![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Child not to file a return |

|

P6 |

|

|

8814 |

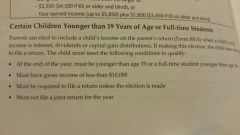

Election to include child's income on parents return |

|

|

|

Unearned income |

Unemployment compensation, taxable Social Security benefits, taxable pensions, annuity income, canceled debt, unearned income from trust, taxable interest, dividends, capital gains |

|

|

|

Earned income |

Salary, wages, tips, fees, taxable scholarship, fellowship grants |

|

|

|

Single dependent requirements for over age 65 |

Unearned 2550, earned 7750, gross greater than the larger of 2550 or earned income plus 1900 |

|

|

|

Single dependent requirements for under age 65 |

Unearned 1000, earned 6200, grows more than the larger of 1000 or earned plus 350 |

|

|

|

Serving in combat zone |

Deadline to file is 180 days after the latter of Last day in combat zone or Last day of continuous hospitalization stay related to injury from Service |

|

|

|

4868 |

Extension up to October 15th |

|

|

|

8379 |

Injured spouse form |

|

|

|

Injured spouse relief |

Spouse files a joint return All or part of the refund is applied against the separate paths do federal tax state tax child support or student loan |

|

|

|

1040 X |

Amends returns to correct forms 1040, 1048, 1040ez, 1040 EZ T, 1040nr, 1040nr - EZ |

|

|

|

Deadline for filing a claim for refund |

Latter of 3 years from date of filing original return or Two years after paying tax |

|

|

|

Refunds cannot go into what kind of an account? |

SIMPLE IRA |

|

|

|

8888 |

Form for a refund to go to more than one account or to buy up to $5,000 in savings bonds |

|

|

|

9465 |

Installment agreement request form |

|

|

|

W7 |

Form for ITIN |

|

|

|

How to determine if someone is a resident alien |

They meet either the green card test or the substantial presence test |

|

|

|

Green Card test |

A lawful permanent resident of the United States at any time during 2014 and took no steps to be treated as a resident of foreign country under an income tax treaty |

|

|

|

Substantial presence test |

Considered a US resident if you are physically present in the United States for 31 days during the year 183 days during the previous three years (all 2014 + 1/3 2013+ 1/6 2012) |

|

|

|

Qualifying child |

|

|