![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

35 Cards in this Set

- Front

- Back

|

What are the types of Depreciation?

|

1. Physical

2. Functional |

|

|

Note

|

Physical depreciation is the type of depreciation that is related to an asset's deterioration and wear over a period of time.

|

|

|

Note

|

Functional depreciation is the type of depreciation that arises from obsolescence or inadequacy of the asset to perform efficiently.

|

|

|

Note

|

Depreciable asset estimated useful life may be revised at any time but any revision must be accounted for prospectively, in current and future periods only (change in estimate).

|

|

|

Note

|

The depreciable base is the amount Subject to depreciation which is the difference between the cost and residual or salvage value.

|

|

|

Note

|

Under IFRS, the depreciation method used should reflect the expected pattern of fixed asset consumption. Additionally, under IFRS, estimated useful life, salvage value, and the depreciation method used should be reviewed for appropriateness at each balance sheet date. These are not requirements under U.S. GAAP.

|

|

|

What are the advantages of Component Depreciation over Composite Depreciation?

|

1. Depreciation expense for the year would be more accurate because each component item would be depreciated over its useful life.

2. Repair and maintenance expense would be more accurate because replacements of components would be excluded. |

|

|

Note

|

IFRS require component depreciation. Separate significant components of a fixed asset with different lives should be recorded and depreciated separately. The carrying amount of parts or components that are replaced should be derecognized.

|

|

|

What is meant by composite depreciation?

|

This is the process of averaging the economic lives of a number of property units and depreciating the entire class of assets over a single life.

|

|

|

Note

|

No gain or loss is recognized when one asset in the group is retired.

|

|

|

Note

|

If the average service life of the group of assets has not been reached when an asset is retired, the gain or loss that results is absorbed in the accumulated depreciation account. The accumulated depreciation account is debited (credited) for the difference between the original cost and the cash received.

|

|

|

What is the entry that should be recorded for the disposal of a composite asset?

|

|

|

|

What is the sum-of-the-year’s-digits method?

|

The sum-of-the-years'-digits method is one of the accelerated methods of depreciation that provides higher depreciation expense in the early years and lower charges in the later years.

|

|

|

Note

|

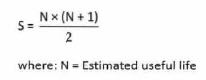

Formula of the sum of the year’s digit is

|

|

|

Note

|

When dealing with an asset with a long life, it is necessary to use the general formula for finding the sum-of-the-years'-digits:

|

|

|

Note

|

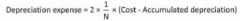

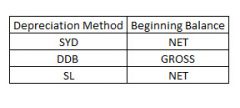

Double-declining balance depreciation is calculated using the following formula:

|

|

|

Note

|

The only method that Ignore salvage value in the annual calculation of depreciation is the declining balance method. Salvage value is only used as the limitation on total depreciation.

|

|

|

Note

|

|

|

|

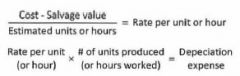

What is the formula for the depreciation method called “Units of Production“?

|

|

|

|

What is the information that should be disclosed in the financial statements or the notes thereto relating to Depreciation?

|

1. Depreciation expense for the period.

2. Balance of major classes of depreciable assets by nature or function. 3. Accumulated depreciation allowances by classes or in total. 4. The methods used, by major classes, in computing depreciation. |

|

|

What are the advantages of the straight line method of Depreciation?

|

1. Simple to compute.

2. Applies to virtually all assets. 3. Consistent from year to year. 4. Wide acceptability. 5. Similar to treatment of prepaid items. |

|

|

What is the Journal entry of the partial impairment of depreciable fixed assets?

|

|

|

|

What are the disadvantages of the straight line method of Depreciation?

|

1. Does not reflect difference in usage of asset from year to year.

2. Does not accurately match costs with revenue. |

|

|

What are the advantages of the Units of production method of Depreciation?

|

1. Matches costs with revenues.

2. Reflects activity of the enterprise. |

|

|

What are the disadvantages of the Units of production method of Depreciation?

|

1. If no activity, no depreciation expensed; however, in reality, all assets depreciate.

2. Cannot be used for all assets (e.g., buildings). 3. Can be complex because it requires clerical work and records. |

|

|

What are the advantages of the Double declining balance method of Depreciation?

|

1. Matches costs to revenues since greater utility is reflected in greater depreciation during earlier years.

2. As the amount of depreciation decreases, repairs and maintenance charge increase thereby tending to balance out one another. |

|

|

What are the disadvantages of the Double declining balance method of Depreciation?

|

1. Does not reflect changes in the activity of the asset.

2. Computation can be complex. 3. Greater disparity in amount of depreciation between earlier years and later years. 4. Possibility that with decreasing depreciation and increasing repairs and maintenance, income is artificially smoothed over the years. |

|

|

Note

|

Depletion is the allocation of the cost of wasting natural resources such as oil, gas, timber, and minerals to the production process.

|

|

|

Note

|

Residual Value is the monetary worth of a depleted asset after the resources have been removed.

|

|

|

Note

|

Cost depletion is computed by dividing the cost base (Cost- SV) / estimated recoverable units to arrive at a cost depletion rate which is multiplied by units produced.

|

|

|

Note

|

Percentage Depletion is based on a percentage of sales.

|

|

|

Note

|

The depletion base may be calculated as:

a. Cost to purchase property. b. Plus: Development costs to prepare the land for extraction. c. Plus: Any estimated restoration costs. d. Less: Residual value of land after the extraction of the resources (e.g., mineral ore, oil, etc.). |

|

|

Note

|

Total depletion is calculated by multiplying the unit depletion rate times the number of units extracted.

|

|

|

Note

|

The amount of depletion to be included in cost of goods sold is calculated by multiplying the unit depletion rate by the number of units sold.

|

|

|

Note

|

Depletion applicable to units extracted but not sold is allocated to inventory as direct materials.

|