![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

43 Cards in this Set

- Front

- Back

|

Capital lease

|

A lease of an asset for substantially all of the asset's useful life and for which a lease asset and a lease obligation are placed on the balance sheet. 295

|

|

|

Consolidation accounting

|

The accounting process by which financial statements for one or more related firms are combined into one set of financial statements. 294

|

|

|

Effective tax rate

|

The average tax rate on income. 303

|

|

|

Enterprise assets

|

Net assets used in operating activities, otherwise called net operating assets (NOA). 291

|

|

|

Enterprise income

|

Income from firm's operations, otherwise called operating income or net operating profit after tax (NOPAT). 301

|

|

|

Financial leverage

|

The degree to which net operating assets are financed by net financial obligations. 317

|

|

|

Marginal tax rate

|

The rate at which the last dollar of income is taxed. 303

|

|

|

Minority interest

|

The share of shareholders in subsidiaries other than the common shareholders of the parent company. 296

|

|

|

Net financial assets (obligations)

|

Net assets used in financing activities. Distinguish from net operating assets. 291

|

|

|

Net financial assets

|

The expense generated by a firm's nonequity financing activities. 301

|

|

|

Net financial expense

|

The expense generated by a firm's nonequity financing activities. 301

|

|

|

Net operating assets (NOAs)

|

Net assets used in operating a business, otherwise called enterprise assets. Distinguish from net financial assets (obligations). 291

|

|

|

Net operating profit after tax (NOPAT)

|

Income from a firm's business operations, otherwise referred to as enterprise income. 301

|

|

|

Operating cash

|

Cash used in operations (compared to cash invested in financial assets). 292

|

|

|

Operating income

|

Income from a firm's business of selling products and service otherwise called enterprise income or net operating profit after tax (NOPAT). 301

|

|

|

Operating lease

|

A lease which does not entitle the lessee to use the lease asset for substantially all of the assets useful life and for which no asset or obligation is recognized on the balance sheet. 295

|

|

|

Operating liability leverage

|

The degree to which investment in net operating assets is made by operating creditors. 317

|

|

|

Residual operating income (ReOI)

|

Operating income in excess of the net operating assets earning at the required return. 312

|

|

|

Statutory tax rate

|

The tax rate applied to corporate income by statutes. 304

|

|

|

Strategic balance sheet

|

A reformulated balance sheet that gives insight into how the business is organized. 299

|

|

|

Tax shield

|

The effect that interest on debt has of reducing corporate taxes. 303

|

|

|

Trend analysis

|

Expresses financial statement items as an index relative to a base year. 314

|

|

|

Tax benefit of net debt

|

pg 303

|

|

|

After-tax net interest expense

|

pg 303

|

|

|

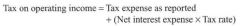

Tax on operating income

|

pg 304

|

|

|

Effective tax rate for operations

|

pg 305

|

|

|

Residual operating income

|

pg 312

|

|

|

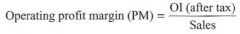

Operating profit margin (PM)

|

pg 313

|

|

|

Sales PM

|

pg 316

|

|

|

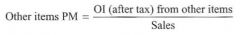

Other items PM

|

pg 316

|

|

|

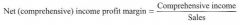

Net (comprehensive) income profit margin

|

pg 316

|

|

|

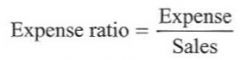

Expense ratio

|

pg 316

|

|

|

Sum of expense ratios

|

pg 316

|

|

|

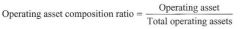

Operating asset composition ratio

|

pg 317

|

|

|

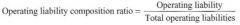

Operating liability composition ratio

|

pg 317

|

|

|

Operating liability leverage (OLLEV)

|

pg 317

|

|

|

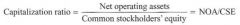

Capitalization ratio

|

pg 317

|

|

|

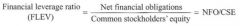

Financial leverage ratio (FLEV)

|

pg 317

|

|

|

Capitalization ratio - Financial leverage ratio

|

pg 317

|

|

|

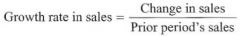

Growth rate in sales

|

pg 318

|

|

|

Growth rate in operating income

|

pg 318

|

|

|

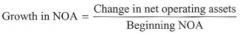

Growth in NOA

|

pg 318

|

|

|

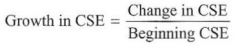

Growth in CSE

|

pg 318

|