![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

193 Cards in this Set

- Front

- Back

|

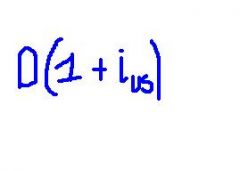

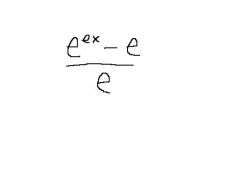

If we took D dollars and invested it in U.S. assets, at the end of the period, how many dollars are we left with?

|

Original amt of D dollars + the interest gained on it

|

|

|

what is "e"?

|

spot exchange rate: "on the spot" trading; within 2 business days

|

|

|

How many pounds will D dollars buy (given e = $/lbs)

|

D dollars will buy (D/e) pounds

|

|

|

"f"?

|

forward exchange rate

a rate agreed on today but transaction takes place later |

|

|

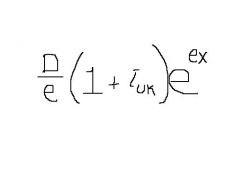

if I invest D dollars into pounds, how much will i get back in the FUTURE?

|

(D/e)*(1+iuk)*(f) Dollars

|

|

|

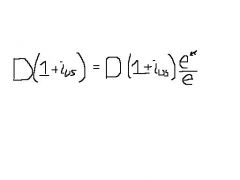

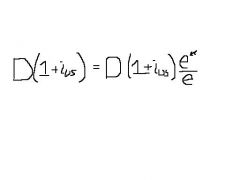

Equilibrium rate between dollars and pounds:

|

D(1+ius) = (D/e)*(1+iuk)*(f)

|

|

|

"covered interest arbitrage"

|

Borrow (D/e) pounds, owe (D/e)(1+ius) in the future

use pounds to buy U.S. asset: get D(1+ius) dollars in future, pay off loan with D/e(1+iuk)f dollars -->"covered" guarantees the equality that D(1+ius)=(D/e)(1+iuk)f |

|

|

"covered interest parity condition"

|

note that the equality must be satisfied in order for this to work

approximation: f & e usually not that different, so (f/e) about = 1 |

|

|

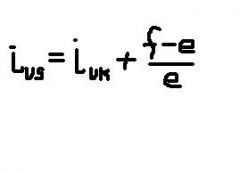

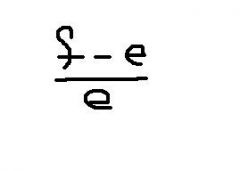

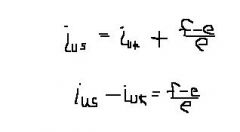

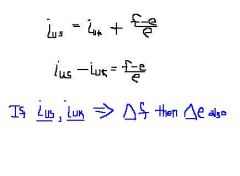

If POSITIVE --> "forward premium"

if NEGATIVE --> "forward discount" on British pound |

What is this? if positive? if negative?

|

|

|

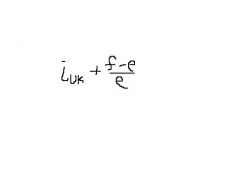

the total return on British asset measured in dollars (if exchange rates are $/lbs)

|

Thanks to the covered interest parity, this vaue represents what?

|

|

|

terms for not "covered" investment?

|

not insure

hedge take an 'open' position |

|

|

What is the "Balance of Payments" or "International Transactions Statement"?

|

An accounting statement recording all transactions between residents of one country and those in the rest of the world during some period of time.

|

|

|

(In general) from the U.S. perspective, what is a "credit"?

|

1. + (positive)

2. Anytime an American sells a good/service to foreigner 3. Foreigner increases ownership of American assets |

|

|

(In general) from the U.S. perspective, what is a "debit"?

|

1. - (negative)

2. Americcan buys goods/services from foreigner 3. American increase holdings of foreign assets |

|

|

What are the three types of "accounts" in the BOP?

|

Current account, capital account (financial account), official reserve account

|

|

|

What is the current account?

|

imports/exports of goods/services, investment income, unilateral transfers

|

|

|

What is the capital account/financial account?

|

transfer of assets, checks

|

|

|

What is the official reserve account?

|

records international transactions undertaken by a country's monetary authority (U.S. --> Fed Reserve; EU--> European Central Bank)

|

|

|

For the U.S., what are credits to the current account?

|

1. EXPORT of goods/services

2. Investment income earned 3. Unilateral transfers received |

|

|

For the U.S., what are Debits to the current account?

|

1. Import of goods/services

2. Investment income paid 3. Unilateral transfers given |

|

|

For the U.S., what are credits to the capital account?

|

1. Foreign increases holding of U.S. assets

2. American writes check to foreigner |

|

|

For the U.S., waht are debits to the Capital account?

|

1. American increases holdings of foreign assets

2. Foreigner writes check to American |

|

|

For the U.S., what are credits to the Official Reserve Account?

|

Foreign monetary authorities buy U.S.($) reserves

|

|

|

For the U.S., what are debits to the Official Reserve Account?

