![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

53 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Physical settlement

|

Physical settlement occurs when the actual underlying asset is delivered in exchange for the agreed-upon price

In cases where the contracts are entered into for purely financial reasons (i.e. the engaged parties have no interest in taking possession of the underlying asset), the derivative may be cash settled with a single payment equal to the market value of the derivative at its maturity or expiration |

|

|

|

Similarities between Futures and Forwards

|

• Both futures and forwards are firm and binding agreements to act at a later date. In most cases this means exchanging an asset at a specific price sometime in the future.

•Both types of derivatives obligate the parties to make a contract to complete the transaction or offset the transaction by engaging in anther transaction that settles each party's obligation to the other. Physical settlement occurs when the actual underlying asset is delivered in exchange for the agreed-upon price. In cases where the contracts are entered into for purely financial reasons (i.e. the engaged parties have no interest in taking possession of the underlying asset), the derivative may be cash settled with a single payment equal to the market value of the derivative at its maturity or expiration. •Both types of derivatives are considered leveraged instruments because for little or no cash outlay, an investor can profit from price movements in the underlying asset without having to immediately pay for, hold or warehouse that asset. •They offer a convenient means of hedging or speculating. For example, a rancher can conveniently hedge his grain costs by purchasing corn several months forward. The hedge eliminates price exposure, and it doesn't require an initial outlay of funds to purchase the grain. The rancher is hedged without having to take delivery of or store the grain until it is needed. The rancher doesn't even have to enter into the forward with the ultimate supplier of the grain and there is little or no initial cash outlay. •Both physical settlement and cash settlement options can be keyed to a wide variety of underlying assets including commodities, short-term debt, Eurodollar deposits, gold, foreign exchange, the S&P 500 stock index, etc. |

|

|

|

Notional value

|

For example, one S&P 500 Index futures contract obligates the buyer to 250 units of the S&P 500 Index. If the index is trading at $1,000, then the single futures contract is similar to investing $250,000 (250 x $1,000). Therefore, $250,000 is the notional value underlying the futures contract.

|

|

|

|

Marking to Market

|

This is done most often in futures accounts to make sure that margin requirements are being met. If the current market value causes the margin account to fall below its required level, the trader will be faced with a margin call.

With futures, credit risk mitigation measures, such as regular mark-to-market and margining, are automatically required. The exchanges employ a system whereby counterparties exchange daily payments of profits or losses on the days they occur. Through these margin payments, a futures contract's market value is effectively reset to zero at the end of each trading day. This all but eliminates credit risk. |

|

|

|

Key features of forward contracts are

|

•Highly customized -Counterparties can determine and define the terms and features to fit their specific needs, including when delivery will take place and the exact identity of the underlying asset.

•All parties are exposed to counterparty default risk - This is the risk that the other party may not make the required delivery or payment. •Transactions take place in large, private and largely unregulated markets consisting of banks, investment banks, government and corporations. •Underlying assets can be a stocks, bonds, foreign currencies, commodities or some combination thereof. The underlying asset could even be interest rates. •They tend to be held to maturity and have little or no market liquidity. •Any commitment between two parties to trade an asset in the future is a forward contract. |

|

|

|

Key characteristics of future contracts

|

Terms and conditions are standardized.

Trading takes place on a formal exchange wherein the exchange provides a place to engage in these transactions and sets a mechanism for the parties to trade these contracts. There is no default risk because the exchange acts as a counterparty, guaranteeing delivery and payment by use of a clearing house. The clearing house protects itself from default by requiring its counterparties to settle gains and losses or mark to market their positions on a daily basis. Futures are highly standardized, have deep liquidity in their markets and trade on an exchange. An investor can offset his or her future position by engaging in an opposite transaction before the stated maturity of the contract. |

|

|

|

Long position of futures contract

|

Agreed to buy the asset in the future.

Accept delivery, make payment. |

|

|

|

Short position in futures contract

|

Agreed to sell the underlying asset in the future.

