![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

|

Stmt of cash flow

Cash receipts and cash payments are classified into three categories: 1. ___________ all transactions and other events that are not investing or financing; generally include transactions that enter into the determination of net income. These include production and delivery of goods and services, interest and dividends received, and payment of interest. 2 __________ all transactions related to the making or collecting of loans and the acquiring and disposing of debt, equity instruments , or property, plant, and equipment. 3. ___________ all transactions related to obtaining resources from owners and providing them with a return on, and a return of, their investment , and to obtaining and repaying debt. |

1. OPERATING ACTIVITIES

2. INVESTMENT ACTIVITIES 3. FINANCING ACTIVITIES |

|

|

A stmt of Cash F shall explain the change during the period in ____________ and its primary purpose is to provide relevent info about _________ and ____________

|

CASH AND CASH EQUIVALENTS

CASH RECEIPTS AND DISBURSEMENTS |

|

|

Cash inflows are not to be netted against __________

|

CASH OUTFLOWS

|

|

|

One of the key purposes of the stmt of CF is to disclose how a business ____________ its operations.

|

FINANCED

|

|

|

Examples of items commonly considered to be cash Equivalents are ________ (4).

Cash purchases and sales of those investments generally are part of the enterprise's cash management activities rather than part of its operating, investing, and financial activities, and detail of those transactions need not be reported in _____________ |

1. Treasury bills

2. commercial paper 3. money market funds, 4 federal funds sold a Statement of cash flows. |

|

|

Cash ________ from _________ activities generally include the following:

1. Cash receipts from sale of goods or services 2. Cash receipts from interest and dividends on investments in another enterprise 3. All other cash receipts that are not classified as either investing or financing activities. |

INFLOWS FROM OPERATING ACTIVITIES

|

|

|

Cash ________ classified as ____________ include the following:

1. Cash payments to acquire materials for manufacture or goods for resale 2. Cash payments to other suppliers and employees for goods and services 3. Cash payments to Gov. for taxes, duties other fees, or penalties 4. Cash payments to lenders and other creditors for interest 5 All other cash payments that are not classified as either investing or financing activities. |

OUTFLOWS

OPERATING ACTIVITES |

|

|

The following are types of cash ________ from _______:

1. Cash receipts form collections or sales of loans made by the enterprise and of other debt instruments that are purchased by the enterprise 2. Cash receipts form sale of equity securities of other enterprises 3. Cash receipts form the sale of PP&E and other productive assets |

INFLOWS

INVESTING ACTIVITIES |

|

|

1. Cash payments for loans made by the enterprise and payments to acquire debt instruments of other entities

2. Cash payments to acquire equity instruments of other enterprises 3. Cash payments to purchase PP&E and other productive assets |

OUTFLOWS

INVESTING ACTIVITIES |

|

|

Cash _________ from __________ include the following:

1. Cash proceeds from issuing equity instruments 2. Cash proceeds from issuing bonds, mortgages, notes, and other short-and- long-term debt instruments |

INFLOW

FINANCING ACTIVITIES |

|

|

Cash _________ classified as ____________ are as following:

1. Cash payments of dividends of other distributions to owners, including outlays to reacquire the enterprise's instruments 2. Cash repayments of amounts borrowed 3. other principal cash payments to creditors who have extended long-term credit |

OUTFLOW

FINANCING ACTIVITIES |

|

|

Cash received from sale of equipment with accumulated depreciation for Gain =

|

= cost - depr. + Gain

|

|

|

A reconciliation of ending retained earnings to net cash flow from operations is _________ to be disclosed on the Stmt of CF.

|

NOT REQUIRED

|

|

|

The Gain on sale of the land does ___________ Investment activities.

Gain = |

NOT affect

Gain = Proceeds from Sale of FA - NBV NBV= Cost - Accum. Depr. |

|

|

The amortization of the bond discount is classified as Interest Expense and has been deducted in arriving at NI. Using INDIRECT method, this amortization must be __________ to NI to compute net cash provided by _________.

|

Added

Operating Activities. |

|

|

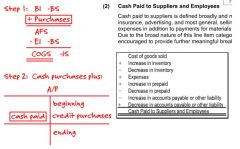

Using direct method compute Cash paid to suppliers.

