![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

3 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

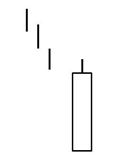

Bullish Belt Hold Line

A bullish belt-hold is a tall white candlestick that opens on, or near, its low and closes well above the opening price and is in a strong trend. Candlestick body should be opposite color of the prevailing trend. |

71% successful. Actual bull market: Bearish reversal 68% of the time (ranking 16). Actual bear market: Bearish reversal 69% of the time (ranking 17). Frequency: 19th out of 103. |

|

|

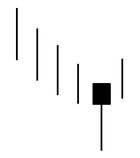

Hammer Occurs after prolonged downtrend. Lower shadow must be twice size of the body. Instrument trades significantly lower after open but rallies into the close. The longer the lower shadow the more significant the candle. The signal does not mean bullish investors have taken full control of a security, it simply indicates that the bulls are strengthening. |

Opening gap confirmation results in the best performance. Trade only if price gaps open higher the day after the hammer. |

|

|

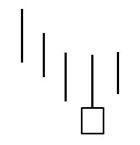

Inverted Hammer The Inverted Hammer looks exactly like a Shooting Star, but forms after a decline or downtrend. Inverted Hammers represent a potential trend reversal or support levels. After a decline, the long upper shadow indicates buying pressure during the session. However, the bulls were not able to sustain this buying pressure and prices closed well off of their highs to create the long upper shadow. Because of this failure, bullish confirmation is required before action. |

51.73% success. |