|

Fed buys foreign currency reserves

|

|

|

What kind of system is the BOP?

|

system of double-tracking book-keeping

every transaction has two sides |

|

|

BOP: 2 issues to all Credits = all debits (i.e. Balance)

|

1. don't have perfect bookkeeping

2. not all credits and debits in same account |

|

|

Current account(as %GDP) rltnsp between surplus/deficit and credit/debit:

|

1. Surplus (Credit>Debit)

2. Deficit (Credit<Debit) |

|

|

Terminology, CA+KA =?

|

CA+KA=B

"Basic Balance" |

|

|

What is the Basic Balance used for?

|

-used as another measure of the state of the economy

-only reason why central banks buy foreign curency reserves is to influence the value of their currency |

|

|

CA+KA+OR=?

|

CA+KA+OR=0

B= -OR |

|

|

What is the U.S. CA %GDP?

|

the current account is almost -6%GDP

|

|

|

Suppose OR=0. What does it mean if CA<0 and KA>0?

|

-U.S. is a net-debtor country

-Foreigners are acquiring US Assets more rapidly than Americans are acquiring foreign assets |

|

|

What does it mean for the U.S. to be a net-debtor country?

|

if we were to cash out all assets we would owe foreigners assets

|

|

|

Domestic Absorption(A)=?

|

A = C+G+I

|

|

|

NX =?

|

X-M = CA

(with adnustments for unilateral transfers, investment interest, etc.) |

|

|

CA= Y-A

Therefore, if CA is negative then..? |

If CA<0, then A>Y (absorption > income) or Y-A < 0

so we spend more than we produce! in order to do this we have to borrow from foreigners |

|

|

Y= C+G+I+(X-M) = C+S+T

means what? |

Y= GDP(Output) = Ntnl Income

|

|

|

In terms of GDP = Ntnl Income, what does CA =?

|

CA = S + (T-G) - I

CA = Saving - Investment |

|

|

CA = S + (T-G) - I

If CA<0, then? |

If CA<0 then Ntnl saving less than investment saving

Invest less (decrease absorption) and save more |

|

|

Why is every trade double-counted?

|

double-counted since there's two currencies

|

|

|

"we are quoting the exchange rate in European terms" -->

|

how many Euros to $1

|

|

|

"we are quoting the exchange rate in American terms"-->

|

the $ cost of foreign currency

|

|

|

What should exchange models account for?

|

1. high volatility in minute-to-minute trading (SR)

2. long-term trends (LR) |

|

|

Who are the participants in the Foreign Exchange Market?

|

1. very large financial institutions around the world

2. multinational corporations 3. Central banks |

|

|

What are the 2 markets in the FX market?

|

1. Interbank (wholesale)

2. Retail Central Banks(Their purpose of buying/selling is to influence the foreign exchange rate) |

|

|

Arbitrage:

|

a riskless activity of buying low and selling high

the purchases and sells are made almost simultaneous; NOT waiting |

|

|

Two types of arbitrage:

|

1. Locational Arbitrage

2. Triangular Arbitrage |

|

|

Locational arbitrage

|

Exchange rate in one location is different than another location (ex. NY and London) buy cheap sell high

|

|

|

Triangular Arbitrage

|

involves three currencies; two direct rates and one crossrate

|

|

|

Why does Supply and Demand analysis apply well to the foreign exchange market?

|

since the FX displays all the qualities of a perfectly comopetitive market: all price-takers; high competition; perfect information

|

|

FX market: Why is the demand curve downwards sloping?

|

When the pound gets cheaper, then the things that the pound buys gets cheaper

|

|

Is the supply curve upward sloping?

|

the supply curve may not be upward sloping(ordinally think of MC of production) but we are not producing currency

|

|

What part of the FX market does the Demand and Supply curves represent?

|

D & S from PRIVATE actors

Demand curve does not take into account central banks; all private transactions |

|

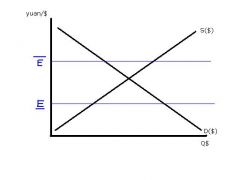

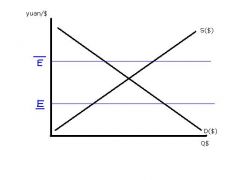

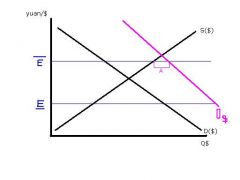

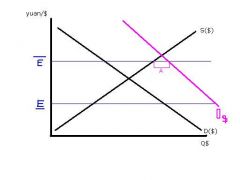

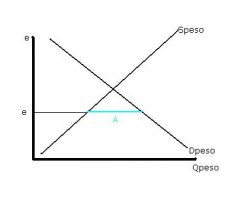

What do the two "E"s stand for?

|

E high bar: "max desired value of the $": the max value the Chinese govt wants the $ to achieve

E low bar: lowest desired value of $ |

|

What does the distance "A" represent?

