![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

101 Cards in this Set

- Front

- Back

|

Note

|

Fiduciary funds are accounted for using:

1- The Full accrual basis of accounting 2- Economic resources measurement focus |

|

|

What does Fiduciary Funds include?

|

1- Pension (& Other Employee Benefit) Trust Funds

2- Agency Funds 3- Private Purpose Trust Funds 4- Investment Trust Funds PAPI |

|

|

Note

|

All Fiduciary Funds (PAPI) don't use Cashflows statement

|

|

|

What is the purpose beyond establishing the Pension & other employee benefit trust Funds?

|

To account for government sponsored defined benefit & defined contribution plans & other employee benefits such as post retirement health care benefits.

|

|

|

What are the examples on the Pension & other employee benefit trust Funds?

|

1- Employee retirement plan

2- Deferred compensation plan |

|

|

What are the Revenue (Addition) Sources of Pension & other employee benefit trust Funds?

|

1- Employer & Employee Contributions-Restricted Account

2- Other Fund Transfers 3- Income from Investments |

|

|

Note

|

Resources received are credited to the account "employee contributions-restricted." which appears in the Net position section of the Pension trust fund B/S & is disclosed in the footnotes.

|

|

|

What is the JE to record the receipt of money from other funds as "Employer & Employee contributions" ?

|

|

|

|

Note

|

In the Pension Trust Fund, the receipt of money from other funds is called "Additions" neither "Revenues" nor "Other financing sources"

|

|

|

What is the JE (in the governmental fund) to record the payment of money for the Pension Trust fund ?

|

|

|

|

What is the JE (in the proprietary fund) to record the payment of money for the Pension Trust fund ?

|

|

|

|

Note

|

Income from investments is recorded as revenue & is closed to the proper employee restricted accounts at year-end.

|

|

|

Note

|

Expenses (Deductions) of pension trust funds frequently include:

1- Benefits Payments 2- Refunds 3- Administrative Expenses |

|

|

Note

|

Pension trust funds & public employee retirement systems (PERS) use the accrual basis of accounting (i.e., no budget & no encumbrances are used).

|

|

|

Note

|

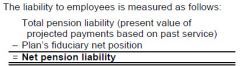

The net pension liability is computed as:

Total Pension Liability – Pension plan’s fiduciary Net position |

|

|

Note

|

|

|

|

Note

|

The net pension liability is determined from data reported in the pension fund FSs.

|

|

|

Note

|

The net pension liability is reported in the GWFSs, as well as the individual fund FSs, as appropriate.

|

|

|

Note

|

Actuarial valuations for the net pension liability must be performed every two years, although more frequent valuations are encouraged.

|

|

|

Note

|

Valuations of the net pension liability should be performed at year-end based on terms & conditions in effect at year-end or rolled forward to year-end using previous actuarial valuations.

|

|

|

Note

|

Valuations are to be made in conformity with the Actuarial Standards of Practice issued by the Actuarial Standards Board.

|

|

|

What does the discount of the projected benefit payment should reflect?

|

1- The long-term expected rate of return to the extent that net position is adequate to pay benefits & assets are available for investments

OR 2- The tax-exempt bond rate to the extent that conditions for use of the long term expected rate of return are not met. |

|

|

Note

|

Actuarial PVs are determined using the entry age actuarial cost method attributed to each plan member individually.

|

|

|

Note

|

"Changes in the net pension liability are typically included in:

1- Pension expense of the GWFSs 2- Appropriate funds responsible for funding the pension obligation." |

|

|

Note

|

Certain changes in the liability that are not included in pension expense are required to be reported as deferred outflows or deferred inflows of resources.

|

|

|

What are the Changes in the net pension liability that are charged to pension expense in the period of change?

|

1- Current period services costs.

2- Interest on total pension cost. 3- Reductions for projected earnings on pension plan investments. 4- Changes in benefit terms not eligible for deferral & therefore required to be included in pension expense immediately. |

|

|

What are those Certain changes in the liability that are not included in pension expense & required to be reported as deferred outflows or deferred inflows of resources?

|

1- Changes of economic & demographic assumptions or other inputs.

