![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

166 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

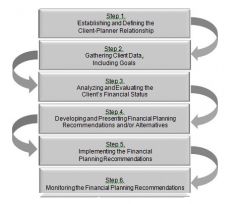

Name the 6 Steps of the Financial Planning Process. |

|

|

|

|

In step 1 - Establishing and Defining the Client-Planner Relationship, what is involved in “mutually defining”?

|

(1) identifying the service(s) to be provided

(2) disclosing the financial planner’s compensation arrangements (3) determining the responsibilities of the client and the financial planner (4) establishing the duration of the engagement (5) providing any additional information necessary to define or limit the scope of the engagement. |

|

|

|

That does the savings bond education tax exclusion allow for?

|

The savings bond education tax exclusion permits qualified taxpayers to exclude from their gross income all or a portion of the interest earned on the redemption of eligible Series EE and I bonds issued after 1989.

Bondholders must be at least 24 years old before the bond’s issue date. Bondholders must be at least 24 years old before the bond’s issue date. To qualify for this exclusion, the taxpayer, the taxpayer’s spouse, or the taxpayer’s dependent at certain postsecondary educational institutions must incur tuition and other educational expenses. Persons with incomes above certain thresholds may not be eligible to participate. |

|

|

|

Eligible educational expenses include.

|

Includes tuition and fees (such as lab fees and other required course expenses) required for enrollment or attendance at an eligible educational institution.

Payments to qualified state tuition programs are also eligible. Eligible expenses must be incurred during the same tax year in which eligible bonds are redeemed. The amount of eligible expenses is reduced by the amount of any scholarships, fellowships, employer-provided educational assistance, and other tuition reduction. |

|

|

|

Eligible educational expenses do not include.

|

Eligible educational expenses do not include expenses relating to any course or other education involving sports, games, or hobbies are eligible only if required as part of a degree or certificate-granting program.

The costs of room and board, as well as books, are not eligible expenses. The amount of eligible expenses is reduced by the amount of any scholarships, fellowships, employer-provided educational assistance, and other tuition reduction. |

|

|

|

Education Tax Exclusion Income phaseout

|

$71,100–$86,100 (single) and $106,650– $136,650 (joint) for 2011

|

|

|

|

What are the rules of thumb for the following debt types:

- Consumer debt - Housing Costs - Total Debt |

Consumer debt - 20% or less of net monthly income

Housing costs - 28% or less of gross monthly income Total debt - 36% or less of gross monthly income |

|

|

|

Emergency Fund Ratio

|

= cash&cash equivalents / expenses

*the emergency fund should be between 3-6 months of expenses |

|

|

|

7 Reasons for Using a Budget

|

•To establish specific financial goals, including amounts and time frames

•When it is important to let everyone in the family know why spending is being limited in one area or another •When the family economics are complex—e.g., when income and/or expenses are widely fluctuating •When it is important to keep track of spending in one specific area or by specific individuals •When the family believes it is important to establish financial incentives for its members •Improving control of household expenses monitoring performance of specific investments such as securities and real estate meeting savings and wealth accumulation goals such as education funding or vacation, new car, and retirement planning |

|

|

|

5 Advantages Budgeting

|

•Budgeting may provide motivation to accomplish financial goals.

•Budgeting provides a way to measure financial performance. It is a self-evaluation of progress. •Budgeting reveals wasteful or inefficient spending patterns. •Budgeting requires the family to identify and deal with potential financial problems before they arise and consider possible alternative courses of action. •Budgeting may be used to establish financial goals and determine the feasibility of meeting them. |

|

|

|

4 Disadvantages Budgeting

|

•If inaccurate information is used to develop the budget, it will be of little or no value.

•Using a budget as an absolute control of spending may preclude a client from taking advantage of opportunities that might aid in the reaching of goals. •Keeping accurate spending records is often difficult, and some people resent it. However, if the client does not keep accurate spending records, the budgeting process will be wasted and will merely increase the client’s stress. •For the client who is successfully working toward his or her financial goals, it may seem like an intrusion or an indication of mistrust. |

|

|

|

Guidelines for creating a budget (8)

|

1 .Limit the budget period to no more than one year.

2. Keep the budget simple and short. 3. Keep it flexible. 4. Avoid information that won’t add to the process. (i.e. location of purchases) 5. Design the budget with specific goals in mind. 6.Budgets should be consistent in form and content from year to year. 7. Budgets are not only guides to spending and saving, they are tools for self-evaluation. 8.When designing the budget, keep in mind things that may be different than in the past. |

|

|

|

Steps in creating a budget.

|

Step 1. Identify the client’s financial goals and determine what is required to reach them.

Step 2. Estimate income from all sources. If income sources fluctuate two budgets should be created - 1) expected income 2) more conservative income projections Step 3. Estimate expenses. (identify fixed and variable) Step 4. Compare income and expenses to determine if expected expenses are equal to or less than expected income. Step 5. Make adjustments (if expenses are too high, attempt to identify potential sources of additional income or places where expenses may be reduced or are lower than expected income, apply the excess to the categories of expenses that will bring the family closer to its goals.) Step 6. Present each category of income and expense as a percentage of the total. (used in year to year comparisons) |

|

|

|

Consumer Debt

|

short-term debt that is used by consumers to acquire products and services.

|

|

|

|

Secured Debt

|

Secured debt is one for which collateral is used to back the promise to repay.

If the borrower does not repay the loan, the lender can repossess the collateral. An auto loan typically is secured. Generally interest rates are lower on secured debt than unsecured debt. |

|

|

|

Unsecured Debt

|

With unsecured debt, no specific property is pledged.

Credit cards are one form of unsecured debt. Generally interest rates are higher on unsecured debt than secured debt. |

|

|

|

Leverage

|

The an advantage in using debt to finance an appreciating asset.

|

|

|

|

Additional costs of a mortgage (4)

|

Additional costs of a mortgage include:

1. loan origination fees 2. appraisal fees 3. credit reporting costs 4. title search costs 4. points, which represent prepayment of interest. |

|

|

|

Mortgage Points

|

-Represent prepayment of mortgage interest.