|

The Q$ the chinese govt has to supply to FX market to maintain rate

|

|

At E high bar, what is the value of the dollar and yuan in relation to each other?

|

at E high bar, the dollar is undervalued and the yuan is overvalued

|

|

What if this demand shock is permanent?

|

the Chinese govt will run out of dollars, then the dollar will appreciate and the yuan will depreciate

|

|

|

not insured/uncovered investment

|

What type of investment does the spot exchange rate represent?

|

|

|

What is the expectation of how many dollars an investor will have at the end of the period for an UNINSURED investment?

|

expectation of how many dollars i'll have at the end of the period

|

|

|

If risk neutral then I am indifferent between two assets if they have the same expected return. Show this equation:

|

risk neutrality

|

|

What does this equation lead to?

|

the uncovered interest parity condition

|

|

|

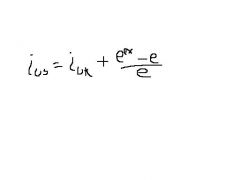

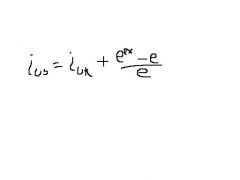

What is the equation for the uncovered interest parity condition?

|

uses expected exchange rate

|

|

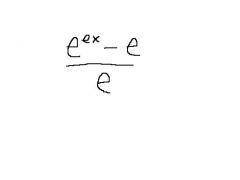

what does this represent

|

if POSITIVE: the expected % appreciation of pound

if NEGATIVE: expected % depreciation of pound |

|

|

what drives the spot exchange rate?

|

average belief/market belief

|

|

|

if we have BOTH covered and uncovered interest parity, then...

|

the forward exchange rate = expected exchange rate

|

|

|

Since f = e(expected) then...

|

every time e(expected) changes, f changes with it

|

|

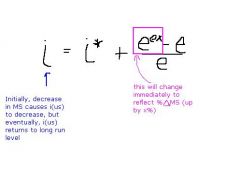

What happens if the interest rates are fixed/not changing?

|

If interest rates are not changing minute to minute but "f" is, then "e" must also change minute to minute

|

|

|

Why is "e" always changing?

|

As new information is available, influences "e"

since information is always changing, "e" always changing |

|

|

What is hedging?

|

a.) hedging involves acquiring an asset in a foreign currency to offset a net liability position already held in the foreign currency, or acquiring a liability in a foreign currency to offset a net asset position already held.

b.)hedging means reducing both kinds of "open" positions in a foreign currency--both long positions and short positions |

|

|

what is a "long position"?

|

holding net assets in a foreign currency

|

|

|

what is a "short position"?

|

owing more of the foreign currency than one holds

|

|

|

what is a "futures contract"?

|

a piece of paper; specifies few specified future dates in the future that says you can exchange currency

-these can be bought and sold multiple times before the specified date |

|

|

what is an "options contract"?

|

more like insurance policy: buy a premium to protect-->

option to buy ("call") option to sell ("put") --> gives me the right (NOT the obligation) to sell currency at a specified price ("strike price"(exercise price)) on specified date |

|

|

what determines whether or not i will choose to sell with an options contract?

|

depends on the spot exchange rate on that specified date

|

|

|

Short Run vs. Long Run exchange rate determination

|

Short Run: Interest parity

Long Run: Purchasing Power Parity (absolute and relative) |

|

|

What does absolute PPP say?

|

at a given point of time, if two goods are completely identical then the price must be the same everywhere

(price levels and exchange rate at a moment in time) |

|

|

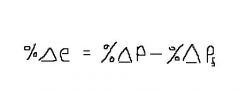

What does relative PPP say?

|

percent depreciation of dollar = U.S. inflation - Foreign inflation

(inflation and the exchange rate) |

|

|

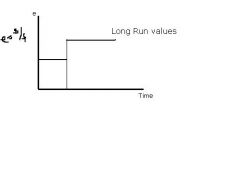

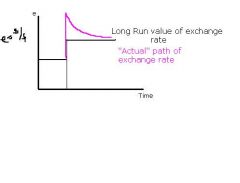

What is exchange rate overshooting?

|

the immediate impact of unexpected change in monetary policy has a bigger impact than the eventual long-run impact

|

|

|

What is the monetary model?

|

if U.S. money supply increases by x% then all U.S. prices ultimately increase by x%

|

|

|

What is the rltnsp between exchange rate overshooting and the monetary model?

|

one of the prices is the price of foreign currency (i.e. foreign currency appreciates by x%, $ depreciates by x%)

|

|

This is the normal long-run values. but what does overshooting say?

|

overshooting says that a decrease in MS will cause people to think that the expected exchange rate will be higher than what it actually is

|

|

|

What is the reasoning behind overshooting?

|

uncovered interest parity

|

|

|

What are the different degrees on the exchange rate spectrum?

