![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

157 Cards in this Set

- Front

- Back

|

Note

|

CPAs can perform two levels of service with respect to unaudited FSs of a nonissuer:

1- Compilation 2- Review |

|

|

What is the objective of the Compilation engagements?

|

To present in the form of FSs, information that is the representation of management without undertaking to express any assurance on the FSs.

|

|

|

Note

|

Although a compilation is not an assurance engagement, it is an attest engagement.

|

|

|

What is the objective of the Review engagements?

|

To express limited (Negative) assurance that there are no material modifications that should be made to the FSs in order for the statements to be in conformity with the applicable financial reporting framework.

|

|

|

Note

|

A review is both an assurance engagement and an attest engagement.

|

|

|

Note

|

When an accountant performs more than one service (for example, a compilation and an audit), the accountant generally should issue the report that is appropriate for the highest level of service rendered .

|

|

|

Note

|

The Accounting and Review Services Committee of the AICPA is the authoritative body designated to issue pronouncements (Called Statements on Standards for Accounting and Review Services "SSARS") in connection with the unaudited FSs of non issuers.

|

|

|

What are the qualifications that should be available in the accountant applying the SSARS?

|

An accountant should:

1- Have sufficient knowledge to identify applicable SSARS. 2- Exercise professional judgment in applying SSARS. 3- Be able to justify departures from SSARS. |

|

|

What are the other guidance that the accountant should consider in applying the SSARS?

|

Applicable interpretive publications such as:

1- SSARS interpretations and appendices 2- AICPA Accounting and Audit Guides 3- AICPA Statements of Position |

|

|

Note

|

Other compilation and review publications (e.g. , AICPA Compilation and Review Alert, articles in professional journals) have no authoritative status but may be helpful to the accountant.

|

|

|

Note

|

An accountant who submits unaudited FSs of a non issuer should comply with SSARS.

|

|

|

Who is the Nonissuer?

|

A nonissuer is an entity:

1- whose securities are not registered with the SEC 2- who is not required to file reports with the SEC 3- who has not filed a registration statement with the SEC. |

|

|

Note

|

SSARS also apply to engagements in which the accountant is engaged to compile or issue a compilation report on specified elements, accounts, or items of a non issuer's FSs, or on pro forma financial information of a non issuer.

|

|

|

What are the other accounting services that SSARS do not apply to ?

|

1- Preparing one or a few adjusting or correcting entries

2- Consulting on financial matters 3- Preparing tax returns 4- Rendering manual or automated bookkeeping or data processing services 5- Processing financial data for clients of other accounting firms |

|

|

Note

|

If the accountant prepares many adjusting or correcting entries, this could be considered preparation of FSs, and SSARS would apply. The accountant must exercise judgment in making this determination.

|

|

|

Note

|

SSARS are not applicable to reviews of interim financial information when Statements on Auditing Standards (SAS) apply

|

|

|

Note

|

Accountants should not consent to the use of their name in connection with unaudited FSs unless they have compiled or reviewed them or the FSs are accompanied by an indication that the accountant has not compiled or reviewed them and assumes no responsibility for them

|

|

|

What are the elements of compilation and review engagements?

|

1- Three-party Relationship

2- Financial Reporting Framework 3- FSs or Financial Information 4- Sufficient Appropriate Evidence (review only) 5- Written Communication or Report |

|

|

Who are the 3 parties involved in the compilation and review engagements?

|

1- Management

2- CPA 3- Intended users of the FS |

|

|

What are management's responsibilities regarding the compilation and review engagements?

|

1- The identification of an applicable financial reporting FW and individual accounting policies

2- The preparation and fair presentation of the FSs in accordance with that FW 3- The design, implementation , and maintenance of internal control |

|

|

Note

|

The accountant cannot issue an unmodified compilation or review report when management is unwilling to accept its responsibilities.

|

|

|

Note

|

The accountant has no responsibility to identify the intended users.

|

|

|

What is the Financial Reporting FW?

|

It is the financial accounting standards established by an authorized or recognized standards setting body.

|

|

|

Give me examples on the Financial Reporting FW

|

1- U.S. GAAP as established by the Financial Accounting Standards Board

2- Governmental Accounting Standards Board 3- Federal Accounting Standards Advisory Board 4- OCBOA |

|

|

When could be the FS prepared in accordance with OCBOA are considered appropriate in form?

|

1- A description of the OCBOA, including a summary of significant accounting policies and a description of the primary differences from GAAP.

