![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

24 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Indirect taxes |

Taxes on expenditure |

|

|

|

Ad valorem taxes (type of indirect tax) |

% of the price of a product |

|

|

|

Specific taxes (type of indirect tax) |

Set amount per unit of the product |

|

|

|

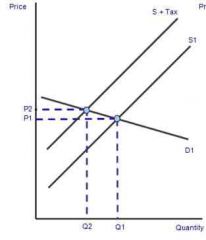

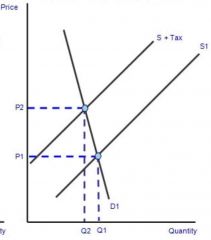

Which direction do indirect taxes cause the supply curve to shift in? |

Left |

|

|

|

What will indirect tax allow the producer to do when demand is inelastic? |

Allow them to pass on some or all of this tax onto the consumer through a higher price

|

|

|

Indirect tax when demand is... |

Elastic |

|

|

Indirect tax when demand is... |

Inelastic |

|

|

|

Incidence of tax |

How the burden of tax is distributed between different groups (eg producers and consumers) |

|

|

|

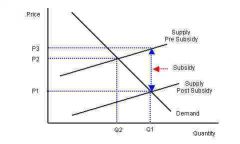

Grant from the government which has the effect of reducing the costs of production... |

Subsidy |

|

|

|

Which directors will subsidies cause the supply curve to shift in? |

Right |

|

|

|

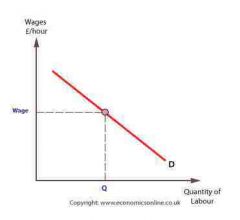

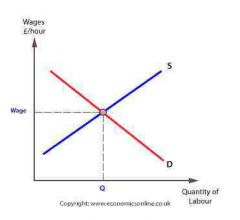

Wage rate |

Amount paid per hour/day/week/month for working |

|

|

|

Derived demand |

Demand dependant on the demand for the final product |

|

|

What effect does a subsidy have? |

Price will fall and quantity will increase |

|

|

A decease in wage rates... |

Increase in demand for labour |

+ Add a hin |

|

|

3 factors which influence elasticity of demand for labour |

1) elasticity of demand for final product 2) wage area high proportion of total costs, demand elastic 3) replacing labour with machinery, hard to replace - inelastic |

|

|

|

3 factors which influence demand for labour to particular industry |

1) if labour costs rise relative to cost of machinery, firms likely to replace labour with capital 2) productivity of labour 3) labour market regulations. |

|

|

|

What does the supply curve of labour show? |

How many people are willing to work given the wage rates |

|

|

If wage rates drop... |

The supply of workers drop as the incentive to work drops |

|

|

|

2 influencing factors of the elasticity of supply of labour |

1) skills, qualifications are high, supply of labour inelastic 2) level of unemployment, high unemployment, supply elastic |

|

|

|

5 changes which could cause a shift in supply curve for labour in particular industry |

1) net migration - rise relative to emigration, > shift 2) real wage in other occupations 3) non-monetary factors - eg hours of work 4) income tax rates - reduction might encourage more to seek employment 5) qualifications and legal requirements - increase = decease supply of labour |

|

|

|

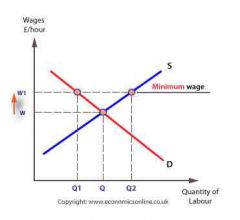

National Minimum Wage |

Rate set by government to specify the lowest legal amount workers can be paid |

|

|

|

What is the main aim of NMW? |

prevent exploitation of workers and reduce inequality |

|

|

Where is the surplus labour? (Unemployment) |

Q1 to Q2 |

|

|

|

Unemployment determined by 3 factors... |

1) how high NMW compared to equilibrium wage 2) price elasticity of demand for labour 3) price elasticity of supply of labour |

|