![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

14 Cards in this Set

- Front

- Back

|

What are Greeks and what are its parameters |

Greeks are parameters quantifying risk attributes associated with options.

Delta, Gamma, Vega, Theta, Rho Delta force shooting a gamma ray on group of vegans in a theater in Rho Island |

|

|

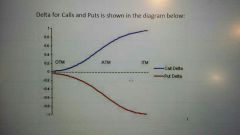

What is Delta and how is value determined? |

Delta is option price sensitivity in relation to changes in security price. Measure expected change in option price based on a $1 change in security.

Black Scholes formula |

|

|

Calls have a _____ delta and Puts have a _____ delta. |

positive, between 0 to 1 negative, between 0 to -1 |

|

|

How does an increase in the security affect the delta and option price |

increase in price pushes call option towards ITM, increasing delta and option price. |

|

|

what happens to delta when options near expiration |

ITM options goes to 1, OTM options nears 0, regardless of price change. |

|

|

what is Gamma |

Measure of change in Delta given a $1 change in security. Not directional. Just measures amount of change in Delta. |

|

|

How is Gamma value related to expiration date. |

Gamma value is greater closer to expiration |

|

|

Gamma value in relation to OTM, ATM, ITM. |

Gamma value highest ATM. |

|

|

meaning of Delta beats Theta and vice versa |

Money beats time for OTM, thus profitable. |

|

|

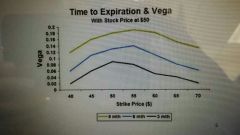

Relation between Vega and time of expiration |

The more time remaining, the higher the vega |

|

|

What is Rho |

Interest rate sensitivity to options. Anount option value change based on 1 percent -point change in interest rate. If interest increase, call prices increase and put prices fall. |

|

|

What is Vega and how does it effect the options price What part of options does it effect |

Time value |

|

|

What is Theta Relation to closeness to expiration date |

|

|

|

Why does ATM experience more dollar loss over time than in or out of the money options |

Has most time value built into the premium |