![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

71 Cards in this Set

- Front

- Back

|

Business Cycle - Long Run: Price, Y and Employment

|

LR: Price is flexible; Y & employment are at "natural" levels

|

|

|

Business Cycle - Short Run: Price, Y, and Employment

|

P is "sticky"

shocks and shifts push Y & employment away from natural levels |

|

|

Business Cycle: Shape of AD, LRAS and SRAS curves

|

AD slopes down

LRAS is Vertical SRAS is Horizontal |

|

|

Shocks to AD or AS cause---

|

fluctuations in GDP and employment

|

|

|

How are fiscal and monetary policy used?

|

to stimulate or stablize the economy

|

|

|

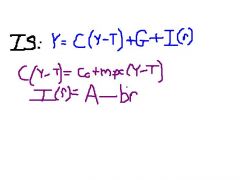

The Goods market -->

|

IS (investment-saving) curve

Y=C+G+I (Closed Economy -- NX = 0) |

|

|

The money market -->

|

LM (liquidity-money) curve

|

|

|

Definition of IS curve

|

Y-r combinations where Goods Market is in equilibrium

|

|

|

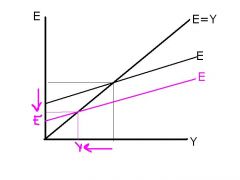

Define Keynesian Cross

|

the equilibrium where output = expenditure (Y=E)

|

|

|

planned expenditure

|

income, how much money able to spend

|

|

|

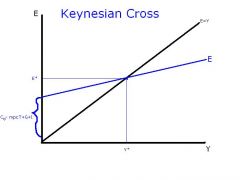

Draw the basic graph for the Keynesian Cross

|

2 equations:

1.) E = Co - mpcT + G+ I + mpcY slope = mpc 2.) E=Y (m=1) |

|

|

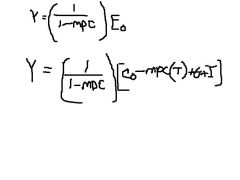

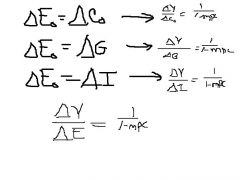

Using the Keynesian Cross; how can we rewrite the equation to solve for Y in terms of Eo?

|

derived from original equation E=Y=C+G+I

|

|

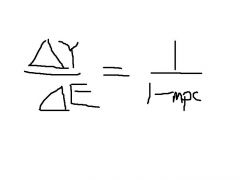

How does output change from a change in Eo?

|

(1/1-mpc) = Eo multiplier

|

|

|

How does a change in Co, G, or I affect Eo?

|

Any change in Co, G, or I changes Eo by the same amount

|

|

|

Causes of increase in G, Co, I (real life)

|

increase in G --> Govt spending

increase in Co--> consumer confidence increase in I --> interest rate |

|

|

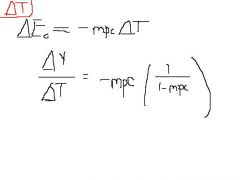

Effects of change in T(taxes) on Eo?

|

Any change in T changes Eo by negative marginal propensity to consume X change in T

(taxes cause consumers to spend less but not dollar for dollar) |

|

|

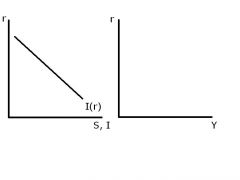

What is the relationship of I and I(r)?

|

Negative relationship between I and I(r)

(Change in I shifts E curve up if positive, down if negative) |

|

|

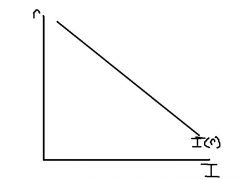

Graph I as a function of r

|

Given an equation:

Example: I(r) = 1000 - 100r |

|

|

Graph changes in Y, E, and I when r (interest) goes up

KEYNESIAN CROSS |

if interest goes up then Y decreases, E decreases, I decreases

|

|

|

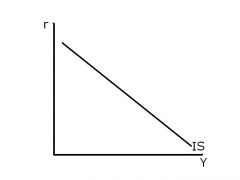

Graph a basic IS curve

|

downwards sloping, relates Y to r

|

|

|

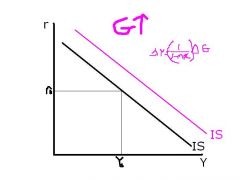

Graph change in IS when G increases

|

Shifts to the right

|

|

|

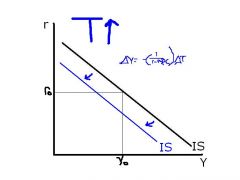

Graph changes in IS when T increases

|

shifts to the left

|

|

|

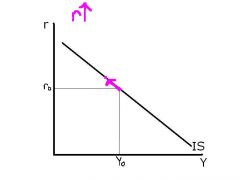

Graph changes in IS curve when r increases

|

move along curve up and left (NO SHIFT)

|

|

|

What is the equation for IS curve

|

Y as a function of r

|

|

|

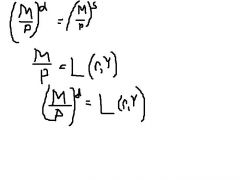

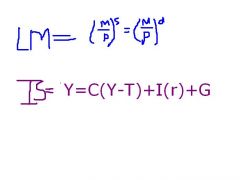

Equations for LM curve

|

LM Curve is a function of Y, r

|

|

|

IS curve: when Y increases, what happens to S? (if mpc<1)

|

As long as mpc<1 then as Y increases, S increases

Derive the IS curve from the market for loanable funds (Saving = Investment) |

|

|

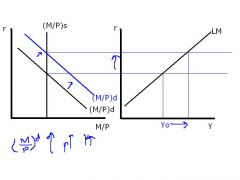

What is the LM curve?

|

The Money Market

Y-r combinations where real money market is in equilibrium (P fixed) |

|

|

Real money supply with LM curve

|

Vertical line; P is fixed and M is fixed

|

|

|

Real Money Demand

|

Money Demand = L(r) for a given Y

|

|

|

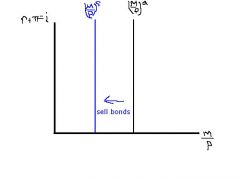

Properties of Real Money Supply Curve = M/P (M, P fixed)

|

1. P is fixed ("sticky")

2. M is fixed at M, money supply exogenous 3. At any interest rate, the real money supply is the same --> 4. (M/P)s is a vertical line |

|

|

Properties of (M/P)d = L(r)

|

r is the cost of holding money, so as r increases money demanded decreases (for a given Y); downwards sloping

|

|

|

Properties of the LM curve

|

Relationship between r and Y where Real Money supply = Real Money Demand

Set of Y-r pairs where money market is in equilibrium Upward sloping |

|

|

Show effects of increase of money demand on LM curve

|

increase in real money demand forces the interest rate up, increase in Y

|

|

|

Equations for both the IS and LM curve

|

IS curve: Goods Market Equilibrium

LM curve: Money Market Equilibrium |

|

|

Effect of increase in capital for individual?

|

Population increase causes loss of capital/investment for individual person since the wealth has to be shared amongst other workers

|

|

|

Graph the changes to consumption and steady state capital due to an increase in population

|

increase in population leads to a decrease in both capital and consumption and output

|

|

|

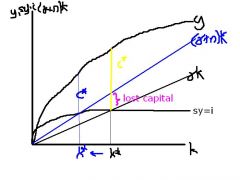

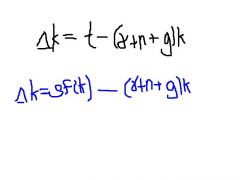

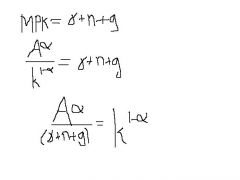

what is the equation for change in k (solow growth)

|

output - decrease in capital (depreciation, pop growth, growth rate)

|

|

|

what is the total GDP growth rate equal to?

|

g + n

(each worker is getting more effective, there are more of each of these workers) |

|

|

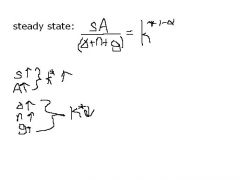

how do you find the steady state?

|

i = outflow

sf(k) = (&+n+g)k |

|

|

Equation for steady state using production function and how changes in variables effect k*

|

Note that per worker production function y = f(k) = Ak^(alpha)

|

|

|

Golden Rule (equations)

|

golden rule: optimize over the steady state consumption

|

|

|

What is the growth rate and technological progress rate at the steady-state?

