![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

299 Cards in this Set

- Front

- Back

|

MD&A

|

company management discusses results of operations, capital resources, and liquidity

|

|

|

Basic Accounting Equation

|

Assets = Liabilities + Owners’ Equity

|

|

|

Assets (Balance Sheet Make-up)

|

Current Assets + Long Term Assets

|

|

|

Types of Audit Opinion

|

1.) Standard

|

|

|

Financial Accounting Principles

|

Historical Cost

|

|

|

Asset Definition

|

probable future economic benefit.

|

|

|

Single Step Income Statement

|

Does not show Gross Profit

|

|

|

What is a Conservative Revenue Recognition Method for LT Projects

|

Completed Contract: Recognizes revenue only when project is completed.

However, costs are still being incurred throughout the life of the Project. |

|

|

Cost of Goods Available for Sale

|

Beg. Inventory + Changes in Inventory

|

|

|

FIFO (Definition)

|

the First costs In to inventory are the First costs Out to COGS

|

|

|

LIFO v.s. FIFO

|

FIFO costing results in the best ending Inventory value (and balance sheet) since the most recent costs are represented

|

|

|

COGS (FIFO)

|

COGS LIFO – (LIFO Reserve (EOP) – LIFO Reserve (BOP))

|

|

|

Inventory under IFRS and U.S. GAAP includes

|

Cost of Inventory

|

|

|

Accelerated Depreciation Formula

|

Book Value t-1 * 2/L

|

|

|

Computer Software Expense

|

Expense software development costs as incurred.

|

|

|

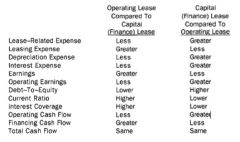

Capital (Finance) Lease Criteria

|

if any of the four apply:

(1) Lease transfers ownership of the leased asset at the end of the lease U term (2) Lease contains a "bargain" purchase option. (3) Lease term is for 75% or more of the leased asset's life. (4) Discounted present value of the contractual lease payments, as of the start of the lease, is 90% or more of the fair market value of the leased asset at that time. |

|

|

Steps in a Financial Statement Analysis Framework

|

1.) Articulate the purpose and context of the analysis

2.) Collect data 3.) Process data 4.) Analyze/interpret the processed data 5.) Develop and communicate conclusions and recommendations 6.) Follow up |

|

|

Overall Purpose of Analysis

|

1.) NOT just WHAT happened, but WHY did it happen

2.) did it advanced the firm’s strategy 3.) need for an effective (credible) story line |

|

|

MD&A Content

|

1.) Results of Operations

2.) Capital Resources & Liquidity |

|

|

Results of Operations

|

discuss trends and major expense categories. If material, discuss discontinued operations, extraordinary operations, and any other unusual item

|

|

|

Capital Resources & Liquidity

|

discuss cash flow trends: operating, investing, and financing cash flows

|

|

|

Footnotes vs. MD&A

|

-Footnotes: provide additional factual information about past results.

-MD&A: provides more management opinions about results and is somewhat forward looking. |

|

|

What are the 5 Major Financial Statement Sections in Accounting

|

1.) Assets

2.) Liabilities 3.) Owner’s Equity 4.) Revenues – inflows of economic resources to the company. 5.) Expenses – outflows of economic resources and/or increases in liabilities. |

|

|

Liabilities & Equity (Balance Sheet Make-Up)

|

Current Liabilities + Long Term Liabilities + Equity

|

|

|

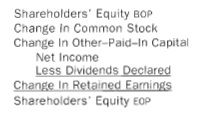

Stockholders’ Equity Equitation (End of Period)

|

Stock Holder's Equity (beg) + chg in Common Stock + chg in Other Paid in Capital + Net Income - Dividends Paid + Chg in Retained Earnings

|

|

|

Accrual Accounting

|

Recognize revenues and expenses as goods or services are provided rather than when cash is received

-Match expenses to corresponding revenues |

|

|

Standard Audit Opinion

|

unqualified opinion or “clean” opinion – statements comply with GAAP

|

|

|

Financial Accounting Principles

|

Historical Cost

Revenue Recognition Matching Principle |

|

|

Materiality

|

Full disclosure is required for items that have sufficient size and importance for the business entity.

For immaterial items, more approximate disclosure is required. |

|

|

Qualities of Accounting Information

|

1.) Relevance

2.) Reliability 3.) Comparabilty |

|

|

Asset Definition

|

probable future economic benefit.

|

|

|

Liability

|

probable future sacrifice of economic benefits

|

|

|

Footnotes in the financial statements

|

provide additional detail of Company Financial Statements

Choices are all legitimate, but can have a major impact on reported earnings, NOT cash flow |

|

|

Financial Accounting Choices

|

Liberal/Aggressive or Conservative

|

|

|

When to recognize a Loss

|

when the loss is “probable” AND can be reasonably estimated

|

|

|

When to recognize a Gain

|

Recognize a Gain when realized

|

|

|

Uncollectable A/R

|

Direct write-off → Liberal or aggressive

Allowance method → Conservative |

|

|

Focus of Inventory Costing

|

Costs either stay in Inventory

or move to COGS on the Income Statement |

|

|

LIFO (Definition)

|

the Last costs In to inventory are the First costs Out to COGS

|

|

|

Average Cost

|

an average cost per unit is developed to determine COGS and Inventory values

|

|

|

LIFO LIQUIDATION

|

Inventory level decreases and price levels are increasing,

lots of old, low cost layers leave inventory and REDUCE the COGS Result is a large increase in earnings |

|

|

FIFO Inventory

|

LIFO inventory + LIFO Reserve

|

|

|

Decline in LIFO Reserve

|

-Price declines

-Liquidation of inventories in periods of rising prices |

|

|

Inventory Carry Value

|

Inventory should be carried at the lower of cost or market.

If inventory is over valued, it should be written down to current market value, with a charge to the income statement. IFRS does permit reversal of inventory writedowns, but this is the max writeup |

|

|

Total Depreciation

|

Cost – Salvage Value

|

|

|

Depreciate Methods

|

Straight Line (STL)

Accelerated |

|

|

Straight Line Depreciate Formula

|

(K – S) * 1/ L

|

|

|

Book Value of an asset

|

Historical Cost – Accumulated Depreciation

|

|

|

Units-of-Production Depreciation

|

depends on the no. of units produced to the total lifetime expected production

|

|

|

Asset Retirement Obligation (ARO) Definition

|

liability for legally required clean up or asset disposal.

expense over the useful life of the asset. |

|

|

Intangible Assets (Definition)

|

Initially recorded at acquisition cost.

In most cases is amortized over not more than 20 years. U.S. GAAP: can only be written down. IFRS: can be both written down and up. |

|

|

Goodwill

|

Old GAAP: amortize over not more than forty years.