2- Disclosures similar to those required by GAAP if the FSs contain items that are similar to those included in FSs prepared in accordance with GAAP. |

|

|

Note

|

An accountant may be engaged to compile or review a complete set of FSs or an individual financial statement.

|

|

|

Note

|

The accountant has no responsibility to obtain evidence about the accuracy or completeness of the FSs in a compilation engagement.

|

|

|

Note

|

When performing a review engagement, the accountant should perform procedures to accumulate evidence to provide a reasonable basis for obtaining limited assurance that there are no material modifications that should be made to the FSs in order for the statements to be in conformity with the applicable financial reporting framework.

|

|

|

Note

|

The accountant should use professional judgment to determine the nature, timing and extent of review procedures, which are limited relative to audit procedures.

|

|

|

Note

|

Review evidence is generally obtained through inquiry and analytical procedures.

|

|

|

Note

|

Whether in Compilation or Review engagement, a report or written communication is required unless the accountant withdraws from the engagement.

|

|

|

Note

|

The accountant's determination of materiality is based on professional judgment and is affected by the needs of the users of the FSs.

|

|

|

Note

|

A compilation of FSs is a service, the objective of which is to present in the form of FSs information that is the representation of management without undertaking to express any assurance on the FSs.

|

|

|

Note

|

Compilation of FSs is performed for non issuers only

|

|

|

Note

|

The accountant should establish an understanding with management and, when appropriate, those charged with governance, regarding the services to be performed for the compilation engagement and should document the understanding in an engagement letter.

|

|

|

What are the issues that the accountant should understand with management or those charged with governance?

|

1- The objectives of the engagement

2- Management’s responsibilities 3- The accountant’s responsibilities 4- The limitations of the engagement 5- A description of other accounting services to be performed |

|

|

Note

|

When the FSs are not expected to be used by a third party and the accountant does not expect to issue a compilation report, an engagement letter containing an acknowledgment of management's representation and an agreement that the FSs are not to be used by a third party should be issued.

|

|

|

What are the matters that should be addressed when an engagement letter is issued instead of a compilation report?

|

1- Material departures from the applicable financial reporting framework may exist, and the effects of those departures, if any, on the FSs may not be disclosed.

2- Substantially all disclosures (and statement of cash flows, if applicable) required by the applicable financial reporting framework may be omitted. 3- Reference to supplementary information. |

|

|

What are the compilation requirements?

|

1- Knowledge of Industry Accounting Principles and Practices

2- Understanding of Client's Business 3- Reading the FSs 4- Considering effects of Fraud and Illegal Acts, Going Concern, and Subsequent Events on the FSs |

|

|

What are the accounting principles and practices that an accountant performing compilation is required to understand of the client's business?

|

1- Staff qualifications

2- Transaction types and frequency 3- Accounting basis used to prepare the FSs 4- Form of the accounting records 5- FSs’ form and content STAFF |

|

|

Note

|

Before issuing a compilation report, accountants should read the compiled FSs and consider whether they are appropriate in form and free from obvious material errors.

|

|

|

Note

|

The term error refers to mathematical and clerical mistakes, as well as to mistakes related to the applicable financial reporting framework.

|

|

|

What are the actions that an accountant performing compilation services to a client should undertake if he becomes aware that fraud or an illegal act may have occurred , that there is a going concern uncertainty, or that a subsequent event has occurred?

|

1- He or she should request management to consider the effect on the FSs,

2- Evaluate management conclusions, 3- Consider the effect of the matter on the compilation report. |

|

|

Note

|

Accountants are not required to, but may, make inquiries or perform other procedures to verify, corroborate, or review the information supplied by the client. However, if they discover the information is incorrect, incomplete, or unsatisfactory, they should obtain additional or revised information from the client. If the client refuses to provide such information, the accountants should withdraw from the compilation engagement.

|

|

|

Note

|

Documentation provides the support that the accountant complied with SSARS when performing the compilation engagement.

|

|

|

Note

|

Documentation should provide clear detail of the work performed.

|

|

|

Note

|

The form and content of the documentation depends on the engagement, the methodology and tools, and the accountant's professional judgment.

|

|

|

What are the documents that should be prepared in the compilation engagement?

|

1- The engagement letter.

