![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

24 Cards in this Set

- Front

- Back

|

Accounting Equation

|

An equation showing the relationship among assets, liabilities, and owner's equity.

|

|

|

Adjusting Entries

|

Journal entries recorded to update general ledger accounts at the end of a fiscal period.

|

|

|

Balance Sheet

|

A financial statement that reports assets, liabilities, and owner's equity on a specific date.

|

|

|

Chart of Accounts

|

A list of accouts used by a business.

|

|

|

Closing Entries

|

Journal entries used to prepare temporary accounts for a new fiscal period.

|

|

|

Post-Closing Trial Balance

|

A trial balance prepared after the closing entries are posted.

|

|

|

Posting

|

Transferring information from a journal entry to a ledger account.

|

|

|

Proprietorship

|

A business owned by one person.

|

|

|

Revenue

|

An increase in owner's equity resulting from the operation of a business.

|

|

|

Service Business

|

A business in which income is produced chiefly by personal services rendered.

|

|

|

Source Document

|

A business paper from which information is obtained for a journal entry.

|

|

|

T-Account

|

An accounting device used to analyze transactions.

|

|

|

Temporary Accounts

|

Accounts used to accumulate information until it is transferred to the owner's capital account.

|

|

|

Trial Balance

|

A proof of the equality of debits and credits in a general ledger.

|

|

|

Net Income

(Formula) |

(Total Revenue)

-(Total Expenses) |

|

|

Total Expenses Component Percentage

(Formula) |

((Total Expenses)

/(Total Sales)) *100 |

|

|

Net Income Component Percentage

(Formula) |

((Net Income)

-(Total Sales) * 100) |

|

|

Current Capital

(Formula) |

(Capital Account Balance)

± (Net Income+ or NetLoss-) - (Drawing Balance) |

|

|

Adequate Disclosure

|

Financial statements contain all of the information necessary to understand a business's financial condition.

|

|

|

Going Concern

|

Financial statements are prepared with the expectation it will stay in business.

|

|

|

Objective Evidence

|

A source document is prepared for each transaction.

|

|

|

Accounting Period Cycle

|

Changes in financial information are reported for a specific period of time in the form of financial statements.

|

|

|

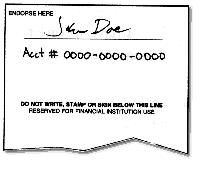

Blank Endorsement

|

|

|

|

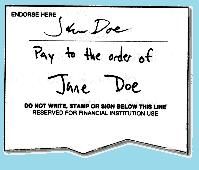

Special Endorsement

|

|