|

Floating/Flexible, Managed/Dirty float, Adjustable Peg, Fixed/Pegged exchange rate

|

|

|

What are the qualities of a floating/flexible exchange rate?

|

-Supply and Demand determine the exchange rate

-(Non-official players-->ignore central banks) -Equivalent to perfectly competitive markets |

|

|

Qualities of Managed float/Dirty float

|

-monetary authorities intervene when "necessary"

|

|

|

Qualities of Fixed/Pegged exchange rate

|

Govt determines the exchange rate

|

|

In this instance of a sudden supply shock of the Chinese supply of US$, what does "A" represent?

|

A represents the excess demand for $ to be supplied by Chinese govt

|

|

What if the govt did nothing?

|

the $ would appreciate and yuan depreciate

|

|

|

Graph a pegged exchange rate where there is an excess supply of $ to Chinese yuan

|

the lowest desired value of the $ (9 yuan/$) is ABOVE the market exchange rate

|

|

What does the excess supply of $ mean in terms of the U.S. BOP?

|

excess supply of $ (length "A") represents a deficit in CA & FA of U.S. in relation to China

|

|

|

If the Chinese govt has an excess supply of $ relative to their pegged rate, why wouldn't they sell it?

|

1. US$ held by Chinese govt mostly overnight deposits; opp. cost of holding these low-interest rate $ is pretty high

2.) Chinese govt buys up US$ by selling yuan by putting more yuan on market, inflates their currency (inflating Chinese Money supply) |

|

|

In maintaining pegged rate, what is the problem if foreign govt has to sell $?

|

may run out

|

|

|

In maintaining pegged rate, what is the problem if foreign govt has to buy $?

|

could be inflationary

|

|

|

When is a pegged exchange rate sustainable?

|

if shifts in S&D "cancel out" over time

|

|

|

What does exchange control do?

|

kind of short circuit S&D all together

|

|

|

Graph instance of exchange control

|

E bar = pegged exchange rate

|

|

|

With exchange control, what administrative body is needed?

|

currency board

|

|

|

how does exchange control work?

|

any local resident who earns $ is required by law to bring those $ to the currency board and the currency board will give E bar back

the currency board determines who gets to exchange, and at what rate |

|

|

Problems with currency board

|

since foreign exchange earnings are distributed in bureaucratic manner, inefficient and scope for corruption

|

|

|

What is the "Parallel Market"

|

in situation of exchange control, non-official channel where govt "allows" but not quite fully legal

|

|

|

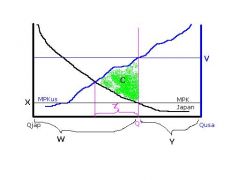

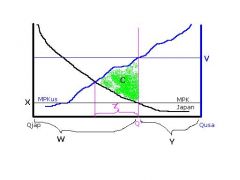

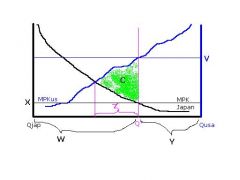

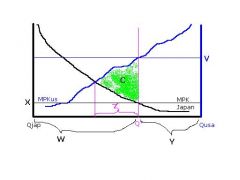

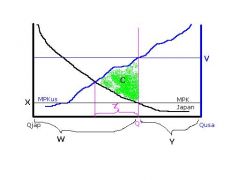

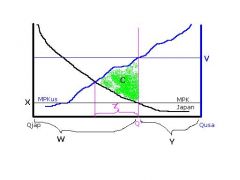

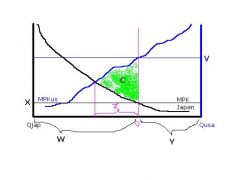

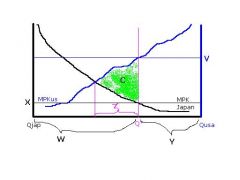

Graph world wealth and international lending for the case of a world with 2 countries with Japan having 80% world wealth and US 20%

|

Marginal Product of Capital vs. Quantity for both Japan and US

|

|

What does Q* represent?

|

Q* represnts if there is no trade in wealth//no intl trading lending/borrowing

|

|

What do W and Y represent

|

Percentage of world wealth held by each country:

W = 80% wealth posessed by Japan Y = 20% wealth posessed by US |

|

What do X and V represent?

|

Return on investment for each respective country:

X --> Japan V--> USA |

|

If Z=10%, what does it represent?

|

Japanese loan 10% of world wealth to USA

the percentage is the amount Q* to point where the two MPKs intersect: marginal return is same in both countries most efficient outcome, net increase in world output |

|

What is C?

|

the net increase in world output if Japan loans the % of its world wealth to the US where the marginal return is same for both countries (intersection of two MPKs)

|

|

|

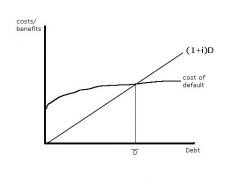

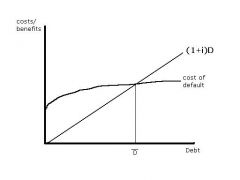

Graph the costs/benefits of default on debt

|

Two lines: cost of default and Benefit of default (1+i)D

|

|

What is the significance of D bar?

