![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

71 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Life Insurance Selection Facts (7) |

1. Client profile

2. Client goals and objectives 3. Survivors’ needs 4. Estate liquidity 5. Risk tolerance 6. Existing insurance 7. Amount of insurance needed |

|

|

|

Life Insurance Selection Facts - CLIENT PROFILE

Name 5 key client profile facts |

1. Age

2. Income 3. Health 4. Savings 5. Investment levels |

|

|

|

Which insurance products, term or permanent, are relatively inexpensive at younger ages?

|

Both term and permanent insurance are relatively inexpensive at younger ages.

|

|

|

|

What might be a good insurance option for clients with substantial insurance needs and little discretionary income (as in the case with younger clients)?

|

Term insurance may be the most effective use of the client’s limited resources.

Once term insurance is in place, it usually can be converted to permanent insurance as needs and income dictate. |

|

|

|

Types of risk ratings associated with a client's health ?

(3) |

1) Preferred (lower than average risk of loss)

2) Standard (average risk of loss) 3) Sub-standard (higher than average risk of loss) Lower risk rating = lower premium |

|

|

|

TRUE OR FALSE

Term insurance initially has a lower premium than permanent insurance at younger ages. |

FALSE

Term insurance initially has a lower premium than permanent insurance at any issue age. |

|

|

|

What type of coverage is available for clients considered a substandard health risk?

|

- Usually, some type of impaired risk policy is available at an increased cost.

- The client may be offered modified coverage for the standard premium or standard coverage at a higher premium. - Typically not rejected although it is an underwriting option. |

|

|

|

What are some benefits of permanent insurance?

|

- The Premiums on permanent products either are guaranteed to remain level (e.g. several types of whole life products) or can be designed so they are likely to remain level (e.g. universal products)

- Level premiums allow clients to lock in lower premiums - May become paid up or made self-supporting while the client is young and the product is relatively inexpensive. |

|

|

|

What is typically the preferred course of action if f the client’s health has changed and is now rated substandard?

|

It is generally far safer and more cost-effective to retain an existing standard issue policy than to try to find another policy at a reasonable premium based on substandard rates.

|

|

|

|

Why must conversion privileges be considered when evaluating term

policies? |

If a rated client eventually wants to change to permanent insurance, it is much easier to convert a policy with the same company than to apply for new coverage with another company.

|

|

|

|

Insurance selection: Stage 2 - Establish Goals

What goals should be included when establishing goals for life insurance selection purposes? (6) |

1. Providing liquidity at death for the estate

2. Establishing an income fund for dependents 3. Establishing an education fund 4. Creating a pre-retirement income fund and a retirement income fund for the surviving spouse 5. Accounting for final expenses (e.g., funeral, unpaid medical, etc.) 6. Providing an adequate emergency fund. |

|

|

|

Life Insurance Selection Facts -

SURVIVOR'S NEEDS Name examples of survivor's needs that should be identified (4) |

1. An education fund and how large a fund is needed;

2. Providing dependents with income and how large an income is desired 3. Pre-retirement income fund and post-retirement income fund for the spouse, and how large of an income is desired 4. Adequate postmortem emergency fund |

|

|

|

What is typically the preferred insurance to deal with estate liquidity needs?

|

Permanent Insurance

- Given increasing life expectancies, estate liquidity is likely to be a very long-term need. Generally, due to the long-term cost implications, permanent insurance is the preferred method of dealing with such needs (and a term insurance policy may not be renewable for a long enough term to be used for this purpose). |

|

|

|

Life Insurance Selection Facts -

ESTATE LIQUIDITY Variables that would cause an estate to shrink at death (4) |

1. Decedent’s debt

2. Probate and administrative costs 3. Federal and state estate tax 4. Any state inheritance tax *These costs must be paid in cash , usually within 9 months of death |

|

|

|

Life Insurance Selection Facts -

RISK TOLERANCE Name two ways that a client might view risk as related to insurance. |

1) Risk can refer to the fluctuation of the cash value (if any) of the policy.