Accept payment, make delivery. |

|

|

|

Differentiate between an exchange-traded and OTC derivative

|

Exchange-traded derivatives are standardized and backed by a clearinghouse

A dealer market with no central location is referred to as an over-the-counter market. They are largely unregulated markets and each contract is with a counterparry, which may expose the owner of a derivative to default risk (when the counterparty does not honor their commitment). |

|

|

|

Define a contingent claim

|

a claim (to a payoff) that depends on a particular event. Options are contingent claims that depend on a stock price at some future date. While forwards,

futures, and swaps have payments that are made based on a price or rate outcome whether the movement is up or down, contingent claims only require a payment if a certain threshold price is broken (e.g., if the price is above X or the rate is below Y). It takes two options to replicate a future or forward. |

|

|

|

Define a swap

|

a series of forward contracts. In the simplest swap, one party agrees to pay the short-term (floating) rate of interest on some principal amount, and the counterparty agrees to pay a certain (fixed) rate of interest in return. Swaps of different currencies and equity returns are also common.

As long as the present value of the streams is equal, swaps can entail almost any type of future cash flow. They are most often used to change the character of an asset or liability without actually having to liquidate that asset or liability. For example, an investor holding common stock can exchange the returns from that investment for lower risk fixed income cash flows - without having to liquidate his equity position. Cash flow streams are often structured so that payments are synchronized, or occur on the same dates. This allows cash flows to be netted against each other (so long as the cash flows are in the same currency). Typically, the principal (or notional) amounts of the loans are netted to zero and the periodic interest payments are scheduled to occur on that same dates so they can also be netted against one another. Swaps are private, negotiated and mostly unregulated transactions |

|

|

|

Discuss the purposes and criticisms of derivative markets.

|

The criticism of derivatives is that they are "too risky," especially to investors with limited knowledge of sometimes complex instruments. Because of the high leverage involved in derivatives payoffs, they are sometimes likened to gambling.

The benefits of derivatives markets are that they: * Provide price information * Allow risk to be managed and shifted among market participants * Reduce transactions costs |

|

|

|

Explain arbitrage

|

Arbitrage is an important concept in valuing (pricing) derivative securities. In its purest

sense, arbitrage is riskless. If a return greater than the risk-free rate can be earned by holding a portfolio of assets that produces a certain (riskless) return, then an arbitrage opportunity exists. Arbitrage opportunities arise when assets are mispriced. Trading by arbitrageurs will continue until they affect supply and demand enough to bring asset prices to efficient (no-arbitrage) levels. |

|

|

|

Explain delivery/settlement and default risk for both long and short positions in a forward contract

|

Each party to a forward contract is exposed to default risk (or counterparty risk), the probability that the other party (the counterparty) will not perform as promised. It is unusual for any cash to actually be exchanged at the inception of a forward contract, unlike futures contracts in which each party posts an initial deposit (margin) as a

guarantee of performance. At any point in time, including the settlement date, only one parry to the forward contract will "owe" money, meaning that side of the contract has a negative value. The other side of the contract will have a positive value of an equal amount. Following the example, if the T-bill price is $992 at the (fumre) settlement date and the short does not deliver the T-bill for $990 as promised, the short has defaulted. |

|

|

|

The Law of One Price

|

The law of one price exists due to arbitrage opportunities. If the price of a security, commodity or asset is different in two different markets, then an arbitrageur will purchase the asset in the cheaper market and sell it where prices are higher.

When the purchasing power parity doesn't hold, arbitrage profits will persist until the price converges across markets. |

|

|

|

Differentiate between a deliverable forward contract and a non-deliverable forward contract

|

Deliverable - actually delivering the underlying security or asset.

Non-deliverable - A cash-settled, short-term forward contract on a thinly traded or non-convertible foreign currency, where the profit or loss at the time at the settlement date is calculated by taking the difference between the agreed upon exchange rate and the spot rate at the time of settlement, for an agreed upon notional amount of funds. |

|

|

|

Discuss how termination alternatives prior to expiration can affect credit risk

|

A party to a forward contract can terminate the position prior to expiration by entering into an opposite forward contract with an expiration date equal to the time remaining on the original contract.

