![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

18 Cards in this Set

- Front

- Back

|

minimum variance hedge ratio |

a mathematical approach to determining the hedge ratio -regression to minimize the value of the tracking error -based on historical returns, so if the correlation btwn returns on portfolio and returns on hedging instrument change, the hedge will not perform as well as expected -strong Positive correlation btwn R(fx) and R(fc) INCREASES VOLATILITY of R(dc). Hedge Ratio >1.0 would REDUCE Volatility of R(dc) |

|

|

Currency Roll Yield |

-SALE at a FORWARD PREMIUM will earn POSITIVE roll yield, which will REDUCE hedging cost compared to initial spot price -when a manager buys an asset, they are initially LONG that foreign currency -Implied Roll Yield = (Fo-So)/So and is the fwd premium or discount, and also the hedged currency return -hedging locks in the forward price as an end of period exchange rate |

|

|

INCREASES in the value of a currency are associated with currencies that |

-are more undervalued relative to their fundamental value -that have the greatest rate of increase in their fundamental value -have higher REAL or Nominal Rates -have lower inflation relative to other countries -are of countries with DECREASING RISK PREMIUMS |

|

|

regarding hedging currency risk, the IPS should specify |

1) target % of currency exposure to be hedged 2) allowable discretion for manager 3) frequency of rebalancing hedge 4) benchmarks to evaluate results of currency decisions 5) allowable/prohibited hedging tools |

|

|

Factors that SHIFT the currency management Program Decision TOWARD Benchmark Neutral or Fully Hedged |

1) SHORT time horizon for portfolio objectives 2) HIGH RISK AVERSION 3) client who is UNCONCERNED with opportunity costs of missing positive currency returns 4) HIGH LIQUIDITY needs 5) significant foreign currency bond exposure 6) LOW HEDGING costs 7) clients who doubt the benefits of discretionary management |

|

|

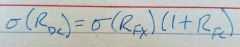

Investor's Returns in Domestic Currency = R(dc) = *always use DC/FC |

R(dc) = [1+R(fc)][1+R(fx)] - 1 R(fc) = return of the foreign asset measured in its local (foreign to investor); aka Local Mkt Return (LMR) R(fx) = % change in value of the foreign currency; aka Local Currency Return (LCR) *can approximate by adding R(fc) + R(fx) |

|

|

FX SWAP manager purchases 10mln ZAR 3 month forward @ ZAR/USD .1058. If manager decides to extend transaction 30 days, how is it done? |

FX Swap is NOT a currency swap. It rolls over a maturing fwd contract using a spot transaction into a new fwd contract 2 days before original contract expires, manager sells ZAR 10mln to offset original Buy. Both the initial fwd and offsetting spot transaction will settle in 2 days. Manager enters NEW 30 day contract to buy ZAR 10mln vs USD to roll over trade |

|

|

challenges for managing emerging mkt currency exposures |

-low trading volume leads to larger bid/ask spreads -liquidity can be lower and transactions costs higher to EXIT than to ENTER trades -EM currency return distributions are non-normal with fatter tails and negatively skewed returns; many trading strategies and risk measures assume normal distributions -higher yield of EM currencies lead to LARGE FWD DISCOUNTS, producing negative roll yield if manager needs to sell them fwd -CONTAGION is common and during crises, correlations tend to converge to +1.0 -TAIL RISK: gov'ts in EM tend to actively intervene in mkts producing long periods of artificial price stability followed by sharp price movements when gov't capacity to intervene is overwhelmed by the mkt -NON-DELIVERABLE FORWARDS (NDFs) for mkts where gov't restricts movement of currency: requires cash settlement of profits/losses in developed mkt currency |

|

|

strategies to reduce currency hedging costs and modify risk-return characteristics of a foreign currency portfolio |

