![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

100 Cards in this Set

- Front

- Back

|

Rent-control laws dictate

|

the maximum rent that landlords may charge tenants

|

|

|

Minimum-wage laws dictate

|

a minimum wage that firms may pay workers

|

|

|

Price controls are usually enacted

|

when policymakers believe that the market price of a good or service is unfair to buyers or sellers

|

|

|

A legal maximum on the price at which a good can be sold is called a

|

ceiling

|

|

|

If a price ceiling is not binding, then

|

the equilibrium price is below the price ceiling

|

|

|

If a non-binding price ceiling is imposed on a market, then the

|

quantity sold in the market will stay the same

|

|

|

A price ceiling will be binding only if it is set

|

below the equilibrium price

|

|

|

Which of the following observations would be consistent with the imposition of a binding price ceiling on a market? After the price ceiling becomes effective,

a. smaller quantity of the good is bought and sold b. smaller quantity of the good id demanded c. larger quantity of the good is supplied d. the price rises above the previous equilibrium |

a smaller quantity of the good is bought and sold

|

|

|

Suppose the government has imposed a price ceiling on laptop computers. Which of the following events could transform the price ceiling from one that is not binding to one that is binding?

a. improvements in production technology reduce the costs of producing laptop computers b. the number of firms selling laptop computers decrease c. consumers' income decreases, and laptop computers are a normal good d. the number of consumers buying laptop computers decreases |

the number of firms selling laptop computers decrease

|

|

|

If the government removes a binding price ceiling from a market, then the price paid by buyers will

|

increase and the quantity sold in the market will increase

|

|

|

A price ceiling is binding when it is set

|

below the equilibrium price, causing a shortage

|

|

|

A binding price ceiling

|

causes a shortage and is set at a price below the equilibrium price

|

|

|

A non-binding price ceiling

|

is set at a price above the equilibrium price

|

|

|

A shortage results when a

|

binding price ceiling is imposed on a market

|

|

|

Suppose the government wants to encourage Americans to exercise more, so it imposes a binding price ceiling on the market for in-home treadmills. As a result,

|

a shortage of treadmills will develop

|

|

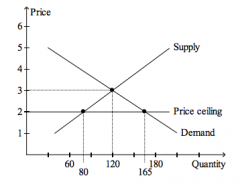

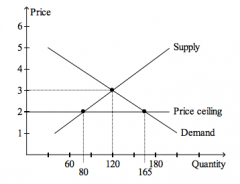

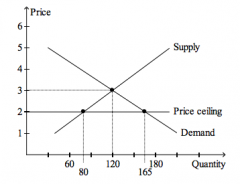

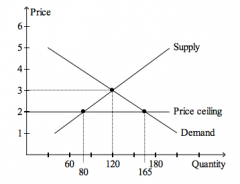

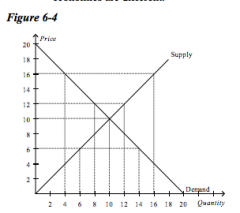

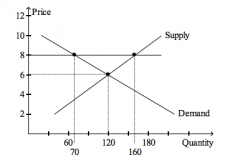

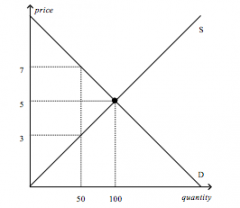

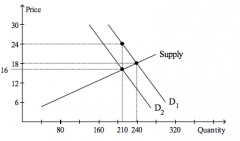

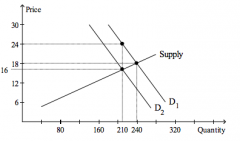

Refer to the figure above.

A binding price ceiling is shown in |

panel (b) only

|

|

Refer to the figure above.

In which panel(s) of the figure would there be a shortage of the good at the price ceiling? |

panel (b) only

|

|

Refer to the figure above.

The price ceiling shown in panel (a) |

is not binding

|

|

Refer to the figure above.

The price ceiling shown in panel (b) |

creates a shortage

|

|

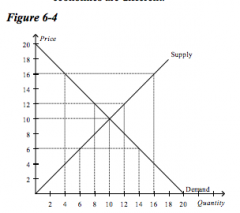

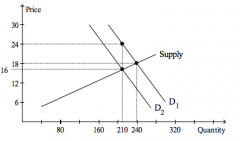

Refer to the figure above.

The price ceiling |

is binding, causes a shortage, and causes the quantity demanded to exceed the quantity supplied

|

|

Refer to the figure above.

The price ceiling |

makes it necessary for sellers to ration the good

|

|

Refer to the figure above.

The price ceiling causes a |

shortage of 85 units

|

|

Refer to the figure above.