However, if the short's new forward contract is with a different party than the first forward contract, some credit risk remains. If the price of the T-bill at the expiration date is above $992, and the counterparty to the second forward contract fails to perform, the short's losses could exceed. An alternative is to enter into the second (offsetting) contract with the same party as the original contract. This would avoid credit risk. |

|

|

|

Differentiate between a dealer and an end user of a forward contract.

|

The end user of a forward contract is typically a corporation, government unit, or nonprofit institution that has existing risk they wish to avoid by locking in the future price of an asset. A U.S. corporation that has an obligation to make a payment in

Euros 60 days from now can eliminate its exchange rate risk by entering into a forward contract to purchase the required amount of Euros for a certain dollar-denominated payment with a settlement date 60 days in the future. Dealers are often banks, but can also be nonbank financial institutions such as securities brokers. Ideally, dealers will balance their overall long positions with their overall short positions by entering forward contracts with end users who have opposite existing risk exposures. A dealer's quote desk will quote a buying price (at which they will assume a long position) and a slightly higher selling price (at which they will assume a short position). The bid/ask spread between the two is the dealer's compensation for administrative costs as well as bearing default risk and any asset price risk from unbalanced (unhedged) positions. Dealers will also enter into contracts with other dealers to hedge a net long or net short position. |

|

|

|

Describe the characteristics of equity forward contracts

|

the underlying asset is a single stock, a portfolio of stocks, or a stock index, work in much the same manner as other forward contracts. An investor who wishes to sell 10,000 shares of IBM stock 90 days from now and wishes to avoid the uncertainty about the stock price on that date, could do so by taking a short position in a forward contract covering 10,000 IBM shares.

A portfolio manager who wishes to sell a portfolio of several stocks 60 days from now can similarly request a quote, giving the dealer the company names and the number of shares of each stock in the portfolio. The only difference between this type of forward contract and several forward contracts each covering a single stock, is that the pricing would be better (a higher total price) for the portfolio because overall administration/ origination costs would be less for the portfolio forward contract. Dividends are usually not included in equity forward contracts, as the uncertainty about dividend amounts and payment dates is small compared to the uncertainty about future equity prices. Since forward contracts are custom instruments, the parties could specify a total return value (including dividends) rather than simply the index value. This would effectively remove dividend uncertainty as well. |

|

|

|

Describe the characteristics of zero-coupon and coupon bonds

|

Forward contracts on short-term, zero-coupon bonds (T-bills in the United States) and coupon interest-paying bonds are quite similar to those on equities. However, while equities do not have a maturity date, bonds do, and the forward contract must settle before the bond matures.

T-bill prices are often quoted as a percentage discount from face value. The percentage discount for T-bills is annualized so that a 90-day T-bill quoted at a 4% discount will be priced at a (90 I 360) x 4% = 1 o/o discount from face value. This is equivalent to a price quote of (1 0.0 1) x $1,000 = $990 per $1,000 of face value. The price specified in forward contracts on coupon-bearing bonds is typically stated as a yield to maturity as of the settlement dare, exclusive of accrued interest. If the contract is on bonds with the possibility of default, there must be provisions in the contract to define default and specify the obligations of the parties in the event of default. Special provisions must also be included if the bonds have embedded options such as call features or conversion features. Forward contracts can be constructed covering individual bonds or portfolios of bonds |

|

|

|

Define LIBOR

|

LIBOR is published daily by the British Banker's Association and is compiled from

quotes from a number of large banks; some are large multinational banks based in other countries that have London offices. An interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. The LIBOR is the world's most widely used benchmark for short-term interest rates. It's important because it is the rate at which the world's most preferred borrowers are able to borrow money. It is also the rate upon which rates for less preferred borrowers are based. For example, a multinational corporation with a very good credit rating may be able to borrow money for one year at LIBOR plus four or five points. |

|

|

|

Describe the characteristics of the Eurodollar time deposit market

|

Eurodollar deposit is the term for deposits in large banks outside the United States