2) May refer to his or her willingness to retain risk (think in terms of personal risk management, as opposed to investment risk). |

|

|

|

Life Insurance Selection Facts -

EXISTING INSURANCE What is a primary consideration when evaluating existing insurance? |

Types of policies held-

group/employer provided vs. individual policies |

A client who has no individually owned insurance, and who needs to maintain coverage, may be forced into an expensive conversion situation in the event of a job termination.

|

|

|

If a large amount of insurance is needed what type is typically preferable?

|

Term Insurance

If a large amount of insurance is needed, term insurance may be the only method of completely covering the need. Permanent insurance may be too expensive, resulting in less coverage, leaving a risk exposure. It is also appropriate to use term insurance to cover temporary needs and permanent insurance to cover permanent needs. |

|

|

|

Life Insurance Selection Facts -

CHANGING NEEDS Why is it important to consider changing needs when evaluating life Insurance needs? (2) |

1) Changes in lifestage.

- Younger clients may need to provide for a spouse and young children - Empty-nesters may need to account for how a loss in an income source would impact the survivior's lifestyle. -Older client's may want to keep an estate intact for children/grandchildren. - Purchasing power should be evaluated - Over time the purchasing power of a potential death benefit will decrease. |

|

|

|

Considerations when identifying resources for insurance selection (2)

|

1. Review of the clients financial statements

- Determine which resources are available and which can be repositioned to purchase any needed insurance based 2. Resources already earmarked for other goals may not be available for repositioning 3. Determinations should be made on items such as whether to pay off a mortgage at death |

|

|

|

What economic assumptions should be identified for insurance selection (2)

|

1. Inflation rate

- should be based on an average rate over an extended period 2. After-tax return - should be a long-term average and should not be based solely on today’s economic scenario |

|

|

|

Adjustment Fund

|

- Considered a postmortem expense

- Fund associated with assisting the surviving spouse with adjusting to the death of a spouse. |

e.g. Some surviving

spouses find it so difficult to adjust to the death of their spouse that they cannot work for a time. Others may find it necessary to spend money on themselves or others, and still others may try to adjust by traveling. Each situation is unique, and the planner should carefully investigate the possible need for an adjustment fund. |

|

|

What type of insurance is typically used to cover required estate liquidity

|

- Permanent

|

- Due to the long-term cost implications of estate liquidity needs, permanent insurance is usually the preferred method for funding these needs.

- Also, a term insurance policy may not be renewable for a long enough term to be used for this purpose). |

|

|

A client with a low to moderate risk tolerance may prefer:

|

- Whole life or universal life

- Permanent (lower risk of premiums increasing) |

|

|

|

A client with a moderate to high risk tolerance may prefer:

|

- Variable or Variable universal life (returns fluctuate with the market)

- Term (assume risk of being able to pay higher premiums) |

|

|

|

True or False

The planner’s objective is not to recommend a specific dollar amount of insurance that is “guaranteed” to take care of all client needs. |

False

The objective of the planner is to help the client identify specific goals based on clearly recognizable events, or specific periods of life, while still keeping an eye on the bigger picture. |

|

|

|

Name the 12 Stages of the Insurance Selection Proceeds:

(12) |

Stage 1: Identify a Client’s Life Insurance Selection Facts

Stage 2: Establish Goals Stage 3: Identify Resources Stage 4: Identify Economic Assumptions Stage 5: Determine Life Insurance Needs Stage 6: Determine Appropriate Type & Product Stage 7: Evaluate Existing Type and Product Stage 8: Appropriate Amount Stage 9: Sufficient Resources Stage 10: Purchase Appropriate Coverage Stage 11: Cancel Inappropriate Coverage Stage 12: Modify Goals |

|

|

|

Insurance Selection - Stage 3: Identify Resources

How can the client's current resources be identified? What should be identified? |

Review client's financial statements:

- Cash flow statement - Statement of financial position What should be identified: - Cash Flow Statement - Inflows: salaries, cash dividends, interest, trust income - Outflows: - Statement of Financial Position - Assets and breakdown of assets - Liabilities - Net Worth **note that assets that are earmarked may not be available for repositioning. |

|

|

|

Insurance Selection - Stage 4: Identify Economic Assumptions

What economic assumptions must be made? (2) |

1. Inflation rate

2. After-tax return *both should be long-term averages |

|

|

|

Insurance Selection - Stage 5: Determine Life Insurance Needs

Methods for determining life insurance needs? (4) |

1) Six, eight, or ten times salary” rules

of thumb 2) Income-replacement approach (human life value) 3) Percentage of income method (all somewhat arbitrary in process) 4) Personalized needs approach |

|

|

|

The major steps in determining a client’s life insurance needs:

(10) |

1. Gathers= information regarding the client's financial and social situation.

2. List available liquid and non-liquid assets 3. Determine liabilities and estimate postmortem expenses. 4. Compare liquid assets with the sum of liabilities and postmortem expenses to determine insurance needed, if any, to meet estate liquidity needs. 5. If children are involved in the analysis, estimate the funds needed to provide dependents with adequate income until the youngest child reaches the age of 18 (or another age that the client chooses). 6. Estimate the amount required to establish a higher education fund, if desired. 7. Estimate the funds required to provide an adequate pre-retirement income to the spouse after the youngest child reaches the age of 18 (if children are involved, and if such an income is desired). 8. Estimate the funds required to provide an adequate retirement income to the surviving spouse (if such an income is desired). 9. Estimate the amount required to establish an emergency fund. 10. Compare available assets with total needs to determine the amount of insurance needed, if any. |

|

|

|

Determining Life Insurance Amount:

Step 1 What information is collected in this step. |

- Ages

- Attitudes - Goals - Personal financial resources of family members. |

|

|

|

Determining Life Insurance Amount:

Step 2 - List All Liquid Assets What liquid assets should be included when listing liquid assets at death? (3) |

1) The net death benefit value of any life insurance policies

(except UL type 2 or type B policy, do not include both the cash value of a life insurance policy and its death benefit) 2) Amounts held in savings accounts and certificates of deposit 3) The fair market value of any stocks, bonds, money market mutual funds, or other investments that the client feels could be liquidated easily and that are not earmarked for specific needs |

|

|

|

Determining Life Insurance Amount:

Step 2 - List All Liquid Assets What assets SHOULD NOT be included when listing liquid assets at death? (5) (3) |

1) Checking accounts (amounts in excess of current expenses can be

included, but exercise caution in doing so) 2) Funds earmarked for other purposes, like college educations 3) Automobiles and other use assets 4) Expected inheritances (not yet received) 5) Personal effects, like jewelry |

|

|

|

Determining Life Insurance Amount:

Step 2 - List All Liquid Assets What assets MAY OR MAY NOT be included when listing liquid assets at death? (4) |

1) Lump-sum pension benefits (payouts can take from 12 to 24 months to process)

2) IRAs (the surviving spouse may continue the account until retirement) 3) Equity in real estate 4) Collectibles |

|

|

|

Determining Life Insurance Amount:

Step 3 - Determine liabilities and postmortem expenses. What liabilities should be considered? ( ) |

1) Repayment of any debts owed

2) Estimated last illness expenses 3) Estimated funeral expenses 4) Estimated probate costs 5) Estimated estate taxes 6) Adjustment Fund |

|

|

|

Major components of Probate Fees include:

(4) |

- Atorney’s fees

- Executor’s fees - Appraisal fees - Court fees. |

|

|

|

Determining Life Insurance Amount:

Step 5 - Estimate the funds needed to provide dependents with adequate income What economic losses should be considered? |

1. Expense related to childcare if a spouse currently provides those services full time

2. The economic value of a homemaker 3. The loss of the right to file a joint tax return 4. The loss of the estate tax marital deduction 5. The loss of the gift tax martial deduction |

|

|

|

Determining Life Insurance Amount:

Step 5 - Estimate the funds needed to provide dependents with adequate income How do you estimate the desired monthly income when using the 75% rule of thumb? |

Gross salaries minus all taxes minus savings and investments divided by 12, and multiplied by 75%

|

|

|

|

Determining Life Insurance Amount:

Step 5 - Estimate the funds needed to provide dependents with adequate income What is considered when calculating the expected monthly income? |

- Expected monthly after-tax earnings of the surviving spouse (taking into account the new tax bracket)