Current GAAP and IFRS: Test Annually for impairment. If impaired, write down (or off) the GW. If NOT impaired, leave on the balance sheet. |

|

|

Leasing

|

Lessee acquires the use of an asset and agrees to make periodic payments.

Lessee prefers to avoid any debt for the asset appearing on their balance sheet. |

|

|

Operating Lease (Definition)

|

a purely rental arrangement.

Income statement expense is equal to the lease payment. No asset and no debt appear on the balance sheet of the lessee for the leased asset. |

|

|

Accrued Interest (Accounting Definition)

|

is noted as INTEREST EXPENSE on the Income Statement.

Money is accrued each year based on the “debt” or lease liability outstanding. |

|

|

Interest Payable (Line Item)

|

a Liability carried forward as it is paid.

|

|

|

Finance Lease Classification by Lessor

|

Sales-type lease if dealer profit.

Direct financing lease if interest income for the dealer, but no dealer profit. |

|

|

Off-Balance Sheet Financing Methods

|

were the use of asset without debt appearing.

Methods: -Operating Lease -Throughput Contract -Take-or-Pay Contract -Joint Venture -Finance Sub. Less than Majority Owned -Sale of Receivables |

|

|

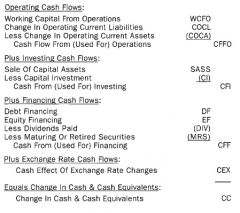

What are the 3 main Components of the Cash Flow Statement

|

(1)Cash Flow From (Used For) Operations (CFFO)

(2) Cash From (Used For) Investing (CFI) (3) Cash From (Used For) Financing (CFF) |

|

|

MANAGEMENT DISCUSSION AND ANALYSIS REPORT

|

SEC requires that a company discuss the follow topics at least once a year.

(1) Results of operations (2) Capital resources and liquidity (3) Favorable and unfavorable trends should be reported |

|

|

Proxy Statement

|

issued in connection with a company's stockholder meeting.

contains information about the company's board members and management, executive compensation, stock options, and major stockholders. Also indicates matters that are subject to a vote at the stockholders' meeting. |

|

|

Five broad groupings of financial statement elements

|

(1) Assets

(2) Liabilities (3) Owners' Equity (4) Revenues (5) Expenses |

|

|

Expanded Accounting Equation

|

Assets + Liabilities + [Contributed Capital + Retained Earnings BOP + Net Income - Dividends Declared]

where: BOP = Beginning of Period |

|

|

Stockholder's Equity Accounting Equation

|

Common Stock (par value) + Other Paid-in Capital + Regained Earnings

|

|

|

Retained Earnings (End of Period) (Formula)

|

Retained Earnings (BOP) + Net Income + Dividends Declared

|

|

|

Other Income Line Item on Income Statement

|

Generally used to display Gains/Losses of Sale of PPE (Property, Plant, & Equipment)

|

|

|

Operating Income (Formula)

|

Revenues (including Depreciation Expense) - Operating Expenses

|

|

|

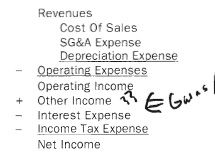

Basic Income Statement Format

|

|

|

|

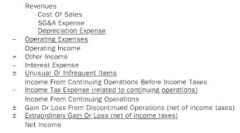

INCOME STATEMENT FORMAT

WITH SPECIAL COMPONENTS OF NET INCOME THAT ARE NON-RECURRING |

|

|

|

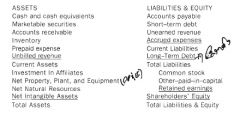

Balance Sheet Basic Format

|

|

|

|

Shareholder's Equity Statement

|

|

|

|

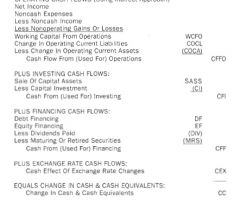

Cash Flow Statement - Basic Format

|

|

|

|

Accrual Accounting

|

involves the recognition of revenues and expenses corresponding to cash inflows and outflows (past, present, and future) as goods and services are provided and used, rather than as cash is received and paid out.

|

|

|

Unearned (Deferred) Revenue (Accounting Classification and Example)

|

Unearned Revenue for a company but receives the cash prior to earning the related revenue.

Example: Magazine Subscription. Classified as a Liability under "Cash Received". |

|

|

What is Un-Billed (Accrued) Revenue Asset

|

Is when you provide a Service but the Client has not paid.

This goes under the "Un-Billed Revenue" Asset, then Accounts Receivable (Asset) once it has been paid. |

|

|

Prepaid Expenses

|

occurs when a company pays cash some time prior to

recognizing the related expense. Ex. Pre-Pay the Rent Filed under the Prepaid Expenses (Asset) then move to related expense once the time is appropriate |

|

|

Accrued Expenses

|

Liability. Basically Billed but has not been paid

|

|

|

FOUR POSSIBLE AUDITOR'S OPINIONS

|

(1) Standard Unqualified Opinion

(2) Qualified Opinion (3) Adverse Opinion (4) Disclaimer Of Opinion ***Only the standard unqualified or "Clean" opinion is desirable*** |

|

|

QUALIFIED Audit OPINION (Definition)

|

Finance Statements PRESENT FAIRLY, in all material respects, the financial position, results of operations and cash flows of the entity in conformity with GAAP, EXCEPT for the matters to which the audit has found.

|

|

|

2 Very Highly Undesirable Audit Results

|

ADVERSE OPINION

DISCLAIMER OF OPINION |

|

|

Sarbanes-Oxley Act

|

requires that a company provide a Management Report On

internal Control, that: 1. States it is management's responsibility to establish and maintain adequate internal control 2. Identifies management's framework for evaluating internal control 3, Includes management's assessment of the effectiveness of the company's internal control over financial reporting 4. Includes a statement that the company's auditors have issued an attestation report on management's assessment 5. Certify that the company's financial statements are fairly presented. |

|

|

6 KEY BASIC FINANCIAL ACCOUNTING PRINCIPLES

|

1. Historical Cost Principle

2. Revenue Recognition Principle 3. Matching Principle 4. Consistency Principle 5. Adequate Disclosure Principle 6. Objectivity Principle |

|

|

3 IMPORTANT FINANCIAL ACCOUNTING MODIFYING CONVENTIONS

|

1.) Materiality

2.) Conservatism 3.) Industry Practices |

|

|

FASB Statement Of Financial Accounting Concepts #2

|

RELEVANT

RELIABLE COMPARABLE CONSISTENT |

|

|

MULTI-STEP FORMAT VS

SINGLE-STEP FORMAT INCOME STATEMENT |

If an Income Statement DOES have a Gross Profit subtotal --> Multi-Step Format

If an Income Statement DOES NOT have a Gross Profit subtotal --> Single-Step Format |

|

|

2 APPROACHES FOR GROUPING OF EXPENSES ON THE INCOME STATEMENT

|

1. Grouping Of Expenses by Nature

2. Grouping Of Expenses by Function |

|

|

NON-CURRENT ASSETS (Definition)

|

assets not expected to be liquidated or used up within one year (or one operating cycle of the company, if longer than one year).

|

|

|

Non-Current (long-term) liabilities

|

are liabilities not expected to be settled within one year (or one operating cycle of the company, if longer than one year).

|

|

|

How should an Analyst Evaluate Cash for a Firm?

|

1. Evaluate the major Sources and uses of Cash:

2. Evaluate the Primary Determinants of Cash Should be within the following areas: a. Operating Cash Flows b. Investing Cash Flows c. Financing Cash Flows |

|

|

How do Liberal Financial Accounting Choices affect Earnings?

|

A more liberal choice among alternative GAAP normally results in in higher current reported earnings.

|

|

|

Quality of Earnings

|

Determined based on if they use Liberal or Conservative Choices.