denominated in U.S. dollars. The lending rate on dollar-denominated loans between banks is called the London Interbank Offered Rate (LIBOR). It is quoted as an annualized rate based on a 360-day year. In contrast to T-bill discount yields, LIBOR is an add-on rate, like a yield quote on a short-term certificate of deposit. LIBOR is used as a reference rate for floating rate U.S. dollar-denominated loans worldwide. Eurodollars have two basic characteristics: they are short-term obligations to pay dollars and they are obligations of banking offices located outside the U.S. In principle, there is no hard and fast line between Eurodollars and other dollar-denominated claims. The interest paid for these dollar deposits generally is higher than for funds deposited in U.S. banks because the foreign banks are riskier - they will not be supported or nationalized by the U.S. government upon default. Furthermore, they may pay higher rates of interest because they are not regulated by the U.S. government. They are backed by the full faith and credit of the local domestic bank and are issued by its offshore branch. Eurodollar time deposits are designed for corporate, commercial, institutional and high-net-worth investors who want a short-term, high-yield money market investment |

|

|

|

Define Euribor

|

The rate of interest at which panel banks borrow funds from other panel banks, in marketable size, in the EU interbank market

In other words, this is the rate at which participant banks within the European Union money market will lend to another participant bank in the EU money market. Because banks involved with Euribor are the largest participants in the EU money market, this rate has become the benchmark for short-term interest rates. |

|

|

|

Describe the characteristics of forward rate agreements (FRAs)

|

A forward rate agreement (FRA) can be viewed as a forward contract to borrow/lend money at a certain rate at some future date. In practice, these contracts settle in cash, but no actual loan is made at the settlement date. This means that the creditworthiness of the parties to the contract need not be considered in the forward interest rate, so an essentially riskless rate, such as LIBOR, can be specified in the contract. (The parties to the contract may still be exposed to default risk on the amount owed at settlement.)

The long position in an FRA is the party that would borrow the money (long the loan with the contract price being the interest rate on the loan). If the floating rate at contract expiration (LIBOR or Euribor) is above the rate specified in the forward agreement, the long position in the contract can be viewed as the right to borrow at below market rates and the long will receive a payment. If the reference rate at the expiration date is below the contract rate, the short will receive a cash payment from the long. (The right to lend at rates higher than market rates would have a positive value.) |

|

|

|

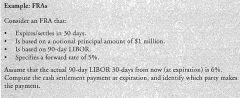

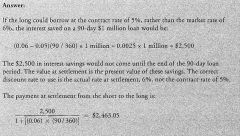

Calculate the gain/loss of forward rate agreements (FRAs).

|

To calculate the cash payment at settlement for a forward rate agreement, we need to calculate the value as of the settlement date of making a loan at a rate that is either above or below the market rate. Since the interest savings would come at the end of the "loan" period, the cash payment at settlement of the forward is the present value of the interest "savings." We need to calculate the discounted value at the settlement date of the interest

savings or excess interest at the end of the loan period. |

|

|

|

|

In doing the calculation of the settlement payment, remember that the term of the FRA and the term of the underlying "loan" need not be the same and are not interchangeable.

While the settlement date can be any future date, in practice it is usually some multiple of 30 days. The specific market rate on which we calculate the value of the contract will typically be similar, 30-day, 60-day, 90-day, or 180-day LIBOR. If we describe an FRA as a 60-day FRA on 90-day LIBOR, settlement or expiration is 60 days from now and the payment at settlement is based on 90-day LIBOR 60 days from now. Such an FRA could be quoted in (30-day) months, and would be described as a 2-by-5 FRA (or 2 x 5 FRA). The 2 refers to the number of months until contract expiration and the 5 refers to the total time until the end of the interest rate period (2 + 3 5). |

|

|

The general formula for the payment to the long at settlement is:

|

|

|

|

|

Describe the characteristics of currency forward contracts

|

Under the terms of a currency forward contract, one party agrees to exchange a certain amount of one currency for a certain amount of another currency at a future date. This

type of forward contract in practice will specify an exchange rate at which one party can buy a fixed amount of the currency underlying the contract. If we need to exchange 10 million Euros for U.S. dollars 60 days in the future, we might receive a quote of USD0.95. The forward contract specifies that we (the long) will purchase USD9.5 million for EURIO million at settlement. Currency forward contracts can be deliverable or settled in cash. As with other forward contracts, the cash settlement amount is the amount necessary to compensate the party who would be disadvantaged by the actual change in market rates as of the settlement date. An example will illustrate this. |

