![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

24 Cards in this Set

- Front

- Back

|

Credit terms |

The terms on which credit is made available to a customer; they will invoice the credit period, amount, discounts, payment details, late penalties |

|

|

Cash terms |

Immediate payment |

|

|

Net monthly |

Payment of a months supplies is due at the end of the following month |

|

|

Net 30 days |

Payment of a supply of goods is due 30 days after delivery |

|

|

Settlement discount |

Discount given for an early settlement of invoices |

|

|

Interest penalties |

Penalties charged on amounts outstanding after the due date of payment charged to a fixed rate of interest |

|

|

Late payment of commercial debts act 1998 |

Allows suppliers to charge interest on overdue amounts |

|

|

Retention of title |

The right of a seller of goods to retain ownership until payment is made |

|

|

Credit insurance |

Insurance of the supplier of goods against irrecoverable debts incurred - cover available for a range of combination of customers |

|

|

Granting credit summary |

Decision involves a variety of different factors involving levels of risk: internal and external credit information, nature of the ownership of the organisation, it's location, amount of information available and the level of risk attached to the sales policy |

|

|

Refusal of credit summary |

Communication to the potential customer should be carried out in a tactful and diplomatic way and the opportunity to trade on cash terms offered |

|

|

Credit terms summary |

Include: Credit period Credit limit Payment terms Details of discount Payment instructions Interest penalties on late payments |

|

|

Settlement discount summary |

Most cost effective when interest rates are high. Annual cost worked out by formula and compared with the current cost of borrowing or interest rates for investing |

|

|

Retention of title summary |

Enable them to recover goods sold of the buyer becomes insolvent |

|

|

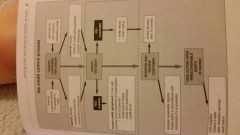

Credit control process |

|

|

|

Granting credit - factors |

Ownership of the customer Overseas customers Amount of information available Sales policy |

|

|

Ownership of the customer |

Will often determine the level of risk involved when granting credit. Small business are more risky - less backing |

|

|

Overseas companies |

High risk. Problems sending and receiving currency payments. Also could be complications with legal systems |

|

|

Amount of information available |

Limited information available. Which makes a credit decision hard to make. Initial refusal of credit, with a review in 6 months time. |

|

|

Sales policy |

Tension between sales department and credit control department. Sales department want to obtain as many sales as possible but the credit control department see high risks involved. |

|

|

Refusing credit |

Difficult decision. In danger of losing a potential customer to another supplier. Potential customer will lose both a supplier and a source of liquidity. Supplier is likely to suggest cash trading. Treat the matter with tact and diplomacy |

|

|

Half way house credit |

Shorter credit periods Part payment This reduces the risk of the customer not paying and helps maintain a good customer |

|

|

Changes in credit terms |

Could be: an increase limit or a longer payment period. Factors to examine: Amount of the increase - is it enough?, is it justifiable? Has the customer kept within the existing limit? Trading history |

|

|

Credit control policies and procedures |

|