![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

49 Cards in this Set

- Front

- Back

|

What is the short term? |

Period of time during which one or more of a firms factors of production, are fixed |

|

|

What is the long term? |

When all factors of production are variable and can be changed |

|

|

Which types of cost are effected by both variable and fixed costs |

• Total cost • Average costs |

|

|

Which type of cost is not effected by fixed costs, and only effected by variable costs? |

•Marginal cost

• Therefore an increase in a fixed cost shifts ATC but not MC on a diagram • A rise in variable costs shifts both ATC and MC |

|

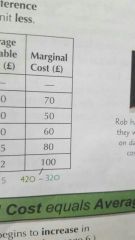

What is the marginal cost at each output? |

|

|

|

Explain the shape of the MC curve |

• Decreases at first, then increases • This is due to the law of diminishing returns which reduces marginal productivity |

|

|

Where does MC meet ATC? |

• At the lowest ATC |

|

|

Why does MC meet ATC here? |

• When MC is less than ATC, the average will be decreasing, because the next unit is cheaper than the original average • When MC is above ATC, the average costs will be increasing. • Therefore, the curve must meet ATC at the lowest point |

|

|

What is marginal product? |

• The additional output gained from adding one unit of a factor of production while other factors remain fixed |

|

|

What is the law of diminishing returns? Use an example |

• When one variable factor is increased while other factors remain fixed, marginal product/return from the variable factor eventually decrease as other factors are limiting. This increases marginal cost

• For example, If Labour is increased while capital and raw materials remain fixed, Output per worker will decrease because there is not enough capital for them to be productive. So each unit costs more to make, MC increases |

|

|

Why does MC increase at first? |

Adding more workers may allow specialisation which improves productivity |

|

|

What does the long run average cost curve show? |

• The minimum possible average cost at every level of output? |

|

|

How does a firm move from the Short run ATC curve to long run one? |

• By increasing all factors of production (All are variable in the long run) |

|

|

What effects the shape of the Long run AC curve? |

• Internal Economies and diseconomies of scale |

|

|

What causes a shift in the Long run average cost curve? Give examples |

External changes

E.g: • Increased taxation shifts LRAC upwards • External economies of scale shifts it downwards • Improvement in technology shifts it downwards |

|

|

What is returns to scale? |

The effect on output when all factors of production are increased |

|

|

Name and explain the three types of returns to scale |

• Increasing RTS = Increasing input leads to a more than proportional increase in output

• Constant RTS = Increasing input increases output proportionally

• Decreasing RTS = Increasing input leads to a less than proportional increase to output |

|

|

What is the link between Returns to scale and economies of scale |

• Increasing RTS reduces average costs, because more output is produced per unit of input. This creates economies of scale

• Reducing RTS increases ATC as less output is produced per unit input. |

|

|

What is the MES? Where does it occur? |

• Minimum efficient scale of production • This is the minimum output required to minimise ATC • It occurs where there is constant returns to scale, when a firm no longer has economies of scale, but is not yet experiencing diseconomies of scale |

|

|

What is the effect of an industries fixed costs on its MES? |

• Higher fixes cost = Higher MES as it needs to be spread across a greater output

• High fixed costs therefore favours big firms who can increase output |

|

|

Why is a price takers demand curve perfectly elastic? |

• If they increase the price demand falls to zero as there are lots of better value options |

|

|

Why does MR = AR for price takers? |

• Each additional unit provides the exact same amount of revenue, which is the price |

|

|

What are the characteristics for Total Revenue for price takers? |

• Straight line with a constant gradient, Because each additional output provides the same increase in revenue

• TR increases proportionally to output |

|

|

At what PED is TR maximised |

-1 |

|

|

Why? |

• Above this point (Higher price) demand is elastic, So it is better to reduce the price to increase revenue

• Below this point, demand is inelastic, so revenue would fall by reducing the price any further |

|

|

What is the profit maximising level and why? |

•MC = MR

Because if MC is higher, they can reduce output to increase profit

If MR is higher, they can increase output to increase profits |

|

|

What are the three most common objectives of firms, and at which points do they occur? |