The price ceiling causes quantity |

demanded to exceed quantity supplied by 85 units

|

|

|

A legal minimum on the price at which a good can be sold is called a price

|

floor

|

|

|

If a price floor is not binding then

|

the equilibrium price is above the price floor

|

|

|

If a price floor is not binding then

|

there will be no effect on the market price or quantity sold

|

|

|

If a non-binding price floor is imposed on a market, then the

|

quantity sold in the market will stay the same

|

|

|

A binding price floor

|

causes a surplus and is set at a price above the equilibrium price

|

|

|

A non-binding price floor

|

is set at a price below the equilibrium price

|

|

|

A price floor will be binding only if it is set

|

at a price above the equilibrium price

|

|

|

Suppose the government has imposed a price floor on cellular phones. Which of the following events could transform the price floor from one that is binding to one that is not binding?

a. cellular phones become less popular b. traditional land line phones become more expensive c. the components used to produce cellular phones become less expensive d. firms expect the price of cellular phones to fall in the future |

traditional land line phones become more expensive

|

|

|

If the government removes a binding price floor from a market, then the price paid by buyers will

|

decrease, and the quantity sold in the market will increase

|

|

|

If the government removes a binding price floor from a market, then the price received by sellers will

|

decrease, and the quantity sold in the market will increase

|

|

|

A surplus results when a

|

binding price floor is imposed on a market

|

|

|

Suppose the equilibrium price of a tube of toothpaste is $2, and the government imposes a price floor of $3 per tube. As a result of the price floor, the

|

quantity demanded of toothpaste decreases, and the quantity of toothpaste that firms want to supply increases

|

|

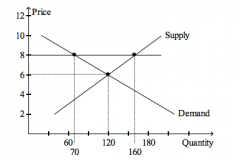

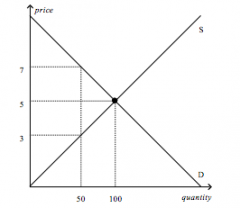

Refer to the figure above.

A binding price floor is shown in |

panel (b) only

|

|

Refer to the figure above.

A non-binding price floor is shown in |

panel (a) only

|

|

Refer to the figure above.

In Panel (b), there will be |

surplus of wheat

|

|

Refer to the figure above.

In Panel (a), there will be |

equilibrium in the market

|

|

|

You have responsibility for economic policy in the country of Freedonia. Recently, the

neighboring country of Sylvania has cut off all exports of oranges to Freedonia. Harpo, who is one of your advisors, suggests that you should impose a binding price ceiling in order to avoid a shortage of oranges. Chico, another one of your advisors, argues that without a binding price floor, a shortage will certainly develop. Zeppo, a third advisor, says that the best way to avoid a shortage of oranges is to take no action at all. Which of your three advisors is most likely to have studied economics? |

Zeppo

|

|

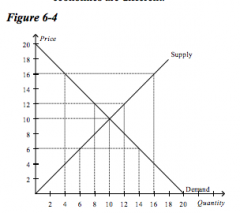

Refer to the figure above.

Which of the following is not correct? a. When the price is $10, quantity supplied equals quantity demanded b. When the price is $6, there is a surplus of 8 units c. When the price is $12, there is a surplus of 4 units d. When the price is $16, quantity supplied exceeds quantity demanded by 12 units |

b. When the price is $6, there is a surplus of 8 units

|

|

|

Refer to the figure above.

A government-imposed price of $6 in this market could be an example of a |

binding price ceiling and non-binding price floor

|

|

Refer to the figure above.

A government-imposed price of $16 in this market could be an example of a |

non-binding price ceiling and binding price floor

|

|

Refer to the figure above.

A government-imposed price of $12 in this market could be an example of a |

binding price floor that creates a surplus

|

|

Refer to the figure above.

A government-imposed price of $6 in this market could be an example of a |

binding price ceiling that creates a shortage

|

|

Refer to the figure above.

If the horizontal line on the graph represents a price ceiling, then the price ceiling is |

not binding and there will be no surplus or shortage of the good

|

|

Refer to the figure above.

If the horizontal line on the graph represents a price floor, then the price floor is |

binding and creates a surplus of 90 units of the good

|

|

|

Refer to the figure above.

