![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

94 Cards in this Set

- Front

- Back

|

The classical model assumes that wages and prices

|

are always completely flexible

|

|

|

What are flexible prices?

|

Flexible prices adjust in the long run to shortages or surpluses.

|

|

|

What accounts for the vertical slope of the LRAS curve? Why?

|

Flexible prices.

|

|

|

In the classical model, an increase in aggregate demand will result in (a(n)) ____________ in price level and (a(n)) _______________ output

|

increased, no change

|

|

|

In the classical model, equilibrium is where the AD curve intersects the ____ curve

|

LRAS

|

|

|

A decrease in income taxes shifts the AD curve ______

|

right

|

|

|

An increase in money in circulation shifts AD curve _____

|

right

|

|

|

A decrease in government spending shifts AD curve ________

|

left

|

|

|

A change in the AD curve in a system with the Keynesian short run AS curve will _______ real GDP and _______ the price level because

|

increase, not change, because SRAS is horizontal in original keynesian model

|

|

|

The original Keynesian economic theory states that many prices including wages would _______ when aggregate demand decreases

|

not change

|

|

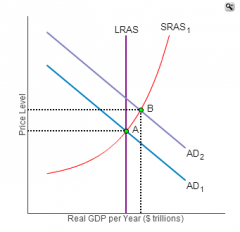

If the AD2 curve intersects the SRAS curve above and to the right of intersection of AD1 with the LRAS curve, is unemployment higher at point A or point B

Why? |

point A

|

|

|

In modern Keynesian analysis, an increase in AD results in ____________ in price level and ___________ in output

|

an increase, an increase

|

|

|

Tech change, expanded work force, greater productivity, more natural resources, etc... Shifts LRAS curve _____ and SRAS curve

|

right, right

|

|

|

Disasters that temporarily disrupt production shifts LRAS _____ and SRAS ______

|

nowhere, to the left

|

|

|

Assuming we import, what is the short term effect on our economy if there is a significant raw materials price inflation in other nations around the world

|

shift SRAS to the left

|

|

|

What is the effect on the economy of a shift of the SRAS to 'shock'?

|

inflation (greater price level) and a lower real GDP

|

|

|

A decrease in consumer confidence shifts the ____ curve _____

|

AD, left

|

|

|

A weaker dollar in foreign exchange markets shifts AD curve _____ and SRAS curve _________

|

right, left

|

|

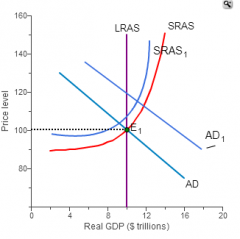

What is the effect on the economy (output, price level) of the pictured scenario?

|

price level increases (inflation), and real gdp may change or remain the same depending on the size of the curve shifts

|

|

|

Potential GDP rises to 6 million because factors of production increase

Consumers become more pessimistic about the future so AD growth is not large sharp increase in price of oil What curves shift where? |

LRAS shifts right, SRAS shifts left (due to price increase of oil which is a determinate of SRAS), and AD curve shifts slightly right

|

|

|

Three determinates of Aggregate Supply and which way they shift the curve

|

resource quantity (increase shifts both SRAS and LRAS to the right)

resource quality (improvement shifts both SRAS and LRAS right) resource price (increase shifts ONLY SRAS left) |

|

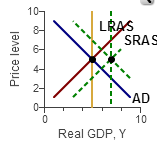

This represents (a/an) economic ______________ with ___________ inflation

|

growth, no

|

|

|

To have growth without inflation, what must be true of the AD SRAS and LRAS curves?

|

They must all increase by the same amount

|

|

|

The LRAS curve represents full employment, so points to the right of LRAS have _____ unemployment, and points to the left have ___________

|

lower, higher

|

|

|

inflation rate =

|

price level current - price level base year / price level base year

|

|

|

multiplier for government spending

|

1 / (1 - MPC)

|

|

|

Shift in real GDP from x change in gov spending

|

(1/ 1- MPC) * x

|

|

|

Given a consumption function and investment i, equilibrium is equal to...

