![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

25 Cards in this Set

- Front

- Back

|

Call option

|

A claim that gives the holder the right, but not the obligation, to buy shares at a particular price (the exercise price). 266

|

|

|

Clean-surplus accounting

|

Produces a statement of shareholders' equity that contains only net income (closed from the income statement) and transactions with shareholders. 262

|

|

|

Contingent equity claim

|

A claim that may be converted into common equity if conditions are met. Examples are call options, put options, and convertible securities. 270

|

|

|

Convertible securities

|

Securities (such as bonds and preferred stock) that can be converted into common shares if conditions are met, but which have additional claims also. 272

|

|

|

Dilution (to existing shareholders)

|

Occurs when shares are issued to new shareholders at less than market value. 267

|

|

|

Dirty-surplus item

|

An accounting item in shareholder's equity other than transactions with shareholders or income closed from the income statement. 262

|

|

|

Forward share purchase agreement

|

An agreement to buy back shares at a specified price in the future. 271

|

|

|

Hidden dirty-surplus expense

|

An expense that arises from the issue of shares but is not recognized in the financial statements. 267

|

|

|

Incentive options

|

Employee stock options that are not taxed to the employee on exercise and are not tax deductible for the issuing firm. 267

|

|

|

Nonqualifying options

|

Employee stock options that are taxable o the employee on exercise and tax deductible to the issuing corporation. 267

|

|

|

Option overhang

|

The value of stock options unexercised. 269

|

|

|

Payout

|

Amounts paid to shareholders. The term is sometimes used to refer only to dividends, sometimes to dividends and stock repurchases. Compare with retention. 265

|

|

|

Put option

|

A claim that gives the holder the right, but not the obligation, to sell shares at a particular price (the exercise price). 271

|

|

|

Redeemable securities

|

Securities (such as bonds and preferred stocks) that can be redeemed by the issuer under specified conditions. 258

|

|

|

Retention

|

Paying out less than 100 percent of earnings. Compare with payout. 265

|

|

|

Tax benefit

|

A tax deduction or credit given for specified transactions. 268

|

|

|

Warrant

|

Similar to a call option but usually of longer duration. A put warrant is similar to a put option. 270

|

|

|

Dividend payout

|

pg 264

|

|

|

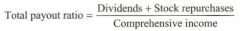

Total payout ratio

|

pg 265

|

|

|

Dividends-to-book value

|

pg 265

|

|

|

Total payout-to-book value

|

pg 265

|

|

|

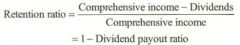

Retention ratio

|

pg 265

|

|

|

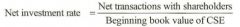

Net investment rate

|

pg 266

|

|

|

Growth rate of CSE

|

pg 266

|

|

|

Growth rate of CSE v2

|

pg 266

|