![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

32 Cards in this Set

- Front

- Back

|

Full Price of a Bond (Dirty Price) (Formula)

|

Clean Price + Accrued Interest

|

|

|

TIPS Coupon Payment (Formula)

|

Inflation Adj. Par Value * [Coupon Rate/2]

|

|

|

Tax Equivalent YTM (Formula)

|

YTM * (1-t)

where: YTM=Yield to Maturity, t=Marginal Tax Rate |

|

|

Tax Free YTM for a Taxable Bond (Formula)

|

(Tax Free YTM)/[1-t]

where: YTM=Yield to Maturity, t=Marginal Tax Rate |

|

|

Forward Rate Agreement (FRA) (Formula)

|

NP * [(Float - Fwd)(days/360)]/[1+(Float)(days/360)]

where: N.P.=Notional Principle, Float=Float Rate, Fwd=Forward Rate |

|

|

Cost of Common Equity (CAPM) (Formula)

|

RrR+ B(Rm - RrR)

where RfR=Risk Free Rate, Rm=Expected Rate of Return, B=Stock's Beta Coefficient |

|

|

Cost of Common Equity (DDM) (Formula)

|

D1/[P0 -F] + g

where: D1=Dividends next period, P0=Price of stock in Current Period F=Flotation Cost g=expected growth Rate of Dividends |

|

|

Bond Yield Plus Risk Premium (Formula)

|

YTM + Risk Premium

|

|

|

Country Risk Premium

|

SY+ (Country stock Index Return/US Bond Index Return) + US Equity Risk Premium

where: SY=Sovereign Yield Spread |

|

|

Marginal Cost of Capital (MCC) also called new WACC

|

(New WACC/old WACC)-1

where: WACC=Weighted Average Cost of Capital |

|

|

Earnings Multiplier and EPS Connection

|

|

|

|

Expected Growth Rate (Retention Rate)

|

(1 – dividend payout rate)

|

|

|

Future Divended

|

D(o)(1+g)

where: D(o)=Divended Previous Period g=Expected Growth Rate (Retention Rate) |

|

|

Operating Earnings Ratio

|

EBIT/Sales

where: EBIT=Earnings Before Interest and Taxes (Operating Income) |

|

|

Price To Cash Flow (Formula)

|

P/CF

Cash flow is a truer metric of a company's results in comparison to earnings. |

|

|

Cash Flow from Operations

|

This is Operating Income (EBIT).

Revenue - COGS - Operating Cost - Interest Expense This is the amount of cash available after all Operating Costs are paid. |

|

|

Gross Margin (Gross Profit)

|

Revenue - COGS

|

|

|

Implied Growth rate

|

retention rate * ROE

or (1-DPR) * (Net Income/Shareholder's Equity) where: ROE=Return on Equity DPR=Diviend Payout Rate |

|

|

EBIT (Operating Income)

|

Gross Margin - Operating Cost - Interest Expense

|

|

|

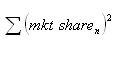

Herfindahl Index (Formula)

|

|

|

|

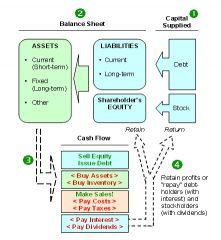

Stock and Bond Issue Affect on Balance Sheet, Net Income, and Equity Statements

|

|

|

|

What is the Purpose of CFO, CFI, CFF

|

|

|

|

Free Cash Flow (Formula)

|

CFO - Net Capital Expenditures

Cash Flow After all expenses paid |

|

|

Net Capital Expenditures (Formula)

|

total capital expenditure - after-tax proceeds from sale of assets

|

|

|

Free Cash Flow Yield (Formula)

|

Free Cash Flow per Share/Price per Share

or (Free Cash Flow/Shares Outstanding)/Price per Share |

|

|

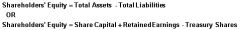

Shareholder's Equity (Formula)

|

|

|

|

Modified Duration

|

Macually Duration/[1+(ΔYTM)]

|

|

|

Margin Call (Formula)

|

Required Equity - Current Value

where: Required Value=MV of Stock * Margin Rate |

|

|

Reverse DDM

|

Future Price(n)/[1+g(n)]^n

where: n=Number Periods, g(n)=Growth Rate at Future time N. Will return Current Price of today, given |

|

|

Margin Call (Formula)

|

Required Equity - Current Value

where: Required Value=MV of Stock * Margin Rate |

|

|

Dividend per Share (Formula)

|

(Sum of Dividends)/Number Shares Outstanding

|

|

|

Reverse DDM

|

Future Price(n)/[1+g(n)]^n

where: n=Number Periods, g(n)=Growth Rate at Future time N. Will return Current Price of today, given |