|

For any point D, if D<Dbar then country will pay back loan

If D>Dbar then country will default |

|

|

What is the benefit of defaulting on a loan?

|

-less interest rate to pay back

the more you borrow, the bigger the benefits |

|

|

what are the costs of defaulting?

|

-let's assume cost of defaulting not really associated with amt borrowed

-loss of repuration, seized assets, etc. |

|

|

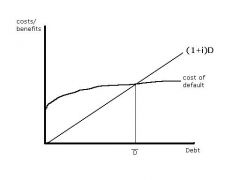

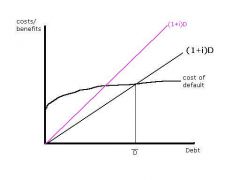

What would the graph of costs/benefits of default look like with interest rate shock?

|

interest rate shock (increase in i)

|

|

|

What are two categories of macroeconomic goals/objectives?

|

Internal and External Balance

|

|

|

What are characteristics of Internal balance?

|

1. Full employment

2. Price stability (low rate of inflation; predictable rate of inflation) 3. Reasonable economic growth (higher SOL in future) |

|

|

What are characteristics of External balance?

|

1. "Reasonable" balance in current account (debatable)

2. (OR) CA+FA=O (Normally CA+FA+OR=0; therefore, implication that balanced w/o govt intervention) 3. (OR) "Appropriate" value of currency on FX market |

|

|

What are the govt tools to achieve macroeconomic goals?

|

1. Fiscal policy (use of govt spending and taxes to influence economic activity)

2. Monetary policy (control of money supply [M1,M2] to influence economic activity) 3. Exchange rate policy (Govt directly influence value of currency) *Note: we may find that it is not possible to do both Monetary and Exchange rate policy simulateously |

|

|

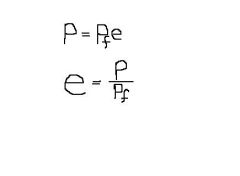

What are the endogenous variables?

|

Interest rate(i), Income(Y), and in later versions Price level(P), Exchange rate(e)

|

|

|

What are the exogenous variables?

|

Money Supply, Govt Spending(G), Taxes(T)

|

|

|

What does Y(income) depend on?

|

i (interest rate)

|

|

|

what happens when i decreases (in relation to Y)

|

interest-sensitive items increase-->income goes up

|

|

|

what are examples of interest-sensitive items?

|

consumer durables (cars)

investment |

|

|

IS(Investment-Saving)?

|

All combinations of i & Y that equate desired saving with desired investment

"equilibrium & goods market" |

|

|

what happens as income(Y) increases?

|

drives up interest rates --> want to hold lower share of wealth in form of "money"

|

|

|

What is "Money"

|

non-interest bearing assets

(DOES NOT EARN interest) |

|

|

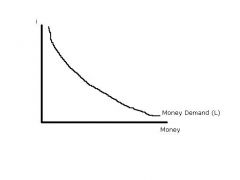

What does the share held in money depend on?

|

the interest rate; when i increases, (M/P)d decreases (Money demand, the amt we want to hold in money, decreases)

|

|

|

Since interest rates go up as income increases, graph rltnsp between interest rate and money demand...effects?

|

As income goes up, interest rates go up, want more wealth in form of money (higher money demand)

|

|

|

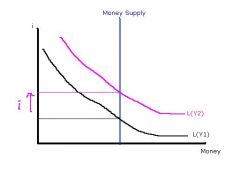

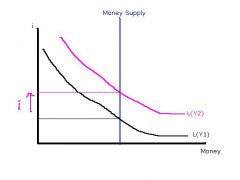

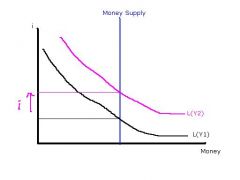

Graph Money liquidity when Y2>Y1

|

Higher income represented in upwards shift of Liquidy/Money Demand curve

Higher interest rate |

|

Why is the MS curve vertical?

|

Vertical since it is an EXOGENOUS variable

|

|

|

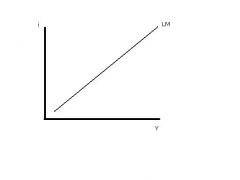

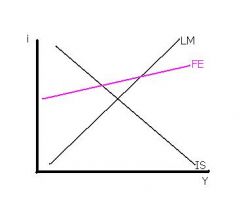

Graph and define the LM curve

|

LM: All combinations of i and Y that lead to equilibrium in Money Market [Where L(Y) = MS]

|

|

|

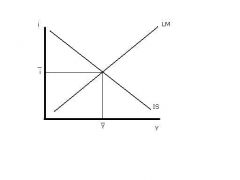

Graph Equilibrium in goods and money market simultaneously

|

intersection is EQ

|

|

|

If you're at Y bar (intersection between IS and LM) does that mean it is the best?