|

|

|

Standardization of future contracts

|

A major difference between forwards and futures is that futures

contracts have standardized contract terms. Futures contracts specify the quality and quantity of goods that can be delivered, the delivery time, and the manner of delivery. The exchange also sets the minimum price fluctuation (which is called the tick size). For example, the basic price movement, or tick, for a 5,000-bushel grain contract is a quarter of a point (1 point"' $0.01) per bushel, or $12.50 per contract. Contracts also have a daily price limit, which sets the maximum price movement allowed in a single day. For example, wheat cannot move more than $0.20 from its close the preceding day. The maximum price limits expand during periods of high volatility and are not in effect during the delivery month. The exchange also sets the trading times for each contract. It would appear that these rules would restrict trading activity, but in fact, they stimulate trading. Why? Standardization tells traders exactly what is being traded and the conditions of the transaction. Uniformity promotes market liquidity. |

|

|

|

Futures clearinghouse

|

Each exchange has a clearinghouse. The clearinghouse guarantees that

traders in the futures market will honor their obligations. The clearinghouse does this by splitting each trade once it is made and acting as the opposite side of each position. The clearinghouse acts as the buyer to every seller and the seller to every buyer. By doing this, the clearinghouse allows either side of the trade to reverse positions at a future date without having to contact the other side of the initial trade. This allows traders to enter the market knowing that they will be able to reverse their position. Traders are also freed from having to worry about the counterparty defaulting since the counterparty is now the clearinghouse. In the history of U.S. futures trading, the clearinghouse has never defaulted on a trade. |

|

|

|

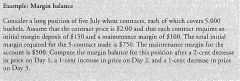

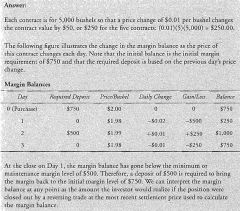

Differentiate between margin in the securities markets and margin in the futures markets

|

In securities markets, margin on a stock or bond purchase is a percentage of the market value of the asset. Initially, 50% of the stock purchase amount may be borrowed, and the remaining amount, the equity in the account, must be paid in cash. There is interest charged on the borrowed amount, the margin loan. The margin percentage, the percent of the security value that is "owned," will vary over time and must be maintained at some minimum percentage of market value.

In the futures markets, margin is a performance guarantee. It is money deposited by both the long and the short. There is no loan involved and, consequently, no interest charges. Each futures exchange has a clearinghouse. To safeguard the clearinghouse, the exchange requires traders to post margin and settle their accounts on a daily basis. Before trading, the trader must deposit funds (called margin) with a broker (who, in turn, will post margin with the clearinghouse). |

|

|

|

Define initial margin

|

the money that must be deposited in a futures account before any trading takes place. It is set for each type of underlying asset. Initial margin per contract is relatively low and equals about one day's maximum price fluctuation on the rota! value of the contract's underlying asset.

|

|

|

|

Define maintenance margin

|

the amount of margin that must be maintained in a futures account. If the margin balance in the account falls below the maintenance margin due

to a change in the contract price for the underlying asset, additional funds must be deposited to bring the margin balance back up to the initial margin requirement. This is in contrast to equity account margins, which require investors only t bring the margin percentage up to the maintenance margin, not back to the initial margin level. |

|

|

|

Define variation margin

|

the funds that must be deposited into the account to bring it back to the initial margin amount. If account margin exceeds the initial margin requirement, funds can be withdrawn or used as initial margin for additional positions.

|

|

|

|

Describe price limits

|

Many futures contracts have price limits, which are exchange-imposed limits on how

much the contract price can change from the previous day's settlement price. Exchange members are prohibited from executing trades at prices outside these limits. If the (equilibrium) price at which traders would willingly trade is above the upper limit or below the lower limit, trades cannot take place. Consider a futures contract that has daily price limits of two cents and settled the previous day at $1.04. If, on the following trading day, traders wish to trade at $1.07 because of changes in market conditions or expectations, no trades will take place. The settlement price will be reported as $1.06 (for the purposes of marking-to-market). The contract will be said to have made a limit move, and the price is said to be limit up (from the previous day). If market conditions had changed such that the price at which traders are willing to trade is below $1.02, $1.02 will be the settlement price, and the price is said to be limit down. If trades cannot take place because of a limit move, either up or down, the price is said to be locked limit since no trades can take place and traders are "locked" into their existing positions. |

|

|

|

Describe the process of marking to market

|

the process of adjusting the margin balance in a futures account each day for the change in the value of the contract assets from the previous trading day, based on the new settlement price.