Liberal= Low Quality Earnings Conservative = High Quality Earnings |

|

|

MAJOR AREAS OF ALTERNATIVE GAAP

|

1. Revenue Recognition methods

2. Uncollected Account Methods 3. Inventory Costing Methods 4. Depreciation Methods 5. Lease Methods 6. Pension Plan Assumptions 7 Other Post Retirement Benefit Rate Assumptions |

|

|

REVENUE RECOGNITION POLICIES FOR LONG-TERM PROJECTS (6 Total)

|

1. Percent of Completion

2. Completed Contract 3. Revenue Recognition Upon Delivery To Customer 4. Revenue Recognition At Some Specified Time After Delivery 5. Revenue Recognition Only As Cash ls Collected After Delivery 6. Revenue Recognition After Cash ls Collected |

|

|

Completed Contract (Recognition Policy)

|

Acceptable to recognize total revenue (and expenses) at completion of project, whether or not all of the three conditions above are satisfied.

|

|

|

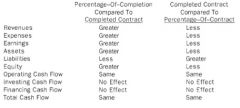

PERCENT OF COMPLETION v.s. COMPLETED ON CONTRACT Policies at Mid-point of Long-term Project

|

|

|

|

Percentage-Of-Completion (Recognition Policy)

|

Acceptable to recognize some revenue during long-term project, along with corresponding expenses and earnings, if:

(1) lengthy protect (2) project contract with stated revenues to be received (3) accurate estimates can be made |

|

|

REVENUE RECOGNTTTON CONDTTTONS

|

Revenue should be recognized in financial accounting when it is earned

|

|

|

When is Revenue is Generally said to be earned?

|

(1) Economic exchange between independent parties

(2) Transaction not subject to revocation (3) Accurate estimates of revenues and expenses (4) Earning process is complete, or virtually complete |

|

|

2 Variations of Revenue Recognition Only As Cash ls Collected After Delivery (Revenue Recognition Policy)

|

1. Installment Method

2. Cost-Recovery-First Method |

|

|

Installment Method of Cash Collected (Revenue Recognition)

|

A constant portion of each dollar collected is recognized as an expense --> Bad Debt Expense

based on projected expense ratio |

|

|

Cost-Recovery-First Method of Cash Collected (Revenue Recognition Policy)

|

The entire amount of each dollar collected is also recognized as

expense and matched against a dollar of revenue, resulting in no gross profit until all costs have been recovered |

|

|

Barter Transaction

|

the direct exchange between two parties of goods or services for other goods or services.

|

|

|

Revenue for the sale equal to the Gross Revenue only if what condition apply?

|

i. Company is primary obligator under sales contract;

ii. Company bears inventory risk and credit risk; and iii. Company has reasonable latitude to establish sales price. -Otherwise, the company should report Revenue for the sale equal to the Net Revenue. |

|

|

RELATIVE IMPACTS OF

DIRECT WRITE-OFF v.s. ALLOWANCE FOR UN-COLLECTIBLE ACCOUNTS |

|

|

|

Cost of Goods Available for Sale (Formula)

|

|

|

|

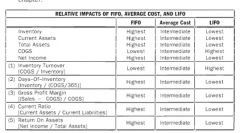

RELATIVE IMPACTS OF FIFO, AVERAGE COST, AND LIFO

IF PRICES INCREASING AND NO INVENTORY LIQUIDATION |

|

|

|

HOW DOES LIFO TO AFFECT EARNINGS

|

normally makes it easier for a company to manage reported earnings than the use of FIFO or Average Cost.

*Now, LIFO is most popular |

|

|

Pro's for Using LIFO Method

|

(1) Inventory carried at lower cost of cost or market

(2) Lower Federal Income Taxes |

|

|

LIFO RESERVE (BOP FORMULA)

|

|

|

|

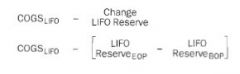

ADJUSTING LIFO COGS

TO FIFO COGS |

|

|

|

GROSS PROFIT MARGIN (Formula)

|

|

|

|

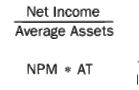

Return of Assets (Ratio Formula)

|

|

|

|

RELATIVE IMPACTS OF FIFO, AVERAGE COST, AND LIFO ON KEY FINANCIAL RATIOS FOR INVENTORY MANAGEMENT

|

|

|

|

Total Deprecation Cost

|

C-S

where: C=Original Cost, S=Estimated Salvage Value |

|

|

What are the Three Depreciation Methods

|

(1) Straight-Line Depreciation

(2) Sum-Of-Years-Digits Depreciation Method (3) Double-Digit-Declining-Balance Depreciation Method |

|

|

Straight-Line Depreciation (Formula)

|

[C-S] * 1/L

Equal Expenses each year where: C=Original Cost, S=Estimated Salvage Value, L=Lifetime of Equipment |

|

|

SUM_OF_YEARS_DIGITS DEPRECIATION (Formula)

|

[C-S] * [L+1-t]/SYD

SYD=[L(L+1)]/2 where: C=Original Cost, S=Estimated Salvage Value, L=Lifetime of Equipment, SYD=Sum of Years Digit |

|

|

Double-Declining-Balance Depreciation (Formula)

|

BV(t)=BV (t-1) - DDBDepr(t)

DDBDepr(t)=BV(t-1) * 2/L where: t=Current Period, t-1=Previous Period BV=Book Value, L=Lifetime of Equipment, |

|

|

IMPACTS OF STRAIGHT_LINE V.S. ACCELERATED DEPRECIATION METHODS ON DEPRECIATION EXPENSE

|

|

|

|

Salvage Value Differences under GAAP vs IFRS

|

Under U.S. GAAP, a company can adjust the estimated salvage value downward.

Under IFRS, a company can adjust the estimated salvage value either upward or downward. |

|

|

UNITS OF PRODUCTION-DEPRECIATION (Formula)

|

|

|

|

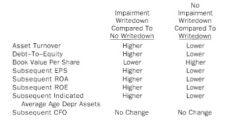

What are the Financial Ratio Impacts of Impairment Write-Down of Long-Lived Depreciable Assets

|

|

|

|

What is the First-Year Income Statement Impact of the Impairment Write-Down of a Long Lived Impact

|

Decrease in Net Income.