|

COGS for the year

+ increase in inventory + Decrease in A/P ___________________ Cash paid to suppliers |

|

|

Only those changes that are NOT investing ( purchase of equipment) or financing ( change in notes payable) are _________________

|

OPERATING ACTIVITIES

|

|

|

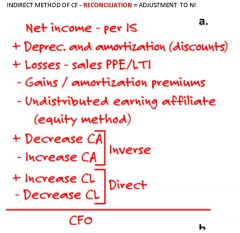

In calculating CF fom Operating act. using Indirect method, NONCASH expenses (Depreciation and Amortization) are ___________. The sale of equipment is included in CF form investing activities; the Gain on the sale of that equipment is __________ in the Operating activities section so that it will not counted in both NI and Sale of Equipment.

|

ADDED BACK

DEDUCTED NI + Depr. Exp. (Non Cash) - G/+L ( Investment Activity) -------------------------------------- CF from Oper. Activity INDIRECT METHOD |

|

|

Indirect method - is a _________

IF used - must report the same amount of net CF form Operating activities indirectly, by adjusting NI to _________ it to net CF from Operating activities. |

RECONCILIATION METHOD

RECONCILE |

|

|

Under the ___________, NI is adjusted to arrive at net CF form Operating activities. In addition, supplemental disclosure of cash paid for interest and income tax is required.

|

indirect method

|

|

|

Under the ___________, major classes of cash receipts and disburesements are presented in their gross amounts and totaled to arrive at at net CF form Operating activities.

|

DIRECT METHOD

|

|

|

Categories to Report separately under the Direct method (10)

|

INFLOW

1 cash received from customers 2 interest received 3. dividends received 4 Other operating cash receipts such as receipt of insurance proceeds and lawsuit settlement 5 cash received from the sale of securities classified as Trading securities OUTFLOW 6 cash paid to suppliers and employees 7 interest payed 8 income taxes payed 9 cash paid to acquire securities classified as Trading sec. 10 other operating cash payments |

|

|

The amortization of a bond discount is the difference between ______ and __________.

Because more expense has been deducted in computing income than the amount of cash paid for interest, the difference must be 2_____________ to reconcile to the cash provided to used for operating activities. |

CASH INTEREST AND INTEREST EXPENSE;

INTEREST EXP IS GREATER THAN CASH INTEREST. 2 ADDED TO INCOME |

|

|

A discount (in sale of the bond)

results when the ___________ is LESS than the _________ |

STATED INTEREST RATE

EFFECTIVE (MARKET) RATE |

|

|

A premium results when the ______________ RATE is GREATER than the ___________RATE.

|

STATED INTEREST RATE

EFFECTIVE (MARKET) RATE |

|

|

Only the _________ portion of the monthly lease payments would be reported as cash outflow for Financing activities in the CFS.

___________portion of the monthly lease payments would be reported as cash outflow for Operating activity in the CFS. |

1. PRINCIPAL

2. INTEREST |

|

|

The amortization of the bond discount is classified as __________ and has been deducted in arriving at ___________. Using the indirect method, this amortization must be added to _________ to compute net cash provided by _____ activities.

|

INTEREST EXPENSE

NET INCOME NET INCOME OPERATING |

|

|

Categories to Report separately under the Direct method (10) from the book

|

|

|

|

Cash collections from CUSTOMERS

|

|

|

|

HOW TO CALC CASH PAID TO SUPPLIERS?

|

|

|

|

INDIRECT METHOD - GAINS & LOSSES

how to adjust CF? |

|

|

|

INDIRECT METHOD OF CF - RECONCILIATION = ADJUSTMENT TO NI

|

|

|

|

Stmt of cash flow

1. OPERATING ACTIVITIES 2. INVESTMENT ACTIVITIES => you _____a LOAN and get $$$ receipts is a change in _________ inflow when - _________ outflow when _________ "_________" relationship 3. FINANCING ACTIVITIES => you get a ____ and repay it * _________on notes, bonds, mortgages * your own _________ * Pay _________ "_________" relationship |

Stmt of cash flow

1. OPERATING ACTIVITIES 2. INVESTMENT ACTIVITIES => you MAKE a LOAN and get $$$ receipts is a change in NON- CA inflow when - SELL outflow when BUY "INVERSE" relationship 3. FINANCING ACTIVITIES => you get a LOAN and repay it * Principal on notes, bonds, mortgages * your own stock * Pay dividends "DIRECT" relationship |