![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

49 Cards in this Set

- Front

- Back

|

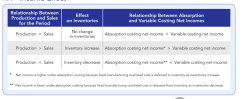

Absorption (Full Costing) Approach |

- GAAP - capitalized fixed factory overhead as a part of inventory |

|

|

Variable (Direct Costing) Approach |

- contribution margins compatible w/ breakeven analysis -fixed factory overhead is excluded from inventory and treated as a period cost: |

|

|

Income Effect |

|

|

|

Cost-Volume- Profit Analysis Assumptions |

- costs are either variable or fixed, with volume the only relevant factor - in relation to production volume, cost behaviors will remain constant --> FC remain fixed in total based on production - the longer/shorter the time period, the greater the percentage of variable/fixed costs |

|

|

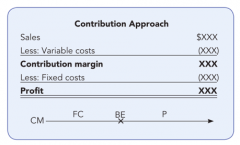

Breakeven Analysis |

-determines the sales required ($/units) to result in zero profit or loss from operations - each additional unit sold will increase net income by the amount of the CM/unit |

|

|

Contribution Approach |

|

|

|

Breakeven Point in Units |

= total FC/ CM per unit |

|

|

Breakeven point in dollars |

= unit price X breakeven point in units |

|

|

Contribution margin ratio approach |

= total FC/ CM ratio |

|

|

CM Ratio |

= CM/sales |

|

|

Required Sales in Units |

= (total FC + desired profit)/ CM per unit |

|

|

Required Sales in Dollars |

= (total FC + desired profit)/ CM % |

|

|

Margin of Safety |

- excess of sales over breakeven sales = [tot. sales ($)]- [BE sales ($)] % = margin of safety ($)/ tot. sales |

|

|

Target Costing |

- used to establish the product cost allowed that ensures both total sales volume and profitability per unit - target cost will be equal to market price less required profit |

|

|

Transfer Pricing Non-Global Perspective |

-price charged for the sale/purchase of a product internally (between 2 divisions within one overall company) - prices are set based on the following strategies: negotiated price, market price and cost |

|

|

Transfer Pricing Global Perspective |

- methodology for allocating profits or losses among related entities within the same corporation (or legal group) in different tax jurisdictions - should approximate the prices for comparable transactions between unrelated parties - Comparability assessed on following strategies; - transactional methods (comparable uncontrolled price, resale price, gross margin, cost plus) - profitability methods (comparable profits, transactional net margin, comparable profit split, residual profit split) |

|

|

Special Orders |

- infrequent opportunities that require the firm to decide if a special order should be accepted or rejected Decision rule: accept, if price > relevant costs |

|

|

Presumed Excess Capacity Special Orders |

- incremental costs of the order to the incremental revenue generated by the order - if selling price per unit is greater than the variable cost per unit, CM will increase and special order should be accepted - fixed costs are sunk and will not be relevant to these decisions |

|

|

Presumed Full Capacity Special Orders |

- VC/unit + opp. cost/unit - opportunity cost will be the contribution margin that would have been produced if the special order were not accepted - production that is forfeited to produce the special order is referred to as the next best alternative used of the facility |

|

|

Excess Capacity Make or Buy Decisions |

- cost of making the product internally is the cost (relevant costs) that will be avoided (saved) if product is not made, this will be the maximum outside purchase price - compare VC to the purchase price and select the cheapest alternative Decision Rule: MAKE, if relevant cost < outside purchase price |

|

|

No Excess Capacity Make or Buy Decisions |

- cost of making the product internally is the cost that will be avoided (saved) if the product is not made PLUS the opportunity cost associated with the decision - compare the variable costs + opportunity cost to the purchase price and select the cheapest alternative |

|

|

Sell or Process Further |

- mgmt's decision as to sell at the split-off point involves comparing incremental revenues and incremental costs generated after the split-off point Separable costs (incurred after split-off) are relevant, while joint costs (incurred prior to split-off) are NOT relevant SELL: incremental costs > incremental revenues Process Further: Incremental revenues > incremental costs |

|

|

Keep or Drop a Segment |

- avoidable fixed costs go away if the segment is dropped and are therefore relevant - unavoidable fixed costs will be reallocated to other products and continue to be incurred by the company even if the segment is dropped, therefore making them irrelevant Keep: Lost CM (cost of discontinuing) > avoidable fixed costs Drop: Avoidable fixed costs > Lost CM |

|

|

Simple Linear Regression |

y = a + bx total cost = fixed cost + variable rate * units |

|

|

Coefficient of Correlation (r) |

- measures the strength of the linear relationship between the independent variable (x) and the dependent variable (y) - standard range: -1 to +1 The closer to +/-1, stronger the relationship between X&Y |