Because of the corresponding charge against Pretax Earnings |

|

|

What is the Subsequent-Year Income Statement Impact of the Impairment Write-Down of a Long Lived Impact

|

Increase in Net Income.

Because there will be less subsequent Depreciation Expense related to the long-lived asset after its impairment write down. |

|

|

What is the First-Year Balance Sheet Initial Impact of Upward Revaluation of PPE (Under IFRS)?

|

(1) Increase in Carrying Value Of Property, Plant, And Equipment

(Because, this is a direct consequence of the upward revaluation of Property, Plant, And Equipment.) (2) Increase in Stockholders' Equity Because, an upward revaluation of Property, Plant, And Equipment is credited directly to Stockholders' Equity (bypassing the Income Statement). |

|

|

What is the Subsequent-Year Balance Sheet Impact of Upward Revaluation of PPE (Under IFRS)?

|

(1) Increase in Depreciation Expense

(Because. an upward revaluation of depreciable plant and equipment results in greater depreciable cost, and therefore greater Depreciation Expense.) (2) Decrease in Net Income (Because, there is greater subsequent Depreciation Expense) |

|

|

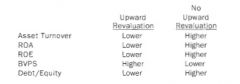

FINANCIAL RATIO IMPACTS OF UPWARD REVALUATION OF PPE ALLOWED UNDER IFRS

|

|

|

|

Asset Retirement Obligations (ARO)

|

environmental costs that will remain as legal obligations when a long-lived asset is retired

|

|

|

FIRST-YEAR BALANCE SHEET IMPACTS OF ASSET RETIREMENT OBLIGATIONS

|

(1) Increase in Assets.

Because an amount equal to the initial ARO liability is added to the initial carrying value of the retired asset (2) Increase in Liabilities. (Because of the ARO liability that is recognized) |

|

|

SUBSEQUENT-YEAR BALANCE SHEET IMPACTS OF ASSET RETIREMENT OBLIGATIONS

|

(1) Decrease in the Retired Asset Carrying Value.

(Because of the Retired Asset Depreciation Expense.) (2) lncrease in the ARO Liability. (Because of the Accretion Expense, which increases the ARO liability.) (3) Decrease in Retained Earnings. (Because of decrease in Net Income (due to the additional Depreciation Expense and the Accretion Expense). |

|

|

FINANCIAL RATIO IMPACTS OF SFAS 143 (ASSET RETIREMENT OBLIGATIONS - ARO)

|

|

|

|

Examples of Intangible Assets

|

|

|

|

Internally Developed Computer Software

|

all costs incurred to establish the

technological and/or economic feasibility of computer software be viewed as "research and development costs" and therefore expensed when incurred. But, once the economic feasibility of computer software has been established, subsequent costs can be capitalized and then amortized, |

|

|

Goodwill

|

classified as an unidentifiable intangible asset

-It is not amortized over time -Should be evaluated every year |

|

|

How and When does Goodwill Appear on Balance Sheet??

|

displayed as an Asset of Balance Sheet when using "Purchase Accounting Method" during a Business Acquisition.

Shows up as Goodwill for the acquiring company. NOT INTERNALLY DEVELOPED |

|

|

What is the normal Lease Classification Preference by a Lessee

|

typically prefers to have a lease classified as an operating lease, rather than as a capital (finance) lease.

|

|

|

Why does a Lessee prefer their Lease classified as a Operating Lease rather than a capital (finance) lease

|

Because, an operating lease classification results in lower reported lease related expense for the lessee early in the life of the lease (although there is no difference over the life of the lease),

keeps additional debt off the Balance Sheet of the lessee. |

|

|

Impact of Operating Lease on a Cash Flow Statement (Lessee)

|

the entire amount of each lease payment made by the lessee is reported by the lessee under "Operating Cash Outflow".

|

|

|

Impact of Capital (Finance) Lease on the Balance Sheet (Lessee)

|

This discounted present value amount (or the fair market value, if less) initially appears as BOTH a CAPITAL LEASE ASSET value and the sum of TWO CAPITAL LEASE LIABILITY values

|

|

|

What is a Capitalized Lease Asset and What is it used for?

|

it is a Line Item on the Balance Sheet.

(1) 1/2 of the way a Capital Lease is accounted for on the Balance Sheet (2) normally depreciated over the life of the capital lease (on a straight-line basis), down to the guaranteed residual value, with a corresponding equal annual depreciation expense |

|

|

What are the Capitalized Lease Liabilities? What are they Used For?

|

(1) Within the year, classified as "CURRENT CAPITALIZED LEASE LIABILITY", otherwise filed under "NON-CURRENT CAPITALIZED LEASE LIABILITY"

(2) The sum of the two make up the total on the liability side. |

|

|

Impact of Capital (Finance) Lease on the INCOME STATEMENT (Lessee)

|

(1) Increase in Depreciation Expense

(2) Increase in Interest Expense |

|

|

Capital (Finance) Lease Interest Expense for Year (Formula)

|

[Current Lease Liability + Previous-Period Interest Payable] * Discount Rate

* Should be equal to Interest Payable for the Period (Year) |

|

|

Impact of Capital (Finance) Lease on the CASH FLOW STATEMENT

|

(1) Portion of each lease payment (Interest Payable from previous Period/Year) is reported under OPERATING CASH FLOW OUTFLOW

(2) rest of each lease payment made is reported as FINANCING CASH FLOW OUTFLOW |

|

|

Impacts for Lessee of

OPERATING LEASE v.s. CAPITAL (FINANCE) LEASE |

|

|

|

LEASE CLASSIFICATION PREFERENCE BY LESSOR

|

typically prefers to have a lease classified as a capital (finance) lease, rather than as an operating lease.

Because, a capital (finance) lease classification results in HIGHER reported Lease-Related Revenue in the INCOME STATEMENT of the lessee early in the life of the lease (although there is no difference over the life of the lease). |

|

|

LESSOR CRITERIA FOR CLASSIFYING A LEASE

|

(1) Lease transfers ownership of the leased asset at the end of the lease term.