1) Profit maximisation, MC = MR

2) Sales maximisation, AR = AC

3) Revenue Maximisation, MR = 0 |

|

|

Why does sales maximisation occur at AR = AC |

a loss

This is the lowest price a firm can sell at without making a loss So sales are maximised (As it increases demand) while being sustainable in the long run (Due to normal profit) a loss So sales are maximised (As it increases demand) while being sustainable in the long run (Due to normal profit) So sales are maximised (As it increases demand) while being sustainable in the long run (Due to normal profit) |

|

|

Why is profit maximisation usually a long term objective? |

• Because to maximise profits in the long run, profits are sacrificed in the short run, for example to help enter a marker or increase market share

• Also because brand recognition takes time

• Economies of scale are long term |

|

|

What are the advantages of sales maximisation? |

+ Increase brand awareness + Increases market share + Makes it easier to obtain loans |

|

|

What is divorce of ownership from control? |

• Whereby owners are no longer in complete control of the business and how its run

• This may be due to sale of shares, or delegation to managers |

|

|

What is the effect of this on objectives? |

• Different directors and stake holders have different objectives

• If pay/bonuses for managers is related to revenue/sales, then they aim to maximise those instead of profit • Some directors aim to maximise sales to increase the size of the business as it will help further their careers |

|

|

How can owners retain control of objectives? |

• By offering incentives to maximise profits E.g. Giving employees free shares in the business or linking their bonus to profits |

|

|

What is satisficing? Give an example |

• Whereby owners of a firm dont maximise anything but instead do enough to satisfy the conflicting objectives of all stake holders.

•E.g. Making enough profit to satisfy shareholders but sacrificing some profit to provide higher wages for employees so they dont leave |

|

|

Why do firms want to grow? |

• Increase economies of scale • Increase market share and sales • Gain Monopoly (Price setting power)

All helps to increase profit |

|

|

What is growth? |

• Increase in output/scale of operations |

|

|

What is internal growth? |

Growth as a result of increasing factors of production, E.g Hiring more workers or building a bigger factory |

|

|

What is the benefit and drawback of internal growth |

+ Maintain control over how the firm grows - Very slow |

|

|

What is external growth? |

• Growth due to a merger or takeover |

|

|

What is the difference between a meger and takeover? |

• Merger = Two firms combining into one bigger firm. Both sets of directors remain

• Takeover = One firm buying another firm, Owners of original firm are in control |

|

|

What are the benefits and drawbacks of inorganic growth? |

+ Quicker + May be cheaper + Can gain experience and expertise quickly if entering a new industry

- Heavily regulated by competition commission, may not go through - Diseconomies of scale |

|

|

What are the three types of external growth? |

• Vertical Integration (Forwards/Backwards) • Horizonal integration • Conglomerate |

|

|

What are the advantages of horizontal integration? |

+ Increases economies of scale + Reduces competition + Increases market share - Monopoly power |

|

|

What are the advantages of vertical integration? |

+ Prevents access to suppliers or retailers for competitors + Control over production process, Can ensure higher quality + More efficient production, cheaper supplies |

|

|

What is a conglomerate, What are the benefits? |

• Combining firms from two completely unrelated industries

+ Diversifies risk (Risk taking EoS), Profit from one firm covers losses from the other + Allows profits from one to be invested in the other |

|

|

What is a demerger, why does it occur? |

• When a firm sells of part of its business to become separate firms

• May occur because a merger led to diseconomies of scale, or inexperience in a new market causes inefficiency • Splitting into separate firms allows each to focus on separate markets, improving efficiency • Selling off weak parts of this business which are making losses, prevents overall losses |

|

|

How can new technology effect the growth of firms? |

• It allows new products and new markets to be created

• New products may boost demand for other products, E.g. social media increases demand for computers. This is synergy demand

• Or new goods can reduce demand for other products, E.g. Online film sites like netflix put film rental shops out if business, Online shopping damages high street shops |

|

|

What is a niche market? |

A very small market |

|

|

Why do some firms stay small? |

• Avoid diseconomies of scale • Niche market, no reason to invest as theres no potential for demand • Work load, some owners prefer free time to profit • Avoid legal requirements and tax, E.g. VAT and submitting accounts for auditing • If they cant raise the finance to expand |