|

the intersection of y =x with the line c + i

|

|

|

MPS =

|

1 - MPC

|

|

|

Questions to go over:

|

quiz 6 - 4

quiz 6 - 7 quiz 7 - 10 budget deficit/surplus quiz 8 - 11 |

|

|

What is the consumption equation? *

|

C = m + mpc*Y

m = autonomous spending mpc is slope of C Y is disposable or national income |

|

|

multiplier = n

no taxes paid by household GDP = Y C = 12 real autonomous consumption = ? |

(Y - C) / n

|

|

|

If price level is not fixed and economy is operating above full employment, increase in gov spending Q with multiplier n shifts AD curve _____________

|

rightwards less than n * Q

|

|

|

Y =

|

C + I + G + X

|

|

|

if real GDP is > than equilibrium GDP, there will be an unplanned _______ in inventories, and real GDP will _____ next period

|

increase, decrease

|

|

|

APC =

APS = |

C / Y

1 - C/Y |

|

|

break even income/consumption point is at

|

intersection of C = Y and C

|

|

|

if there are no taxes, Y is

|

disposable income

|

|

|

national savings =

|

Y - C - G = I

|

|

|

DI =

|

Y - T + TP

|

|

|

If interest rates increase, planned investment ___________

|

decreases

|

|

|

Higher taxes on business shifts investment to the __________

|

left

|

|

|

savings =

|

-a + MPS(Y) (no taxes)

a = autonomous consumption |

|

|

Three examples of loanable funds

|

Bonds

bank certificates of deposit mutual fund shares |

|

|

Real estate is a loanable fund T/F

|

F

|

|

|

Why do households supply loanable funds

|

interest income received from the borrowers

|

|

|

In terms of saving and investment, equilibrium GDP is where

|

I = S = -a + MPS(Y)

planned savings/investment are equal |

|

|

investment - saving equality

|

S = Y - C - G

|

|

|

In the market for loanable funds, an increase in business taxes shifts demand ____ and suppyl ______, causing a _______ in equilibrium interest rate and a ____________ in the equilibrium quantity of loanable funds

|

left, nowhere

decrease decrease |

|

|

increase in business taxes means quantity of investment ________ and future capital stock ________________

|

decreases decreases

|

|

|

in the market for loanable funds budget surpluses shift the _____________ curve ___________

|

supply right

|

|

|

in the market for loanable funds a budget surplus __________ equilibrium interest rate and ___________ the equilibrium quantity of loanable funds

|

decreases, increases

|

|

|

budget surplus causes savings and investment to _____________ and ____________ respectively

|

increase and increase

shift supply curve down demand curve |

|

|

indirect finance

example? |

Indirect finance is where borrowers borrow funds from the financial market through indirect means, such as through a financial intermediary.

banks! |

|

|

direct finance

example |

flow of funds from savers to firms through financial markets

new york stock exchange |

|

|

stock -

bond - |

-financial security that represents partial ownership of a firm

-financial security that represents a promise to repay fixed amount of funds |

|

|

in loanable funds market budget deficit shifts supply _______ and demand _______

This causes real interest rate to __________ and the equilibrium quantity of loanable funds to ____ |

left, nowhere

increase, decrease |

|

|

budget deficit causes savings and investment to __________ respectively

|

decrease

|

|

|

private savings =

|

y - t - c + TR

|

|

|

public savings

|

t - g - TR

|

|

|

total savings =

|

PrS+PubS = y - g - c

|

|

|

current value of x dollars in n years at i interest rate

|

x / (1 + i)^n

|

|

|

a decrease in price of a firm's bonds indicates what?

|

cost of external funds has increased

|

|

|

a decrease in price of stocks would indicate that

|

investors expect firm to have lower profits in the future

|

|

|

a decrease in loanable funds means quantity of savings __________ and investment _________

|

decreases, decreases

|

|

|

present value =

|

sum of future value/ (1 + i)^n

ex. 80/1.15 + 80/1.15^2 + 1000/1.15^2 |

|

|

discretionary fiscal policy

|

Discretionary fiscal policy is The deliberate manipulation of government purchases, taxation, and transfer payments to promote macroeconomic goals, such as full employment, price stability and economic growth.

|

|

|

automatic stabalizers

|

Structural features of government spending and taxation that reduce fluctuations in disposable income and thus consumption over the business cycle.