(2) Lease contains a "bargain" purchase option. (3) Lease term is for 75% or more of the leased asset's life (4) Discounted present value of the contracted lease payments, as of the start of the lease, is 90% or more of the fair market value of the leased asset at that time. AND (1) Collection of the contractual lease payments is reasonably assured (2) There are no significant uncertainties regarding the amount of un-reimbursable costs yet to be incurred by the lessor under the provisions of the lease agreement. |

|

|

Impact of Operating Lease on a Balance Sheet (Lessor)

|

continues to report the carrying value of the leased asset

|

|

|

Impact of Operating Lease on Income Statement (Lessor)

|

-Reports lease revenue on it's income statement

-also reports DEPRECATION EXPENSE (Straight line depreciation) |

|

|

Impact of Operating Lease on the Cash Flow Statement (Lessor)

|

-each lease payment received is reported as "OPERATING CASH FLOW INFLOW"

|

|

|

Impact of Capital (Finance) Lease on Balance Statement (Lessor)

|

Initially reports a Lease Receivable Asset equal to the Present Value of the future lease payments

***Sales-Type Capital lease will create a difference, recognized as a Pretax Profit.*** |

|

|

Impact of Capital (Finance) Lease on Income Statement (Lessor)

|

Reports Interest Income from the Lease Receivable Asset (on balance sheet)

***The interest income will decrease each year down to the Salvage value*** No depreciation expense since it the asset has been removed from the lessor's Balance Sheet |

|

|

Impact of Capital (Finance) Lease on the Cash Flow Statement (Lessor)

|

Interest Income earned will be reported into "OPERATING CASH FLOW INFLOW"

Lease payments received will be reported into the "OPERATING CASH FLOW INFLOW" |

|

|

Impacts for Lessor of OPERATING LEASE v.s. CAPITAL (FINANCE) LEASE

|

|

|

|

What is the purpose of Off Balance Sheet Financing Methods??

|

allow a company to acquire the certain assets, but do not require any corresponding debt to be shown company's balance sheet.

|

|

|

OFF BALANCE SHEET FINANCING METHODS TYPES (6 Total)

|

(1) Operating Leases

(2) Throughput Contract (3) Take-or-Pay Contract (4) Joint Venture (5) Finance Subsidiary Less Than Majority Owned (6) Sale of Receivables |

|

|

What is a "Throughput Contract" and what does it do?

|

Company agrees (in a contract) to run a specified amount of goods through a processing or distribution facility owned by another company.

***The other company builds and finances the processing or distribution facility on the basis of this contract, with no corresponding debt on balance sheet of company that is running the goods through the facility.*** |

|

|

What is a Take-Or-Pay Contract and how does it affect the Balance Sheet?

|

Company agrees (in a contract) to pay for a specified quantity of inputs from a production facility owned by another company, whether needed or not.

The other company builds and finances the production facility on the basis of this contract, with no corresponding debt on balance sheet of company that has agreed to pay for the inputs ***common in natural gas, chemical, paper, and metal industries*** |

|

|

What is a Joint Venture? How does it Impact the Balance Sheet?

|

U.S. company enters into a joint venture to purchase assets, with an ownership position of 50 percent (or possibly somewhat less).

Because of ownership percentage, the EQUITY METHOD can be used with no corresponding debt on balance sheet |

|

|

How does the Financing of a Subsidiary (Less Than Majority Owned) help raise the Balance Sheet?

|

Can use EQUITY METHOD and no corresponding debt on the balance sheet

U.S. company has a finance subsidiary (with a huge amount of debt), with an ownership position that is 50 percent or somewhat less. |

|

|

What is the Sale Of Receivables? How does it impact the Balance Sheet?

|

lf company sells receivables, without recourse [no guarantee by the company selling the receivable], the company obtains funds with no corresponding debt appearing on balance sheet of company selling its receivables without recourse

Can also do this with recourse, but the following conditions must be true: (1) Seller is isolated from receivables sold (2) Seller surrenders effective control over receivables sold (3) Buyer has the right to pledge or exchange the receivables purchased. |

|

|

Why would an Analyst want to adjust the BALANCE SHEET for a Company

|

may want to adjust the balance sheet (for analysis purposes) to show the actual debt/liability

|

|

|

FINANCIAL ACCOUNTING

CASH FLOW CATEGORIES |

(1) Operating Cash Flows

(2) Investing Cash Flows (3) Financing Cash Flows |

|

|

Investing Cash Flows (Definition)

|

Investing cash flows are the firm's net cash flows used for acquiring, or from disposing of, long-term assets

Investing cash flows are a key measure of the firm's commitment to it's long-term viability. |

|

|

Operating Cash Flows

|

Operating cash flows are the firm's net cash flows generated by operating activities.

Level of operating cash flows is a key measure of the firm's operating performance and liquidity when operating cash flows > Net Income generally indicate high quality earnings report |

|

|

What are Common Operating Activities for a Firm which effect the Cash Flow Statement

|

(1) Sales of goods and/or services to customers

(2) Costs of providing goods and/or services to customers (3) Income tax payments (4) Change in amount of operating current assets (5) Change in amount of operating current liabilities (6) Interest paid or received (under U.S. GAAP); (7) Dividends received (under U.S. GAAP). |

|

|

What are Investing Activities which may affect the Cash Flow Statement for a Firm

|

(1) Purchase or sale of property, plant, and equipment

(2) Purchase or sale of equity and/or debt securities of other entities |

|

|

What are Financing Activities for a Firm which affect the Cash Flow Statement

|

(1) Issuance or repurchase of the company's stock

(2) Issuance or repurchase of the company's debt (3) Taking out a bank loan, or repaying the principal on a bank loan (4) Dividends (common and/or preferred) paid to company shareholders |

|

|

NON-CASH INVESTING AND FINANCING ACTIVITIES OF COMPANIES (Examples)

|

(1) Exchange of one property for another

(2) Exchange common stock for a convertible bond (converted) **any significant non-cash investing or financing activity of a company must be disclosed in a note to the company's Cash Flow Statement or in other supplementary information.** |

|

|

TWO APPROACHES TO DETERMINE CASH FLOW FROM OPERATIONS

|

(1) Indirect Method

(2) Direct Method |

|

|

Indirect Approach (CFO)

|

start with net income and then adjust to a cash basis

Advantage of the indirect approach is that it shows the reasons for differences between Net Income and Operating Cash Flow. Also mirrors a common approach for forecasting Operating Cash Flow, that begins by first forecasting Net Income |

|

|

Direct Approach (CFO)

|

cash inflows and cash outflows are projected directly.

provides information on the specific sources of operating cash inflows and cash outflows, in contrast to the indirect approach, which shows only the net result of these cash inflows and cash outflows. |

|

|

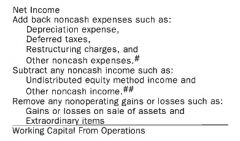

DETERMINING WORKING CAPITAL FROM OPERATIONS WITH INDIRECT APPROACH

|

|

|

|

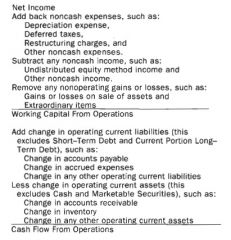

Determining CASH FLOW FROM OPERATIONS with the Indirect Method

|

|

|

|

CASH REVENUE FROM SALES (Direct Approach)

|

|

|

|

CASH FOR PURCHASES (Direct Approach)

|

|

|

|

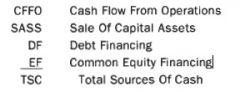

What are the TOTAL SOURCES OF CASH (TSC)

|

|

|

|

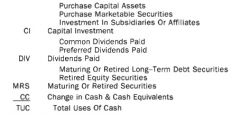

USES OF CASH

|

|

|

|

Total Capital Investment (CI) Formula

|

Purchase Capital Assets + Purchase Marketable Securities + Investment in Subsidiaries or Affiliates

|

|

|

Total Dividends Paid (DI) Formula

|

Common Dividends Paid + Preferred Dividends Paid

|

|

|

What is the CASH FLOW RECONCILIATION REQUIRED Format?