Suppose the market is initially in equilibrium. Then the government imposes a price control, as represented by the horizontal line on the graph. If the price control is a price floor, then the price control |

causes the quantity demanded to decrease by 50 units, causes the quantity supplied to increase by 40 units, and results in some firms being more successful than others in selling their goods

|

|

|

The goal of rent control is to

|

help the poor by making housing more affordable

|

|

|

Under rent control, tenants can expect

|

lower rent and lower quality housing

|

|

|

Rent control

|

is an example of a price ceiling, leads to a shortage of apartments in the long run than in the short tun, and it leads to lower rents, and in the long run, to lower-quality housing

|

|

|

Rent control policies tend to cause

|

relatively smaller shortages in the short run than in the long run because supply and demand tend to be more inelastic in the short run than in the long run

|

|

|

The minimum wage is an example of a

|

price floor

|

|

|

A minimum wage that is set below a market's equilibrium wage will result in an excess

|

nothing

|

|

|

A binding minmum wage

|

alters both the quntity demanded and quantity supplied of labor

|

|

|

A minimum wage that is set above a market's equilibrium wage will result in an excess

|

supply of labor, that is, unemployment

|

|

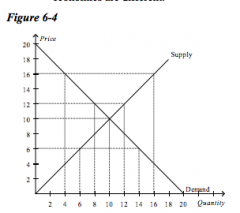

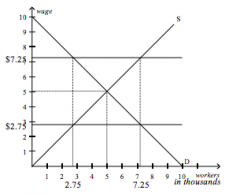

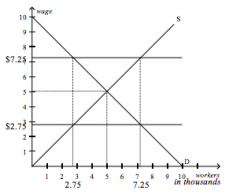

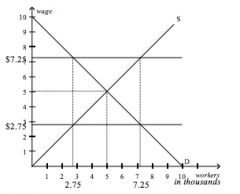

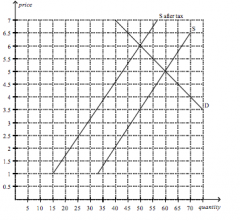

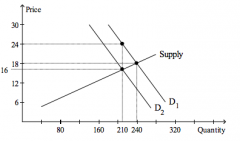

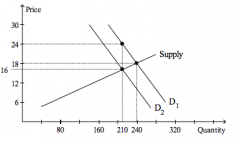

Refer to the figure above.

In this market, a minimum wage of $7.25 is |

binding and creates unemployment

|

|

Refer to the figure above.

In this market, a minimum wage of $2.75 is |

non-binding and creates neither a labor shortage nor unemployment

|

|

Refer to the figure above.

In this market, a minimum wage of $7.25 creates a labor |

surplus of 4,500 workers

|

|

|

Refer to the figure above.

In this market, a minimum wage of $2.75 creates a labor |

neither a labor shortage nor surplus

|

|

|

A tax on the sellers of coffee mugs

|

decreases the size of the coffee mug market

|

|

|

When a tax is placed on the sellers of a product, buyers pay

|

more, and sellers receive less than they did before the tax

|

|

|

A tax imposed on the sellers of a good will raise the

|

price paid by buyers and lower the equilibrium quantity

|

|

|

If the government levies a $1,000 tax per boat on sellers of boats, then the price paid by buyers of boats would

|

increase by less than $1,000

|

|

|

If the government levies a $500 tax per car on sellers of cars, then the price received by sellers of cars would

|

decrease by less than $500

|

|

|

A $2.00 tax levied on the sellers of birdhouses will shift the supply curve

|

upward by exactly $2.00

|

|

|

A $0.10 tax levied on the sellers of chocolate bars will cause the

|

supply curve for chocolate bars to shift up by $0.10

|

|

|

A tax on the buyers of cereal will increase the price of cereal paid by buyers,

|

decrease the effective price of cereal received by sellers, and decrease the equilibrium quantity of cereal

|

|

|

A tax imposed on the buyers of a good will raise the

|

price paid by buyers and lower the equilibrium quantity

|

|

|

A tax imposed on the buyers of a good will lower the

|

effective price received by sellers and lower the equilibrium quantity

|

|

|

If the government levies a $2 tax per DVD on buyers of DVDs, then the price received by sellers of DVDs would

|

decrease by less than $2.00

|

|

|

A $0.50 tax levied on the buyers of pomegranate juice will shift the demand curve

|

downward by exactly $0.50

|

|

|

If the government wants to reduce smoking, it should impose a tax on

|

either buyers or sellers of cigarettes

|

|

|

If the government wants to reduce the burning of fossil fuels, it should impose a tax on

|

either buyers or sellers of gasoline

|

|

|

The term tax incidence refers to

|

the distribution of the tax burden between buyers and sellers

|

|

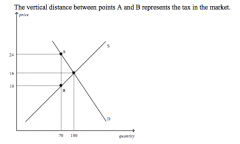

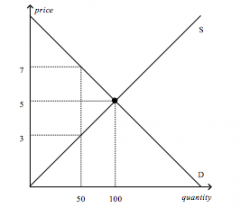

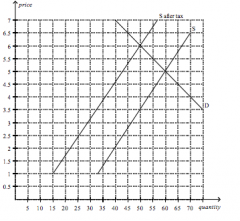

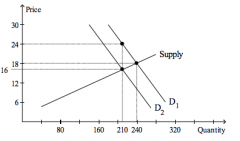

Refer to the figure above.