2- Any significant findings or issues, 3- Oral or written communications with management regarding fraud or illegal acts that came to the accountant's attention. |

|

|

What are the significant findings that an accountant should include in the documents prepared in the compilation engagement?

|

1- Results of compilation procedures indicating that the FSs could be materially misstated and the actions taken to address these findings.

2- The resolution of questions and concerns raised during compilation procedures. |

|

|

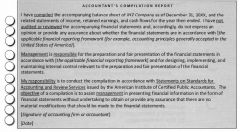

What is the compilation report?

|

The report is the method by which the accountant communicates the extent of the responsibility assumed for the FSs.

|

|

|

What are the items that should be included in the compilation report?

|

1- Title

2- Addressee 3- Introductory Paragraph 4- Management's Responsibility Paragraph 5- Accountant's Responsibility Paragraph 6- Signature of Accountant 7- Date of the Accountant's Report |

|

|

What does the compilation report include in its title?

|

1- Accountant's Compilation Report

OR 2- Independent Accountant's Compilation Report |

|

|

What does the introductory paragraph in a compilation report should include?

|

1- Identify the entity.

2- State that the FSs have been compiled 3- Identify the FSs. 4- Specify the date or period covered by the FSs. 5- State that the accountant has not reviewed or audited the FSs and does not express an opinion or provide any assurance about whether the FSs are in accordance with the applicable financial reporting framework. |

|

|

What does management's responsibility paragraph of the compilation report should state?

|

It should state that management is responsible for the preparation and fair presentation of the FSs in accordance with the applicable financial reporting framework, and for designing, implementing and maintaining internal control relevant to the preparation and fair presentation of the FSs.

|

|

|

What does accountant's responsibility paragraph of the compilation report should state?

|

It should state the following:

1- The accountant's responsibility is to conduct the compilation in accordance with SSARS issued by the AICPA, 2- The objective of a compilation is to assist management in presenting financial information in the form of FSs without undertaking to obtain or provide any assurance that there are no material modifications that should be made to the FSs. |

|

|

Note

|

Date of the compilation report should be the date of the completion of the compilation report

|

|

|

Note

|

Each page of the FSs should be marked

1- See Accountant's Compilation Report OR 2- See Independent Accountant's Compilation Report. |

|

|

Note

|

SSARS does not require that the compilation report be printed on the accountant's letterhead .

|

|

|

Note

|

At the accountant's discretion , a separate paragraph of the report may be used to emphasize any matter already disclosed in the FSs, such as going concern issues or subsequent events.

|

|

|

CAR MR ARSOM

|

|

|

|

Note

|

If an accountant is asked to compile FSs included in a prescribed form that calls for a departure from the applicable financial reporting framework, an alternative form of standard report is used. An additional paragraph is added stating that the FSs are presented in accordance with requirements not consistent with the applicable financial reporting framework, and that the FSs are not designed for those who are uninformed about the resulting differences.

|

|

|

Note

|

If requested by the client, an accountant may compile FSs that omit substantially all disclosures required by the applicable financial reporting framework (but are otherwise in conformity with the financial reporting framework).

|

|

|

When the compiled FSs that omit GAAP disclosures is acceptable?

|

1- If FSs are otherwise in conformity with GAAP.