|

|

|

recessionary gap is

|

equilibrium gdp is less than potential (inflationary is versa)

|

|

|

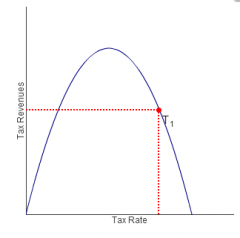

laffer curve

|

|

|

|

discretionary fiscal policy is most effective during normal economic times or times of great economic stress

why? |

due to lags and uncertainty created by tax changes it is not effective during normal economic times, and is more useful in extreme cases, such as wartime

|

|

|

aggregate expenditure is the same as

|

national income

c + I + G + X |

|

|

aggregate expenditure shifts ____ by __________ after a tax increase of T with mpc

|

down, mpc(T)

|

|

|

Crowding out is when

|

increases in government spending cause interest rates to rise reducing investment and consumption

|

|

|

effect time lag

|

time that lapses between implementation of a policy and the result of the policy

|

|

|

ricardian equivalence theorem

|

An economic theory that suggests that when a government tries to stimulate demand by increasing debt-financed government spending, demand remains unchanged. This is because the public will save its excess money in order to pay for future tax increases that will be initiated to pay off the debt. This theory was developed by David Ricardo in the nineteenth century, but Harvard professor Robert Barro would implement Ricardo's ideas into more elaborate versions of the same concept.

|

|

|

direct expenditure offset :

|

private sector doesn't buy things they would have in the absence of the gov expenditure

|

|

|

indirect crowding out: *

|

Increase in autonomous expenditure → IS curve shifts outwards → rise in income → rise in transactions demand for cash → raise interest rate → fall in investment

|

|

|

money illusion

|

tendency to think in nominal not in real terms

|

|

|

say's law

|

An economic rule that says that production is the source of demand. According to Say's Law, when an individual produces a product or service, he or she gets paid for that work, and is then able to use that pay to demand other goods and services.

"supply creates its own demand" |

|

|

classical model assumptions:

|

market is a self-correcting mechanism

|

|

|

according to keynesian economists equilibrium real gdp is ________ determined

|

demand

|

|

|

problem 29

|

see the solutions for that one about crowding out

|

|

|

determinates of aggregate supply

|

Supply Shocks - Supply shocks are sudden surprise events that increase or decrease output on a temporary basis. Examples include unusually bad or good weather or the impact from surprise military actions.

Resource Price Changes - These, too, can alter SAS. Unless the price changes reflect differences in long-term supply, the LAS is not affected. Changes in Expectations for Inflation - If suppliers expect goods to sell at much higher prices in the future, their willingness to sell in the current time period will be reduced and the SAS will shift to the left. |

|

|

determinates of aggregate demand

|

Real Interest Rate Changes - Such changes will impact capital goods decisions made by individual consumers and by businesses. Lower real interest rates will lower the costs of major products such as cars, large appliances and houses; they will increase business capital project spending because long-term costs of investment projects are reduced. The aggregate demand curve will shift down and to the right. Higher real interest rates will make capital goods relatively more expensive and cause the aggregate demand curve to shift up and to the left.

|

|

|

determinates of aggregate demand

|

Changes in Expectations - If businesses and households are more optimistic about the future of the economy, they are more likely to buy large items and make new investments; this will increase aggregate demand.

The Wealth Effect - If real household wealth increases (decreases), then aggregate demand will increase (decrease) Changes in Income of Foreigners - If the income of foreigners increases (decreases), then aggregate demand for domestically-produced goods and services should increase (decrease). |

|

|

determinates of aggregate demand

|

Changes in Currency Exchange Rates - From the viewpoint of the U.S., if the value of the U.S. dollar falls (rises), foreign goods will become more (less) expensive, while goods produced in the U.S. will become cheaper (more expensive) to foreigners. The net result will be an increase (decrease) in aggregate demand.

Inflation Expectation Changes - If consumers expect inflation to go up in the future, they will tend to buy now causing aggregate demand to increase. If consumers' expectations shift so that they expect prices to decline in the future, t aggregate demand will decline and the aggregate demand curve will shift up and to the left. |

|

|

an increase in DI leads to a ______ in APS

|

increase

C/Y = APC, if disposable income increases Y increase making APC smaller. 1 - APC = APS and if APC is smaller APS is larger |

|

|

What changes autonomous consumption

|

interest rate

wealth expectations concerning economic conditions |

|

|

with a lack of internal funds a company would do what (hint: bonds)

|

demand loanable funds by selling bonds

|

|

|

values of homes rise meaning interest rate

|

shifts supply of loanable funds right meaning greater investment lower interest rates

|

|

|

expectation of greater interest rates shifts demand and supply curves in loanable funds market

|

right and left respectively

|

|

|

optimism about economic conditions causes an

|

increase in investment and interest rate

(shifts aggregate demand curve in loanable funds market right) |

|

|

If a tax cut is enacted, and ricardian equivalence holds true savings will

|

increase exactly by amount of tax cut

|