|

Operating Cash Flows + Investing Cash Flows + Financing Cash Flows + Exchange Rate Cash Flows

|

|

|

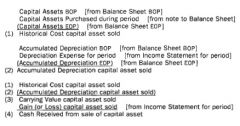

How to determine CASH FROM SALE OF CAPITAL (FIXED) ASSET

|

|

|

|

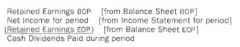

CASH DIVIDENDS PAID

|

|

|

|

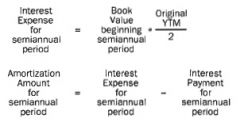

INTEREST EXPENSE BY CORPORATE BOND ISSUER (DISCOUNT BOND)

|

|

|

|

INTEREST EXPENSE BY CORPORATE BOND ISSUER (Premium Bond)

|

|

|

|

Effective Interest Amortization Method for Interest Expense of Bond Issuer

|

|

|

|

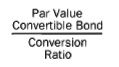

Convertible Bond Conversion Price

|

|

|

|

What are the current condition under which CONVERTIBLE BONDS

likely will be Converted |

|

|

|

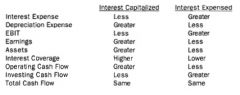

IMPACTS OF CAPITALIZING V.S. EXPENSING INTEREST

|

|

|

|

What is Capitalized Interest

|

Interest of Bond Issued which Funds a Construction Project for a Building (or creation of a long-term asset)

The capitalized interest will be part of the asset’s cost reported on the balance sheet, and will be part of the asset’s depreciation expense that will be reported in future income statements. |

|

|

Income Tax approaches for Financial Accounting (U.S. G.A.A.P.)

|

(1) Uses the Liability Approach, which is Balance Sheet Focused

(2) Income Tax Expense reported on the INCOME STATEMENT is a by-product of the Balance Sheet Focus |

|

|

FINANCIAL ACCOUNTING FOR INCOME TAXES

|

(1) Recognize the amount of income taxes payable or refundable for the current year.

(2) Recognize deferred tax liabilities and deferred tax assets for the future tax consequences of events that have been recognized in an enterprise's financial statements or tax returns. |

|

|

Income Taxes Payable

|

|

|

|

Income Tax Expense (Income Statement Formula)

|

|

|

|

Deferred Tax Expense (Formula)

|

|

|

|

Impact of an Increase/Decrease in Value for a DEFERRED TAX ASSETS on Reported NET INCOME

|

|

|

|

Examples Of Unusual Or Infrequent Events which affect NET INCOME STATEMENT

|

i. Gains or losses from disposal of a portion of a business segment.

ii. Gains or losses from sale of assets, or from sale of investments in affiliates or subsidiaries. iii. Losses from environmental disaster that are ineligible for treatment as extraordinary items. iv. Impairments, write-offs, write-downs, and restructuring costs. v. Effects of a strike. |

|

|

What is COMPREHENSIVE INCOME

|

is the change in the equity for a company in the period

***excludes equity changes resulting from investments by owners and distributions to owners.*** ***Excludes Dividends*** G(L) Certain Marketable Securities FX Translation Adjustment Minimum Pension Liability Def G(L) on Cash Flow Hedges |

|

|

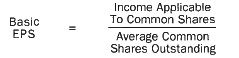

BASIC EARNINGS PER SHARE Formula

|

|

|

|

TWO DIFFERENT CATEGORIES OF POTENTIALLY DILUTIVE SECURITIES

|

(1) Stock Warrants And Stock Options.

(2) Convertible Bonds And Convertible Preferred Stock. |

|

|

What is a Dilutive Security

|

financial instruments (like stock options, warrants, convertible bonds, etc.) which increases the number of Common stock, if exercised,it reduces the Basic EPS (Earnings Per Share)

Only if the Diluted EPS is less than the Basic EPS then it is called Dilutive Securities. |

|

|

Categories of Dilutive Securities

|

(1) Stock warrants and stock options:

***use the Treasury Stock method.*** (2) Convertible debt and Convertible Preferred Stock ***Use "if converted" method*** |

|

|

Delutive Test for Stock Warrants & Options

|

If average market price > exercise price, then are dilutive

If average market price < exercise price, then not dilutive. IGNORE the security in Diluted EPS calculation. |

|

|

If Converted Method

|

No simple test for convertible bonds and convertible preferred stock.

Must test each security to see if dilutive. If dilutive, include in Diluted EPS [DEPS]. If not dilutive, do not include in the calculation. But if dilutive, expect both numerator and denominator adjustments. |

|

|

OR v.s. AND (Infrequent Items Earnings)

|

unusual OR infrequent → part of continuing operations on the income statement.

unusual AND infrequent → an extraordinary item (net of tax) on the bottom of the income statement. |

|

|

Deferred Tax Liability

|

recognized for an estimated FUTURE TAX OBLIGATION attributed to a taxable temporary difference

|

|

|

What is a Deferred Tax Asset

|

FUTURE TAX BENEFIT

related to a deductible temporary difference |

|

|

Bonds with Warrants

|

Both U.S. GAAP & IFRS: Bonds are accounted for as debt based on fair value, but the warrants are accounted for as equity

Bonds and warrants are treated as two separate securities. Warrants can be detached from the bonds and sold separately. |

|

|

Diluted EPS (Formula)

|

[net income – preferred dividend + (convertible debt interest * (1-t))] / [WASO + New Convertible Securities + New Options + warrants and Convertible Bonds]

where: WASO=Weighted Average Shares Outstanding |

|

|

Accounting Shenanigans

|

(1) Stretching out payables

(2) Switching to third-party financing of payables (3) Securitization of receivables, (4) Granting stock options to employees that are exercised |

|

|

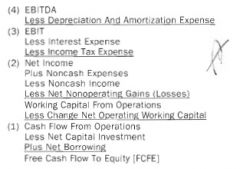

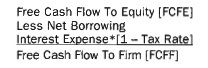

FREE CASH FLOW TO EQUITY (CFCE) Statement Structure or Formula

|

|

|

|

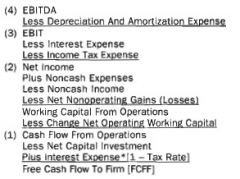

FREE CASH FLOW TO FIRM (FCFF) (Format/Formula)

|

|

|

|

Relationship Between FCFF and FCFE

|

|

|

|

What are the Limitation of Financial Ratios

|

(1) Financial ratio value for a firm can be affected by the financial accounting choices made by the firm (liberal vs. conservative)