|

not necessarily desired outcome

|

|

|

What are the rltnsps between CA, FA, Y, and i?

|

CA depends on Y (As income increases we want to buy more of everything, including imported goods)

FA depends on i(As i increases, better opportunity for foreigners in US-->Financial inflow so FA increases) |

|

|

Y and CA?

|

Inverse relationship

|

|

|

i and FA?

|

i increases, FA increases

|

|

|

What do we want for CA and FA?

|

We want CA+FA=0

|

|

|

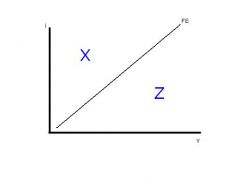

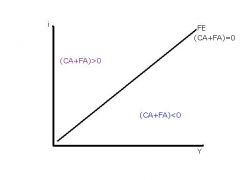

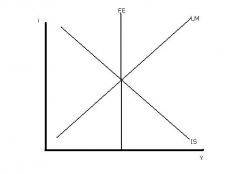

Graph and define the FE curve

|

FE: Normally BP -Balance of Payments Curve)

All combinations of i & Y such that CA+FA=0 |

|

What do X and Z represent?

|

X: CA+FA>0

Y: CA+FA<0 |

|

|

slope of the FE curve?

|

upward sloping: the two extremes are vertical and horizontal

|

|

|

What are the exogenous variables to the IS-LM model?

|

Money Suply, Planned investment, Govt. Spending, Taxes, exchange rate, exports, price levels

|

|

|

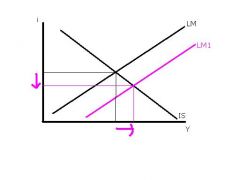

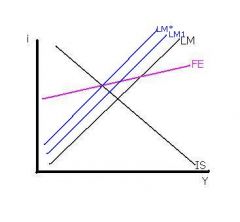

IS-LM: Show graphically the effects of increase in MS

|

LM curve shifts down and to the right

Y increases i decreases |

|

|

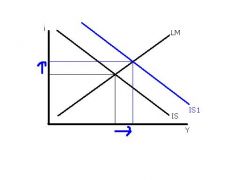

IS-LM: Graphically show effects of exogenous increase in spending

|

Exogenous increase in spending = (increase in G and/or I, and/or Xexports)

i increases Y increases |

|

|

What causes the same effect as an exogenous increase in spending?

|

same effect if decrease taxes and/or dollar depreciates

|

|

|

Compare and contrast expansionary policy for fiscal/monetary policy

|

Expansionary policy tends to increase income regardless of whether monetary or fixed

BUT expansionary monetary policy works to drive i DOWN expansionary fiscal policy works to drive i UP |

|

|

What does an increase/decrease in "i" effect in rltnsp to intl economics?

|

increase/decrease in i has different implications for the exchange rate

|

|

|

What is the terminology for "CA+FA"?

|

"CA+FA" = "Official Settlements Balance

|

|

|

When is the official settlements balance naturally = 0?

|

if there is a truly free floating exchange rate, then by definition CA+FA=0

|

|

|

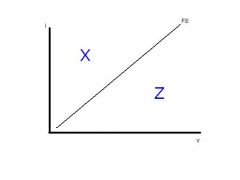

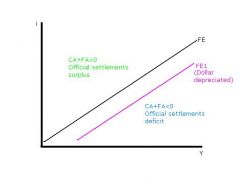

Graph and define the FE curve in terms of the official settlements balance

|

FE: All combinations of i, Y where official settlements Balance = 0

CA+FA=0 |

|

|

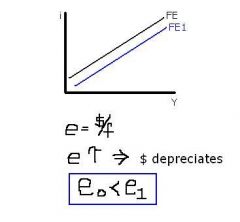

What does the position of FE depend on?

|

exogenous variables...particularly the EXCHANGE RATE

|

|

|

Show the graph and equation for effects on exchange rate and FE curve of increase in "e(d/f)"

|

dollar depreciates, lower interest rate to attract investment, increase output

|

|

|

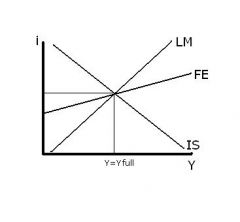

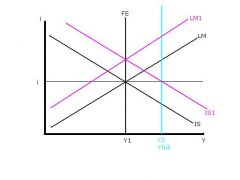

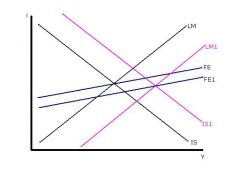

Graph simultaneous internal and external balance

|

Official Settlements Balance = 0

IS=LM Y=Yfull |

|

|

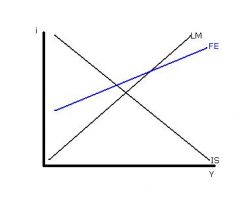

Graph example of when CA+FA<0

|

Note: FE curve crosses ABOVE the equilibrium (i.e. our IS-LM EQ is on the RIGHT hand side of FE)

|

|

|

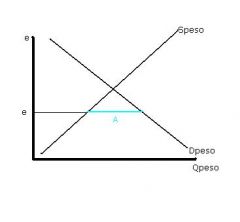

Graph effects of a fixed exchange rate between the US$ and pesos where the US Demand for peso > US supply of pesos

|

e = $/peso

Deficit in official settlements means Americans want more foreign "stuff" than foreigners want US "stuff" |

|

What does "A" represent

|

A = Qpesos US Fed has to supply

|

|

|

What is the rltnsp between central bank selling foreign currency to maintain exchange rate on domestic MS?