2- Differences between projected earnings & actual experience. 3- Changes to pension provisions for which benefits have not already been earned by plan participants (current & former employees). 4- Employer contributions subsequent to the measurement date. |

|

|

Note

|

Other changes in the net pension liability that are accounted for as deferred inflows & outflows of resources are subsequently amortized to pension expense over the average remaining service life of the employees.

|

|

|

Note

|

"Changes in the pension fund liability are accounted for:

1- As an expense in the GWFSs. 2- As an expense in the proprietary FSs. 3- As an expenditure & liability in the governmental funds to the extent that the liability is normally expected to be liquidated with expendable available financial resources." |

|

|

Note

|

Pension (& other employee benefit) trusts capitalize fixed assets & record related depreciation expense.

|

|

|

Note

|

Pension (& other employee benefit) trusts carry long-term debt & pay both principal & interest (Not paid by Debt Service Governmental fund).

|

|

|

Note

|

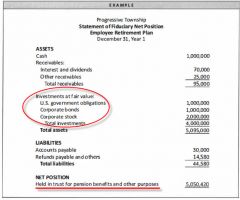

Net position is typically reported in a single line item titled , "Net Position: Held in trust for pension benefits & other purposes."

|

|

|

Note

|

IRC Section 457 deferred compensation plans are similar to 403(b) & 401 (k) defined contribution plans.

|

|

|

Note

|

IRC Section 457 deferred compensation plans that are reported in the fiduciary funds should be reported as pension (& other employee benefit) trust funds.

|

|

|

Note

|

Investments held by deferred compensation plans are to be reported (according to GASB 31) at fair value wherever readily determinable.

|

|

|

Note

|

GASB 25, as amended by GASB 67, requires that pension plan assets generally be measured using the accrual basis of accounting applied on a fair value basis; however, pension benefit obligations should be recognized when "due & payable."

|

|

|

Note

|

The statement of pension plan net position is prepared on an accrual basis & reports the plan's assets, liabilities, & net position.

|

|

|

Note

|

The Pension plan's net assets (investments) are reported on a fair value basis.

|

|

|

Note

|

Statement of pension plan net position identifies the major assets of the plan.

|

|

|

Note

|

Reported Pension plan's liabilities should be subtracted from the total assets, & the difference should be reported as "net position restricted for pension."

|

|

|

Note

|

Statement of pension plan net position does not report the required actuarial liability. Instead, it is reported in the RSI.

|

|

|

Example on "Statement of Fiduciary Net Position"

|

|

|

|

Note

|

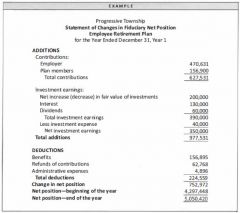

The statement of changes in fiduciary net position of the Pension Trust Fund reports the net increase or decrease in net position from the beginning of the year until the end of the year.

|

|

|

Note

|

Additions to Fiduciary net position include:

1- Contributions received from employees & employers. 2- Net appreciation (or depreciation) of the fair value of the plan assets, including realized & unrealized gains & losses. 3- Premiums & discounts on debt securities. |

|

|

Note

|

Premiums & discounts on debt securities should NOT be amortized as part of investment income.

|

|

|

Note

|

Deductions from Fiduciary net position include:

1- Pension benefit payments to retirees & beneficiaries 2- Administrative expenses. |

|

|

Example on "Statement of Changes in Fiduciary Net Position"

|

|

|

|

Note

|

|

|

|

What are the Notes to the Fiduciary fund FSs?

|

1- Descriptive information

2- Investment disclosures 3- Disclosures regarding contributions, reserves, etc. 4- The total pension liability 5- The pension plan's fiduciary net position 6- The net pension liability 7- The pension plan's fiduciary net position as a percentage of the total pension liability 8- Significant assumptions & other inputs used to calculate the total pension liability |

|

|

What are the examples on Descriptive information that should be disclosed in the Notes to the Fiduciary fund FSs?

|

1- Types of benefits provided

2- Classes of plan members covered 3- Composition of the pension plan board |

|

|

What are the investment disclosures that should be included in the Notes to the Fiduciary fund FSs?

|

1- Pension plan investment policies.