The futures exchanges can require a mark-to-market more frequently (than daily) under extraordinary circumstances. |

|

|

|

|

|

|

|

Describe how a futures contract can be terminated at or prior to expiration

|

1) A short can terminate the contract by delivering the goods, and a long can terminate the contract by accepting delivery and paying the contract price to the short. This is called delivery. The location for delivery (for physical assets), terms of delivery, and details of exactly what is to be delivered are all specified in the contract. Deliveries represent less than 1% of all contract terminations.

2) In a cash-settlement contract, delivery is not an option. The futures account is marked-to-market based on the settlement price on the last day of trading. 3) You may make a reverse, or offsetting, trade in the futures market. This is similar to the way we described exiting a forward contract prior to expiration. With futures, however, the other side of your position is held by the clearinghouse-if you make an exact opposite trade (maturity, quantity, and good) to your current position, the clearinghouse will net your positions out, leaving you with a zero balance. This is how most futures positions are settled. The contract price can differ between the two contracts. If you initially are long one contract at $370 per ounce of gold and subsequently sell (take the short position in) an identical gold contract when the price is $350/oz., $20 times the number of ounces of gold specified in the contract will be deducted from the margin deposit(s) in your account. sale of the futures contract ends the exposure to future price fluctuations on the first contract. Your position has been reversed, or closed out, by a closing trade. 4) A position may also be settled through an exchange for physicals. Here, you find a trader with an opposite position to your own and deliver the goods and settle up between yourselves, off the floor of the exchange (called an ex-pit transaction). This is the sole exception to the federal law that requires that all trades take place on the floor of the exchange. You must then contact the clearinghouse and tell them what happened. An exchange for physicals differs from a delivery in that the traders actually exchange the goods, the contract is not closed on the floor of the exchange, and the two traders privately negotiate the terms of the transaction. Regular delivery involves only one trader and the clearinghouse. |

|

|

|

Describe the characteristics of Treasury bills

|

Treasury bill futures contracts are based on a $1 million face value 90-day (13-week) T-bill and settle in cash. The price quotes are 100 minus the annualized discount in percent on the T-bills.

A price quote of 98.52 represents an annualized discount of 1.48%, an actual discount from face of 0.0148 x (90 / 360) = 0.0037, and a "delivery" price of(1 - 0.0037) x 1 million = $996,300. T-bill futures contracts are not as important as they once were. Their prices are heavily influenced by U.S. Federal Reserve operations and overall monetary policy. T-bill futures have lost importance in favor of Eurodollar futures contracts, which represent a more free-market and more global measure of short-term interest rates to top quality borrowers for U.S. dollar-denominated loans. |

|

|

|

Exchange for physicals

|

a negotiated off-market transaction in which one party buys physical assets and sells futures contracts while the other party sells the physical market products and sells the physical market products and buys futures contracts that enable customers to swap physical exposure for an offsetting futures position.

It offers the flexibility and certainty of an over-the-counter market plus the counterparty guarantee of an exchange market. |

|

|

|

Swap vs. Forward

|

The difference between a forward contract and a swap is that a swap involves a series of payments in the future, whereas a forward has a single future payment.

|

|

|

|

Interest rate swap

|

This is a contract to exchange cash flow streams that might be associated with some fixed income obligations. The most popular interest rate swaps are fixed-for-floating swaps, under which cash flows of a fixed rate loan are exchanged for those of a floating rate loan.

|

|

|

|

Currency swap

|

This is similar to an interest rate swap except that the cash flows are in different currencies. Currency swaps can be used to exploit inefficiencies in international debt markets. For example, assume that a corporation needs to borrow $1O million euros and the best rate it can negotiate is a fixed 6.7%. In the U.S., lenders are offering 6.45% on a comparable loan. The corporation could take the U.S. loan and then find a third party willing to swap it into an equivalent euro loan. By doing so, the firm would obtain its euros at more favorable terms.