-Generally tax deductible. -One point is equal to 1% of the mortgage amount. If the mortgage amount is $100,000 and the lender is charging two points, the cost of the points would be $2,000. -Typically, the borrower is offered several interest rate and point combinations by the lender. Higher points will be offered with a lower interest rate, and vice versa. -If the buyer plans to stay in the house for a short period of time the higher interest rate (low points) may be better because the short-term costs are reduced. |

|

|

|

Tax Implications of Home Ownership - Mortgages (3)

|

1. Points paid are generally deductible for the buyer of a home. 2. Home mortgage interest is generally deductible.

3. Capital gains on a home are taxed only under certain circumstances. |

|

|

|

Types of Mortgages (10)

|

- Fixed-rate mortgage

- Biweekly mortgage - Adjustable rate mortgage - Interest-only mortgage - Balloon mortgage - Graduated payment mortgage - Conventional mortgages - VA mortgages - FHA mortgages - Reverse mortgage |

|

|

|

Fixed-rate mortgage.

|

- Most widely used

- The interest rate does not change over the repayment period - Typically long (25 - 30 years) - The payment amount is fixed at the outset, based upon the interest rate charged on the loan, the repayment period, and the original loan balance - Payments include both interest and principle (generally made monthly). Initially the interest portion is larger and reduces over time. |

|

|

|

Biweekly mortgage

|

- Payments on a fixed-rate mortgage are sometimes structured to be payable on a biweekly basis

- 26 payments are made each year - Annual amount paid is higher. The additional payment is applied to the mortgage principle. |

|

|

|

Adjustable Rate Mortgage

|

- Features an interest rate that varies with interest rate changes in the economy

- The payment amount also varies - Changes in rates are usually tied to changes in a stated economic index. - Typically feature limits on how often and how much interest rates may change. - Many have an initial period during which no interest rate changes will occur (e.g., five years). - Borrowers bear most of the risk of changes in interest rates and therefore generally the initial rates are lower. |

|

|

|

Interest-only Mortgage

|

- Most are arranged so that interest rates vary with the market.

- Interest rate that is applied to the loan is usually tied to an index such as the LIBOR - Borrowers make only interest payments for some predetermined period (e.g., five, ten, or twenty years) - Lower initial payments, significantly higher future payments - Does not create owner-equity - Caution should be encouraged when using this type of mortgage |

|

|

|

Balloon Mortgage

|

- The borrower makes fixed payments, based upon the established interest rate for a long-term mortgage

- Payments are made only for a short duration, frequently five or seven years, and then the borrower is required to pay off the remainder of the mortgage in a lump sum -Payments with some loans may be limited to interest only. - Interest rate on a balloon mortgage is usually more favorable than for typical 30-year mortgages - Balloon mortgage may be appropriate for borrowers who plan to sell their homes before the fixed payment period is over. |

|

|

|

Graduated Payment Mortgage

|

- Payable over a long time period, such as 30 years, and has a fixed interest rate.

- Payments are lower for the first few years (although they sometimes increase each year), then adjust to a higher fixed payment - May be appropriate for people who anticipate increases in income with some certainty - Caution should be used as it may result in the borrower having to come up with additional money when the house is sold. |

|

|

|

Disadvantages of a Graduated Payment Mortgage

|

- Higher payments during the second period of the loan than if the loan had been a standard fixed-rate loan

- Higher interest costs - Negative equity buildup in the early years |

|

|

|

Conventional Mortgages

|

- Made by commercial lenders in the private sector

- aka Conforming Loan - because they conform to Fannie Mae and Freddie Mac dollar limit requirements |

|

|

|

Conforming Loans

|

- Conventional Mortgages

- Loans that conform to Fannie Mae and Freddie Mac dollar limit requirements |

|

|

|

Jumbo or Nonconforming Loans

|

- Loans that do not conform to Fannie Mae and Freddie Mac dollar limit requirements

- aka Subprime Loans - Have higher down payment and/or higher interest rate requirements. - Loans for those with damaged credit may also be called nonconforming. |

|

|

|

VA mortgages

|

-Guaranteed by the Department of Veterans Affairs

- Available only to eligible veterans. - May be fixed-rate or graduated payment mortgages |

|

|

|

FHA mortgages

|

- Guaranteed by the Federal Housing Administration

- May be fixed-rate or graduated payment mortgages |

|

|

|

Reverse Mortgage

|

- Making use of the equity in a home to achieve goals

- aka home equity conversion mortgage (HECM— HUD/FHA) or HomeKeeper mortgage (Fannie Mae) - Allows senior homeowners to receive income from their homes (generally) without having to make any repayments for as long as they remain in the house - Does not require repayment as long as the home is the borrower’s principal residence - HUD/FHA guarantees that the maximum loan repayment amount will not exceed the value of the home. |

|

|

|

Core Requirements for a Reverse Mortgage

|

Core requirements:

1) at least 62 years old 2) must own the home 3) must occupy the home as the primary residence 4) May have to attend a consumer information session given by an approved counselor |

|

|

|

Properties that qualify for reverse mortgage:

|

1) Single family homes or 1–4 unit homes with one unit occupied by the borrower

2) HUD-approved condominiums 3) Manufactured homes and leased land |

|

|

|

Reverse Mortgage Amount is based on:

|

The mortgage amount will be based on:

•Age of the youngest borrower •Current interest rate •Lesser of appraised value or the FHA insurance limit |

|

|

|

5 Reverse Mortgage Funding Plans

|

•Tenure. Equal monthly payments as long as at least one borrower lives and continues to occupy the property as a principal residence.

•Term. Equal monthly payments for a fixed period of months selected. •Line of credit. Unscheduled payments or in installments, at times and in amount of borrower’s choosing until the line of credit is exhausted. •Modified tenure. Combination of line of credit with monthly payments for as long as the borrower remains in the home. •Modified term. Combination of line of credit with monthly payments for a fixed period of months selected by the borrower |

|

|

|

Tenure Reverse Mortgage Funding Plans

|

Equal monthly payments as long as at least one borrower lives and continues to occupy the property as a principal residence.

|

|

|

|

Term Reverse Mortgage Funding Plans

|

Equal monthly payments for a fixed period of months selected.

|

|

|

|

Line of credit Mortgage Funding Plans

|

Unscheduled payments or in installments, at times and in amount of borrower’s choosing until the line of credit is exhausted.

|

|

|

|

Modified Tenure Mortgage Funding Plans

|

Combination of line of credit with monthly payments for as long as the borrower remains in the home.

|

|

|

|

Modified Term Mortgage Funding Plans

|

Combination of line of credit with monthly payments for a fixed period of months selected by the borrower

|

|

|

|

TALC

|

- The total annual cost of the loan

- Identifies what the all-inclusive interest rate would be if the lender could only charge interest and not charge any other fees |

|

|

|

Considerations When evaluating Buying vs. Renting (6)

|

- Length of time the home will be owned (longer the time period the more favorable buying looks)