2- A description of how fair value is determined. 3- Concentrations of investments with individual organizations exceeding five percent of the pension plan fiduciary net position. 4- The annual money-weighted rate of return on pension plan investments. |

|

|

What are the Significant assumptions & other inputs used to calculate the total pension liability that should be included in the Notes to the fiduciary fund FSs?

|

1- Inflation

2- Salary changes 3- Post-employment benefit changes & cost of living adjustments 4- Inputs to the discount rate 5- Mortality assumptions |

|

|

Note

|

RSI about employer & non-employer contributing entity obligations for pensions provided through the pension plan should be presented for each of the 10 most recent fiscal years

|

|

|

What are the RSI included to the Fiduciary fund FSs?

|

1- Sources of changes in the net pension liability.

2- Information about the components of the net pension liability & related ratios 3- Significant methods & assumptions used in calculating the actuarially determined contributions, 4- The annual money-weighted rate of return on pension plan investments for each of 10 years presented. 5- An explanation of trends in amounts reported in the supplementary schedule, |

|

|

What are the information about the components of the net pension liability & related ratios that should be disclosed in the RSI of the Fiduciary funds FSs?

|

1- The pension plan's fiduciary net position as a percentage of the total pension liability.

2- The net pension liability as a percentage of the covered employee payroll. 3- Actuarially determined contributions. 4- The amount of contributions. |

|

|

Note

|

Significant methods & assumptions used in calculating the actuarially determined contributions are presented as notes to the schedules.

|

|

|

What are the Trend amounts that should be disclosed in the RSI included in the Fiduciary fund FSs?

|

Changes in:

1- Benefit terms 2- Population 3- Assumptions |

|

|

Note

|

Agency trust fund do NOT have the following:

1- Statement of Revenues & Expenses 2- Cashflows statement 3- Net position section in the statement of fiduciary Net position |

|

|

What is the purpose beyond establishing the Agency Fund?

|

It collects cash to be held temporarily for an authorized recipient to

whom it will be later disbursed. |

|

|

Note

|

Agency Fund recipient may be either:

• Another fund • Some individual • Firm • Government outside of the government |

|

|

What are the examples on Agency Fund?

|

1- Tax collection funds

2- Clearance funds 3- Special assessments |

|

|

Note

|

Revenues are not recognized in agency funds.

|

|

|

Note

|

Expenses are not recognized in agency funds.

|

|

|

What are the "Tax Collection Funds"?

|

It exist when one local government collects a tax for an overlapping governmental unit & remits the amount collected , less administrative charges, to the recipient unit.

|

|

|

What are the examples on Tax Collection Funds?

|

1- Sales tax agency fund

2- Payroll withholding agency fund 3- Real estate taxes agency fund |

|

|

What is the JE made by the Agency Fund for collection of money and retaining of a fee percentage?

|

|

|

|

Note

|

Fees incurred by the Agency fund are recorded in the General Fund

|

|

|

What are the "Clearance Funds"?

|

They are funds used to accumulate a variety of revenues from different sources & apportion them to various operating funds in accordance with a statutory formula or procedure.

|

|

|

Note

|

Cash Conduit Arrangements has no monitoring from the governmental unit

|

|

|

What are the examples on "Cash Conduit Arrangements"?

|

1- Pass-through grants

2- Food stamps 3- Traffic citations 4- Alimony, child support & other court ordered payments |

|

|

Note

|

If a governmental unit has monitoring &/or determines eligibility, the special revenue fund is used.

|

|

|

Note

|

When the governmental unit "is not otherwise obligated" for the debt (i.e., not primarily or potentially liable), the receivables & debt service transaction are appropriately accounted for in the agency fund.

|

|

|

Note

|

If a governmental unit has liability, accounting is made through the capital projects & debt service funds.

