![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

34 Cards in this Set

- Front

- Back

|

Why do we pay taxes 1)

|

Raise Revenue to finance spending on goods and services

|

|

|

Why do we pay taxes 2)

|

So gov't can control AD

|

|

|

Why do we pay taxes 3)

|

Redistribute Income

|

|

|

Why do we pay taxes 4)

|

Correcting Externalitites

|

|

|

Why do we pay taxes 5)

|

Control Balance of Payments and Imports

|

|

|

What is the effect of Indirect Taxes

|

Regressive Taxes and proportion of income paid decreases as income rises

|

|

|

What is the effect of Direct Taxes

|

Progressive Taxes and proportion of income paid increases as income rises

|

|

|

What is the effect of Proportional Taxes

|

Proportion of Income stays constant as income changes

|

|

|

What are Direct Taxes

|

Direct Taxes are typically on income divided for certain expense like (Insurance, Corporate Tax, Peteroleum Tax, Inheritance Tax, Capital Gains Tax)

|

|

|

What is Fiscal Drag

|

Earnings rise faster than prices

|

|

|

What are Excise Duties

|

Specific taxes levied on a certain good or service. Measurable in units per good

|

|

|

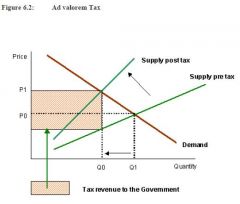

What is Value Added Tax

|

Tax as a proportion of Price - Raises Prices and Reduces Demand

|

|

|

Whats the advantage of Indirect Taxes to Direct Taxes

|

Income and Corporate Taxes get lowered. Incentive to work is increased, increasing productivity and AS, pushing prices down. More Flexible and can be used by Gov't to meet policy objectives

|

|

|

What is the Substitution Effect

|

Income Taxes are cut, and working more earns more. Opportunity Cost of leisure time is higher

|

|

|

What is the Income Effect

|

Income Taxes are cut, and people can work fewer hours to get the same amount of income

|

|

|

Which types of taxes increase Saving

|

Indirect Taxes reduce consumption and in effect increase saving

|

|

|

How are Indirect Taxes used for the environment

|

Indirect Taxes correct for Market Failure and/or externalities

|

|

|

What are Externalities

|

Occur when Social Costs of Production exceed Private Costs of Production

|

|

|

What is easier to Administer from Gov't standpoint Direct or Indirect Taxes

|

Indirect Taxes because collection only comes from Businesses

|

|

|

Reasons for Gov't Spending 1)

|

Providing Public and Merit Goods

|

|

|

Reasons for Gov't Spending 2)

|

Redistributing Wealth and Income

|

|

|

Reasons for Gov't Spending 3)

|

Regulating Economic Activities

|

|

|

Reasons for Gov't Spending 4)

|

Influence Resource Allocation and Industrial Efficiencies

|

|

|

Reasons for Gov't Spending 5)

|

Influencing Macro Level Activities

|

|

|

What does the Private Finance Initiative do?

|

Long-Term Leases and/or Financing Projects for Public Goods.

|

|

|

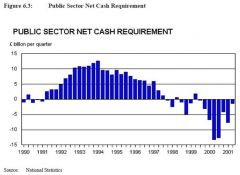

What is PSNCR or PBNR

|

Public Sector Net Cash Requirement (Public Sector Borrowing Requirement) - Combined Financial deficit of Central Gov't, Local Govt, and Public Capital

|

|

|

Three Ways to Measure PSNCR: 1)

|

Nominal PSNCR - Money Terms, not adjusted for economic variables

|

|

|

Three Ways to Measure PSNCR: 2)

|

PSNCR as % of GDP - Measures Debt Problem Well

|

|

|

Three Ways to Measure PSNCR: 3)

|

Cyclically Adjusted PSNCR - Allows for adjustments of Economic Variables

|

|

|

How is National Debt Different than PSNCR

|

This is the Unpaid Portion of Borrowing or the Sum of all Central Gov't Debt

|

|

|

What are the Risks of a High Level of Borrowing 1)

|

Interest Rates could rise and crowd out Private Investment

|

|

|

What are the Risks of a High Level of Borrowing 2)

|

Increase of Tax Burden

|

|

|

What are the Risks of a High Level of Borrowing 3)

|

Interest Payments are higher

|

|

|

Reasons for Govt Spending

P R R E M |

1)Providing Public / Merit Goods

2) Redistribution of income and Wealth 3) Regulation 4) Influencing Economic Efficiency 5) Influencing Macro Activity |