|

|

Coefficient of Determination (R^2) |

- the portion of the total variation in the dependent variable (y) explained by the independent variable (x) - value lies between 0 and 1 - the higher the value, the greater proportion of the total variation in y that is explained by the variation in x - positive means the move in the same direction, we expect this relationship - EX: 81% of variation in Y is explained by the change in X |

|

|

Learning Curve Analysis |

- per-unit labor hours will decline as workers become more familiar with a specific task or production process EX: if takes 30 hrs to produce 1st unit of a product and 18hrs to produce the second the learning curve rate is 80% [(30+18)/(30+30)] and average time is 24hrs/unit |

|

|

High-Low Method |

- used to estimate the fixed and variable portions of cost - assumes the difference between costs at the highest and lowest production levels are due directly to variable costs (Ch - Cl)/(Activities.h - Activities.l) = changes in costs/ changes in activities = VC/unit |

|

|

Computation of Total Fixed Costs |

Total cost - (VC/unit * activity) = FC |

|

|

Short-Term Financing |

- anticipate higher levels of temporary working capital Advantages: - increased liquidity, higher profitability, lower financing costs Disadvantages: - higher interest rate risk (rate goes up in future) and reduced capital availability (NOT locking in LT fixed rate loan - usually cheaper than LT |

|

|

Long-Term Financing |

- anticipate higher levels of 'permanent' working capital Advantages: - lower interest rate risk and increased capital availability Disadvantages: - reduced profitability (b/c higher financing costs), decreased liquidity, and higher financing costs (as PPE ^, its non- CA, less liquid) |

|

|

Working Capital Financing Methods of ST Financing |

- entails CA being financed with trade a/p and accrued liabilities (salaries of employees) |

|

|

Letter of Credit Methods of ST Financing |

- 3rd party guarantee (e.g. a bank) - required by a vendor before they extend credit, makes borrower more credit worthy, lowers cost of borrowing |

|

|

Line of Credit Methods of ST Financing |

- revolving line of ST borrowing w/ a financial institution |

|

|

Operating Leases Methods of LT Financing |

- 'off b/s financing' b/c there is no b/s effect for the lessee (just rent expense recorded on I/S) |

|

|

Capital Leases Methods of LT Financing |

- transfers 'substantially all' of the risks and benefits of ownership associated the lease (asset) to the lessee - lessee records both an asset and liability on the balance sheet and recognizes both depreciation expense and interest expense on the I/S |

|

|

Debentures |

- unsecured bonds that are backed by the full faith and credit of the issuer |

|

|

Debentures & Bonds |

- as debt goes up, credit-worthiness goes down ,therefore credit risk goes up |

|

|

Subordinated Debentures |

- unsecured obligations that rank behind senior fixed-income securities in the even of an issuer liquidation - expose lenders to risk ^, thus cost ^ |

|

|

Income Bonds |

- fixed-income securities that pay interest only upon achievement of target income levels |

|

|

Mortgage Bonds |

- long term loans that are secured by residential or commercial real property - secured lowers the cost of borrowing |

|

|

Preferred Stock Equity Financing |

- hybrid security that has similar features to both debt and equity - shareholders usually receive a FIXED dividend payment and in the even of an issuer liquidation, rank higher than common stockholders |

|

|

Common Stock Equity Financing |

- basic equity ownership of a corporation - last claim to the issuer's assets in the event of a liquidation - assumes the most risk, but the highest potential returns -nothing fixed, all variable |

|

|

Debt Covenants |

- creditors use debt covenants in their lending agreements to protect their interests by limiting or prohibiting the action of the debtor that might negatively affect the position of the creditors - can be positive (i.e., issuer must provide periodic f/s) - can be negative (i.e., restriction on asset sales) - can be financial (i.e., minimum interest coverage ratio) |

|

|

After-Tax Costs |

(1 - tax rate) X tax-deductible cash expense = |

|

|

After-Tax Benefits |

-cost savings from an investment (1- tax rate) X taxable cash receipt = |

|

|

Depreciation Tax Shield |

-does not directly affect cash flows, but reduces the amount of income tax a co. will pay tax rate X depreciation expense = |

|

|

Discounted Cash Flow valuation methods |

- use the time value of money concepts to measure the present value of cash inflows/outflows expected from a project Factors that must be known: - dollar amount of initial investment - rate of return desired for project (discount/hurdle rate) - dollar amount of future cash inflows/outflows (net of related income tax effects) |

|

|

Net Present Value |

- best technique to evaluate capital projects - |