|

When central bank sells pesos, they are collecting USD$

Dollars are pulled out of circulation; Money Supply FALLS |

|

|

Graph IS-LM, FE to show instance where Feds sell money to reduce MS

|

IS-LM equil. to the right of FE; official settlements balance<0

|

|

|

Graph how the MS continues to shrink until official settlements balance is elminated

|

Remember, reduction in MS is reflected in shift to the left of LM curve

LM curve shifts continue until reach 3-way EQ |

|

|

What happens to a country's control over its money supply when it fixes/pegs its exchange rate?

|

it gives up control of its money supply because of having to accomodate for deficits/surpluses in the official settlements balance

|

|

|

What is the monetary response to a deficit in the official settlements balance?

|

decrease MS

|

|

|

what is the monetary response to a surplus in official settlements balance?

|

increase MS

|

|

|

What is "sterilization"?

|

Attempt to use domestic MONEY SUPPLY operations to undo effect of FX operations

|

|

|

Graph an attempt to increase money supply to stimulate income (moving away from EQ)

|

reduces interest rate (downward pressure on value of domestic currency)

Buy domestic currency ($) to keep value from falling Shrinks money supply back |

|

|

What effect does a decrease in the interest rate have on the exchange rate?

|

decrease in interest rate has a downward pressure on the value of domestic currency

|

|

|

What is the monetary policy response to downward pressure on value of domestic currency?

|

buying domestic currency to keep value from falling, which decreases MS

|

|

|

What is the solution for an economy with downward pressure on value of currency so money supply is shrinking AND excessive unemployment?

|

fiscal policy

|

|

|

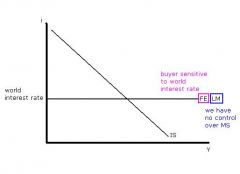

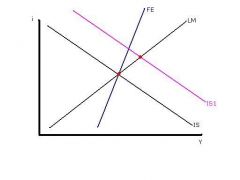

Graph IS, LM, FE when there is NO international capital mobility

|

Sterlizied intevention is possible

some control over money upply for some time horizon |

|

|

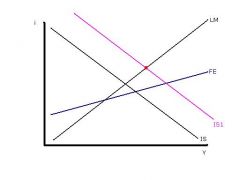

Graph IS, LM, FE with Perfect Capital Mobility

|

Absolutely zero control over money supply (not even for an instant)

|

|

|

What is the reality of capital mobility?

|

capital mobility is not infinite, but fairly high

|

|

|

What does it mean to be left of FE curve for D$, S$, OR, official statements balance?

|

D$>S$

positive OR official statements balance > 0 |

|

|

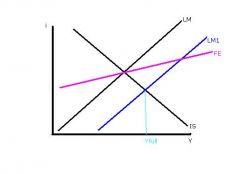

If we wanted to raise Y to Yfull with fiscal policy, why wouldn't we have to push the IS curve all the way out to where IS-LM=Yfull?

|

With international trade, the federal reserve makes up for the extra amount through OR; this automatically increases MS which pushes LM to the right

|

|

|

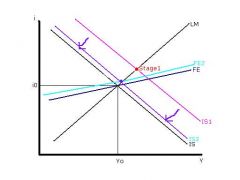

Graph using fiscal policy to raise Y to Yfull (fixed exchange rates)

|

Note: FE curve here is drawn flatter than LM curve

exogenous policy: (i.e. lower T to push IS right) endogenous response: MS increases --> LM shifts to right |

|

|

Show using fiscal policy to increase Y with perfect capital mobility

|

0 crowding out of investment

0 increase in interest rate ***Here, fiscal policy is at its strongest |

|

|

Graph fiscal policy to raise Y with no capital mobility

|

1. IS shifts right

2. Now end up at right side of FE; CA deficit, FA 0 by definition of no capital mobility 3. $D<$S --> LM shifts left as fed decreases MS Perfect crowding out of investment Income stays the same, interest rate increases for every dollar spent on fiscal, dollar taken out of I |

|

|

When the D$<S$, what is the Fed's response?

|

The Fed has to buy up $ on Fx mkt to keep value of $ from decreasing

|

|

|

How effective is fiscal policy in changing income if exchange rate is fixed with NO capital mobility?