|

|

|

|

European vs. American options

|

Europeans Options can only be exercised on the expiry date

American options can be exercised at any time up to and including the expiry date. American options are rarely exercised early. This is because all options have a non-negative time value and are usually worth more unexercised. Owners who wish to realize the full value of their options will mostly prefer to sell them rather than exercise them early and sacrifice some of the time value. |

|

|

|

Option payoff

|

Calculated by deducting the option premium paid from the intrinsic value of the option. In this case, an in-the-money option could produce a negative payoff if the premium is greater than the intrinsic value of the option.

|

|

|

|

Intrinsic Value

|

Intrinsic value in options is the in-the-money portion of the option's premium. It is the value that any given option would have if it were exercised today. It is defined as the difference between the option's strike price (X) and the stock's actual current price (CP). In the case of a call option, you can calculate this intrinsic value by taking CP - X. If the result is greater than zero (in other words, if the stock's current price is greater than the option's strike price), then the amount left over after subtracting CP - X is the option's intrinsic value. If the strike price is greater than the current stock price, then the intrinsic value of the option is zero - it would not be worth anything if it were to be exercised today (please note that an option's intrinsic value can never be below zero). To determine the intrinsic value of a put option, simply reverse the calculation to X - CP.

|

|

|

|

Time Value

|

The time value is any value of an option other than its intrinsic value. Time value is basically the risk premium that the seller requires to provide the option buyer with the right to buy or sell the stock up to the expiration date. While the actual calculation is complex, fundamentally, time value is related to a stock's beta or volatility. If the market does not expect the stock to move much (if it has a low beta), then the option's time value will be relatively low. Conversely, the option's time value will be high if the stock is expected to fluctuate significantly.

Time value decreases as an option gets closer and closer to expiration. This is why options are considered "wasting" assets. As an option approaches expiration, the underlying stock has less and less time to move in a favorable direction for the option buyer; therefore, if you have two identical options - one that expires in six months and one expires in 12 months - the option that expires in 12 months will have greater time value because it has a better chance of moving higher. |

|

|

|

Stock Option

|

Also known as equity options, these are a privileges sold by one party to another. Stock options give the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed-upon price during a certain period of time or on a specific date.

|

|

|

|

Index Option

|

A call or put option on a financial index, such as the Nasdaq or S&P 500. Investors trading index options are essentially betting on the overall movement of the stock market as represented by a basket of stocks.

|

|

|

|

Bond option

|

An option contract in which the underlying asset is a bond. Other than the different characteristics of the underlying assets, there is no significant difference between stock and bond options. Just as with other options, a bond option allows investors to hedge the risk of their bond portfolios or speculate on the direction of bond prices with limited risk.

A buyer of a bond call option is expecting a decline in interest rates and an increase in bond prices. The buyer of a put bond option is expecting an increase in interest rates and a decrease in bond prices. |

|

|

|

Interest Rate Option

|

Option in which the underlying asset is related to the change in an interest rate. Interest rate options are European-style, cash-settled options on the yield of U.S. Treasury securities. Interest rate options are options on the spot yield of U.S. Treasury securities. They include options on 13-week Treasury bills, options on the five-year Treasury note and options on the 10-year Treasury note. In general, the call buyer of an interest rate option expects interest rates will go up (as will the value of the call position), while the put buyer hopes rates will go down (increasing the value of the put position.) Interest rate options and other interest rate derivatives make up the largest portion of the worldwide derivatives market.

|

|

|

|

Currency option

|

A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified price during a specified period of time. Investors can hedge against foreign currency risk by purchasing a currency option put or call.

|

|

|

|

Options on Futures

|

Like other options, an option on a futures contract is the right but not the obligation, to buy or sell a particular futures contract at a specific price on or before a certain expiration date. These grant the right to enter into a futures contract at a fixed price. A call option gives the holder (buyer) the right to buy (go long) a futures contract at a specific price on or before an expiration date. The holder of a put option has the right to sell (go short) a futures contract at a specific price on or before the expiration date.

|

|