![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

21 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

It is permissible, but extremely rare, to deviate from one of the 6 PRONOUNCEMENTS if compliance would cause the fin. statmts. to be misleading. List hierarchy of sources of GAAP.

|

1. B – Accounting Research Bulletins

2. O – Accounting Principles Board Opinions 3. S – FASB Statements of Financial Accounting Standards 4. S – FASB Staff Positions 5. I – FASB Interpretations 6. I – FASB Statements 133 Implementation Issue. |

|

|

|

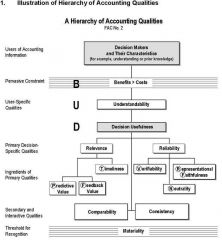

SFAC # 2 – “Qualitative characteristics of accounting information”

Financial info must be (7): |

1. UNDERSTANDABLE to decision makers

2. RELEVANT ( timely information with predictive or feedback value) 3. RELIABLE ( verifiable, faithfully representable, and neutral) 4. COMPARABLE 5. CONSISTENT 6. MATERIAL 7. LESS COSTLY THAN THE BENEFIT PROVIDED. |

STAR

|

|

|

PRIMARY QUALITIES OF DECISION USEFULNESS – (2)

|

1. Relevance – ( Passing Feels Terrific)

a) P – Predictive Value b) F – Feedback Value c) T – Timeliness 2. Reliability ( Nobody Relies on Financials unless Verified ) a) N – Neutrality – free from bias b) RF – Representational Faithfulness - info is valid c) V – Verifiability |

|

|

|

Representation order of the major components of an Income and RE statement (“IDEA”)

|

1. Reported on IS –

(I) INCOME (OR LOSS) FROM CONTINUING OPERATIONS – BEFORE TAX include Operating and Non-operating activities (D) Income from DISCOUNTINUED OPERATIONS – NET OF TAX (E) EXTRAORDINARY ITEMS – NET OF TAX unusual in nature and infrequent in occurrence. 2. Reported on RE Statement (A) cumulative effect of change in ACCOUNITNG PRINCIPLE – NET OF TAX RULE #1: line items ABOVE “income form continuing operations” are shown “gross” (before tax) RULE #2: line items BELOW “income form continuing operations” are shown “NET” (after tax) |

|

|

|

Recognition and realization are NOT ________

|

SYNONYMOUS

|

|

|

|

IDE(A)

Accounting changes are broadly classified as (3) 1. Changes in accounting ESTIMATE -_________ 2. Changes in accounting PRINCIPLE - GR -______________ 3. Changes in accounting ENTITY -________________ |

1. Changes in accounting ESTIMATE - Prospective as Income from Cont. oper.

2. Changes in accounting PRINCIPLE - GR - Retrospective 3. Changes in accounting ENTITY = RESTATE ->Retrospective |

|

|

|

҉

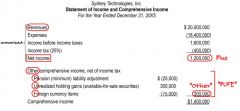

Other Comprehensive Income - includes those items that are excluded from Net Income. (4) Comprehensive income: Net income +Other compr. income _________________________ Comprehensive income |

P ension minimum liability adjustments

U nrealized gains and losses F oreign currency items E ffective portion cash flow hedges PUFE is not reported on IS - it is direct to Equity Adjustment |

|

|

|

Other comprehensive income includes all changes in Equity from nonOwner sources. The components of OTHER COMPREHENSIVE INCOME are: (4)

|

P ension minimum liability adjustments

U nrealized G/L - available-for-sale securities only F oreign currency items E ffective portion cash flow hedge |

|

|

|

Examples of items commonly considered to be cash equivelents are: Treasury bills, commercial paper, money market funds, and federal funds sold. Cash purchases and sales of those investments generally are part of the enterprise's cash management activities rather than part of its operating, investing, and financing activities, and details of those transactions need not be reported in _________

|

A Statement of Cash flows.

|

|

|

|

You will be able to easily remember approximately 85% of the adjustments made to the operating activities section under the INDIRECT METHOD by remembering the mnemonic CLAD

|

Current assets and liab.

Losses and Gains Amortization and Depreciation Deferred Items |

|

|

|

What is basic accounting equation?

|

Beginning Balance + Additions - Deletions = Ending Balance

|

|

|

|

THE A/R TURNOVER RATIO=

|

NET CREDIT SALE / AVG. RECEIVABLES

AVG RECEIVABLES= (A/R - allowance for doubtful accounts YR1 + A/R - allowance for doubtful accounts YR2) / 2 |

|

|

|

ROI - Return on Investment =

|

Net income / Total Investment =

Net income + Interest expense after the effect of Income tax / Liabilities + Equity |

|

|

|

Debt-to-Equity ratio =

|

DEBT/EQUITY

DEBT = ASSETS - CAPITAL STOCK - EQUITY |

|

|

|

TOTAL ASSET T/OVER=

|

NET SALES / AVG TOTAL ASSETS

|

|

|

|

THE QUICK RATIO =

|

= (CASH + MARKETABLE SEC. + RECEIVABLE) / CL

= (CA - INVENTORY) / CL Current Ratio = CA / CL |

|

|

|

AVRG COLLECTION PERIOD for A/R =

|

360 / A/R T/OVER

AR T/OVER = NET SALE/ AVG A/R |

|

|

|

҉ GENERATE MULTIPLE STEP INCOME STATEMENT

|

|

|

|

|

҉ Single statement approach display Other Comprehensive. Inc

|

|

|

|

|

Two statement Approach

presentation of Comprehensive Inc. |

|

|

|

|

A hierarchy of accounting qualities

draw a diagram |

|

|