- Cash outflows resulting from renting (i.e. security deposit, periodic rent payments (assume annual increases), insurance costs, and utility costs) - Inflows resulting from renting (i.e.return of a security deposit, inflows relating to the increased savings) - Cash outflows resulting from home ownership (i.e.down payment, closing costs, monthly payment of mortgage principal and interests, property taxes, insurance costs, utilities, and home maintenance costs, expected loss) - Cash inflows relating to home ownership (i.e. reduction in taxes, rental income and capital gains) - Marginal tax bracket (higher tax bracket greater tax savings) |

|

|

|

Refinancing a Home

|

- Allows the homeowner to take advantage of declining interest rates

-Able to reduce their monthly payments, reduce the time period for repayment, or both - Allows home owner to (potentially) free up some of the equity in the home - If refinancing to free up equity when interest rates are higher payments may be increased or the time period may be extended. |

|

|

|

Considerations When Refinancing

|

- Costs

- New appraisal may be necessary - Same costs as original mortgage (i.e. closing costs) - Expected length of time the home will be owned |

|

|

|

Home Equity

|

- The difference between the market value of the home and the principal balance of the mortgage

- It is an asset that can be used to achieve goals - State law may preclude the use of home equity loans for any purpose unrelated to the home. |

|

|

|

Second mortgage

|

- The amount of credit is based on a percentage of the individual’s equity in the home, such as 70%, 75%, or 80%.

- Secured debt - Home equity loan - Second mortgage holder gets paid second if there is enough money any remaining balance on the loans is still owed by the borrower. |

|

|

|

Home Equity Line Of Credit

|

- The amount of which is based upon the equity in the home

- line of credit that may be accessed at any time once it has been established - No repayment obligation exists until funds from the line of credit are accessed - Interest is generally tax deductible (restrictions apply) - Using an equity line of credit in conjunction with consumer credit can be a powerful financial management tool. |

|

|

|

Steps for planning for special goals (8):

|

Step 1: Define Goals in Terms of Dollar

Amounts and Time Frames Step 2: Determine Existing Resources Step 3: Determine if Additional Resources Are Needed Step 4: Consider Potential Strategies/Products for Achieving Goals Step 5: Consider Client Constraints Affecting Selection of Vehicles and Strategies Step 6: Select Appropriate Vehicles and Strategies Steps 7 and 8: Implement the Action Plan, and Schedule and Monitor Results |

|

|

|

Types of Leases

|

- Closed-end lease

- Open-end lease |

|

|

|

Closed-End Lease

|

- aka fixed-cost lease

- The lessee agrees to pay a stated monthly fee for the use of the asset for a specified period of time - May be an automatic adjustment for inflation for long-term leases - At the end of the lease period the lessee can walk away from the asset - Usually have no additional costs at the end of the lease (may have damage provision) - More often used for businesses to acquire equipment - An option for consumers wanting to get an automobile |

|

|

|

Open-End Lease

|

- aka finance or equity lease

- Generally has a lower monthly payment - At the end of the lease lessee may owe the lessor additional money if the asset rents or sells for an amount that is less than the value projected at the time the lease was initiated - Often used for consumer automobile acquisition |

|

|

|

Considerations in the Lease versus Buy Decision -

Consider Leasing an Automobile if (6): |

- Wants to have a new car every two to four years

- Doesn’t like to borrow money - Does not have the funds for the 20% or more down payment -Will not drive the car more than 12,000 to 15,000 miles per year - Uses his or her car for business - Needs a lower monthly car payment and is willing to give up ownership for the lower payment |

|

|

|

Considerations in the Lease versus Buy Decision -

Consider Buying an Automobile if (4): |

-Keeps a car for many years

-Drives well over 15,000 miles per years - Carries the state minimum of liability insurance - Wants to stop making payments eventually |

|

|

|

Considerations / Issues when Leasing - Automobile (6)

|

- Leasing companies often require higher limits of liability

- In some states, the cost of registering a leased vehicle is higher than that for registering a purchased vehicle. - At the end of a leasing period, any mileage over a stated amount and any damage or apparent abuse will result in additional costs. - Leasing generally does not affect any other lines of credit a client may have. - Leases often require a damage or security deposit. (Opportunity cost of not having these funds available) - Some lease agreements require a “capitalized cost reduction” payment at the inception of the lease. This is a nonrefundable payment that serves to reduce the remaining value of the asset that is used to determine the lease payments. It is essentially a down payment on an asset that is to be rented. |

|

|

|

Considerations in the Lease versus Buy Decision -

Consider Leasing an Home if (5): |

- Does not have the funds for a down payment

- Has temporary housing need - Expects his or her housing needs to change substantially in the foreseeable future and does not now own a home - Is looking for a job or changing careers, which would likely require him or her to move within a few years - Is not willing to deal with the general maintenance requirements of ownership |

|

|

|

Considerations in the Lease versus Buy Decision -

Consider Buying a Home if (4): |

- Intends to live in an area for many years

- Wants to improve the appearance or structure of the residence - Can benefit from the income tax advantages of ownership |

|

|

|

Considerations / Issues when Leasing - Home (6)

|

- Income tax considerations. Generally, the interest portion of the monthly mortgage payment for a residence is deductible from income.

- Property taxes paid are generally deductible for tax purposes. - A renter who improves a rental unit may do so at his or her expense; however, when the renter leaves, the owner of the unit benefits from the improvement. If anything was attached to the structure by the renter, generally the renter must leave it as a fixture, and it becomes the property of the owner. |

|

|

|

Annual inflation rate of college costs over the past 30 years

|

8%,

|

|

|

|

Section 529 Plans

|

- Called qualified tuition programs by the IRS

- Vary by state - Allow a substantial amount of money to be saved for college on a tax-free basis - Many allow out-of-state contributions, and do not require attendance at an in-state college. - Account owner controls distribution of the funds - Distributions made to pay for qualified educational expenses are tax free - Distributions that do not pay for qualified expenses taxable as ordinary income and may also be subject to a 10% penalty - Fees associated with plans should be evaluated |

|

|

|

Qualified Educational Expenses include:

|

- Tuition

- Mandatory fees - Books - Supplies - Equipment required for enrollment or attendance - Room and board expenses may also be eligible. |

|

|

|

Transfer Rules for Section 529 Plans

|

- Can be transferred to: a child or grandchild, a stepchild, siblings and their children, parents and step-parents, “in-laws,” spouses

of the preceding people, and a child’s first cousin. - May be rolled into another 529 plan. |

|

|

|

Coverdell Education Savings Accounts

|

- Originally created by Congress in 1997

- aka Education IRA - EGTRRA increased the annual contribution limit to $2,000 (subject to modified adjusted gross income limits) - Distributions may be used for elementary, secondary or education expenses for special needs students - Must be used by the time the beneficiary reaches age 30 - Accounts may be owned by the student or the student’s parent. - Beneficiaries may change - MAGI phaseouts for contributions to a Coverdell plan: $95,000–$110,000 (single) and $190,000–$220,000 (joint). |

|

|

|

MAGI phaseouts for contributions to a Coverdell plan:

|

$95,000–$110,000 (single) and $190,000–$220,000 (joint).