- Expected monthly Social Security benefits available to the survivors - Any other expected monthly benefits the survivors will be entitled to receive (trust benefits, proceeds from a buy-sell agreement, etc.) |

|

|

|

Determining Life Insurance Amount:

Step 6 - Estimate the amount required to provide a higher education fund What are the steps required to estimate the education fund? |

1) Determine the annual costs for college in today’s dollars

2) Calculate the future value of the funds needed when the payment begins 3) Calculate the present value of an annuity due (PVAD) using an inflation-adjusted interest rate. 4) Calculate the present value of the results of step 6. |

|

|

|

Inflation- Adjusted Interest Rate

|

|

|

|

|

Determining Life Insurance Amount:

Step 7 - Estimate the funds required to provide an adequate preretirement income to the spouse after the youngest child reaches the age of 18 What are the steps to estimating this amount: (4) |

1. Estimate the surviving spouse’s desired annual income, based on today’s dollars.

2. Estimate the surviving spouse’s expected annual after-tax earnings, again based on today’s dollars. 3. Subtract the need from expected income (step 2 from step 1) 4. Calculate the amount needed to provide a series of inflation-adjusted “blackout period” income payments (beginning when the youngest child reaches age 18 and continuing until the surviving spouse retires). |

|

|

|

Determining Life Insurance Amount:

Step 8- Estimate the Retirement Needs for a surviving spouse |

- Estimate required annual income subtract Social Security retirement benefits and other retirement benefits.

- Estimate the clients life expectancy to determine the total need. |

|

|

|

True of False

If a client can qualify for one type of life insurance, he or she generally can qualify for any type of life insurance. |

True -

The main exception to this rule is that term products often are not offered to prospective insureds over the age of 65, whereas permanent products may be available at age 70 or 80. |

|

|

|

True of False

Term products often are typically available after age 65. |

False

Term products often are not offered to prospective insureds over the age of 65, whereas permanent products may be available at age 70 or 80. |

|

|

|

True of False

Original issue rates on any kind of insurance remain level with advancing age. |

False

Original issue rates on any kind of insurance become higher with advancing age. |

|

|

|

Common Life Insurance Pitfalls

|

1. Recommending term insurance simply because the client is young.

2. Assume that a variable product will perform better than a non-variable (nonequity) product, or to ignore the emotional implications of such products for the client. 3. Assume that a client can invest his or her own money to get better returns than an insurance company. 4. Assume that a client should “diversify” the types of insurance he or she purchases. |

|

|

|

Net Amount at Risk

|

The difference between the cash value and the death benefit, which is provided through what amounts to term insurance.

|

|

|

|

Two components of Permanent Life Insurance products?

|

1. Decreasing net amount at risk (the difference between the cash value and the death benefit, which is provided through what amounts to term insurance).

2. Increasing cash value that serves two purposes. 1) Provides investment income for the insurance company that will assist in paying future term charges for the net amount at risk, thus keeping the premium level 2) Endow the cash value (i.e., make it equal to the face amount) at maturity |

|

|

|

What are some reasons that a recommendation to purchase term insurance and convert to permanent insurance? (3)

|

1) The client may not have enough money to pay for permanent insurance now.

2) The client's needs are expected to decrease substantially in the future so that less permanent insurance will be needed 3) The client is a very good investor and actually has achieved results that consistently beat insurance policy returns on an after-tax basis. |

|

|

|

What are some considerations when purchasing Variable insurance products?

(3) |

1) Net Investment returns

2) Short-term effects the policy would suffer if there were a market drop in the early years 3) Client risk tolerance |

|

|

|

What are two possible solutions for addressing the risk that there is a market drop in the first few years of owning a variable policy?

|

1) Select conservative investments for the first few years

2) Start the policy with a contribution that is larger than is anticipated for future annual payments (but that is still within federal guidelines) |

|

|

|

What is the purpose of the cash value of a permanent life insurance policy?

|

1) Provides investment income for the insurance company that will assist in paying future term charges for the net amount at risk, thus keeping the premium level.

2) Most permanent products also must generate sufficient additional investment income to endow the cash value (i.e., make it equal to the face amount) at maturity |

|

|

|

What are common ways of evaluating an insurance company's policy?