|

At the steady-state, the per “effective worker” growth rate is zero. Technological progress rate is positive (g)

GDP per worker growth rate is technological progress rate, g>0, population growth rate is positive (n) |

|

|

What is money?

|

Stock of assets that can be readily used to make transactions.

|

|

|

Function of Money (3)

|

1. Medium of exchange (transactions--replaces barter)

2. Unit of account (measures value; goods and services measured in $) 3. Store of value |

|

|

2 types of money

|

1. Fiat money "paper money"

2. Commodity Money; money that has value itself (gold, cigarettes) |

|

|

C =

(Money) |

Currency

|

|

|

M1 =

|

Currency, Demand Deposits, Travelers Checks, Other Checkable Deposits

|

|

|

M2 =

|

M1, Savings Deposits (inc. MMDA), Small Time Deposits, MM Mutual Funds (retail)

|

|

|

M3=

|

M2, Large Time Deposits, Repurchase Agreements, Eurodollars, MM Mutual Funds (institutional)

|

|

|

What is V?

(Money) |

Velocity: Number of times the Average dollar changes hands in a given period

|

|

|

Quantity Theory of Money/Quantity Equation

|

M x V = P x Y

|

|

|

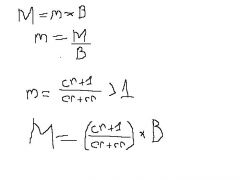

Money Supply (equation)

|

M = C + D

Money = currency + deposits |

|

|

Monetary Base = ?

(formula) |

B = C + R

Monetary Base = Currency + reserves |

|

|

100 Percent Reserve Banking

|

All deposits held in a bank must be kept in the bank (reserves) available for withdrawal; no loans

|

|

|

Fractional Reserve Banking

|

Some fraction of deposits is kept in the bank (reserves) available for withdrawal; balance is loaned out. Consider this repeated in multiple banks

|

|

|

T = ?

|

Transactions: Total value of transactions

M x V = T (Note: Transactions is "similar" to nominal GDP) |

|

|

m = ?

|

monetary base

|

|

|

What is the effect of a decrease in the reserve ratio on the monetary base and money supply?

|

decrease in reserve ratio is an incrase in money supply

|

|

|

What is the effect on MS when you buy bonds?

|

increases the quantity of money (--> Drives down the interest rate)

|

|

|

What is the effect on MS when sell bonds?

|

decreases the quantity of money (M/P)s curve shifts to the left)

|

|

|

3 types of monetary policy

|

1. reserve requirements

2. Open Market Operations 3. Discount Rate |

|

|

Open Market Operations (OMO)

|

buy and sell govt bonds (type of monetary policy)

|

|

|

Discount rate

|

Interest rate charged by fed. reserve for loans to banks

(type of monetary policy) |

|

|

Does Money Supply depend on the interest rate?

|

No, that's why the MS curve is vertical because it is independent of the interest rate

|

|

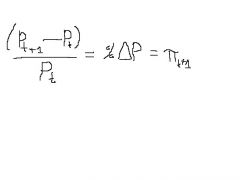

INflation rate =?

|

Inflation rate measures the % increase in the price index per period

|

|

|

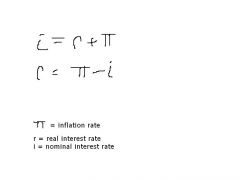

Fisher equation for nominal interest rate and real interest rate

|

nominal = real + inflation

|

|

|

What is the rltnsp between real money demanded and the interest rate?

|

Negative relationship between real money demanded and interest rate

positive relationship to Y |

|

|

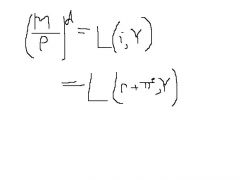

Money Demand = ? (In terms of nominal interest rate)

|

Money Demand depends on interest rate and Y

|

|

|

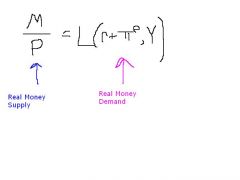

What is the Money Supply and Money Demand Equilibrium?

|

.

|

|

|

Summary of LR Business Cycle Theory

|

Prices Adjust, changes in Demand cause immediate changes in prices, leaving output and income unchanged at F(K, L)

|

|

|

Summary of SR Business Cycle Theory

|

Prices are "Sticky", changes in Demand do not move prices so inventories fluctuate causing production changes

|