|

|

|

|

Hope Tax Credit

|

- Up to $1,800

- 100% of $1,200 plus 50% of the next $1,200 per student only for the first two years of college - Cannot claim both the Hope and Lifetime Learning credits in the same tax year for the same student - Has been superseded by the American Opportunity Credit |

|

|

|

Lifetime Learning Tax Credit

|

- Up to $2,000

- 20% of $10,000 per tax return in any year with qualified education expenses - Cannot claim both the Hope and Lifetime Learning credits in the same tax year for the same student |

|

|

|

Education Expense Tax Deduction (provided by EGGTRA)

|

- Extended through 2010

- The allowable deduction is either $4,000 or $2,000, depending on AGI. |

|

|

|

MAGI phase out for education tax credits

|

- MAGI is between $50,000 and $60,000 for single filers or $100,000 and $120,000 for joint filers

- Completely phased out when MAGI is over $60,000 for single filers and $120,000 for joint filers. |

|

|

|

MAGI phaseout for Education Tax Deduction

|

- The $4,000 higher education expense deduction is eliminated at an AGI of $65,000/$130,000 (single/joint)

- $2,000 deduction is eliminated at an AGI of $80,000/$160,000 (single/joint). |

|

|

|

The American Opportunity Tax Credit

|

- Passed in February 2009, and has been extended for 2011 and 2012

- Credit of $2,500 (100% of the first $2,000 of expenses and 25% of the next $2,000) is available for college years 1-4. - Use of this credit would eliminate the ability to use the standard Hope tax credit during years 1 and 2or the Lifetime Learning Credit in years 3 and 4. Expenses after year four would potentially qualify for the Lifetime Learning Credit. |

|

|

|

MAGI phaseout for The American Opportunity Tax Credit

|

- Income phaseout is $80,000–$90,000 for single filers $160,000–$180,000 for joint filers

|

|

|

|

Two elements of structuring a college savings plan.

|

1. Maintaining the funds in a manner that will take maximum advantage of tax deferral opportunities and

2. Selecting proper investment vehicles to achieve the greatest possible return consistent with preservation of the funds |

|

|

|

The savings bond education tax exclusion permits:

|

- Permits qualified taxpayers to exclude from their gross income all or a portion of the interest earned on the redemption of eligible Series EE and I bonds issued after 1989

- Bondholder must be at least 24 before the bonds issue date - The taxpayer, the taxpayer’s spouse, or the taxpayer’s dependent must incur educational expenses - A child can be named as a beneficiary - Only valid owners may be the tax payer or spouse - Persons with incomes above certain thresholds may not be eligible to participate. years old before the bond’s issue date |

|

|

|

MAGI phaseout for The savings bond education tax exclusion

|

The income phaseout range for 2011

$71,100–$86,100 (single) and $106,650– $136,650 (joint) |

|

|

|

Custodial Education Accounts

|

Uniform Gifts to Minors Act (UGMA)

Uniform Transfers to Minors Act (UTMA) - involve naming an individual as the manager of property belonging to a minor child - Some states may not allow for both - UGMA may limit the type of investments that can be used - The child/ beneficiary must be given the right to possession of the property on reaching the age of majority (age 18 in most states) - relatively inflexible in avoiding the so-called kiddie tax |

|

|

|

Concerns with UGMA /UTMA accounts (2)

|

1) The child/ beneficiary must be given the right to possession of the property on reaching the age of majority (age 18 in most states)

Child may not use the funds for education. 2) Relatively inflexible in avoiding the so-called kiddie tax |

|

|

|

Kiddie Tax

|

- Applies to unearned income greater than $1,900 (indexed annually for inflation) received by children under age 19 or under age 24 if a full-time student

- taxed at the child’s marginal tax rate |

|

|

|

Three basic forms of trusts used in college education funding:

|

• Minor's Trust- established under the provisions of Internal Revenue Code (IRC) Section 2503(c)

•Current Income Trust - structured according to the terms of IRC Section 2503(b) • A demand, or Crummey invasion, trust |

|

|

|

Minor’s trust [2503(c)]

|

- Designed to use the $13,000 ($26,000 for a married couple) annual gift tax exclusion

- May permit accumulation of income on behalf of the child - Provides that a gift to an individual under 21 will not be considered a gift of a future interest as long as the property and its income are payable to the child at 21 -Permits income to escape the kiddie tax by allowing the trustee to accumulate more income at the trust’s separate tax bracket -Income retained in trusts being taxed at the highest personal rate, even at relatively low levels |

|

|

|

Current income trust [2503(b)]

|

- Income must be paid out at least annually to the beneficiary with no discretion left to the trustee to accumulate income

- The trust property, or principal, need not be distributed to the child at any specified age. - Ensures the segregated funds are used only for the purpose they were intended - Important to invest in appreciating assets that do not pay out income |

|

|

|

Crummey trust

|

- Transfers money from one individual to a trust for the benefit of another

- Avoids gift taxes and keep the money out of the estate of the person making the gifts - Permits the beneficiary to withdraw from the trust an amount equal to the lesser of the annual addition to the trust or the annual gift tax exclusion - Allows distribution at any age chosen by the grantor - If the demand trust accumulates income and it is taxed to the trust itself, the tax rates are high. |

|

|

|

How can a retirement plan be used to fund college expenses:

|

- 72(t) distributions

- Funds withdrawn to pay for qualified higher education expenses for the taxpayer, spouse, children, or grandchildren may qualify for an exemption from the 10% penalty (taxed as ordinary income) |

|

|

|

IRC Section 72(t)

|

- “substantially equal payment” exception

- Avoids the 10% penality as long as the participant withdraws roughly equal amounts from his retirement plan annually for at least five years or until reaching age 591/2 (whichever is later) - retirement money can be used for any reason. |

|

|

|

General rule for selecting investment vehicles to fund a savings program for college

|

- Investments that generate growth of principal should be more heavily relied on for a child who may be subject to the kiddie tax.