(9) |

1. Compare the cost of one policy, on a cost-per-thousand basis, against another similar policy

2. Traditional net cost method - ignores the time value of money (premiums paid minus dividends minus cash value at the end of the period, equals net cost) 3. The surrender cost method (or interest adjusted method) 4. The net payment cost method 5. Equal outlay method 6. Cash Accumulation method 7. Linton yield method 8. Belth yearly yield and yearly price protection methods 9. Baldwin method |

|

|

|

Belth Method

|

- The yearly price of protection method.

A method used by insurance agents and financial planners to evaluate life insurance policy costs is the yearly price of protection method. |

|

|

|

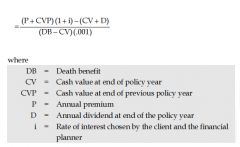

Formula

Yearly Price Per Thousand |

|

|

|

|

What are the steps of the Belth Method?

(3) |

1) Collect policy information

2) Determine the Yearly Price Per Thousand 3) Compare the calculated Yearly Price Per Thousand against a benchmark or other policy. |

|

|

|

What policy information should be collected as part of step 1 of the Belth method?

|

1) Death Benefit at the end of the policy year

2) Surrender value (payable at the end of the policy year) 3) Annual policy premium payable at the beginning of the policy year. 4) Annual dividend payable at the end of each policy year 5) Insured's current age |

|

|

|

Should the client consider replacing an existing policy if

the yearly price per thousand of the policy is less than the benchmark figure. |

- The yearly price is LOW

- The policy owner SHOULD NOT consider replacing the policy on the basis of price. |

|

|

|

Should the client consider replacing an existing policy if

the yearly price per thousand of the policy is more than, but not double, the benchmark figure |

- The yearly price is MODERATE

- The policy owner SHOULD NOT consider replacing the policy on the basis of price. |

|

|

|

Should the client consider replacing an existing policy if

the yearly price per thousand of the policy is more than double the benchmark figure |

- The yearly price is HIGH

- The policy owner SHOULD consider replacing the policy on the basis of price. |

|

|

|

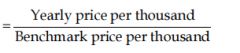

Front-End Load Multiple

|

- Included in the Belth Benchmark table

- Can be used to measure a new policy's front end expenses. |

|

|

|

Formula

Front-End Load Multiple |

|

|

|

|

If the front-end load of the actual policy is less than the benchmark figure...

|

- The front-end load is low

|

|

|

|

If the front-end load of the actual policy is more than, but not double, the benchmark figure...

|

- The front-end load is moderate

|

|

|

|

If the front-end load of the actual policy is more than double the benchmark figure...

|

- The front-end load is high

|

|

|

|

When is the front-end load multiple most effective as an evaluation tool?

|

The front end load multiple is most effective a measurement tool:

A) When used with a proposed policy illustration B) Within the first year or two of a policy’s existence |

|

|

|

When is the front-end load multiple not effective as an evaluation tool?

|

After a policy has been in effect for several years, the front-end load already has been paid, and becomes irrelevant.

|

|

|

|

True or False

The yearly price method may be used if the policy covers more than one life. |

False

The yearly price method should not be used if the policy covers more than one life. |

|

|

|

Considerations when using the yearly price method (Belth method).

(5) |

1) Should not be used if the policy covers more than one life.

2) The year chosen for evaluation might not be representative of the policy as a whole. Calculate and evaluate the policy for several different years to alleviate this problem. 3. The yearly price per thousand could be negative when using a conservative interest rate or evaluating a very competitive permanent policy. 4) Even when comparing the same type of policy they may not be the same - you should consider items such as reliability of the company, services offered to the policy holder. 5) If the cash value (CV) of the policy is very high he financial planner might consider the return on the investment as he or she would with any other investment and compare it to the return on other comparable investments that are available. |

|

|

|

Linton Method

|

- A method of evaluating policies

- Created to compare cash value life insurance with the “buy term and invest the difference” approach - Based on subtracting the “cost of protection” from each year’s policy premium, net of dividends, and treating the remainder as a savings deposit. - Many policy illustrations will include the Linton Yield for the life of the policy |

|