2- If reason for omission was not to deceive the user. 3- If compilation report warns the user of missing disclosures. |

|

|

What did the accountant should state in the compilation report on FSs that omit substantially all disclosures?

|

1- If the disclosures were included, they might influence the user's conclusions,

2- Indicate that the FSs are not designed for those who are uninformed about the omitted disclosures 3- The omission is not intended to mislead any person who might be expected to use such FSs. |

|

|

What is the statement that should be included in the compilation report on FSs that omit substantially all disclosures?

|

In a 4th paragraph the accountant should state the following:

Management has elected to omit substantially all the disclosures required by [the applicable financial reporting FW]. If the omitted disclosures were Included in the FSs, they might influence the user's conclusions about the company's financial position, results of operations, and cash flows. Accordingly, these FSs are not designed for those who are not informed about such matters. |

|

|

What is the statement that should be included in the compilation report on FSs if there is limited disclosure instead of omitting all disclosure?

|

Selected Information-Substantially All Disclosures Required by [the applicable financial reporting framework] are Not Included.

|

|

|

Note

|

Departures from the applicable financial reporting framework should be disclosed in a separate paragraph of the report and should include disclosure of the effects of the departure on the FSs (if known).

|

|

|

Note

|

If the accountant believes disclosure in the report would not be adequate to indicate the deficiencies in the FSs, he or she should withdraw from the engagement and provide no further services with respect to those FSs.

|

|

|

Note

|

An accountant who is not independent with respect to an entity may compile FSs for such an entity and issue a report if he disclosed this lack of independence in the last paragraph of the report.

|

|

|

Note

|

The accountant is permitted, but not required, to disclose the reason(s) for the independence impairment in the report, but All reasons must be included in the disclosure.

|

|

|

When did compilation of personal FSs can be permitted?

|

1- If the client agrees and the accountant states in the report that the personal FSs will not be used to obtain credit or for any purpose other than developing the financial plan

2- If nothing comes to the accountant's attention indicating that the FSs will be used to obtain credit. |

|

|

Note

|

An accountant who submits unaudited FSs to the client that are not expected to be used by a third party may use an engagement letter rather than a compilation report.

|

|

|

Note

|

If the FSs are expected to be used by third parties then:

1- A compilation report is required instead of engagement letter 2- Reporting requirements should be applied |

|

|

Note

|

If the FSs are not expected to be used by third parties then:

1- Engagement letter instead of Compilation report can be used 2- Restricting the use of 3rd parties on each page of the FSs |

|

|

Note

|

Review of FSs means limited assurance

|

|

|

Note

|

Limited assurance needs independence of the reviewer

|

|

|

Note

|

Review of FSs service is performed to non issuers using SSARS, but Review of FSs for issuers is performed using SASs

|

|

|

What are the factors that may affect the Review procedures performed?

|

1- The nature and materiality of financial statement items.

2- The likelihood of misstatement. 3- Knowledge from current and previous engagements. 4- Qualifications of the entity's accounting personnel. 5- The extent to which an item is affected by management's judgment. 6- Inadequacies in the entity's underlying financial data. |

|

|

What are the review of FSs steps for Non-issuers?

|

1- Understanding with client should be established

2- Learn and/or obtain sufficient knowledge of the entity's business 3- Inquiries should be addressed to appropriate individuals 4- Analytical procedures should be performed 5- Review-other procedures should be performed 6- Client representation letter should be obtained from management 7- Professional judgment should be used to evaluate results 8- Accountant (CPA) should communicate results U Liar CPA |

|

|

Note

|

The review of FSs steps are the same for issuers as for non issuers

|

|

|

Note

|

In order to reduce the likelihood of misunderstanding , the accountant should establish an understanding with management and, when appropriate, those charged with governance regarding the services to be performed and should document the understanding in the form of an engagement letter.

|

|

|

What does the accountant should take into consideration in the engagement letter of the Review service with the client?

|

1- The objectives of the engagement.

