Direct Quote] |

Reference Currency = USD Indirect Quote = 1/.001 Direct Quote = 108/1 |

|

|

Indirect Quote |

Price / Home Currency |

|

|

Direct Quote |

Home Currency / Price |

|

|

Forward Rate |

Price at which foreign exchange is quoted for delivery at a specified future date |

|

|

Spot Rate

|

Price at which currencies are traded for immediate delivery, with actual delivery taking place 2 days later |

|

|

Intervention

[Sterilized] |

[Sterilized] Open Market Operation example: Purchase of T-Bill by Fed increases money supply and inflation Results: rise or fall in country's foreign exchange reserve but not in domestic |

|

|

Factors that affect equilibrium exchange rate |

Relative Interest Rates Relative Economic Growth Rates [GDP] Political and Economic Risk |

|

|

Calculating Exchange Rate Changes |

Amount of appreciation (depreciation) = (New Value - Old Value) / Old Value |

|

|

Calculating Exchange Rate Changes in Reference Currency [$] |

[1/(New Value Yen) - 1/(Old Value Yen)] / [1/(Old Value Yen)

|

|

|

Monetize of Debt [leads to] |

Financing public sector by buying government debt with newly created money

leads to higher inflation and devalued currency |

|

|

Intervention [Unsterilized] |

[Unsterilized]Let market buy/sell without focus in domestic money supply (No insulation). Results in one economy deflating, while other inflating An increase in supply of money, will result in more inflation of home currency, and deflation in reference currency |

|

|

Monetary Policy Tools |

1) Money Supply

2) Interest Rates (short term) 3) Open Market Operations |

|

|

International Monetary Systems |

Refers to policies, institutions, regulations and practices which determine rate of exchange between currencies |

|

|

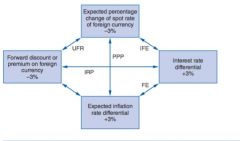

Arbitrage Activities |

1) Purchase Power Parity 2) Fisher Effect 3) International Fisher Effect 4) Interest Rate Parity (IRP) 5) Forward rates as unbiased predictors |

|

|

Spot Market > Forward Market = Sport Market < Forward Market = |

Spot Market > Forward Market = Forward Premium Spot Market < Forward Market = Forward Discount |

|

|

Law of One Price |

Arbitrageurs buy low, sell high prevents any deviations from equality

|

|

|

Calculating Forward Premium/Discount |

(Forward - Spot Rate) / Spot Rate

x 360 / Forward Contract Number of Days |

|

|

Purchasing Power of Parity |

Price levels should be equal worldwide when expressed in common currency Step 1: Home Currency / USD = exchange rate of product Step 2: (New Exchange Rate - Old Exchange Rate) / Old Exchange Rate = Overvalue or Undervalue |

|

|

Nominal vs Real Exchange Rate |

Nominal Exchange = Actual Exchange Rate Real Exchange = Nominal adjusted for changes in purchasing power |

|

|

Relationship between spot rates, forward rates, inflation rates and interest rates |

|

|

|

Fisher Effect

|

Currencies with high rates of inflation should bear higher interest rates than currencies with lower rates of inflation States that the nominal interest rate is: 1) A real required rate of return (a) 2) An inflation premium equal to the expected amount of inflation |

|

|

Fisher Effect Equation

|

1+Nominal Rate = (1+Real Rate) (1+ Expected Inflation Rate)

|

|

|

International Fisher Effect |

A rise in the US inflation rate relative to other countries will create a fall in the dollar's value. But will also be connected to a rise in US interest rates, ratline to foreign interest rates |

|

|

International Fisher Effect equation |

1+(interest rate of home)= [(1+interest rate of foreign)*(expected exchange rate end)] / (expected exchange rate beginning) |

|

|

International Fisher Effect Effect's |

R = Interest Rates

C = Currency If R = ^, C = ^ short term If R = ^, C = v in long term |

|

|

Nominal Interest Rate |

Nominal Interest Rates = Real Rate + Inflation Premium

|

|

|

Carry Trade |

Borrow money in low interest rate countries and trade in higher currencies |

|

|

Interest Rate Parity |

Currency of the country with lower interest rates should be forward premium in terms of currency, than higher rate countries

|

|

|

Interest Rate Parity |

Flow away from home if

1+rh < [(1+rf)*(f1) / (e0)] rh = interest rates at home rf = interest rates in foreign f1 = end of period forward rate e0 = current spot rate |

|

|

Balance of Payments |

1) Current Account -) Records import/exports 2) Capital Account -) Debt forgiveness and transfers 3) Financial Account -)Public/private investment and lending |

|

|

Systematic Risk vs Unsystematic Risk |

Systematic Risk = Marketwise influences that affect all assets

Unsystematic Risk = A company Stick |

|

|

Foreign Exchange Market

|

Permit transfers of purchasing power denominated in one currency to another (trade one currency for another)

|

|

|

Transaction Cost [Bid-Ask Spread] |

Spread between the bid/ask rates for a currency

% Spread = (Ask Price - Bid Price) / Ask Price x 100 |

|

|

Future Vs Forwards |

1) Trading Future: Traded in competitive arena Forwards: Traded via telephone 2) Regulation Future: Regulated Forwards:Self regulating 3) Size of Contracts Future: <1% are settled by delivery Forwards: Expecting delivery 4) Credit Risk Future: Standardize Forwards: Individually tailored 5) Frequency of Delivery Future: Specified Delivery Forwards: Any date delivery 6) Margins Future: Required Forwards: Not required |

|

|

In-the-money At-the-money Out-of-the-money |

In-the-money | Strike < spot | Profit At-the-money | Strike = spot | Indifference Out-of-the-money | Strike > spot | Loss |

|

|

Options [Call] [Put] |

Options = gives the older the right, but not obligation to sell (put) or buy (call) another financial instrument at set date

Call Options = customer the right to purchase Put options = gives the right to sell at expiration date |

|

|

Hedging the Euro, if Euro is down (On a receivable) |

(best bet) Short a forward short a future (less a risk) buy a put sell a call |

|

|

Hedging the Euro, if the Euro is up (On a payable) |

Long Forward

Long Future Buy a call |

|

|

Hedging [Methodology] |

Step 1: Receivable or payable Step 2: Risk Exposure Receivable - Devaluation of foreign currency Payable - Appreciation of foreign currency Step 3: Hedging Strategy Buy Put is best option |

|

|

Hedging Risk and Strategy [Receivable] |

Risk Exposure: Depreciation/Devaluation Strategy: - Short Forwards - Short Futures - Buy Put (Best Option) - Sell Call |

|

|

Hedging Risk and Strategy [Payable] |

Risk Exposure: Appreciation Strategy: - Long Forward - Long futures - Buy call - Sell Put |

|

|

Calculating Forward Premium |

[(1+Foward) / (1+Spot) ] -1

|

|

|

Calculating IRP Forward Dep/Appr |

[(Spot)*(1+i/1+f)] - Spot] / Spot |

|

|

Future vs Forward |

Trading Regulation Contract Size Credit Risk Delivery Risk Margins |

|

|

Future vs Forward |

Trading Regulation Contract Size Credit Risk Delivery Risk Margins |

|

|

Risks assumed by dealer |

Interest

Currency

Counter party

Mis-match |