|

|

|

Note

|

Agency funds record no fund balance because current assets must equal current liabilities.

|

|

|

Note

|

Agency funds "usually" have no year-end balance, as monies are periodically transferred to clear the fund.

|

|

|

Note

|

In Agency Fund Statement of Net Position

Current Assets = Current Liabilities |

|

|

Note

|

Private Purpose Trust Fund is NOT a general public use fund

|

|

|

What is the purpose beyond establishing the Private Purpose Trust Fund?

|

It is designated for reporting all other trust arrangements under which principal & income are for the benefit of one of the following:

1- Specific individuals 2- Private organizations 3- Other governments |

|

|

What are the examples on Private Purpose Trust Fund?

|

1- Escheat (NOT forfeited) property fund

2- Other trusts |

|

|

Note

|

Forfeited property is recorded in the Special Revenue Fund

|

|

|

What are those "Other Trusts" of the Private Purpose Funds?

|

It is the private purpose trust accounts for fiduciary transactions that relate to specific private purposes (rather than general public purposes) other than:

• Public employee retirement systems • Investment pools held on behalf of other governments. |

|

|

Note

|

The income from the principal of a private purpose trust may be placed with another fund.

|

|

|

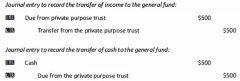

What is the JE recorded by the General Fund for the transfer of income (resulted from investing the Private Purpose Trust Funds principal) to the General Fund ?

|

|

|

|

What is the JE recorded by the Private Purpose Trust Fund for the transfer of income (resulted from investing the Private Purpose Trust Funds principal) to the General Fund ?

|

|

|

|

What are the types of Expenses of the Private Purpose Trust Fund?

|

1- Relate to specific purpose of the trust

2- Relate to benefits 3- Administrative charges |

|

|

Note

|

Capital gains & losses are recorded as adjustments to fund principal & not to income, unless the grantor specified otherwise.

|

|

|

What is the Escheat Property?

|

It is property that reverts to a governmental entity in the absence of legal claimants or heirs at the time the estate is settled.

|

|

|

Note

|

Escheat property generally should be reported as an asset in the governmental or proprietary fund to which the property ultimately escheats.

|

|

|

Note

|

Escheat property held for individuals, private organizations or other governments should be reported in a private purpose trust fund.

|

|

|

Note

|

Transfers to other funds from the Private Purpose Trust Fund are "operating transfers."

|

|

|

Note

|

|

|

|

What is the purpose beyond establishing the Investment Trust Fund?

|

In order to sponsor one or more external investment pools (sponsoring government).

|

|

|

Note

|

Investment Trust Fund has been established by the Accounting & Financial Reporting for Certain Investments & for External Investment Pools (GASB 31)

|

|

|

Note

|

Investment Trust Fund should report the external portion of each pool as a separate investment trust fund.

|

|

|

What are the Revenue (Addition) Sources of Investment Trust Funds?

|

1- Contributions

2- Net Appreciation (or Depreciation) of the fair value of the plan assets including realized & unrealized gains & losses 3- Premiums & discounts on debt securities, which should not be amortized as part of investment income. |

|

|

What are the Expenses (Deduction) types of Investment Trust Funds?

|

1- Payments to Beneficiaries

2- Administrative Expenses |

|

|

Note

|

The investment trust funds are required to use the economic resources measurement focus & the accrual basis of accounting to report transactions & balances.

|

|

|

Note

|

For the most part, the plan's net assets (investments) in the Investment Trust Funds are reported on a fair value basis.

|

|

|

Note

|

Statement of Fiduciary Net Position of the Investment Trust Fund identifies the major assets of the plan.

|

|

|

Note

|

Reported liabilities of the Investment Trust Fund should be subtracted from the total assets, & the difference reported as "net position held in investment trust."

|

|

|

Note

|

The statement of changes in fiduciary net position of the Investment Trust Fund reports the net increase or decrease in net plan position from the beginning of the year until the end of the year.

|