2- Management's responsibilities. 3- The accountant's responsibilities. 4- The limitations of the engagement. |

|

|

Note

|

As in a compilation, the accountant must be familiar with the accounting principles common to the client's industry.

|

|

|

Note

|

The accountant should possess an understanding of the client's business and the accounting principles and practices used by the client.

|

|

|

What are the issues that the accountant should understand about the client's business?

|

1- Client's organization

2- Its operating characteristics 3- Nature of its assets, liabilities, equity, revenues, and expenses. |

|

|

What are the procedures that the accountant is not required to perform during the Review service to the client?

|

1- Test Internal Control

2- Perform Audit Tests 3- Assess Fraud Risk 4- Communicate with the Predecessor Accountant |

|

|

Note

|

The successor accountant may decide (but is not required) to communicate with the predecessor accountant regarding acceptance of the engagement and matters of continuing accounting significance.

|

|

|

What are the factors that may affect the design of the analytical procedures and the inquiries of management review procedures ?

|

1- The accountant's understanding of the industry

2- The accountant's knowledge of the client 3- The risk that the accountant may unknowingly fail to modify the accountant's review report on FSs that are materially misstated. |

|

|

Note

|

The accountant's inquiries WITHIN (not outside) the client's organization should be directed to members of management with financial and accounting responsibilities, to assure that adequate responses are obtained.

|

|

|

Note

|

The accountant is generally not required to corroborate management's responses with other evidence.

|

|

|

Note

|

The inquiries are of internal personnel, not of external people or entities.

|

|

|

What are the issues that the accountant should inquiry?

|

1- Accounting principles and practices used, and the method of applying them

2- Procedures for recording, classifying , and summarizing transactions, and for accumulating information for disclosure in footnotes 3- Whether the FSs have been prepared in conformity with the applicable financial reporting FW 4- Whether there have been changes in the entity's business activities or accounting principles and practices 5- Matters as to which questions have arisen during the course of the review 6- Material subsequent events 7- Unusual or complex situations that may affect the FSs 8- Significant transactions near the end of the period 9- The status of uncorrected misstatements from previous engagements 10- Material fraud or suspected fraud 11- Significant journal entries and adjustments 12- Communications from regulatory agencies 13- Actions authorized by the stockholders, BOD, or other management groups 14- Other items, such as the existence of related party transactions |

|

|

What is the "Analytical procedures" step?

|

It is developing an expectation and comparing recorded amounts or ratios based on recorded amounts to that expectation.

|

|

|

Note

|

While expectations are not as encompassing as those developed during an audit, analytical procedures in a review should still be designed to detect relationships and individual items that appear to be unusual and may indicate material misstatement.

|

|

|

What does the analytical procedures consist of?

|

Comparing the following:

1- Current FSs with prior period FSs, or current ratios with prior period ratios 2- Actual FSs with budgets or forecasts, if available 3- Financial and relevant nonfinancial information 4- Entity's ratios and indicators with those of other entities in the industry 5- Relationships among elements in the FSs within the period and with corresponding prior period relationships. |

|

|

Note

|

Analytical procedures may be performed at the financial statement level or at the detailed account level.

|

|

|

Note

|

If the results of analytical procedures identify fluctuations or relationships are inconsistent with other relevant information or that differ significantly from expected values, the accountant should investigate these differences by inquiring of management and performing other procedures as necessary.

|

|

|

What are the other procedures that the accountant is required to do during performing the Review services?

|

1- Read the FSs for conformity with the applicable financial reporting FW.

2- Obtain reports of other accountants who have been engaged to audit or review significant components of the reporting entity. 3- If appropriate, request management to consider the effects of any going concern uncertainties or any subsequent events. 4- If during the performance of review procedures the accountant becomes aware of information that is incorrect, incomplete, or otherwise unsatisfactory, the accountant should request that management consider the effect of these matters on the FSs. The accountant should consider management's assessment of the matter and determine the effect, if any, on the accountant's review report. |

|

|

Note

|

The accountant is required to obtain a representation letter from management for all FSs and periods covered by the review report, even if current management was not present during all such periods

|

|

|

Note

|

Management representation letter should be dated as of the date of the accountant's report which is the date of the completion of the review procedures performed

|

|

|

Note

|

Management representation letter should be addressed to the accountant and signed by the members of management responsible for and knowledgeable about the matters in the letter (generally the CEO and CFO).

|

|

|

Note

|

Management's failure to provide a representation letter results in an incomplete review, which means that the accountant will have to consider withdrawal from doing the review

|

|

|

What are the contents of the management representation letter?

|

1- Management's responsibility for the preparation and fair presentation of the FSs and their belief that they are fairly stated.