- If the kiddie tax is not a consideration, investments producing a high current yield may be sought. |

|

|

|

Considerations when using annuities to fund education.

|

- Considered during the growth period of college funding

-The parent may maintain ownership, and tax advantages still can be achieved. - Tax-deferred growth - Payments geared toward the child’s college entry date - If the money is taken out before the annuity owner is 591/2, there is a 10% penalty tax on any amounts above original basis/investment. - Gain in value is taxable |

|

|

|

Considerations when using insurance to fund education.

|

- Considered during the growth period of college funding

- Costs associated with a life insurance policy that likely will reduce potential net returns - Consider a permanent life insurance policy only when there is a need for the insurance—i.e., a death benefit - The parent may maintain ownership, and tax advantages still can be achieved. - Loans may be taken against the policy’s accumulated cash value and used to pay college expenses |

|

|

|

Scholarships

|

- Gifts of money applied toward a student’s education

- Full or partial scholarships - Two types: 1) Available for academically or athletically gifted students 2) Based on financial need - Scholarship funds may reduce monies available from other sources |

|

|

|

Types of Federal Education Grants

|

- Pell grants

- Federal Supplemental Educational Opportunity Grants (FSEOGs) - (SMART Grant) - Teacher Education Assistance for College and Higher Education (TEACH) Grant Program |

|

|

|

Federal Grants

|

- Federal grants are gifts by the federal government to a student to be applied toward education funding

- The student is not required to pay back the sum that the government provides. |

|

|

|

Pell grants

(type/desc, eligibility and amount) |

- Federal Grant

- Distributed on the basis of severe financial need Eligibility: - Undergraduate students only - Part-time and Full-time Amount: - Current maximum is $5,550 - Amount varies year to year - Part time students are eligible for reduced grants. - Seldom (if ever) be enough to completely pay tuition expenses |

|

|

|

Federal Supplemental Educational Opportunity Grants (FSEOGs)

(type/desc, eligibility and amount) |

- Funded by the federal government but are administered by individual schools

- Needs based -Pell grant recipients are given highest priority in receiving FSEOGs. Eligibility: - Undergraduate students only - Part time or full time students Amount: - Awards are limited based on the amount available - Current amounts range from $100 to $4,000 |

|

|

|

Academic Competitiveness Grant

(type/desc, eligibility and amount) |

- Created in 2006

- - Provided in addition to the Pell Grant Eligibility: - Full-time students only - Must be eligible for the Pell Grant Amount: - up to $750 for the first year of undergraduate studies - up to $1,300 for the 2nd year |

|

|

|

National Science and Mathematics Access to Retain Talent Grant

(eligibility) |

- New Grant

Eligibility: - Full-time students only - Must be eligible for the Pell Grant |

|

|

|

SMART Grant

(type/desc, eligibility and amount) |

-New Grant

Eligibility: - upper-division students - majoring in physical, life, or computer sciences; mathematics; technology; engineering; or in a foreign language - Min 3.0 GPA Amount: - Update to $4,000 for years 3 and 4 in an undergraduate program. |

|

|

|

Teacher Education Assistance for College and Higher Education (TEACH) Grant Program

(type/desc, eligibility and amount) |

- New Grant

- Established as part of the College Cost Reduction and Access Act of 2007 Eligibility: - Students who intend to teach in a public or private elementary or secondary school that serves students from low-income families - recipients must agree to serve as a full-time teacher in a high-need field in a public or private elementary or secondary school that serves low-income students Amount: - up to $4,000 per year - reduced amounts for part-time students - Failure to complete this service obligation will result in a conversion of all amounts received to a Federal Direct Unsubsidized Stafford Loan |

|

|

|

Types of Federally Funded Education Loans

|

- Perkins Loan

- Stafford Loan - Parent Loans to Undergraduate Students (PLUS) - Direct Consolidation Loans - All loans come directly from the U.S. Department of Education |

|

|

|

Perkins loans

(type/desc, eligibility and amount, rate and repayment) |

- Low interest rate loans funded by the federal government but administered by individual schools

Eligibility: - available both to undergraduate and graduate students - need-based - available to students who are attending on at least a half-time basis and who have an exceptional financial need Amount: - Limits apply to the amount of funds that may be borrowed. Rate: - 5% interest rate - Not charged during the period that the individual is a student. Repayment: - Graduates are not charged interest until nine months following graduation, leaving school, or dropping to less than half time, at which time repayment begins - typically for 10 years |

|

|

|

Stafford loans

|

- aka William D. Ford Direct Stafford Loans

- Include both direct subsidized and direct unsubsidized loans - Loans may be partially subsidized - Loans based on financial need are generally subsidized Rate: - 6.8% fixed rate - for undergraduates first disbursed between: July 1, 2010, and July 1, 2011, have a 4.5% rate - July 1, 2011, and July 1, 2012, have a 3.4% rate - Repayment: - Various repayment options and term extensions are available - Typically 10 year repayment |

|

|

|

Parent Loans to Undergraduate Students (PLUS)

|

- Parents may borrow funds for their children’s undergraduate studies

- Not needs based - Graduate and professional students can borrow money directly (called Grad Plus) Eligibility: - Full-time students only - Students enrolled in programs shorter than an academic year are eligible for reduced loans - Sourced by private lenders - Origination fees and possibility insurance are added Rate: - Fixed rate 7.9% Amount: - Only limit is the total of all aid received cannot be higher than the total cost of schooling Repayment: - Begins within 60 days of taking out the loan - Repayment may be delayed until the student is out of school (interest builds during this time) |

|

|

|

Direct Consolidation Loans

|

- Allows for the combination of multiple student loans into one loan

- Parent loan cannot be consolidated with student loans Rates: - Interest rate varies depending on the weighted average of the loans - Cannot exceed 8.25% |

|

|

|

Federal Grants and Loans available for under-graduate students.

|

- Pell Grant

- Federal Supplemental Educational Opportunity Grants - Academic Competitiveness Grant - Smart Grant - TEACH Grant - PLUS (parent loans) - Perkins Loans - Stafford Loans |

|

|

|

Federal Grants and Loans available for graduate students.

|

- TEACH Grant

- PLUS (parent loans) - Perkins Loans - Stafford Loans |

|

|

|

Federal Grants and Loans available for Part-Time students.

|

- Pell Grant

- Federal Supplemental Educational Opportunity Grants |

|

|

|

Federal Grants and Loans available for Half-Time students.

|

- Pell Grant

- Federal Supplemental Educational Opportunity Grants - TEACH Grant - PLUS (parent loans) - Perkins Loans - Stafford Loans |

|

|

|

Federal Grants and Loans available for Full-Time students.

|

- Pell Grant

- Federal Supplemental Educational Opportunity Grants - Academic Competitiveness Grant - Smart Grant - TEACH Grant - PLUS (parent loans) - Perkins Loans - Stafford Loans |

|

|

|

College Work-Study Programs

|

- Eligible students are provided employment, which may be on- or off-campus

- Limit on the number of hours worked, which is based on course load and academic progress. - Federal funds are used by individual schools to administer the program. - Undergraduate students are paid by the hour. - Graduate students may be paid by the hour or by salary. Eligibility: - Based on financial need - Undergraduate and graduate - Full and part-time |

|

|

|

State-Funded Financial Aid for Education

|

- Types of aid available vary from state to state

|

|

|

|

Divorce/Remarriage Planning

3 Major Areas of Concern with Divorce Planning |

1. Income

2. Property distribution 3. Child custody. |

|

|

|

Divorce/Remarriage Planning

Income Concerns / Topics |

- Income that was available to support one household must now be used, in some manner, to support two households.