COSTS: initial fwd premium/discount + opportunity cost of eliminating any possibility of upside gain from fx changes 1) OVER or UNDER-HEDGE based on manager's view; LOW COST 2) BUY ATM PUTS (aka Protective Puts or Portfolio Insurance); asymmetric protection, eliminating all downside risk and retaining all upside potential; HIGHEST initial cost, NO Opportunity Cost 3) BUY OTM PUTS; deltas <0.5; REDUCES Cost but does NOT eliminate all downside risk 4) COLLAR: buy 35-delta PUTS, sell 35 delta CALLS; provides downside protection but removes upside potential and increases opportunity cost 5) PUT SPREAD: buy OTM PUTS, sell further OTM Puts (buy 35-delta puts, sell 25-delta puts): reduces downside protection 6) SEAGULL SPREAD: Put Spread + Sell a Call (buy 35-delta put, sell 25-delta put, sell 35-delta call); downside protection, lower initial cost, limited upside |

|

|

CARRY TRADE Basics |

-borrow in low interest rate country and invest proceeds in high rate country -UNCOVERED INTEREST RATE PARITY: says fwd exchange rate calculated by Covered Interest Rate Parity is an UNBIASED estimate of the spot rate that will exist in the future; if TRUE the currency with higher rate will fall in value by amount of initial interest rate differential -Carry Trade based on VIOLATION OF UNCOVERED INTEREST RATE PARITY -traders often EXIT carry trade when fx Volatility increases significantly -PROFITABLE if spot exchange rate of higher interest rate currency DECLINES LESS than predicted by Fwd Rate |

|

|

Strategic DIVERSIFICATION ISSUES with Currency Hedging and Strategic COST ISSUES |

DIVERSIFICATION ISSUES: -currency volatility LOWER in LONG RUN; need to hedge reduced in portfolio with LONG TERM perspective -POSITIVE CORRELATIONS btwn R(fc) and R(fx) increase Volatility of R(dc) (returns to investor) and increase need for hedging -HIGHER, POSITIVE correlation btwn asset and currency returns for BONDS over equity portfolios; interest rate movement tends to drive both bond prices and currency values COST ISSUES: hedging not free -purchasing options involves up front premium cost -fwd currency contracts often shorter term than hedging period, requiring rollovers, creating cash flow volatility, realized gains and losses; outflow financing may be costly with high rates -OVERHEAD HIGH: back office and trading infrastructure needed |

|

|

currency management strategies |

PASSIVE HEDGING: Rule-based and typically matches the portfolio's currency exposure to that of the benchmark used to evaluate the portfolio's performance. Requires periodic rebalancing to maintain the match; goal is to eliminate currency risk relative to benchmark DISCRETIONARY HEDGING: allows modest deviation from passive by a specific %; goal is to reduce risk while allowing manager to pursue modest incremental currency returns ACTIVE MANAGEMENT: allows greater deviations from benchmark; goal is to create incremental return (alpha), not reduce risk CURRENCY OVERLAY: outsourcing of currency management; broad term; at extreme, Overlay Manager will treat currency as an asset class and take positions independent of other portfolio assets; seeking pure currency alpha, not risk reduction |

|

|

arguments made for NOT hedging currency risk vs arguments for ACTIVE Management of currency risk |

argument for NOT HEDGING currency risk: -best to avoid time and cost of hedging/trading -in LONG-RUN, unhedged currency effects are a ZERO-SUM game -in LONG-Run currencies REVERT to theoretical fair value argument for ACTIVE MANAGEMENT of currency risk: -in SHORT RUN, currency movements can be extreme and inefficient pricing of currencies can be exploited to add to portfolio return |

|

|

If a manager shorts the appropriate amount of the index and it is PERFECTLY CORRELATED with the portfolio of investments, what is the return from the hedging strategy? If the same manager hedges the currency risk and knows the exact value of the currency to hedge, what is the return? |

If a manager hedges foreign index perfectly, the return must be the foreign risk free rate If a manager also hedges the currency risk, the return must be the domestic risk free rate |

|

|

If a quote is MXN/GBP and u have to sell MXN to hedge, do u use the bid or offer side of the quote? |

Offer side Selling MXN is the same as buying GBP and when trading in currencies you're always thinking of the bid-ask as talking about the Base currency (on the bottom). So buying GBP would need to use offer side |

|

|

U initially have a foreign asset worth 10mln MXN and hedge it by selling 10mln MXN forward, and that asset is now worth 9.5mln MXN before the hedge expires. If u want to rebalance, what do u do? |

U must reduce the size of the hedge by BUYING 500k MXN forward |

|

|

SD of a risk free asset SD(Rdc)= |

|

|

|

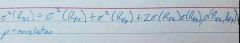

SD of return to a domestic investor is the square root of the variance Variance(Rdc)= |

|