2- Management's acknowledgment of its responsibility for designing, implementing , and maintaining internal control relevant to the preparation and fair presentation of the FSs. 3- Management's full and truthful responses to all inquiries. 4- Representations about the completeness of information. 5- Information concerning subsequent events. 6- Acknowledgement of management's responsibility to prevent/detect fraud. 7- Knowledge of any material fraud or suspected fraud. 8- Additional representations related to matters specific to the entity's business and industry. |

|

|

When may the accountant request updating the Management representation letter?

|

1- When a significant amount of time has passed between the procedures performed and the issuance of the report.

2- When there has been a material subsequent event between completion of the procedures and issuance of the report. 3- When a former client requests the accountant to reissue a prior period report. |

|

|

Note

|

An updating letter should state:

1- If any previous representations should be modified 2- If any subsequent events requiring adjustment to or disclosure in the FSs have occurred. |

|

|

Note

|

The engagement letter is before the review service being performed but the management representation letter is after

|

|

|

Note

|

A review that is incomplete will prevent the issuance of a review report (Accountant will not withdraw), but the accountant may issue a compilation report if the circumstances permit

|

|

|

Note

|

In a compilation engagement the accountant don't need the management representation letter

|

|

|

Note

|

Documentation provides the support that the accountant complied with SSARS when performing the review engagement.

|

|

|

Note

|

Documentation of the review engagement should be sufficient to provide a clear understanding of the work performed, including:

1-The nature, timing, and extent of review procedures performed, 2-The review evidence obtained and its source, 3-The engagement conclusions. |

|

|

Note

|

The form and content of documentation in a review should be designed to meet the needs of the particular engagement.

|

|

|

Note

|

Written documentation from other types of engagements may be used to support the review report.

|

|

|

Note

|

Oral explanations may be used to supplement or clarify documentation, but should not be the primary support for the report.

|

|

|

What are the documents that should be prepared in the review engagement?

|

1- The engagement letter

2- Significant findings, actions taken, and the basis for conclusions reached. 3- Matters about which the accountant has made inquiry and responses thereto. 4- Analytical procedures performed, 5- Unusual matters and their disposition. 6- Communications (oral or written) to management regarding fraud and illegal acts. 7- The management representation letter. |

|

|

What are the documents that are NOT included in the review engagement documentation?

|

1- Test of internal controls

2- Audit test work |

|

|

What are the items that should be included in the review report?

|

1- Title

2- Addressee 3- Introductory Paragraph 4- Management's Responsibility Paragraph 5- Accountant's Responsibility Paragraph 6- Engagement Results Paragraph 7- Signature of Accountant 8- Date of the Accountant's Report |

|

|

Note

|

An appropriate title that includes the word independent, such as "Independent Accountant's Review Report. "

|

|

|

What are the items that should be included in the introductory paragraph?

|

1- Identify the entity.

2- State that the FSs have been reviewed. 3- Identify the FSs. 4- Specify the date or period covered by the FSs. 5- Include a statement that a review includes primarily applying Analytical procedures to Management's financial data and making Inquiries of company management. 6- Include a statement that a review is Substantially less in scope than an Audit, the objective of which is the expression of an opinion regarding the FSs as a whole, and that, accordingly, the accountant Does not express such an opinion. AM I SAD |

|

|

Note

|

Management's Responsibility paragraph of the Accountant's review report should state that management is responsible for the preparation and fair presentation of the FSs in accordance with the applicable financial reporting framework and for designing, implementing, and maintaining Internal control relevant to the preparation and fair presentation of the FSs.

MRFI |

|

|

What did the accountant should state in the Accountant's responsibility paragraph of the Review report?

|

1- State that the accountant's Responsibility is to conduct the review in accordance with SSARSs issued by the AICPA.

