![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

46 Cards in this Set

- Front

- Back

|

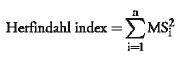

Measure of Industry Concentration

|

|

|

|

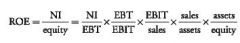

ROE

|

|

|

|

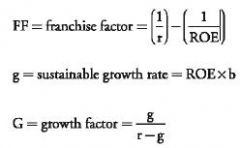

Intrinsic P/E:

FF, g, & G |

|

|

|

Effect of inflation on leading P/E

|

1 / real required return + [ ( 1-inflation flow-through rate) x inflation rate]

|

|

|

Holding Period Return

|

(P1 - P0 + CF1) / P0 = [ (P1 + CF1) / P0 ] - 1

|

|

|

Adjusted Beta

|

(2/3) x (regression beta) + (1/3) x (1.0)

|

|

|

Weighted Average Cost of Capital

|

|

|

|

Gordon Growth Model Equity Risk Premium

|

= One year forecasted dividend yield on market index + consensus long-term earnings growth rate - long term governments bond yield

|

|

|

Gordon Growth Model (V0)

|

[ D0 x ( 1 + g ) ] / ( r - g ) = D1 / ( r - g)

|

|

|

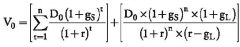

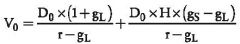

Two-stage Model

|

|

|

|

Value of Perpetual Preferred Shares

|

Dp / rp

|

|

|

Present Value of Growth Opportunities

|

(E / r ) + PVGO

|

|

|

H - Model

|

|

|

|

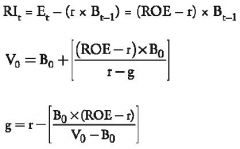

Sustainable Growth Rate

|

|

|

|

Value with Free Cash Flow Models

|

firm value = FCFF discounted at the WACC

equity value = FCFE discounted at the required return on equity |

|

|

Free Cash Flow to the Firm

|

FCFF = Nl + NCC + [Int x (1 -tax rate)] - FCInv - WCInv

= [EBIT x (1 - tax rate)] + Dep - FCInv - WCInv = [EBITDA x (1 - tax rate)] + (Dep x tax rate) - FCInv - WCInv = CFO + [lnt x (1 -tax rate)] - FCInv |

|

|

Free Cash Flow to Equity:

|

=FCFF- [lnt x (I -tax rate}] + net borrowing

=NI + NCC - FCInv - WCInv + net borrowing =CFO - FCInv + net borrowing =Nl - [(I - DR) x (FCInv - Dep)] - [(I - DR) x WCInv] |

|

|

Weighted average cost of capital:

|

= (We x r) + [Wd x rd x (1- tax rate)]

|

|

|

Single-Stage FCFF Model:

Value of the Firm |

= FCFF1 / ( WACC - g )

= [ FCFF0 x ( 1 + g ) ] / ( WACC - g ) |

|

|

Single-Stage FCFE Model:

Value of Equity |

= FCFE1 / ( r - g ) = [ FCFE0 x ( 1 + g ) ] / ( r - g )

|

|

|

Trailing P/E

|

market price per share / EPS over previous 12 months

|

|

|

Leading P/E

|

market price per share / forecasted EPS over next 12 months

|

|

|

P/B Ratio

|

=market value of equity / book value of equity = market price per share / book value per share

|

|

|

P/S Ratio

|

=market value of equity / total sales

=market price per share / sales per share |

|

|

P/CF Ratio

|

=market value of equity / cash flow

=market price per share / cash flow per share where: cash flow= CF, adjusted CFO, FCFE, or EBITDA |

|

|

EV / EBITDA Ratio

|

Enterprise value / EBITDA

|

|

|

Trailing D/P

|

( 4 x most recent quarterly dividend ) / market price per share

|

|

|

Leading D/P

|

forecasted dividends over next four quarters / market price per share

|

|

|

Justified Trailing P/E

|

|

|

|

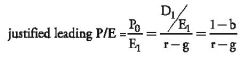

Justified Leading P/E

|

|

|

|

Justified P/B Ratio

|

( ROE - g ) / ( r - g )

|

|

|

Justified P0 / S0

|

[ (E0 / S0) x ( 1 - b ) x ( 1 + g) ] / ( r - g )

|

|

|

Justified P/CF Multiple

|

[ FCFE0 x (1+ g) ] / ( r - g)

|

|

|

Justified Dividend Yield D0 / P0

|

P/E Ratio / g

|

|

|

Weighted Harmonic Mean

|

|

|

|

Residual Income

|

|

|

|

Economic Value Added

|

NOPAT- $WACC

|

|

|

NOPAT

|

=EBIT x (I - t)

=(sales- COGS - SGA - dep) x (I - t) |

|

|

$WACC

|

WACC x invested capital

|

|

|

invested capital

|

= net working capital + net property, plant, and equipment

=long-term debt + stockholders' equity |

|

|

EVA spread

|

= ROC - WACC

= EVA / Invested Capital |

|

|

ROC

|

NOPAT / Invested Capital

|

|

|

Vf

|

= invested capital + ( EVA / WACC)

= invested capital + MVA |

|

|

Implied Growth

|

g = r - [ (B x (ROE - r)) / V - B ]

|

|

|

Market Value Added (MVA)

|

= MV of firm - invested capital

|

|

|

MV of Firm

|

=MV of debt + MV of equity

|