![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

|

An upward trend of real GDP over time. Sometimes, economists use real GDP per capita instead of real GDP because it is a better measure of standards of living in a given country. |

Long-run economic growth |

|

|

What does the level of GDP per capita tells us about the living standards in a given country? |

The higher the GDP per capita, the more goods and services people can afford to buy, and the higher their utility is - Higher GDP per capita also means better healthcare and better health. - Growing GDP per capita results in a decreasing hours of work and increasing leisure time. |

|

|

Generally, thought to be determined by the available supply of productive resources, namely, labor, capital, and technology. |

Economic growth is called potential GDP (Y*): |

|

|

Increases in GDP per capita depends to a great extent on increases |

labor productivity. |

|

|

The quantity of goods and services that can be produced by one worker or by one hour of work. |

Labor productivity |

|

|

Labor productivity is determined by two key factors: |

(1) The quantity of capital per hour worked. (2) The level of technology |

|

|

manufactured goods that are used to produce other goods and services |

Capital |

|

|

acquisition of capital by firms. |

Investment |

|

|

an increase in the quantity of output firms can produce using a given quantity of inputs; is more important for economic growth than capital per hours worked. |

Technological Change |

|

|

the system of financial markets and financial intermediaries through which firms acquire funds from households to make investments: |

Financial System |

|

|

Markets where financial securities, such as stocks and bonds, are bought and sold. |

Financial markets |

|

|

are firms, such as banks, mutual funds, pension funds, and insurance companies, that borrow funds from savers and lend them to borrowers. Households’ savings are transformed into firms’ investments. |

Financial intermediaries |

|

|

Total investment should equal |

Total Saving |

|

|

The interaction of borrowers and lenders that determines the market interest rate and the quantity of loanable funds exchanged |

Market for loanable funds |

|

|

Two main sources of supply of loanable funds: |

1) households (private saving) 2) government (public saving) |

|

|

Three main sources of demand for loanable funds: |

1) households (private loans) 2) government (issues government bonds) 3) corporations (issue bonds and stocks) |

|

|

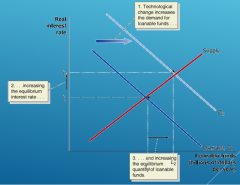

Application 1 of Loanable Funds: Technological Change |

|

|

|

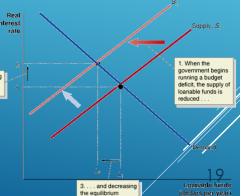

Application 2 of Loanable Funds: Increase in the Budget Deficit |

|

|

|

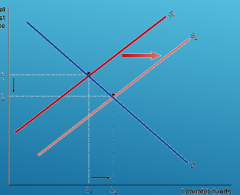

Application 3 of loanable funds: Consumption Tax Instead of Income Tax? |

|