2- State that those standards require the accountant to perform procedures to obtain Limited Assurance that there are no material modifications that should be made to the FSs. 3- State that the accountant believes that the results of the engagement procedures provide a reasonable basis for the report. RSALA |

|

|

Note

|

In the Engagement results paragraph the accountant should state that he is not aware of any material modifications that should be made to the FSs in order for them to be in conformity with the applicable financial reporting framework, other than those modifications, if any, indicated in the report.

|

|

|

Note

|

The date of the accountant's report should be the date of the completion of the review.

|

|

|

Note

|

Each page of the statements should be marked , "See Independent Accountant's Review Report. "

|

|

|

Note

|

Uncertainties (such as those involving going concern issues) and inconsistencies in the application of accounting principles do not require modification of the review report as long as the FSs include adequate disclosure.

|

|

|

Note

|

At the accountant's discretion, a separate paragraph of the report may be used to discuss uncertainties or inconsistencies, or to emphasize any matter already disclosed in the FSs, such as going concern issues, subsequent events, significant related party transactions, or changes in accounting principle.

|

|

|

Note

|

An accountant must be independent of the client to issue a review report on the FSs of such a client. Note that any direct ownership of a company, no matter how small, will impair independence.

|

|

|

Note

|

If the accountant become aware of a material departure from the applicable financial reporting FW and he asked management to revise the FSs and they refused, he might modify his report or withdraw from the engagement

|

|

|

Note

|

In case of report modification the accountant should add a separate paragraph disclosing the effects of the departure on the FSs

|

|

|

What is the wording that should be added to the 4th paragraph of the accountant review or compilation report?

|

Based on our review, with the exception of the matter(s) described in the following paragraph, I am not aware of any material modifications that should be made ...

|

|

|

Note

|

If the accountant believes that disclosure in the report would not be adequate to indicate the deficiencies in the FSs, he or she should withdraw from the engagement and provide no further services.

|

|

|

Note

|

An opinion, even qualified or adverse, requires an audit. When an accountant performing a compilation or review becomes aware of a GAAP departure, the report would be modified or the accountant would withdraw. An opinion would not be expressed.

|

|

|

Note

|

In a review or compilation engagement, if an accountant becomes aware that fraud or an illegal act may have occurred , he should obtain additional or revised information from management, If they will not provide him with additional or revised information the accountant should withdraw from the engagement.

|

|

|

Note

|

Immaterial matters need not be communicated with management

|

|

|

Note

|

Communication may be made in writing or orally, but oral communications should be documented.

|

|

|

Note

|

The accountant should consider withdrawing or consulting legal counsel if fraud or illegal acts involve an owner of the business.

|

|

|

Note

|

Obligations of confidentiality preclude disclosure outside the entity except in certain limited circumstances (e.g., legal/regulatory requirements, successor accountant, subpoena).

|

|

|

Note

|

Upon discovering , after issuance of the report, information that materially affects the report and other persons' reliance on it, the accountant should advise the client to immediately disclose the new information and its impact on the FSs to persons currently relying or likely to rely on the FSs.

|

|

|

What are the disclosure ways that the accountant should advise the client to follow to disclose the subsequent events that may occur?

|

1- Issuing revised FSs (along with a new compilation or review report) describing the reasons for revision

OR 2- Making the necessary disclosures and revisions to any imminent FSs (accompanied by the accountant's report for a subsequent period) OR 3- If the effect on the FSs cannot be determined on a timely basis, the client should provide notification that the FSs and report should not be relied upon. |

|

|

Note

|

If the client refuses to proceed as above, the accountant should notify the appropriate entity personnel, such as the manager (owner) or BOD, of such refusal, and of the fact the accountant will take additional steps to prevent further reliance on the accountant's report and the FSs.

|

|

|

What are the additional steps that should be taken by the accountant in case of the refusal of the client to disclose material subsequent events?

|

1- Notify the client that the accountant's report must no longer be associated with the FSs.