- The divorce agreement often provides maintenance for the spouse who earned less income during the marriage and adequate financial support for any minor children. - Social Security Concerns - If the couple was married for ten years or more, each person may choose between their own Social Security retirement benefits or 50% of those of the ex-spouse. - If there has been more than one ten-year marriage for one or both of the divorcing spouses, each individual may choose the spouse’s benefits or their own, whichever is greater. |

|

|

|

Recommendations that will ease the transition of divorce a Financial Planner can make:

|

- Each person have at least one credit card in his or her name to establish a personal credit history

- Each person should have a liquid cash account in his or her name instead of having all accounts in both names. - Each spouse should be involved in the month-to¬month finances of running the home |

|

|

|

Remarriage Issues

|

- The names of beneficiaries on life insurance policies obtained during a prior marriage may have to be changed.

- Many divorce settlements require that certain amounts of life insurance be maintained for the ex-spouse or for child support obligations. - Changing property titles to include a new spouse, or to balance the estate and minimize estate taxes, may result in a loss of premarital property - Lack of estate planning may disinherit an individual's children |

|

|

|

Charitable Planning

|

- Charitable giving is an important part of some clients’ financial plans.

- Requires provisions in the will, and may require specialized trust documents as well. - help the client balance charitable giving with the need to meet basic family financial obligations. |

|

|

|

Needs of the Dependent Adult or Disabled Child

|

- clients who support dependent adults or disabled children need to plan for their care in the event of death

- Families establish special trusts to take care of dependent individuals for as long as they live. - A trust that meets certain requirements may still allow the dependent person to receive state-provided support without having to be totally impoverished. - Recommend an attorney to prepare trusts. |

|

|

|

Closely Held Business Planning

|

- Succession planning is key

|

|

|

|

6 Ways to Fund Education

|

1. Direct transfer of funds

2. Custodianship 3. Minor’s trust 4. Current income trust 5. Crummey invasion trust 6. Scholarships |

|

|

|

Provide examples of information that is gathered the GENERAL INFORMATION section of the survey form and how it is used (6)

|

Items collected:

1. Name, address, telephone number 2. Date prepared 3. Dates of birth for all family members 4. Social Security numbers 5. Health problems 6. Remarks |

1. Name, address, telephone number - Identification purposes

2. Date prepared - Identifies date at which data is correct; used in constructing financial statements 3. Dates of birth for all family members - Helps in determining time remaining before retirement, children’s education funding, insurability, life expectancies, insurance needs with regard to planning for dependents, etc. 4. Social Security numbers - Identification purposes, tax purposes, to determine SS benefits available, etc. 5. Health problems - Management of personal risks, insurability, care of an incapacitated dependent in the event of a provider’s disability or death, etc. 6. Remarks - Indicate special needs of client or dependents |

|

|

Provide examples of information that is gathered the OTHER ADVISORS section of the survey form and how it is used.

|

- Information for:

accountant,attorney, banker, broker, insurance agents, trust officer, and other advisors Items collected: 1. Names 2. Addresses 3. Telephone numbers |

|

|

|

Provide examples of information that is gathered the ASSETS section of the survey form and how it is used (6).

|

Items collected:

1. Title of Assets 2. Date property was acquired 3. Cost or basis 4. Current fair market value 5. Encumbrances 6. Current yield |

1. Title of Assets

- Estate planning 2. Date property was acquired - Income and estate tax purposes - Evaluating the performance of the investment 3. Cost or basis - Income and estate tax purposes - Evaluating the performance of the investment 4. Current fair market value - Evaluating performance of invested assets - Estate tax implications - Value used in the statement of financial position 5. Encumbrances - Assess the level of debt - income tax implications - debt balances presented on statement of financial position - debt payments presented on cash flow statement 6. Current yield - Evaluating performance and appropriateness of investments - Inflows from investments are presented on the cash flow statement |

|

|

Provide examples of information that is gathered the DEBT section of the survey form and how it is used (6).

|

Items collected:

1. Date incurred 2. Original amount 3. Current balance 4 Payments 5. Maturity 6. Interest rate |

Used to: - Assess expenses and level of debt, estate reduction, duration of expense, etc. - Debt balances are presented on the statement of financial position - Past payments to reduce debt are presented on the cash flow statement - Future payments are presented on projected cash flow statements or budgets |

|

|

Provide examples of information that is gathered the LIFE INSURANCE section of the survey form and how it is used (8).

|

1. Type of policy

2. Ownership 3. Insured 4. Beneficiary 5. Premium and Dividend Option 6. Current cash value 7. Policy loan outstanding 8. Face amount |

1. Type of policy

- Evaluate appropriateness of policy type - Identification of pertinent features 2. Ownership - Estate taxation - Determination of rights 3. Insured - Determine life covered 4. Beneficiary - Evaluation of estate distribution consistent with client wishes 5. Premium and Dividend Option - Evaluate appropriateness of policy - Determining expenses and income 6. Current cash value - Determine financial resources potentially available to achieve goals - Estate tax implications for policies owned on others - Cash Values presented on the statement of financial position 7/ Policy loan outstanding - Determine adequacy of distributions to beneficiary in accordance with client’s wishes - Policy loans are deducted from the face amount of insurance prior to distribution to a beneficiary 8. Face amount - Determine adequacy/appropriateness of distributions to beneficiary |

|

|

Provide examples of information that is gathered the INCOME section of the survey form and how it is used (2).

|

1. Income sources type

- Salary, self- employment income, other; active, passive, or portfolio 2. Income Source Amounts |

Assess:

- Importance of particular income - Whether such income is source to client - Whether expected to continue - Basis for planning future consumption and savings to enable achievement of goals - Whether the income is active, passive, and portfolio designations are important for tax purposes; income is presented on the cash flow statement |

|

|

Provide examples of information that is gathered the OUTLAY DATA section of the survey form and how it is used (2).

|

1. Savings and investment allocations

2. Budgeting |

1. Savings and investment allocations

- Reinforce need to “pay yourself first” to achieve goals - Assess client’s predisposition toward saving and ability to meet savings goals 2. Budgeting - Establishes whether clients would like to have a budget constructed - Existing budget information enables the planner to assess values and determine client’s discipline with regard to saving and consumption goals |

|

|

Provide examples of information that is gathered the SUBJECTIVE INVESTMENT DATA section of the survey form and how it is used (6).

|

1. Client’s satisfaction with current/

previous investments 2. Level of comfort with various investments 3. Risk tolerance 4. Investment goals 5. Decision-making process used for selecting investments 6. Earmarking of assets |

Helpful in constructing investment portfolio consistent with client’s needs, goals, and risk tolerance level

|

|

|

Provide examples of information that is gathered the ESTATE PLANNING DATA section of the survey form and how it is used (6).

|

1. Existence of wills and/or trusts

2. Receipt of trust income by client 3. Potential for receipt of property via remainder interests, inheritances 4. Specific wishes of client Regarding estate distribution; needs (financial and otherwise) of dependents in the event of client’s death 5. Client’s projections of inflation, investment return anticipated 6. Information on gifts made |

1. Existence of wills and/or trusts

- Assess whether estate distribution plans are current and consistent with client wishes 2. Receipt of trust income by client - Provides understanding of income received - reported on cash flow statement 3. Potential for receipt of property via remainder interests, inheritances - Assess future ability to achieve financial goals 4. Specific wishes of client Regarding estate distribution; needs (financial and otherwise) of dependents in the event of client’s death -Assess whether current distribution plans are appropriate - determine if support required for dependents is consistent with client goals 5. Client’s projections of inflation, investment return anticipated - Establish planning assumptions to make projections 6. Information on gifts made - Estate taxation purposes |

|

|

Provide examples of information that is gathered the RETIREMENT PLANNING DATA section of the survey form and how it is used (2).

|

1. Client’s plans for retirement (timing,

lifestyle, income needed) 2. Sources of income |

1. Client’s plans for retirement (timing lifestyle, income needed)

- Determine what resources will be needed at retirement 2. Sources of income - Determine what resources are currently in place to fund retirement (vested benefits from pension plans are included in the statement of financial position) |

|

|

Provide examples of information that is gathered the MISCELLANEOUS FINANCIAL GOALS section of the survey form and how it is used (4).

|

Special goals that the client wishes to achieve as a result of financial

planning: 1. Type 2. Amount 3. Timing 4. Importance |

Inclusion in analysis, development of

recommendations |

|

|

Provide examples of information that is gathered the DISABILITY INSURANCE section of the survey form and how it is used (2).

|

1. Anticipated income required/desired by client in the event of disability

2. Potential sources of income available in the event of disability |

1. Anticipated income required/desired by client in the event of disability

- Determine disability income needs 2. Potential sources of income available in the event of disability - Determine if resources in place are adequate |

|

|

Provide examples of information that is gathered the MEDICAL INSURANCE section of the survey form and how it is used (1).

|

Information on medical expense plan currently held

|

Determine:

- If medical expense coverage is adequate/appropriate - Impact on expenses |

|

|

Provide examples of information that is gathered the EDUCATION DATA section of the survey form and how it is used (2).

|

1. Potential cost

2. Steps already taken to prepare for costs |

Enables planner to focus on most important goals of the client, particularly in cases where all goals cannot be achieved within the client’s

desired time frame |

|

|

what types of documents typically are gathered from the client before

constructing a comprehensive financial plan (10)? And why obtain them? |

1. Wills

2. Instructions to executor 3. Trust agreements 4. Past three tax returns 5. Insurance policies 6. Employee benefit booklets 7. Retirement plans 8. Bank statements/cancelled checks 9. Investment statements 10. Prospectuses |

1. Wills

- Verify that wills in place match client desires 2. Instructions to executor - Establish currency of information 3. Trust agreements - Analyze current documents to verify consistency with client desires 4. Past three tax returns - Analyze and verify client’s income and tax trends 5. Insurance policies - Evaluate specific provisions of each policy 6. Employee benefit booklets - Verify and analyze current client benefits 7. Retirement plans - Verify and analyze current value of plan benefits 8. Bank statements/cancelled checks - Identify spending patterns; verify income and expenses 9. Investment statements - Obtain current valuation, basis, etc. 10. Prospectuses - Analyze and understand existing portfolio |

|

|

Identify items that typically are placed under the CASH AND CASH EQUIVALENT asset category on the statement of financial position (6).

1. Cash/cash equivalents 2. |

1. Cash

2. Checking account 3. Savings account 4. Money market fund 5. Cash surrender value of life insurance (could also be investment asset - esp. variable life) 6. certificates of deposit (if close to maturity or if penalty for early withdrawal is low) |

|

|

|

Identify items that typically are placed under the INVESTED ASSETS asset category on the statement of financial position (9).

|

1. Stocks

2. Bonds 3. Collectibles for investment purposes 4. Real estate other than residence 5. IRAs 6. Vested pension benefits 7. Mutual funds 8. CDs 9. Life Insurance cash value |

|

|

|

Identify items that typically are placed under the USE ASSETS asset category on the statement of financial position (4)

|

1. Residence

2. Automobiles 3. Personal property 4. Collectibles for personal enjoyment, etc. |

|

|

|

Identify items that typically are placed under the INFLOWS category in the cash flow statement (9).

|

1. Gross salaries

2. Interest income 3. Dividend income 4. Withdrawals from savings 5. Liquidation of investments 6. Funds received as a result of borrowing 7. Trust income 8. Alimony received 9. Insurance proceeds received |

|

|

|

Identify items that typically are placed under the FIXED OUTFLOWS category in the cash flow statement (4).

|

Predictable, recurring outflows

1. Mortgage Payments 2. Insurance premiums 3. Car loan payments 4. Some income taxes may be put here |

|

|

|

Identify items that typically are placed under the VARIABLE OUTFLOWS category in the cash flow statement (6).

|

1. Food

2. Transportation 3. Entertainment 4. Household expenses 5. Clothing 6. Some income taxes |

|

|

|

How might the stability of income and number of sources of income

affect a client’s overall financial condition? |

The greater the stability of income and the greater the number of sources of income, the stronger the client is financially.