The price that buyers pay after the tax is imposed is |

$24.00

|

|

Refer to the figure above.

The effective price that sellers receive after the tax is imposed is |

$10.00

|

|

Refer to the figure above.

The amount of the tax per unit is |

$14.00

|

|

Refer to the figure above.

The per-unit burden of the tax on buyers is |

$8.00

|

|

Refer to the figure above.

The per-unit burden of the tax on sellers is |

$6.00

|

|

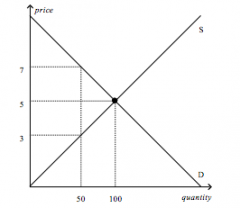

Refer to the figure above.

Suppose a tax of $2.00 per unit is imposed on this market. What will be the new equilibrium quantity in this market? |

between 50 and 100 units

|

|

Refer to the figure above.

Suppose a tax of $2.00 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed? |

between $3.00 and $5.00

|

|

Refer to the figure above.

Suppose a tax of $2.00 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed? |

between $5.00 and $7.00

|

|

Refer to the figure above.

Suppose a tax of $2.00 per unit is imposed on this market. Which of the following is correct? a. 1/4 of the burden of the tax will fall on buyers, and 3/4 of the burden of the tax will fall on sellers b. 1/3 of the burden of the tax will fall on buyers, and 2/3 of the burden of the tax will fall on sellers c. 1/2 of the burden of the tax will fall on buyers, and 1/2 of the burden of the tax will fall on sellers d. 2/3 of the burden of the tax will fall on buyers, and 1/3 of the burden of the tax will fall on sellers |

c. 1/2 of the burden of the tax will fall on buyers, and 1/2 of the burden of the tax will fall on sellers

|

|

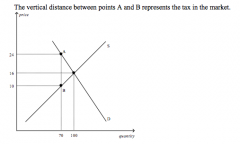

Refer to the figure above.

The equilibrium price in the market before the tax is imposed is |

$5.00

|

|

Refer to the figure above.

As the figure is drawn, who sends the tax payment to the government? |

the sellers send the tax payment

|

|

Refer to the figure above.

The price paid by buyers after the tax is imposed is |

$6.00

|

|

Refer to the figure above.

The effective price sellers receive after the tax is imposed is |

$3.50

|

|

Refer to the figure above.

The amount of the tax per unit is |

$2.50

|

|

Refer to the figure above.

Buyers pay how much of the tax per unit? |

$1.00

|

|

Refer to the figure above.

Sellers pay how much of the tax per unit? |

$1.50

|

|

Refer to the figure above.

Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. After the buyers pay the tax, relative to the case depicted in the figure, the burden on buyers will be |

the same, and the burden of sellers will be the same

|

|

Refer to the figure above.

How much tax revenue does this tax generate for the government? |

$125.00

|

|

Refer to the figure above.

Which of the following statements is correct? a. the amount of the tax per unit is $6.00 b. the tax leaves the size of the market unchanged c. the tax is levied on buyers of the good, rather than on sellers d. all of the above are correct |

c. the tax is levied on buyers of the good, rather than on sellers

|

|

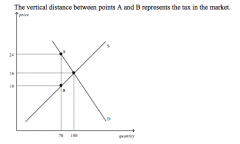

Refer to the figure above.

What is the amount of the tax per unit? |

$8.00

|

|

Refer to the figure above.

The price paid by buyers after the tax is imposed is |

$24.00

|

|

Refer to the figure above.

The per unit burden of the tax on buyers of the good is |

$6.00

|

|

Refer to the figure above.

Andrew is the buyer of the good. Taking the tax into account, how much does Andrew effectively pay to acquire one unit of the good? |

$24.00

|

|

Refer to the figure above.

Suppose sellers, rather than buyers were required to pay this tax (in the same amount per unit as shown in the graph) Relative to the tax on buyers, the tax on sellers would result in |

buyers bearing the same share of the tax burden, sellers bearing the same share of the tax burden, and the same amount of tax revenue for the government

|

|

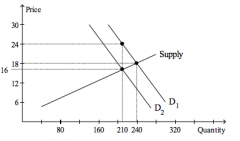

Refer to the figure above.

In the after-tax equilibrium, government collects |

$1,680 in tax revenue; $1,260 represents a burden on buyers and $420 represents a burden on sellers

|