2- Notify, if applicable, any regulatory agencies having jurisdiction over the client that the accountant's report should no longer be relied upon. 3- Notify persons known to be relying or likely to rely on the FSs that the accountant's report should no longer be relied upon. |

|

|

Note

|

Any notification to parties other than the client should be as precise and factual as possible, and should contain a description of the effect the discovered information would have had on the accountant's report and on the FSs.

|

|

|

Note

|

If the client has refused to cooperate, and as a result the accountants were unable to conduct an adequate investigation of the information, the accountants' disclosure need only state that information has come to their attention and that, if the information is true, their report should no longer be relied on or be associated with the FSs, The accountants should use their professional judgment in these circumstances and it may be advisable to consult legal counsel.

|

|

|

Note

|

When the FSs are accompanied by supplementary information for analysis purpose, the accountant should indicate the degree of responsibility he or she is taking with respect to the information.

|

|

|

What are the options available for the accountant to disclose the supplementary information related to the compilation engagement?

|

1- The compilation report should refer to the supplementary information,

OR 2- The accountant can issue a separate report. |

|

|

If a separated report has been issued, what are the disclosure statements related to the compilation supplementary information will involve?

|

1- The supplementary information is presented only for the purpose of additional analysis,

2- The content has been compiled from information that is the representation of management, without audit or review, 3- The accountant does not express an opinion or provides any assurance on such data. |

|

|

What are the options available for the accountant to disclose the supplementary information related to the review engagement?

|

1- The review report should explain the supplementary information,

OR 2- The accountant can issue a separate report. |

|

|

If a separated report has been issued, what are the disclosure statements related to the review engagement supplementary information will involve?

|

1- The review has been made for the purpose of expressing a conclusion that no material modifications should be made to the FSs in order for them to be in conformity with the applicable financial reporting framework,

2- The supplementary information is presented only for the purpose of additional analysis 3- The supplementary information has been subjected to the inquiry and analytical procedures applied in the review of the basic FSs, and that the accountant is not aware of any material modifications that should be made to the data OR 3- The supplementary information has not been subjected to the inquiry and analytical procedures applied in the review of the basic FSs, but were compiled from information that is the representation of management without audit or review, and the accountant does not express an opinion or any other form of assurance on the data. |

|

|

Note

|

During the course of an engagement, a client may ask the accountant to change an audit to a compilation or review, or a review to a compilation.

|

|

|

What are the considerations that the accountant is required to consider before agreeing to change the engagement?

|

1- Reason for the request, especially if there are scope limitations

2- Effort required to complete the engagement 3- Estimated additional cost to complete the engagement. |

|

|

What is the accountant's action if he decides that the change in the engagement is justified?

|

1- He or she must comply with the standards for a compilation or review,

2- Issue an appropriate report. |

|

|

What are the issues that the report shouldn't refer to?

|

1- The original engagement

2- Any procedures performed as part of the engagement 3- Any scope limitation |

|

|

What are the reasons that the accountant can accept for changing the engagement?

|

1- Change in client requirements.

2- Misunderstanding as to the nature of the service to be rendered. |

|

|

What are the reasons that the accountant can refuse changing the engagement for ?

|

1- The engagement would uncover errors or fraud.

2- The client is attempting to create misleading or deceptive FSs. 3- The client refuses to allow correspondence with legal counsel. 4- The client refuses to provide a signed representation letter. |

|

|

Note

|

In case of refusing changing the engagement by the accountant he should withdraw from the engagement

|

|

|

Note

|

Management representation letter is required only in case of Review engagement, but not in case of a Compilation engagement, so if the client refuses to provide a signed representation letter the accountant can only perform a compilation services and not a review one

|

|

|

When should the accountant been precluded from issuing a compilation report or a review report?

|

When:

1- The accountant has been engaged to audit the entity's FSs and has been prohibited by the client from corresponding with the entity's legal counsel. 2- The accountant has been engaged to audit or review the entity's FSs and the client does not provide the accountant with a signed representation letter (But may became able to issue a compilation report in that case) |

|

|

What are the audit procedures that are generally not performed in a review engagement?

|

"1- Tests of the accounting records.

2- Tests of management's assertions regarding continued existence. 3- Inquiries of the entity's attorney concerning contingent liabilities." |