|

expansionary fiscal policy can give temporary raise in income, but in the end it is not sustainable since it triggers increase in interest rate due to monetary policy and crowds out investment

|

|

|

Effectiveness of fiscal policy in changing income if exchange rate is fixed and Perfect Capital Mobility?

|

fiscal policy is super-effective

no crowding out of investment no increase in interest rate |

|

|

Effectiveness of fiscal policy in changing income if exchange rate is fixed and Intermediate Capital Mobility?

|

depends on the relative slope of FE & LM curve

|

|

|

Why does it matter whether the FE or LM curve is steeper?

|

it matters because it determines what side of FE you are at if push IS curve out (since it determines monetary policy)

|

|

|

What are two types of Intermediate Capital Mobility?

|

1. Relatively immobile capital

2. Relatively mobile capital |

|

|

Which of the two types of Intermediate Capital mobility do most people think is reflective of US and most western countries?

|

Relatively mobile capital

|

|

|

Graph and describe corresponding monetary policy with expansionary fiscal policy, fixed exchange rate and relatively immobile capital

|

FE steeper than LM

Official reserves deficit there will be endogenous CONTRACTION of MS |

|

|

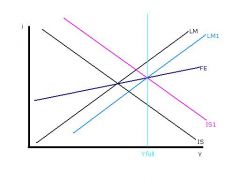

Graph and describe corresponding monetary policy with an expansionary fiscal policy, fxd exchange rate, and relatively mobile capital

|

FE flatter than LM

official reserves surplus There will be endogenous increase in MS |

|

|

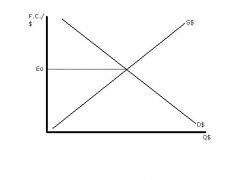

Graph and describe official statements balance with a floating exchange rate

|

At Eo, CA+FA=0

By assumption of pure float, NO official reserve transactions the exchange rate will automatically adjust so that OR=0 |

|

|

(Floating Exchange) If the dollar depreciates, what happens to import/exports?

|

U.S. goods/services more attractive, so export more, import less

|

|

|

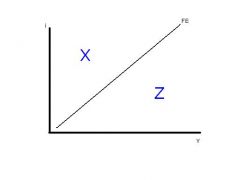

Why does the FE curve shift with new exchange rate?

|

External Balance: CA+FA=0

Internal Balance: maintain full employment at price stability Pick out any combination(i,Y) I will find some exchange rate that will cause the external balance line to go through that point-->at ANY point |

|

|

Effectiveness of fiscal/monetary policy with fixed vs. flexible exchange rate

|

Fixed rate: Monetary policy weak; fiscal policy strong

Flexible rate: Monetary policy effective; fiscal policy weak |

|

|

Show effects of expansionary monetary policy with flexible exchange rate and relatively mobile capital

|

1. MS increases

2. $ depreciates 3. IS curve shifts right 4. FE curve shifts so new equilibrium with external and internal balance |

|

|

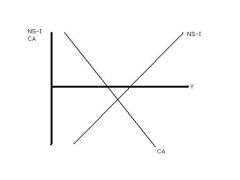

Graphically show how we get the IS curve in terms of CA=NS-I

|

At any interest rate(holding investment constant) income is higher

that means depreciation of $ shifts IS curve to the right |

|

|

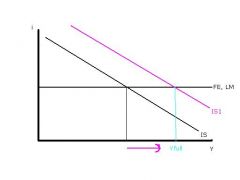

Show effects of expansionary fiscal policy with flexible exchange rate and relatively mobile capital

|

1. Expansionary fiscal policy pushes IS to right

2. Causes i to increase 3. $ appreciates(left of FE) 4. higher value of dollar pushes IS curve back |

|

|

Graph depreciation of Dollar, describe effects on CA and import/exports

|

When dollar depreciates, has effect on CA (import less, export more) CA increases

|

|

|

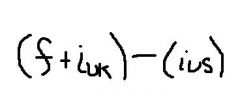

What is the covered interest differential?

|

the difference between the overall covered return to investing in pound-denominated assets(F+iuk) and the return to investing in dollar-denominated assets(ius)

|

|

|

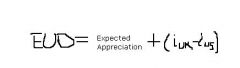

What is the expected uncovered interest differential(EUD)?

|

expected overall uncovered return

|

|

|

How could a govt whose fixed exchange rate overvalues its currency use domestic interest rates to defend the pegged exchange rate?

|

in order to defend the pegged rate, the govt could increase domestic interest rates, shifting the incentives for international capital flows toward investments in that country's bonds (i.e. demand for domestic currency increases)

|

|

|

What is "speculating"?

|

the act of taking a net asset position("long") or a net liability position("short") in some asset class, here a foreign currency

|

|

|

Describe hedging with forward exchange contract

|

forward exchange contract: let's say expecting Xlbs in 60 days, enter into 60 day future exchange rate to guarantee amt will have to sell in lbs and receive in $$ (and vice versa)

|