- The more diverse the income, the more flexibility there is in budgeting. - Emergency fund amount reflects the stability of the client’s income sources |

|

|

|

The rule of thumb suggested in regard to saving and investing income

is _______ of ______ income. |

The rule of thumb suggested in regard to saving and investing income

is 5–10% of gross income. |

|

|

|

What symptoms frequently are present if clients are not living within

their means (4)? |

1. Heavy consumer debt and/or borrowing to make ends meet

2. Withdrawals from savings to meet regular living expenses 3. High miscellaneous expenditures 4. Inability to save |

|

|

|

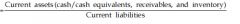

Current Ratio

|

- The current ratio measures a firm’s ability to satisfy current liabilities

with current assets. |

|

|

|

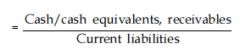

Acid Test Ratio

|

- The acid test ratio measures a firm’s ability to satisfy current liabilities

with its most liquid assets (i.e., without liquidating inventory). |

|

|

|

What are some uses for budgeting?

|

1. To control and monitor household expenses

2. Accomplish wealth accumulation and savings goals 3. Monitor investment performance |

|

|

|

Rules of thumb that may be used to assess whether Housing debt is excessive.

|

- No more than 28% of

the owners’ gross income. (includes principal, interest, taxes, insurance) association fees, etc.) |

|

|

|

Rules of thumb that may be used to assess whether Total monthly debt payments are excessive.

|

- No more than 36% of gross monthly income.

|

|

|

|

Rules of thumb that may be used to assess whether Consumer Debt payments are excessive.

|

- should not exceed 20% of net monthly income

(total income minus FICA and state, federal, and any local taxes) |

|

|

|

Grace period (credit card)

|

A specified period for which no interest is charged on a new purchase.

|

|

|

|

Costs associated with a Consumer Debt (2)

|

1. Interest charges

2. Fees |

|

|

|

Costs associated with a Home mortgage (5)

|

1. Loan origination fees

2. Appraisal fees 3. Credit reporting costs 4. Title search costs 5. Interest charges |

|

|

|

Benefits of Consumer Debt (2)

|

1. Ability to purchase products and services immediately

2. Convenience |

|

|

|

Benefits of a Home mortgage

|

1. Allows people who would not otherwise be able to afford a home to purchase a home

2. Tax benefits 3. May appreciate in value |

|

|

|

Home equity is one potential source of funding for financial goals.

What means may be used to access home equity? |

1. Reverse mortgage

2. Home equity loan 3. Selling the home |

|

|

|

Explain the difference between open-end and closed-end leases.

|

An open-end lease includes the possibility that the lessee may face additional expense at the termination of the lease.

In a closed-end lease, the lessee generally is free to walk away from the leased asset at the end of the lease without being assessed any additional costs. |

|

|

|

Funding College Education

Characteristics of DIRECT TRANSFER OF FUNDS |

1. Simple

2. Inexpensive 3. Avoids taxation of income at parents’ rate (with the exception of the kiddie tax) 4. Works best using investment vehicles that defer taxation, i.e., Series EE bonds |

|

|

|

Funding College Education

Characteristics of CUSTODIANSHIP |

1. No administrative costs

2. Involves naming manager of property for minor 3. Nearly any type of property may be involved (though some restrictions may apply in states that have adopted only the UGMA) 4. Child has right to receive property upon attaining the age of majority, to use as he or she chooses 5. Does not avoid kiddie tax |

|

|

|

Funding College Education

Characteristics of MINOR'S TRUST |

1. Designed to use annual gift tax exclusion ($13,000 for individuals,

$26,000 for married couples) 2. Gift to individual under age 21 is not considered a gift of a future interest if property and income are payable to child at age 21 3. Escapes kiddie tax but is taxed at trust’s rate, which is a punitive one |

|

|

|

Funding College Education

Characteristics of CURRENT INCOME TRUST |

1. Income must be paid out to beneficiary at least annually

2. Trustee has no discretion regarding accumulation of income 3. More difficult to avoid kiddie tax 4. Trust property need not be distributed to child at a specified age |

|

|

|

Funding College Education

Characteristics of CRUMMEY INVASION TRUST |

1. Beneficiary may withdraw an amount equal to the annual addition

to the trust or the annual gift tax exclusion, whichever is less, during intervals specified in the trust agreement 2. Trust property is distributed to the beneficiary at the age chosen by the grantor 3. Accumulated income is taxed at the trust’s rates |

|

|

|

Funding College Education

Characteristics of SCHOLARSHIPS |

1. Generally for academically or athletically gifted students

2. May be need-based 3. Available through colleges, businesses, foundations, community groups, etc. 4. Continued receipt of monies may be contingent upon fulfilling requirements of provider 5. Receipt of scholarship monies may reduce funds that may be available from other sources, such as the federal government |

|

|

|

How might a parent’s qualified retirement plan be used to fund a

child’s college education? |

- Funds may be borrowed without a premature distribution penalty being assessed. (some plans)

- 72t distributions |

|

|

|

What are key issues that arise when planning for a permanently disabled child or adult?

|

1. financial support

2. living arrangement 3. physical support |

|

|

|

What is involved in “mutually defining” the scope of the engagement with between the financial planner and client?

|

(1) identifying the service(s) to be provided;

(2) disclosing the financial planner’s compensation arrangements; (3) determining the responsibilities of the client and the financial planner; (4) establishing the duration of the engagement; (5) providing any additional information necessary to define or limit the scope of the engagement. The scope can include one or more financial planning subject areas (e.g., estate planning, income tax planning, etc.), and it may change by mutual understanding as the engagement proceeds. |

|

|

|

Rule of thumb for the amount of an emergency reserve?

|

A good rule of thumb is that the client should have the equivalent of three to six months of fixed and variable expenses in liquid accounts for emergencies.

This would exclude the expense of income-related taxes and contributions to savings and investments. |

|

|

|

Opportunity Funds

|

Liquid or semiliquid accounts available for large purchases of a nonemergency nature that the client may wish to make, such as jewelry, furniture, or travel. Such funds would prevent the client from having to borrow to attain these items.

|

|

|

|

2 Rules of thumb in assessing whether a home mortgage will be offered to a prospective borrower.

|

• Monthly housing costs (including principal, interest, taxes, fees, and insurance) should be no more than 28% of the prospective borrower’s gross income.

•Total monthly payment on all debts should be no more than 36% of gross monthly income. According to the underwriting guidelines for Fannie Mae, this includes: - monthly housing expense (including taxes and interest) - monthly payments on installment/revolving credit - monthly mortgage payments on non-income-producing property - monthly alimony, child support, or maintenance payments |

|