(2) Implications of a single financial ratio value for a firm may not be consistent with implications that would be provided by other financial ratio values for the firm. (3) Firm may be in several different industries, which may make it difficult to determine an appropriate industry benchmark for a financial ratio. (4) Depends on past public info available and no forward looking data |

|

|

Current Ratio (Definition and Purpose)

|

Current Ratio gives a rough indication of be satisfied by the liquidation of current

Generally the higher the Current Ratio liquidity. |

|

|

Quick Ratio (Definition and Purpose)

|

Gives an indication of how easily current liabilities could be

satisfied by the liquidation of quick assets This ratio is sometimes called the Acid Test Ratio |

|

|

Cash Ratio (Definition and Purpose)

|

Cash Ratio gives an indication of how easily current liabilities could be satisfied with only cash and short-term marketable securities.

|

|

|

Defensive Interval Ratio (Definition and Purpose)

|

indicates how many days a company can pay its expenses from its existing quick assets

|

|

|

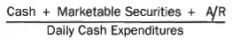

Daily Cash Expenditures

|

|

|

|

Defensive Interval Ratio

|

|

|

|

What are the Liquidity Implications of Short-Term Operating Activities as is relates to Current Liabilities

|

Current Liabilities affected

(1) Accounts Payable (2) Advances From Customers Being able to buy with trade credit and incur Accounts Payable is a source of short-term liquidity for a company. When Customers Pay in Advance for goods or services |

|

|

What are the Liquidity Implications of Current Liabilities to Short-Term Debt Financing

|

Possible Negative liquidity implication if short-term debt is increased because ability to buy with trade credit is reduced.

Current Liabilities affected: (1) Short-Term Debt (2) Current Portion of Long-Term Debt |

|

|

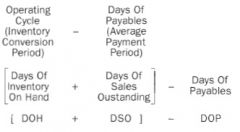

Operating Cycle (Definition)

|

DOH + DSO

|

|

|

Cash Conversion Cycle Formula (CCC)

|

Also:

Inventory Period + Accounts Receivable Period - Payables Period |

|

|

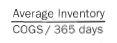

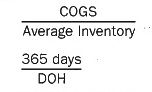

Days of Inventory on Hand Formula (DOH)

|

Author likes:

Avg FIFO Inventory/(LIFO COGS / 365) also called "Inventory Period" |

|

|

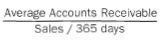

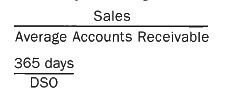

Days of Sales Outstanding Formula (DSO)

|

Also called "Receivables Period" or "Number of Days Receivables"

|

|

|

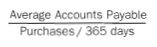

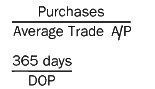

Days of Payables Outstanding (DPO) Formula

|

Can also be Avg. Accounts Payable/[COGS/365]

Also called "Payables Period" |

|

|

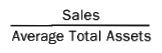

Total Asset Turnover (Formula)

|

|

|

|

Total Asset Turnover (Formula)

|

|

|

|

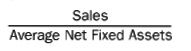

Fixed Asset Turnover (Formula)

|

|

|

|

Working Capital Turnover

|

|

|

|

Working Capital Turnover Formula

|

|

|

|

Inventory Turnover (Formula)

|

|

|

|

Receivables Turnover (Formula)

|

|

|

|

Payables Turnover (Formula)

|

Also be COGS/Avg. Accounts Payable

|

|

|

Day of Inventory On Hand (DOH) (Definition)

|

the avg number of days it would take the company to sell it's inventory

generally the lower number, the less funds tied up in inventory. However, too low a value may result in a lost sales opportunity |

|

|

Days of Sales Outstanding (DSO) (Definition)

|

also called Average Collection Period

a lower the value indicates more effective collection activities and conservation of funds. |

|

|

Days of Payables (DOP) (Definition)

|

also called "Average Payment Period"

generally a higher value indicates a greater conservation of funds However, too high a value may create problems with suppliers |

|

|

Operating Cycle (Definition)

|

Avg. Amount of time from the purchase of goods for inventory until cash is received from Sales of Goods.

Also called Inventory Conversion Period Can be classified as a liquidity measure Lower value is preferred. |

|

|

Cash Conversion Cycle (CCC) (Definition)

|

Avg. Amount of time that cash is tied up per inventory cycle during the year

Also called the company's NET OPERATING CYCLE can be classified as a Liquidity Measure lower value is generally preferred |

|

|

Inventory Turnover (Definition)

|

the number of times per year that INVENTORY is replaced

is a measure of operating efficiency Higher values indicates that less funds are tied up in Inventory relative to COGS |

|

|

Receivables Turnover (Definition)

|

the number of times per year that ACCOUNTS RECEIVABLE is replaced

measure of operating efficiency higher values indicates more efficient collection activities |

|

|

Payables Turnover (Definition)

|

the number of times per year that ACCOUNTS PAYABLE are replaces based on purchases relative to average trade accounts payable

measures payment management generally lower value indicates a greater conservation of funds Too low a value may create problems with suppliers (need to pay them) |

|

|

Working Capital Turnover (Definition)

|

number of times per year that Working Capital is replaced based on Sales relative to Average Working Capital

measures Operating Efficiency a higher value indicates a more efficient use of Working Capital by the Company |

|

|

Fixed Asset Turnover (Definition)

|

the number of times per year that fixed assets are turned over, based on Sales relative to AVERAGE NET FIXED ASSETS

measures operating efficiency a higher value indicates a more efficient use of Fixed Assets by the Company |

|

|

Total Asset Turnover (Definition)

|

the number of times per year that total assets are turned over, based on Sales relative to AVERAGE TOTAL ASSETS

measures operating efficiency a higher values indicates a more efficient use of TOTAL ASSETS by a company. |

|

|

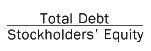

Debt-To-Equity Ratio (Definition)

|

indicates a company's total debt (interest-bearing short-term

debt plus long-term debt) relative to stockholders' equity. Generally the higher the Debt To Equity Ratio value, the greater the financial risk. |

|

|

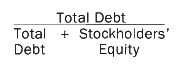

Debt to Capital Ratio (Definition)

|

shows what portion of a company's total debt (interest bearing short-term debt plus long-term debt) and stockholders' equity is total debt.

Generally the higher the value, the greater the financial risk. |

|

|

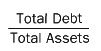

Debt to Assets Ratio (Definition)

|

indicates a company's total debt (interest-bearing short-term debt plus long-term debt) relative to total assets.

Generally the higher the value, the greater the financial risk. |

|

|

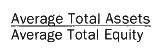

Financial Leverage Ratio (Definition)

|

indicates a company's average total assets relative to average total equity for the measurement period.

Generally the higher the value, the greater the financial risk. |

|

|

Interest Coverage Ratio (Definition)

|

Also called Time Interest Earned Ratio

indicates the protection of debt-holders, due to EBIT relative to Interest Payments. Generally the higher the value, the better the protection of debt holders. |

|

|

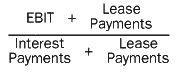

Fixed Charge Coverage (Definition)

|

is an extension of the Interest Coverage Ratio, to also include operating lease payments.

Generally a higher value indicates a better protection of debt-holders and lessees. |

|

|

Fixed Charge Coverage Ratio Formula

|

|

|

|

Interest Coverage Ratio (Formula)

|

|

|

|

Financial Leverage Ratio (Formula)

|

|

|

|

Debt To Assets Ratio (Formula)

|

|

|

|

Debt to Capital Ratio (Formula)

|

Debt=LT Debt + ST Debt

|

|

|

Debt to Equity Ratio (Formula)

|

Debt=LT Debt + ST Debt

|

|

|

Gross Profit Margin (Formula)

|

|

|

|

Gross Profit Margin (Definition)

|

measures gross income after costs (purchasing or manufacturing) relative to sales

|

|

|

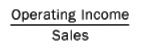

Operating Profit Margin (Definition)

|

measures pre-financing and pre-tax OPERATING EARNINGS relative to Sales

|

|

|

EBIT Profit Margin (Definition)

|

measures earnings before interest expense and income taxes, relative to Sales

*** If there is non-operating income, the value has the same meaning as Operating Profit Margin *** |

|

|

Operating Profit Margin (Formula)

|

|

|

|

EBIT Profit Margin (Formula)

|

|

|

|

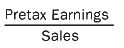

Pretax Profit Margin (Formula)

|

|

|

|

Net Profit Margin (Formula)

|

|

|

|

Pretax Profit Margin (Definition)

|

Measures Pretax Income relative to Sales

|

|

|

Net Profit Margin (Definition)

|

Net Income relative to Sales

Companies can be compared in terms of reported earnings relative to sales |

|

|

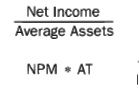

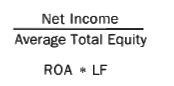

Return on Assets (ROA) (Definition)

|

measures the efficiency that a company allocates and manages its total resources

|

|

|

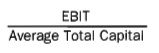

Return on Capital (ROC) (Definition)

|

ROC is a measure of the combined return [Pretax Earnings plus Interest Expense] on total capital [Total Debt plus Equity].

|

|

|

Return on Assets (ROA) (Formula)

|

|

|

|

Return on Capital (ROC) (Formula)

|

|

|

|

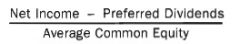

Return on Total Equity (ROTE)

|

|

|

|

Return on Common Equity (ROE or ROCE) (Formula)

|

|

|

|

VALUATION RATIOS

|

Valuation Ratios for a company are measures of value for the company's securities, and are commonly used in investment decision making.

Valuation Ratios include: (i) Payout & Yield Ratios (ii) Sustainable Growth Rate & Implied Total Return, and (iii) Per Share Ratios |

|

|

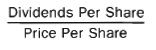

Dividend Payout Ratio (DPO) (company characteristics)

|

RAPIDLY GROWING companies usually have a relatively LOW value, while slowly GROWING companies usually have a relatively HIGH value.

|

|

|

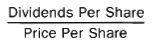

Dividend Yield

|

|

|

|

Dividend Yield (Formula)

|

|

|

|

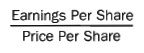

Earnings Yield (Formula)

|

|

|

|

Sustainable Growth Rate (Formula)

|

|

|

|

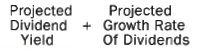

Implied Total Return (Formula)

|

|

|

|

Inflation-Adjusted (Real) Sustainable Growth Rate (Formula)

|

|

|

|

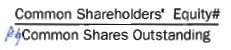

Book Value per Share (Formula)

|

|

|

|

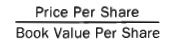

Price To Book Ratio (Formula)

|

|

|

|

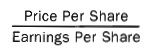

Price/Earnings Multiple (Formula)

|

|

|

|

Price-To-Book Ratio (Definition)

|

the economic value per common share (market price), relative to the accounting value per share (book value per share).

Generally the higher the Price-To-Book Ratio value, the better the expected prospects for the corporation. |

|

|

Price/Earnings Multiple (Definition)

|

Generally the higher the P/E value, the better the expected prospects for the corporation

There are exceptions, particularly for cyclical companies. |

|

|

Forecasting Sensitivity Analysis

|

Analysis involves determining the projected financial statements will change in response to changes in assumption values, changed one-at-a-time.

Analysis can indicate which key assumption values will have the greatest impact, if changed. |

|

|

Scenario Analysis (Definition)

|

involves determining and comparing the projected financial statements corresponding to different scenarios, such as a worst-case scenario and a best-case scenario, with the expected-case scenario

|

|

|

Trend Analysis

|

account values are compared from year-to-year and/or over a period of years.

|

|

|

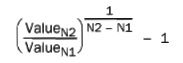

COMPOUND ANNUAL NOMINAL GROWTH (Formula)

|

|

|

|

COMPOUND ANNUAL INFLATION ADJUSTED GROWTH (Approx. Formula)

|

|

|

|

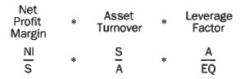

Return on Equity (Formula--> Dupont Analysis)

|

|

|

|

Analysis Preparation Steps for CURRENT COST BALANCE SHEET

|

1. Change everything to FIFO

2. Include off-balance-sheet assets and liabilities (ex future lease commitments) |

|

|

Analysis Preparation Steps for Reported Income

|

1. Remove Non-Current Earnings from Income Statement

2. If need be, include them but adjust to business cycle. Also called Normalization of Income |

|

|

Steps for Analysis of CASH FLOWS

|

(1) Reclassify interest paid, from Cash From Operations to Cash From Financing.

(2) Segregate capital expenditures, from other investment cash flows (3) Remove cash flows related to nonrecurring items. (4) Report free cash flow. Also called "Adjustment of Cash Flows" |

|

|

Impact of Capital (Finance) Lease on the CASH FLOW STATEMENT

|

(1) Portion of each lease payment (Interest Payable from previous Period/Year) is reported under OPERATING CASH FLOW OUTFLOW

(2) rest of each lease payment made is reported as FINANCING CASH FLOW OUTFLOW |

|

|

Avoidable Interest (Long-Term Asset)

|

Weighted Average Interest Rate * Amount involved in Construction of Asset

|

|

|

Amortization (Formula)

|

Cost of Asset/[Sales of Asset/Expected Sales in Useful Life of Asset]

|